April 2025

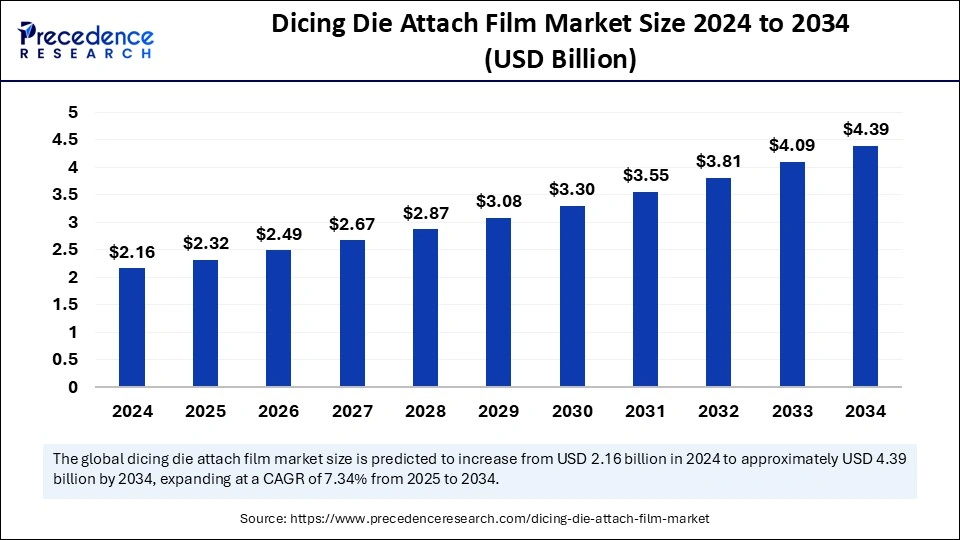

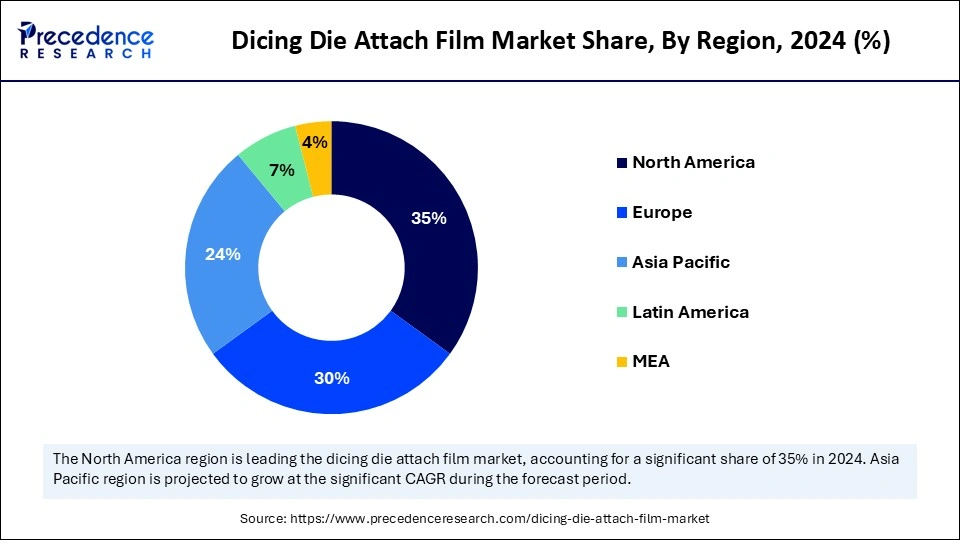

The global dicing die attach film market size is calculated at USD 2.32 billion in 2025 and is forecasted to reach around USD 4.39 billion by 2034, accelerating at a CAGR of 7.34% from 2025 to 2034. The North America market size surpassed USD 760 million in 2024 and is expanding at a CAGR of 7.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dicing die attach film market size accounted for USD 2.16 billion in 2024 and is predicted to increase from USD 2.32 billion in 2025 to approximately USD 4.39 billion by 2034, expanding at a CAGR of 7.34% from 2025 to 2034. The dicing die attach film market is growing at a rapid pace due to increasing government investments to boost semiconductor production. This investment expands the manufacturing capability for advanced semiconductors.

Integrating Artificial Intelligence technologies in the manufacturing processes of dicing die attach film leads to improved yield and reduced waste and production costs. AI helps in the quality control process, ensuring that the film produced meets quality standards. Moreover, AI helps in the development of new materials for dicing die attach films with enhanced properties like thermal conductivity and electrical insulation. Moreover, AI helps develop customized films.

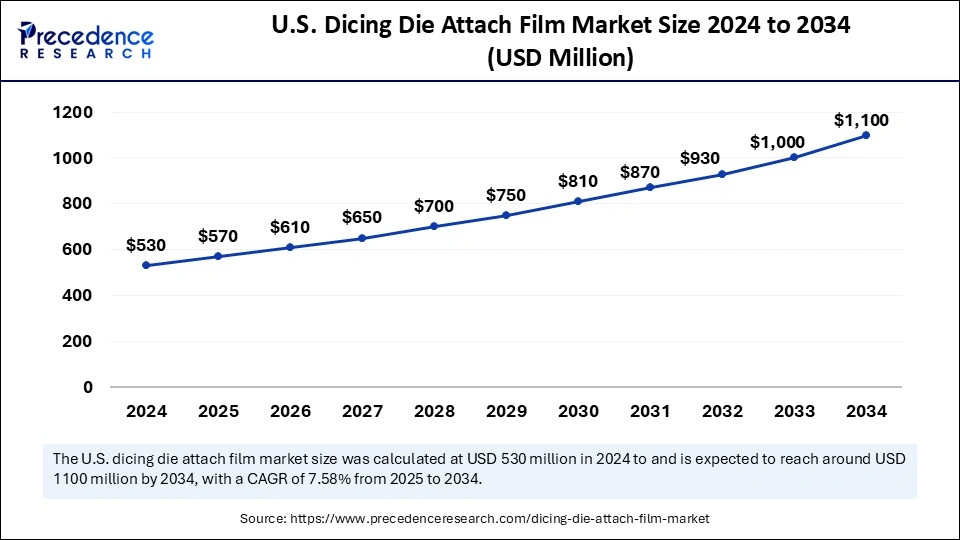

The U.S. dicing die attach film market size was exhibited at USD 530 million in 2024 and is projected to be worth around USD 1.100 million by 2034, growing at a CAGR of 7.58% from 2025 to 2034.

North America’s Sustained Dominance in the Market

North America dominated the dicing die attach film market with the largest share in 2024. The regional market growth is driven by the rise in demand for semiconductor devices in various industries. With the heightened adoption of data centers, AI, and 5G networks, the demand for semiconductor chips has increased, boosting the need for dicing die attach film. The region boasts well-known semiconductor manufacturers like Qualcomm and Intel. This further boosts the demand for die attach film used in their packaging processes.

The U.S. is a major contributor to the North American dicing die attach film market. The rising adoption of EVs and high-tech devices is expected to boost the demand for semiconductor chips, which significantly boosts the need for die attach film. Moreover, rising government investments to boost the domestic production of semiconductors support market growth. For Instance, in March 2025, the CHIPS Act brought enormous investment into the U.S. from major semiconductor firms worldwide, bringing U.S. manufacturing capabilities closer to the cutting edge and improving U.S. national security.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The rising government efforts to boost semiconductor production are a key factor boosting the growth of the market in the region. Taiwan, South Korea, and China are the world’s largest semiconductor manufacturing countries, accounting for more than 70% of the global production. Moreover, the region is at the forefront of consumer electronics and smartphone production that rely on semiconductors, boosting the demand for die attach film. Increasing adoption of advanced semiconductor packaging technologies, like heterogeneous integration, wafer-level packaging, and System-in-Package (SiP), further drive the growth of the market.

India is expected to have a stronghold on the Asia Pacific dicing die attach film market. This is mainly due to the rapid expansion of the semiconductor industry. With the growing adoption and production of smart electronics, semiconductor demand is increasing. Thus, the Indian government is making efforts to boost domestic semiconductor production. For Instance, in September 2024, at the SEMICON India 2024, Honorable Prime Minister Narendra Modi emphasized the semiconductor industry’s critical role in India’s technological advancement and reaffirmed the government’s commitment to strengthening the sector.

Europe: A Notably Growing Region

Europe is observed to grow at a notable rate in the coming years. With the increasing production of vehicles, the demand for semiconductors for automotive electronics is increasing, driving the growth of the market in this region. The rising demand for consumer electronics further supports market growth. Europe’s semiconductor industry is expanding rapidly, with the European Chips Act aiming to bolster the semiconductor ecosystem, reduce external dependencies, and boost technological innovation by focusing on R&D and manufacturing. Moreover, the increasing adoption of advanced technologies contributes to regional market growth.

The dicing die attach film market is growing rapidly due to the rising production of semiconductor devices. Dicing die attach film attaches semiconductor chips to a substrate after the dicing process. This film is mandatory when stack chips are used to achieve greater capacity in the 3D packaging of flash memory equipment. By eliminating the paste dispensing needs of low viscosity, die attach film with appropriate bonding characteristics and melt-flow with engineered molecular structures manage thermal stability, stress, and moisture absorption and sensitivity with unequaled performance. Die attach films are applied for particular electronic manufacturing since they are easy to apply to various substrates. With advances in electronic equipment requiring high-performing and smaller materials, there is an increasing need for die attach films that are both thin and quick curing as well as applied easily in constricted spaces.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.39 Billion |

| Market Size in 2025 | USD 2.32 Billion |

| Market Size in 2024 | USD 2.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.34% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Adhesive Type, Application, Form, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Production of Consumer Electronics

The rising production of consumer electronics is a major factor driving the growth of the dicing die attach film market. Consumer electronics such as smartphones, laptops, tablets, TVs, and other smart devices heavily rely on semiconductor chips, requiring dicing die attach film to securely attach chips to the substrate. The widespread adoption of Internet of Things enabled smart home devices globally further boosts the demand for advanced semiconductor packaging. As consumer electronics manufacturers focus on improving device efficiency and performance, the need for high-performance dicing die attach films with superior adhesion, thermal management, and reliability increases. Moreover, the rising demand for compact consumer electronics drives the market growth.

Poor Adhesion and High Costs

Poor adhesion of die attach film is a key factor restraining the growth of the dicing die attach film market. Poor adhesion leads to voids and failures in the packaging processes, affecting device performance and longevity. These films must maintain huge compatibility with dicing tape adhesives to prevent cross-contamination, which can lead to residues and performance issues in semiconductor packaging. Moreover, the limited availability of materials for die attach films and high costs associated with advanced films limit the growth of the market.

Advancements in Semiconductor Packaging

The rising focus on sustainability among semiconductor businesses is boosting the adoption of advanced packaging technologies, creating opportunities for the dicing die attach film market. Advanced multichip packaging enhances energy efficiency by reducing power consumption, optimizes thermal management, and lowers chip manufacturing expenses, making it a preferred choice for next-generation semiconductor applications. The shift toward highly integrated chips boosts the demand for high-performance dicing die attach films that support precision, adhesion, and reliability in complex semiconductor designs. In addition, innovations in packaging techniques unlock new avenues for the development of advanced dicing die attach films.

The epoxy based segment dominated the dicing die attach film market with the largest share in 2024. Epoxy-based die attach films exhibit excellent elasticity even when the temperature is low. Epoxy resins offer strong adhesion, making them suitable for a wide range of applications. They have superior mechanical properties, chemical structure, and strong cohesiveness. Epoxy-based die attach films are more cost-effective than others, making them the preferred choice.

The polyimide-based segment is expected to grow at the fastest rate during the forecast period. Polyimide has excellent mechanical and thermal properties, low friction, and outstanding chemical resistance. Polyimide is applied as the insulation material in various digital isolators due to its excellent thermal stability and mechanical strength. Its ESD performance, dielectric properties, and relatively less permittivity make it a superior choice for die attach films.

The thermosetting segment dominated the market in 2024. Thermoset adhesives have excellent gap-filling capabilities, high strength, and resistance to temperature and moisture. Thermosets are broadly used for structural load-bearing applications because of their robust strength and resistance to temperature and chemicals. Moreover, thermoset adhesives offer excellent thermal and mechanical properties, making them suitable for die attach films. The rise in demand for high-performance adhesives bolstered the segment.

The thermoplastic segment is anticipated to register the fastest growth over the studied period. Thermoplastic adhesives are durable, flexible, and versatile, making them suitable for use in die attach films. High strength, corrosion and chemical resistance, and resistance to impact make thermoplastic suitable for adhesives. Thermoplastic adhesives can offer strong adhesion to metal and electrical insulation, improving efficiency.

The semiconductor packaging segment dominated the dicing die attach film market in 2024. The growth of the segment is driven by the rise in the demand for compact and advanced electronic devices. Dicing die attach films are essential in semiconductor packaging, enhancing the performance and efficiency of electronic devices. Advances in semiconductor packaging technologies further bolstered the segment growth.

The LED packaging segment is anticipated to expand at a significant rate in the foreseeable future. The rising demand for LED products is a key factor supporting segmental growth. LED packaging optimizes the thermal management of LED products. Packaging ensures a mechanically strong bond in which the temperature mismatches of the leads and board materials are easily tolerated. It has huge reliability, constant bond line thickness, and enhanced temperature management, making it suitable for applications demanding high performance and miniaturization packaging.

The film roll segment dominated held the largest share of the market in 2024. This is mainly due to the cost-effectiveness of film roll compared to film sheet. Since film roll is easy to produce in large quantities, the final cost of the product is low, making it the preferred choice for applications requiring higher quantities of die attach film. Moreover, film rolls are easy to handle and come in different sizes and shapes.

The sheet segment is anticipated to register the fastest growth during the forecast period. Sheets are used as a dicing tape in semiconductor wafer dicing and as a die bonding material due to their greater accuracy in terms of die placement. Sheets are crucial for various applications requiring high-precision packaging. The sheet has strong adhesion capabilities and can easily separate the adhesive layer. Sheets come in various shapes and sizes and reduce material waste during production compared to film rolls.

The consumer electronics segment dominated the market with the largest share in 2024. The growth of the segment is driven by the rise in the production and demand for compact consumer electronics. Dicing die attach film is essential for fixing IC chips to a lead frame or interposer in consumer electronics. It helps optimize thermal management, which can cause short circuits. The increase in the adoption of semiconductor devices also bolstered the segment’s growth.

The automotive segment is likely to grow at a significant rate during the projection period. Die attach film is required for major applications in the automotive sectors, like semiconductor packaging for ADAS systems and dashboard displays. Dicing die attach films offer superior temperature conductivity, which is significant in automotive applications. The rising demand for automotive electronics is expected to boost the segmental growth.

By Material Type

By Adhesive Type

By Application

By Form

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025