September 2024

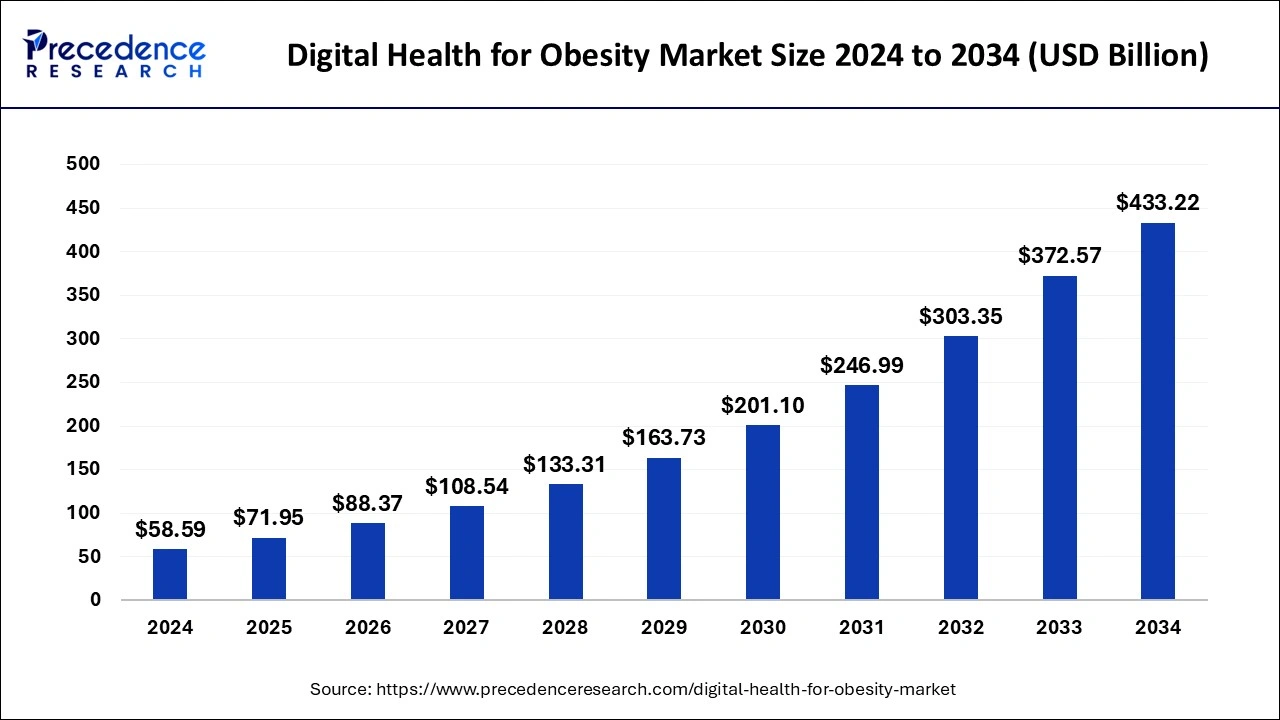

The global digital health for obesity market size is calculated at USD 58.59 billion in 2025 and is forecasted to reach around USD 433.22 billion by 2034, accelerating at a CAGR of 22.15% from 2025 to 2034. The North America digital health for obesity market size surpassed USD 21.09 billion in 2024 and is expanding at a CAGR of 22.19% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital health for obesity market size was estimated at USD 58.59 billion in 2024 and is predicted to increase from USD 71.95 billion in 2025 to approximately USD 433.22 billion by 2034, expanding at a CAGR of 22.15% from 2025 to 2034. Rising awareness about digital health for obesity can boost the market.

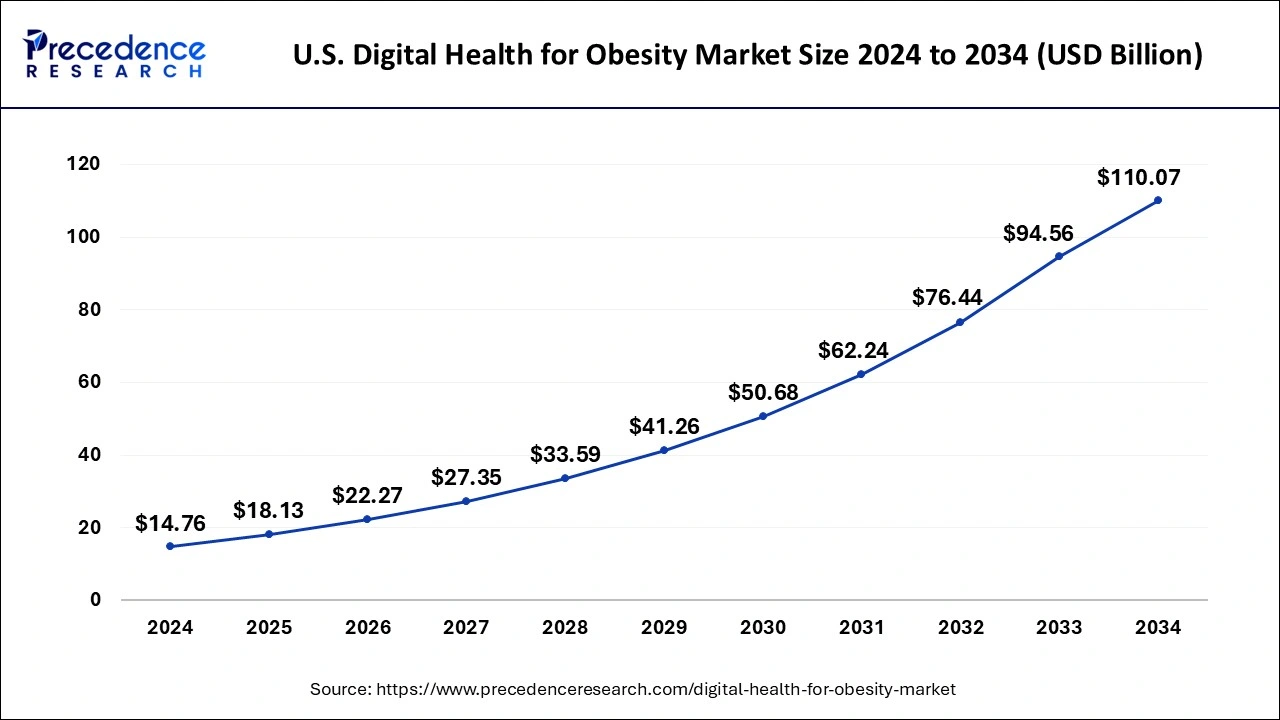

The U.S. digital health for obesity market size was estimated at USD 14.76 billion in 2024 and is predicted to be worth around USD 110.07 billion by 2034, at a CAGR of 22.25% from 2025 to 2034.

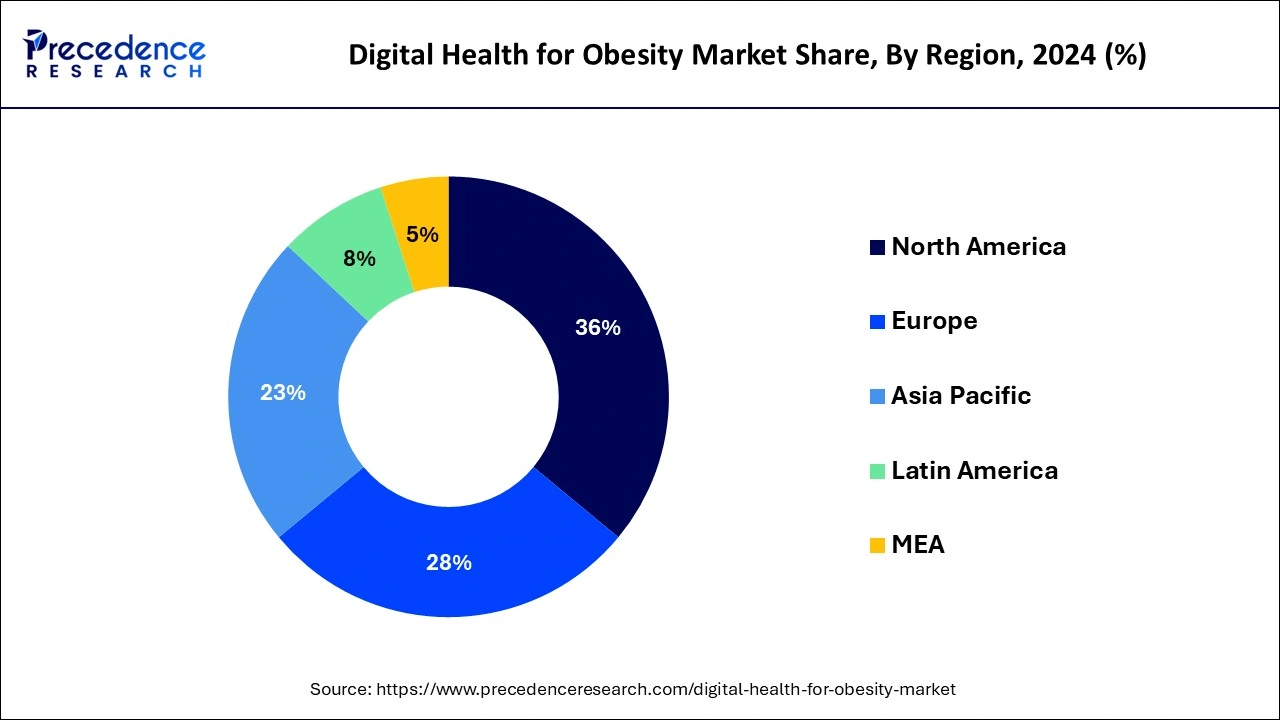

North America dominated the digital health for obesity market by region, in 2024. The high rate of obesity in the area fuels the need for remedies. North America is home to hubs of technology innovation and sophisticated healthcare infrastructure, which support the creation and uptake of digital health solutions. Further driving market expansion is the region's legislative framework and reimbursement practices, which frequently facilitate the incorporation of digital health technologies into healthcare systems. North America's leadership in this field is a result of the existence of important firms and investments made in research and development.

Asia Pacific is expected to grow at the highest CAGR in the digital health for obesity market by region during the forecast period. The obesity rates are rising quickly in the area due to dietary changes, urbanization, and changing lifestyles. Digital health technologies are among the many practical solutions that are in high demand as obesity becomes a more serious health concern. The potential of digital health to address public health issues, such as obesity, is becoming more and more recognized by governments and healthcare players in the region. The market expansion is being driven by investments in healthcare infrastructure and legislation that facilitate the adoption of digital health.

Digital Health for Obesity Market Overview

The digital health for obesity market refers to the use of technology in obesity prevention, management, and treatment, which is referred to as digital health for obesity. This sector uses a range of digital tools and platforms, including wearables, online communities, mobile apps, and telemedicine, to offer resources, support, and individualized interventions to people who are obese. The users can track their food, exercise, and weight loss efforts with a variety of smartphone apps.

To encourage better behaviors and weight control, these applications frequently include features like goal setting, food planning, exercise routines, and calorie counting. Smart-watches and wearable fitness trackers can track sleep patterns, heart rate, and activity levels. These gadgets motivate users to lead healthier lifestyles and to keep active by giving them feedback in real-time. Telemedicine systems facilitate remote consultations between patients and healthcare providers, hence easing access to obesity-related services such as behavioral treatment, nutrition counseling, and medical consultations.

In addition to tracking vital signs and other health data, remote monitoring systems also allow medical professionals to keep an eye on their patient's progress and take appropriate action. By providing individualized interventions, enhancing access to care, and enabling people to take charge of their own health and well-being, digital health technologies present potential opportunities to address the complex and diverse nature of obesity.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 22.15% |

| Market Size in 2025 | USD 71.95 Billion |

| Market Size by 2034 | USD 433.22 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness about digital health for obesity

The rising awareness about digital health for obesity can boost the digital health for obesity market. Digital health care for obesity gives people the ability to take care of their health. The growing awareness of digital health for obesity is driving the demand for their products through wearables, online communities, mobile apps, and telemedicine. Additionally, the ease of use, personalized advice, and ongoing monitoring are provided by digital health solutions, all of which are essential for effectively controlling obesity.

Rising prevalence of obesity

The rising prevalence of obesity can boost the digital health for obesity market. As more people are searching for efficient methods to manage their weight and enhance their health, the market need for solutions, including digital ones, increases due to the rising prevalence of obesity. Digital platforms are appealing possibilities for those who want to address their weight-related concerns because they provide accessibility, convenience, and customized solutions. Digital solutions may also reach a large audience due to their scalability, which makes them an excellent choice for tackling the rising obesity pandemic worldwide.

As per the journal published by the National Institutes of Health, obesity prevalence has almost trebled globally since 1976, with 13% of the world’s population (or > 650 million people) now living with obesity. In most developed countries, obesity rates are much higher than this, such as the U.S., where > 40% of U.S. adults now have obesity, and the numbers continue to rise, particularly in children and adolescents. In the UK, more than a quarter of adults and more than one in five 11-year-olds are now classified as obese, which puts them at increased risk of associated diseases such as type 2 diabetes, cardiovascular disease, and certain cancers.

Privacy and security concerns

Privacy and security concerns may slow the digital health of the obesity market. The digital health for obesity market often gathers sensitive personal data and health information. The safe handling of this data is crucial to avoid misuse. Building trust among consumers about privacy and security concern of digital health for obesity is important and building trust can be helped by activities like clear communication about privacy policies, robust security measures, and regulatory compliance.

Building trust among consumers about privacy and security concerns

Building trust among consumers about privacy and security concerns of digital health for obesity may be the opportunity to grow the digital health for obesity market. Additionally, focusing on the advantages of digital health for obesity, such as ease of use, personalized advice, and ongoing monitoring provided by digital health solutions, all of which are essential for effectively controlling obesity, can build trust and promote the adoption of digital health for the obesity market.

The services segment dominated the digital health for obesity market by component in 2024. Services can provide customized solutions, which are essential for meeting the unique needs of individuals with obesity. Examples of these solutions include individualized diet programs, exercise routines, and behavioral treatment. Services frequently offer complete care that extends beyond calorie or step tracking. They might provide assistance from medical experts, such as dietitians, nutritionists, psychologists, and doctors, to handle different facets of managing obesity. For long-term weight control, digital health services can provide continuous behavioral support in the form of coaching and motivational tools to assist people in adopting and maintaining healthy lifestyle changes. The provision of remote services enhances accessibility and convenience, particularly for persons who may encounter obstacles in accessing conventional healthcare services, by enabling users to obtain help and guidance from any location. Advanced data analytics is used by many services.

The software segment is expected to grow at a rapid pace in the digital health for obesity market by component during the forecast period. The capacity of digital health software to track progress, create individualized solutions, and provide ongoing remote support is the main reason for the software segment's anticipated growth in the obesity industry. Software is becoming an essential tool in the fight against obesity because of technological advancements that allow it to include features like food tracking, activity planning, behavior change, and even virtual coaching. Software solutions can also reach a greater number of people more readily due to their scalability, and their ability to interface with wearables and other digital health tools increases their efficacy.

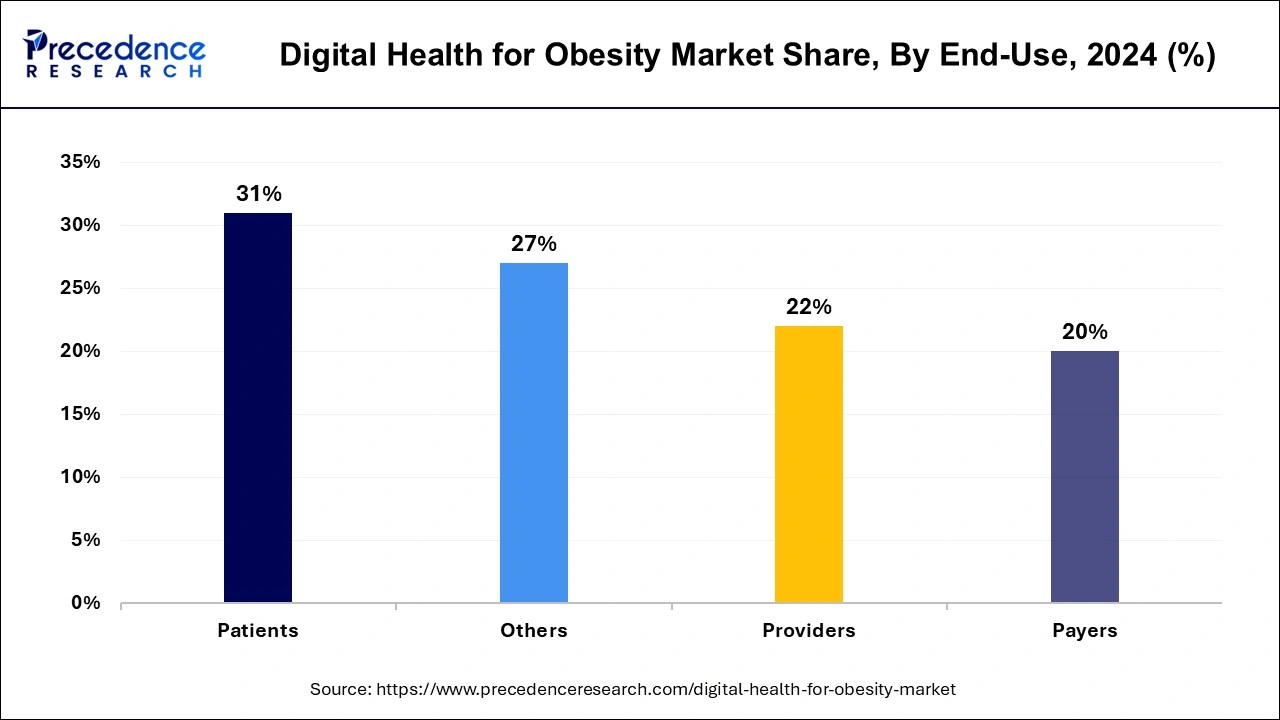

The patients segment dominated the digital health for obesity market by end-use in 2024 and is expected to sustain this dominance throughout the forecast period. This is because the patients are actively looking for assistance and response to manage their obesity.

The digital health platforms allow people to take charge of their health journey by providing ease and customized resources. By looking for products that provide patients with personalized advice, tracking capabilities, and support systems to assist them in reaching their weight control targets, patients dominate the digital health for obesity market and are observed to sustain the dominance of these solutions.

By Component

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025