February 2025

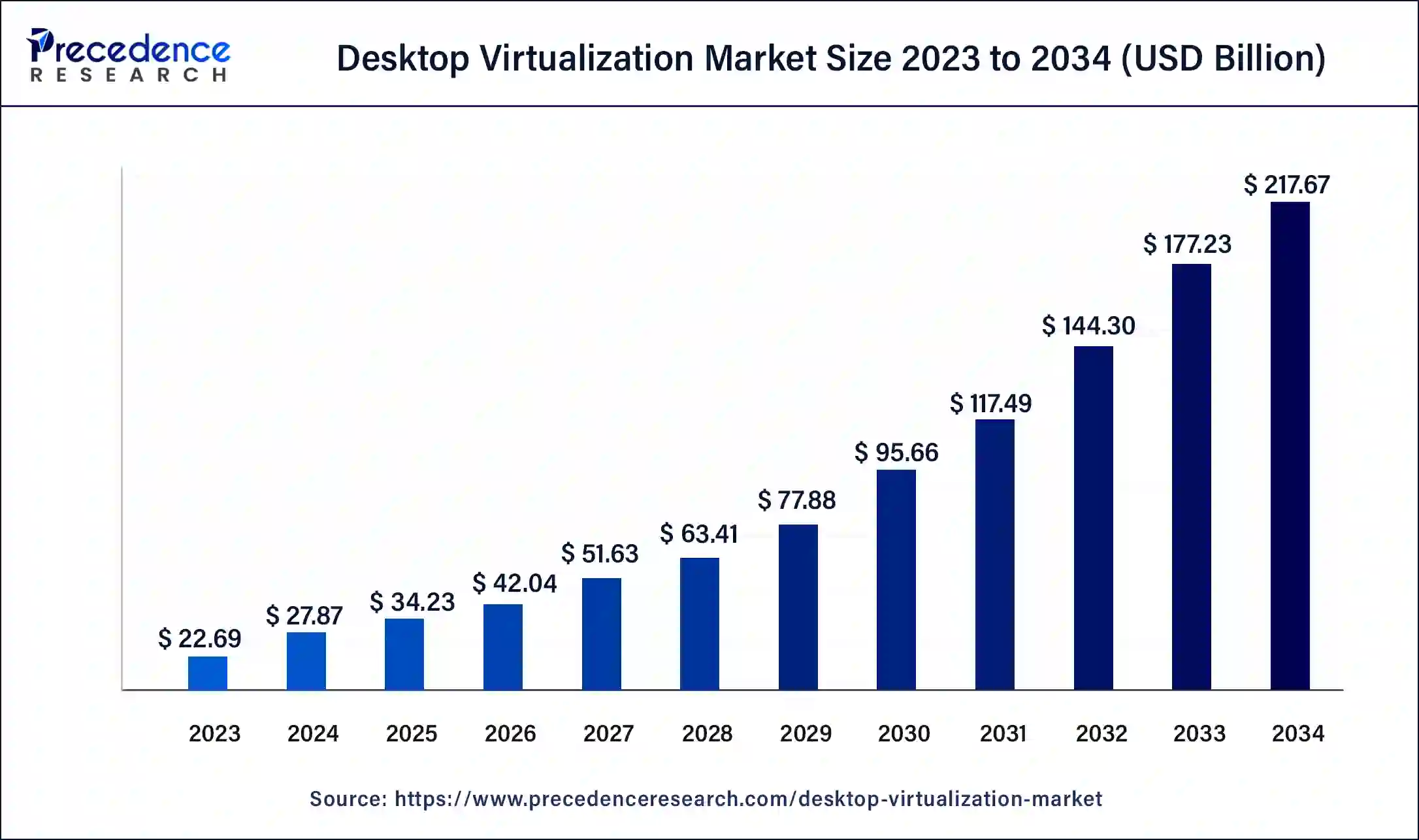

The global desktop virtualization market is worth around USD 27.87 billion in 2024 and is expected to reach around USD 217.67 billion by 2034, representing a healthy CAGR of 22.80% during the forecast period from 2024 to 2034.

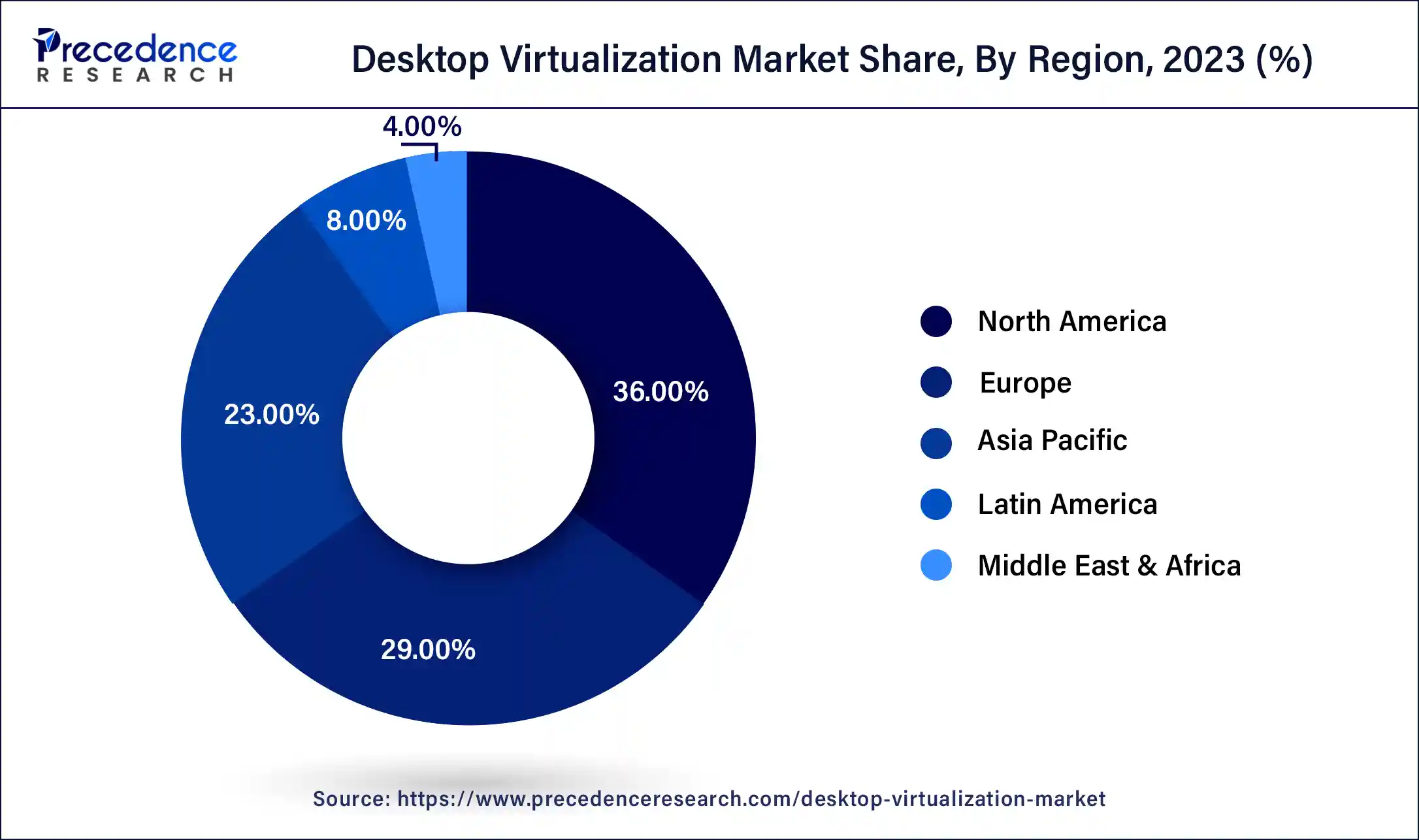

The global desktop virtualization market size is projected to be worth around USD 217.67 billion by 2034 from USD 27.87 billion in 2024, at a CAGR of 22.80% from 2024 to 2034. The North America desktop virtualization market size reached USD 8.17 billion in 2023. The increasing implementation of desktop virtualization by IT users is the key driver for the desktop virtualization market.

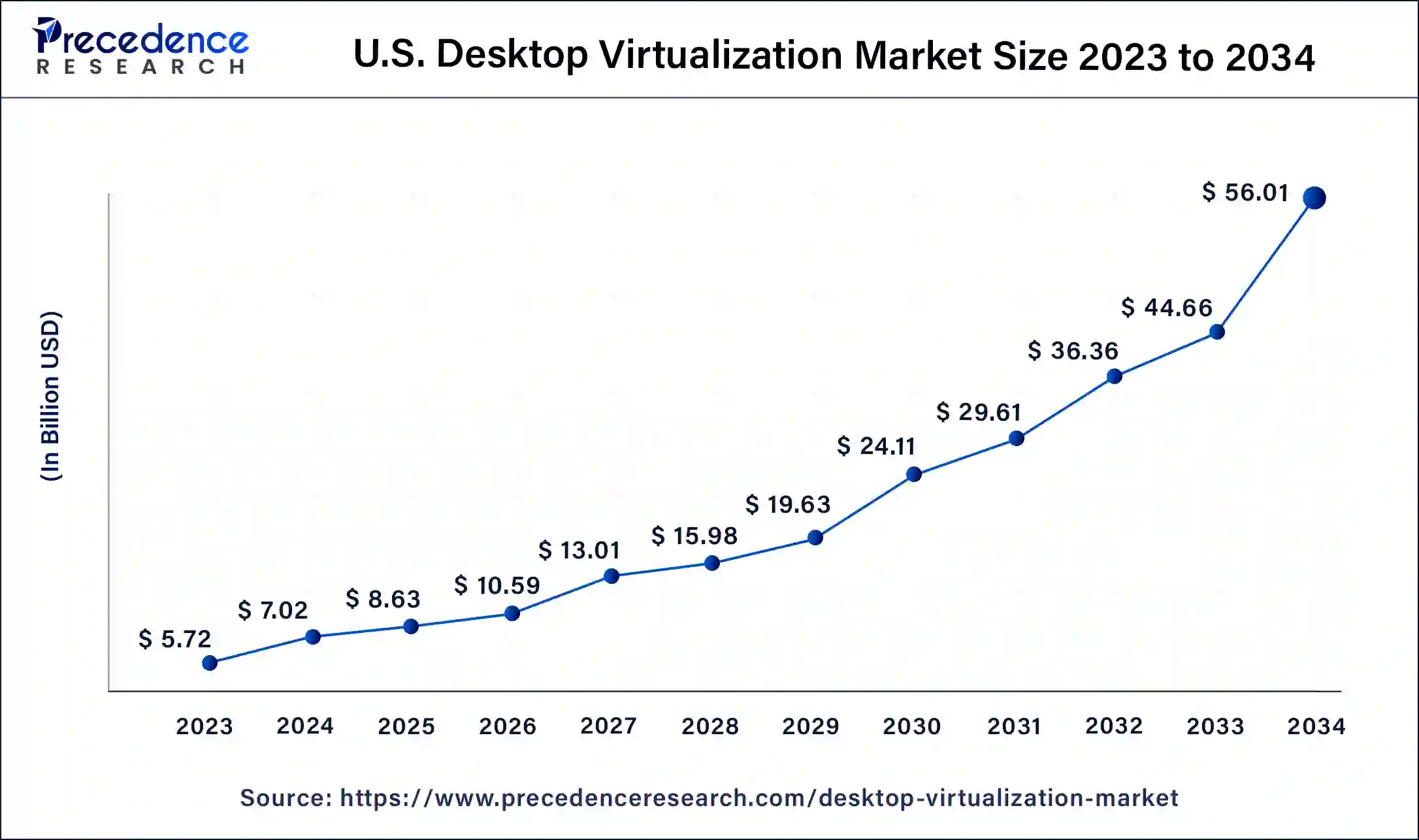

The U.S. desktop virtualization market size was exhibited at USD 5.72 billion in 2023 and is projected to be worth around USD 56.01 billion by 2034, poised to grow at a CAGR of 23.04% from 2024 to 2034.

North America dominated the global desktop virtualization market in 2023 as many North American corporations were quick adopters of this technology which can lead to the expansion of the market in the future. Furthermore, the region's exceptional IT infrastructure enables the easy management and implementation of virtual desktop solutions.

Asia Pacific is expected to show the fastest growth in the desktop virtualization market during the forecast period, which can be attributed to the increasing requirement for cloud computing. Virtual machines are also becoming popular in the region, which is another significant factor fueling market growth. Moreover, there has been massive growth in cloud computing and the digitalization of numerous industrial operations.

List of Regions by number of Internet users (2023)

| Region | 2023 |

| Africa | 37% |

| Americas | 87% |

| Arab States | 69% |

| Asia and Pacific | 66% |

| Commonwealth of Independent State | 89% |

| Europe | 91% |

Desktop virtualization is a method that allows users to ingress their workstations from a remote location. Employees can access their company tools from any laptop, tablet, desktop, or smartphone regardless of device type or operating system. Remote desktop virtualization is a key factor in digital environments. This is due to programs and user data being saved on the desktop virtualization server instead of on other devices. The potential risk of lost or stolen devices is also reduced.

How is AI Revolutionizing the Desktop Virtualization Market?

AI drives efficiency in the desktop virtualization market by redefining the way companies control and optimize their resources, which can lead to significant improvements in the automation and efficiency of operations. Furthermore, the advancements in artificial intelligence (AI) and its impact on all types of technologies utilized globally by users, such as desktop virtualization, are becoming popular among companies, which can present opportunities for the future.

| Report Coverage | Details |

| Market Size by 2034 | USD 217.67 Billion |

| Market Size in 2023 | USD 22.69 Billion |

| Market Size in 2024 | USD 27.87 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 22.80% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Organization Size, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Simplified IT management system

The desktop virtualization market enables IT teams to automate security patches, software upgrades, and user access control. This method reduces the time and resources needed for IT help because IT personnel can access all virtual desktops from a centralized location, which can give more room for IT teams to focus on more strategic projects like tightening security standards, updating IT infrastructure, and developing new solutions for corporate expansion. From the rise of generative AI to evolving regulations and data sovereignty laws, developing solutions that prioritize resiliency and performance will help ensure regulatory compliance and secure innovation.

Network dependency

Desktop virtualization depends solely on stable network connection issues such as latency, lag, and bandwidth limits, which can significantly decrease the user experience and make it less suitable for places with sluggish or unpredictable connections. However, a constant and rapid network is essential to provide smooth and efficient access to virtual apps and desktops, and this can negatively impact the growth of the desktop virtualization market.

Cloud computing

The growing need for and utilization of cloud computing in most applications is expected to create opportunities in the global desktop virtualization market. Desktop services, accessibility, and storage solutions for the cloud are highly efficient. Many organizations are planning to integrate cloud computing for high efficiency. Additionally, there is a great demand for R&D in the virtualization concept. The desktop virtualization market solutions function well for medium and small enterprises.

The virtual desktop infrastructure (VDI) segment dominated the desktop virtualization market in 2023. The growth of the segment can be attributed to the growing adoption of the use-your-device concept. DI also uses virtual machines to provide and control virtual desktops. It offers various benefits like cost saving, centralized management, remote access, and robust security. In VDI, data is primarily stored on the cloud server rather than any device that can protect data if an endpoint device gets compromised.

The desktop-as-a-service (DaaS) segment is expected to grow at the fastest rate in the desktop virtualization market over the forecast period. The growing availability of high-speed internet along with security solutions is boosting the growth of the desktop-as-a-service segment, especially after the pandemic and throughout the forecast period. Moreover, DaaS can also offer many opportunities for resellers and channel partners to sell software and hardware solutions to consumers, which can drive the segment's growth soon.

The large enterprise segment led the global desktop virtualization market in 2023. The growth of the segment can be linked to the growing utilization of desktop virtualization systems by large organizations having complex IT environments and numerous user needs. Also, in large organizations, desktop virtualization can propel employee productivity and speed up application access by enhancing remote work capabilities.

The small & medium enterprises (SMEs) segment is projected to witness the fastest growth in the desktop virtualization market during the forecast period. The segment's growth can be credited to the increasing use of these systems in businesses with limited resources and a smaller workforce. They also have a single product, owner, and service to operate within a local market.

The IT & telecom segment dominated the desktop virtualization market in 2023. The industry's emphasis is on ensuring employee productivity and offering a flexible work location. Modern telecommunications industry players have various communication equipment to deliver data and a set of voice and broadband services, which is expected to drive the segment growth in upcoming years.

The BFSI segment is anticipated to grow at the fastest rate in the desktop virtualization market during the projected period due to customers' rapid adoption of digital tools and platforms. Additionally, the growing revenue generation of the banking and financial sector to provide efficient services and solutions to customers can contribute to the market expansion shortly.

Segments Covered in the Report

By Type

By Organization Size

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

February 2024

July 2024