What is the Digital Freight Matching Market Size?

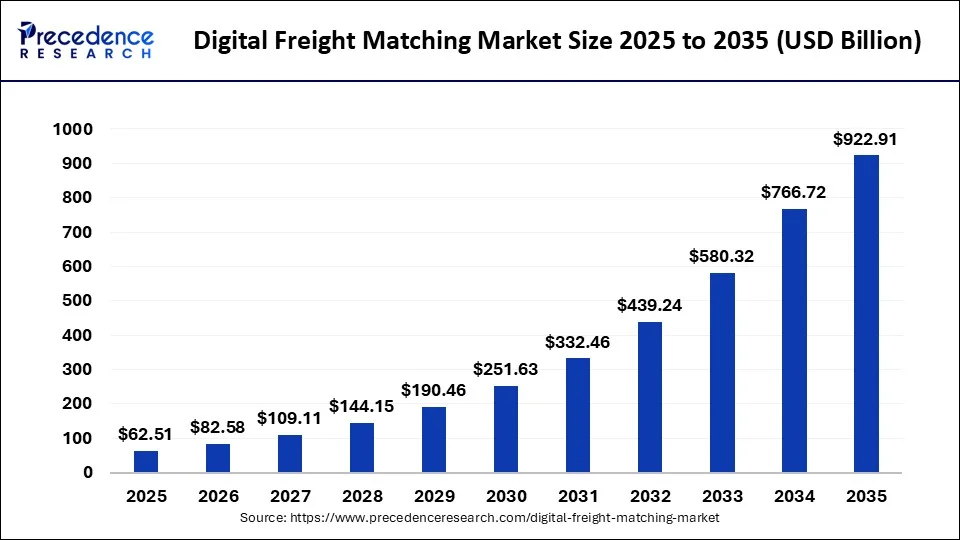

The global digital freight matching market size is calculated at USD 62.51 billion in 2025 and is predicted to increase from USD 82.58 billion in 2026 to approximately USD 922.91 billion by 2035, expanding at a CAGR of 30.89% from 2026 to 2035.

Digital Freight Matching Market Key Takeaways

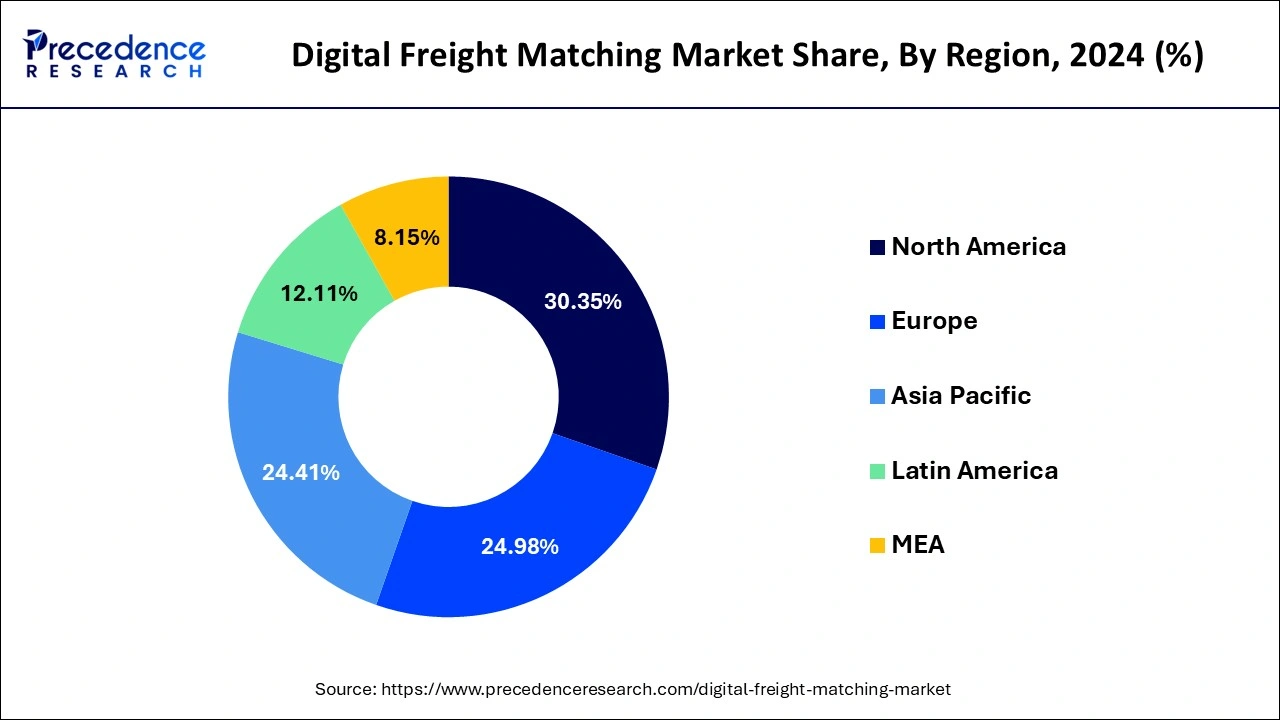

- North America dominated the global digital freight matching market with the largest market share of 32.14% in 2025.

- Asia Pacific is projected to grow at the fastest CAGR of 24.41% in the coming years.

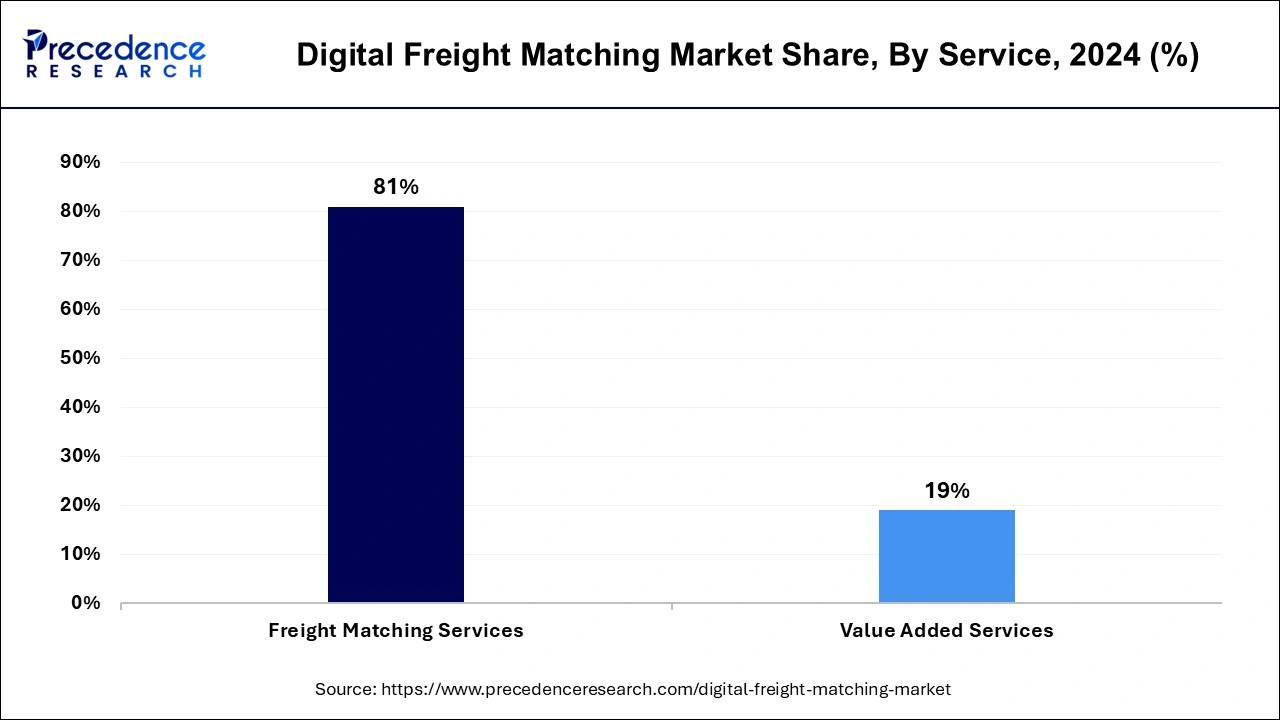

- By services, the freight matching services segment has held a major market share of 81% in 2025.

- By service, the value-added services segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

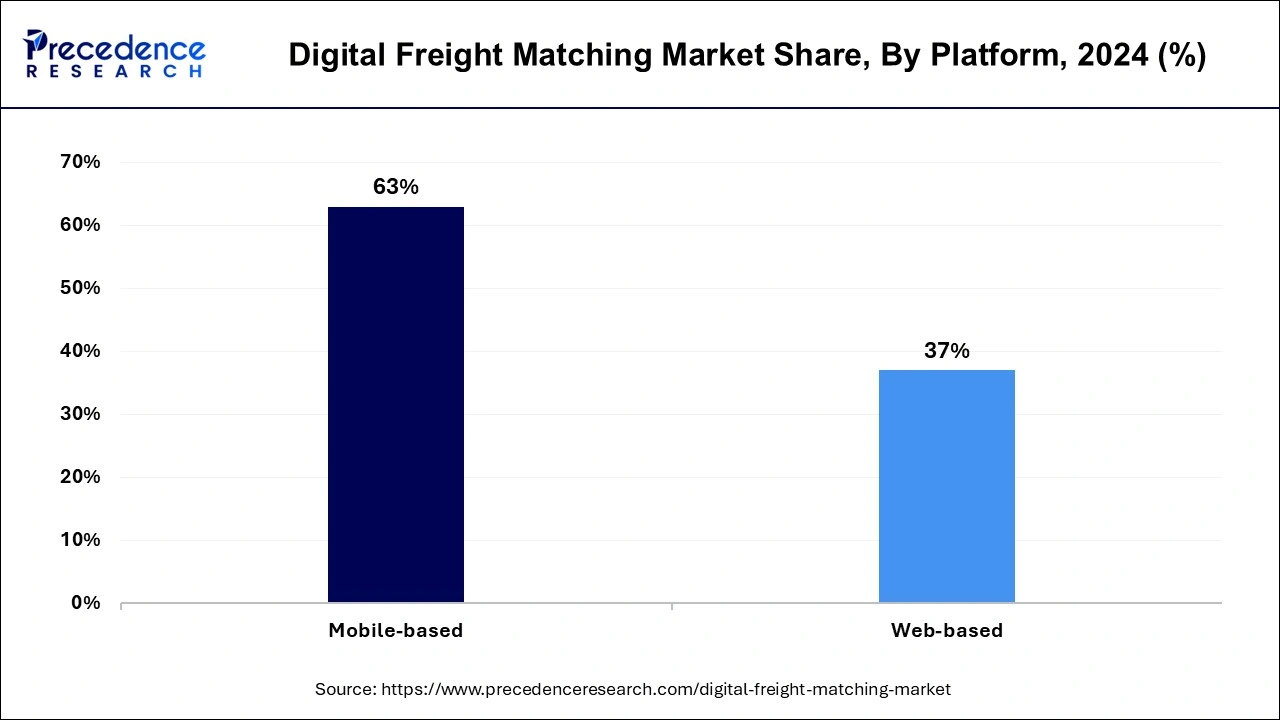

- By platform, the mobile-based segment accounted for a significant market share of 63% in 2025.

- By platform, the web-based segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By transportation mode, the full truckload segment contributed the highest market share of 43% in 2025.

- By transportation mode, the less-than-truckload segment is projected to expand at a solid CAGR in the coming years.

- By industry, the food and beverage segment led the global market with the biggest market share of 22% in 2025.

- By industry, the retail and e-commerce segment is projected to grow at the fastest rate in the market in the future years.

Market Overview

The digital freight matching market is growing dramatically due to the increasing need for up-to-date information in the supply chain. This demand has been mainly driven by the growth of e-commerce businesses that require fast, dependable, and adaptable freight solutions. Companies now want to find solutions that assist large organizations in bettering the management of the logistical processes within the e-commerce environment to help with duration and expenses. Freight matching solutions draw on the use of modern technologies, such as artificial intelligence, machine learning, and the Internet of Things, in the logistics chain. These technologies allow the identification of vehicles' location, the determination of the optimal route, and the creation of conclusions and forecasts, making business processes more efficient and decreasing operational expenses.

Impact of Artificial Intelligence (AI) on the Digital Freight Matching Market

Artificial intelligence enhances an extensive range of improvements within the digital freight matching market by enhancing the speed and accuracy of decisions made. Intelligent devices improve productivity through multiple functions, including matching loads, choosing routes, and anticipating demand. Machine Learning makes it possible for logistics companies to better strategize. Additionally, real-time information handling helps shippers and carriers in timely information exchange, lesser equipment idle time, and optimum use of assets.

Digital Freight Matching Market Growth Factors

- Rising demand for faster deliveries: Increased consumer expectations for faster delivery times are driving the need for more efficient freight-matching solutions.

- Improved data analytics capabilities: Advanced data analytics enables better decision-making, enhancing operational efficiency and optimizing freight routes.

- Rising fuel costs: The need to minimize fuel consumption and optimize routes in response to rising fuel prices is driving the adoption of digital freight matching technologies.

- Government incentives for digitization: Government support and subsidies for digital transformation in logistics are expected to accelerate the adoption of digital freight solutions.

- Increasing supply chain complexity: The growing complexity of global supply chains is pushing logistics providers to adopt digital solutions for better coordination and management.

- Improved connectivity infrastructure: Enhanced mobile and internet connectivity, particularly in developing regions, is expected to drive the growth of the digital freight matching market globally.

Digital Freight Matching Market Outlook

Increased consumer expectations for faster delivery times are driving the need for more efficient freight-matching solutions.

The digital freight matching (DFM) market is anticipated to continue its global expansion, driven by technology adoption, the rise of e-commerce, and increasing demand for supply chain efficiency.

Major investors in the market include venture capital firms, private equity firms, and strategic investors like Uber Technologies, Inc., AEA Investors LP, Roper Technologies, Inc., and Tata Motors.

The startup ecosystem in the market is fuelled by the need for automation, efficiency, and transparency in supply chains, with numerous startups leveraging AI, the Internet of Things (IoT), and blockchain to disrupt traditional brokerage models.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 62.51 Billion |

| Market Size in 2026 | USD 82.58 Billion |

| Market Size in 2035 | USD 922.91 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 30.89% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Platform, Transportation Mode, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing e-commerce sector

Growing e-commerce activity is projected to contribute significantly to the digital freight matching market expansion. This fast-growing online shopping industry puts pressure on delivery solutions, expecting growth in freight-matching platforms. Distribution channels and stores have merged spending for technology solutions in logistics to cope with the high delivery volume and to meet timely delivery commitments. Better shipper-carrier organization leads to quicker responses to supply chain requirements swings. Furthermore, with growing e-commerce businesses in emerging countries, SMEs have a chance to be a part of these platforms, leading to an increase in the overall use of e-commerce.

- According to a report published by the European Commission, in 2023, 92% of surveyed individuals used the Internet, and 70% purchased or ordered products or services online within the 12 months prior to the survey.

Restraint

Resistance to technological change

Resistance to adopting new technologies among traditional logistics providers is anticipated to restrain the digital freight matching market growth. A large number of small and family-run freight companies still use traditional techniques since they are not aware of technologies. They lack adequate technological knowledge and skills, and they are also most likely to develop operational hitches during the conversion process. Furthermore, established management teams are inclined to achieve cost efficiencies at the expense of investment in new digital platforms.

Opportunity

Increasing preference for real-time freight visibility

Increasing preference for real-time freight visibility is anticipated to create immense opportunities for the digital freight matching market. The supply chain is under pressure to be more transparent from the business perspective for better ordering and effective planning. These needs are met by the digital platform, which has the tools for monitoring in real-time to reduce the aspects of insecurity in freight management. Increased pressures in customer satisfaction and supply chain vulnerability make the improvement of real-time freight tracking systems possible. Furthermore, this trend points to the need for real-time visibility solutions to improve optimal operational performance and satisfy customers' needs in the course of a fast-evolving economy.

- According to the 2024 SINAY SAS report, a company specializing in maritime data solutions, businesses with real-time supply chain visibility achieve a 20% reduction in lead times.

Digital Freight Matching Market Segment Insights

Service Insights

The freight matching services segment held a dominant presence in the digital freight matching market in 2025 due to its ability to optimize the allocation of shipments, reduce empty miles, and increase the overall efficiency of freight operations. The pressure on shippers and carriers to cut delivery costs and reduce transportation time results in the increased usage of freight-matching services. Such services enable real-time data sharing, route optimization, automated load matching, and faster delivery of products and services with lower operational expenses. Additionally, these technologies help predict demand patterns.

The value-added services segment is expected to grow at the fastest rate in the digital freight matching market during the forecast period of 2025 to 2034, owing to the growing thrust of organizations to enhance shipment visibility throughout the supply chain. The higher need for customer satisfaction is expected to push the adoption of value-added services because of the increasing complexity of the supply chain. These services were expected to help shippers increase supply chain security, adherence to the set laws and regulations, and control of disruption in the network.

Platform Insights

The web-based segment accounted for a considerable share of the digital freight matching market in 2025 due to the growing reliance on centralized, accessible digital solutions in logistics operations. These websites provide a full package of tools containing tracking in real-time, freight matching, and optimization of routes with the help of permanent access to them from the computer. The flexibility in flexibility that comes with using website interfaces on different gadgets and the integration and enterprise-wide control that come with web applications. They have made web-based platforms a go-to for logistics service providers and shippers.

The mobile-based segment is anticipated to grow with the highest CAGR in the digital freight matching market during the studied years, owing to the increasing reliance on mobile technology and the need for on-the-go access to freight management solutions. These platforms are used to schedule deliveries, monitor freight in real-time, and interact with carriers and shippers from your smartphone or tablet. Mobile workforce management and the change of logistics practices toward being more flexible and adaptable are going to help the growth of mobile-based platforms. Additionally, higher mobility with instant booking and freight tracking has made mobile-based solutions quite appealing to small businesses and independent carriers.

Transportation Mode Insights

In 2025, the full truckload segment led the global digital freight matching market due to the increasing demand for large shipments and the ability to maximize truck capacity, reducing costs per unit. FTL services are usually chosen by shippers in cases where they have big volumes of shipment and need direct routes from the source to the door without having to pass through other locations. The financial predictions about the further development of e-commerce and industry, where a full truckload is needed for the transportation of products, promote the staying of FTL.

According to a report published by Hostinger., as of September 2024, 2.71 billion consumers worldwide shop online.

The less-than-truckload segment is projected to expand rapidly in the digital freight matching market in the coming years, owing to the increasing demand for flexible and cost-effective shipping solutions. Small and medium-sized enterprises are expected to be a driving force to this growth, as they look for cheaper ways of moving consignments of goods. The benefit of LTL is cutting costs by sharing the expenses of transport with other consignees who have similar, smaller volumes. LTL services facilitate digital freight matching, helping to find the best routes and capacities for providing services.

Industry Insights

The food and beverage segment dominated the global digital freight matching market in 2025 due to the growing need for fast, efficient, and also temperature-sensitive logistic services. The global population also continues to increase together with its demand for convenient delivery, contributing to the need for improvements in the logistic systems of this industry.

Industry challenges that pressure manufacturers of food and beverages include variations in demand, the perishable nature of the products, and a strict legal regime emanating from transportation guidelines. There are fairly evident common issues when it comes to freight matching, and having digital freight matching platforms address this problem and offer real-time visibility and optimal routes whereby overcoming these problems is achievable with ease. Furthermore, as the e-commerce function continues to grow, the implementation of these solutions is expected to increase.

The retail and e-commerce segment is projected to grow at the fastest rate in the digital freight matching market in the future years, owing to the massive shift towards online shopping and the increasing demand for faster deliveries. The primary dependency of this sector depends on the freight providers to manage large numbers of small shipments, which should arrive at the customers' places as soon as possible. The increased demand for same-day or now next-day delivery is likely to force retailers and logistics service providers to spend on conventional freight-matching service solutions that increase efficiencies and cut costs. Furthermore, with improved technological approaches in supply chain management, e-commerce facilities have gradually incorporated advanced freight-matching technologies that are forecast to record steep growth.

- According to the National Retail Federation (NRF), online retail sales across the United States only are expected to rise by 10% per annum.

Digital Freight Matching Market Regional Insights

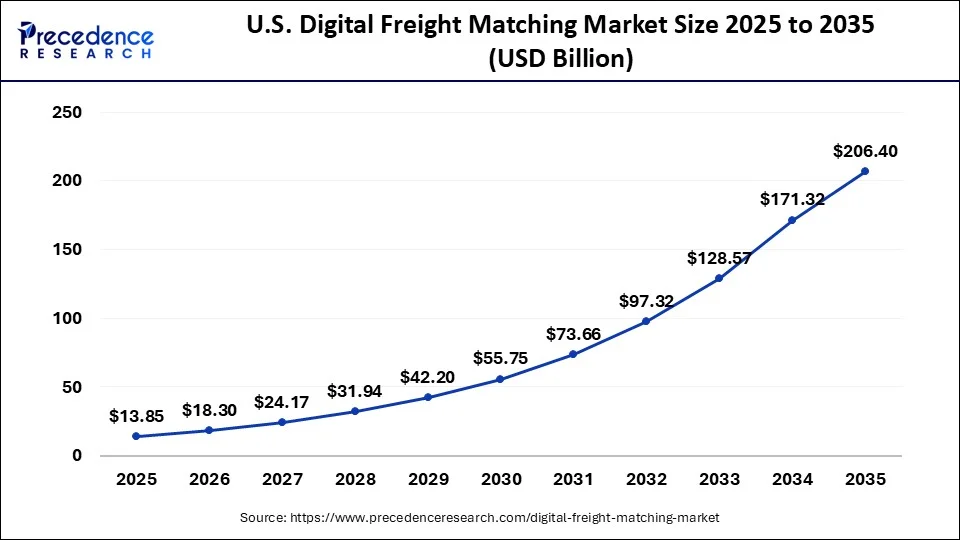

The U.S. digital freight matching market size is exhibited at USD 13.85 billion in 2025 and is projected to be worth around USD 206.40 billion by 2035, growing at a notable CAGR of 31.02% from 2026 to 2035

North America dominated the global digital freight matching market in 2025 due to the strong logistics and transport infrastructure and the attractiveness of digital supply solutions as a means of logistics advancement and expense decrease in growth. The increase in the use of e-commerce and other online shopping systems has led to the increase in the need for providers of faster freight delivery services in the United States and Canada, hence the popularity of freight matching platforms. Additionally, improvements in artificial intelligence and the Internet of Things (IoT) are creating better improvements for freight optimization in the region.

Asia Pacific is projected to host the fastest-growing digital freight matching market in the coming years, owing to the fast-growing e-commerce channels, increasing manufacturing capacity, and a strategic supply-chain hub of the world. India and Japan have been pulling through an increased demand for logistics since more and more goods are being manufactured and consumed. The adoption of digital platforms throughout the region, but especially in China and India, improves the utilization of freight services and objectives optimal routes of transport while reducing its cost. Furthermore, the growing attention to emerging economies like India and SEA facilitates the advance of digital freight-matching technologies.

- According to a report published by the International Trade Administration, global B2C e-commerce revenue is expected to reach USD 5.5 trillion by 2027, growing at a steady compound annual growth rate (CAGR) of 14.4%.

In North America, the U.S. dominated the market due to the growing demand for visibility and efficiency in supply chains, enabled by technological innovations such as AI and data analytics. Businesses in the country are seeking new ways to enhance the effectiveness of their logistics operations, which can impact positive market growth in the U.S.

In the Asia Pacific, India led the market due to the growing need for cost savings and operational efficiency, along with the surge in the e-commerce sector. Companies in the country are using digital freight matching to minimize empty miles, optimize fleet management, and operational costs through better route optimization.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be credited to the growing need for efficiency, sustainability, and increasing regulatory pressure to reduce carbon emissions. Also, the country's wide network of cross-border trade routes creates lucrative demand for various digital solutions.

The growth of the market in Germany can be driven by Germany's strong commitment to climate change targets by reducing emissions and expanding the e-commerce sector, which fuels demand for more scalable, faster, and real-time logistics solutions, leading to positive market growth soon.

Digital Freight Matching Market Value Chain Analysis

This stage involves shippers, including manufacturers, retailers, and e-commerce companies, creating a demand for freight transportation.

This is the core of the DFM market, where technology acts as an intermediary to match shippers with available carriers.

DFM platforms offer carriers direct access to a wider range of loads, reducing empty miles and increasing revenue.

DFM platforms provide VAS to enhance their offerings, which is a rapidly growing segment of the market.

Digital Freight Matching Market Companies

Provides a variety of third-party logistics (3PL) services, and can also function as a 4PL or 5PL, overseeing the entire supply chain.

offers a free load board with map and list views, available 24/7. It offers access to many loads, reliable service, and fast payment. The app allows drivers to scan and submit load paperwork.

Other Major Key Players

- Cargomatic Inc.

- Convoy (Flexport Freight Tech LLC)

- Freight Technologies, Inc.

- Freight Tiger

- Full Truck Alliance (JiangSu ManYun Software Technology Co., Ltd.)

- Redwood Logistics

- Roper Technologies, Inc.

- XPO, Inc.

Latest Announcements by Industry Leaders

- December 17, 2024 – DAT Freight & Analytics

- CEO Trucker Tools – Kary Jablonski

- Announcement- DAT Freight & Analytics has acquired the operations of Trucker Tools LLC, a leader in load visibility, automated booking, digital freight matching, and carrier engagement for commercial trucking. “This is a tremendous opportunity for Trucker Tools to grow and benefit from the resources, expertise, and market reach of DAT,” said Kary Jablonski, CEO of Trucker Tools. “By joining DAT, we're better positioned to shape the future of our industry while unlocking new opportunities for customers, employees, and partners.”

Recent Developments

- In March 2023, Freight Technologies (Fr8Tech) launched a digital freight-matching platform offering less-than-truckload (LTL) services in Mexico. The new Fr8Now platform uses machine learning (ML) algorithms to match shippers with carriers, according to a press release on March 16.

- In February 2022, DAT Freight & Analytics announced an expanded partnership with Parade through a minority investment, enabling deeper integration between Parade and North America's largest freight marketplace. The partnership will allow mutual broker customers to select and price loads on DAT's load board using Parade's artificial intelligence.

- In July 2024, global logistics company C.H. Robinson unveiled a major efficiency improvement for carriers with the launch of an enhanced load matching platform. Powered by a new algorithm that utilizes data science and artificial intelligence (AI), the platform offers more timely and precise load recommendations based on a carrier's unique search history and posted trucks within Navisphere Carrier.

Segments Covered in the Report

By ServiceÂ

- Freight Matching Services

- Value Added Services

By Platform

- Mobile-Based

- Web-Based

By Transportation Mode

- Full Truckload (FTL)

- Intermodal

- Less-Than-Truckload (LTL)

- Others

By Industry

- Automotive

- Food and Beverages

- Healthcare

- Manufacturing

- Oil and Gas

- Others

- Retail and E-Commerce

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting