March 2025

Digital Lending Platform Market (By Solution: Business Process Management, Lending Analytics, Loan Management, Loan Origination, Risk & Compliance Management, Others; By Service: Design & Implementation, Training & Education, Risk Assessment, Consulting, Support & Maintenance; By Deployment: On-premise, Cloud; By End-use: Banks, Insurance Companies, Credit Unions, Savings & Loan Associations, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

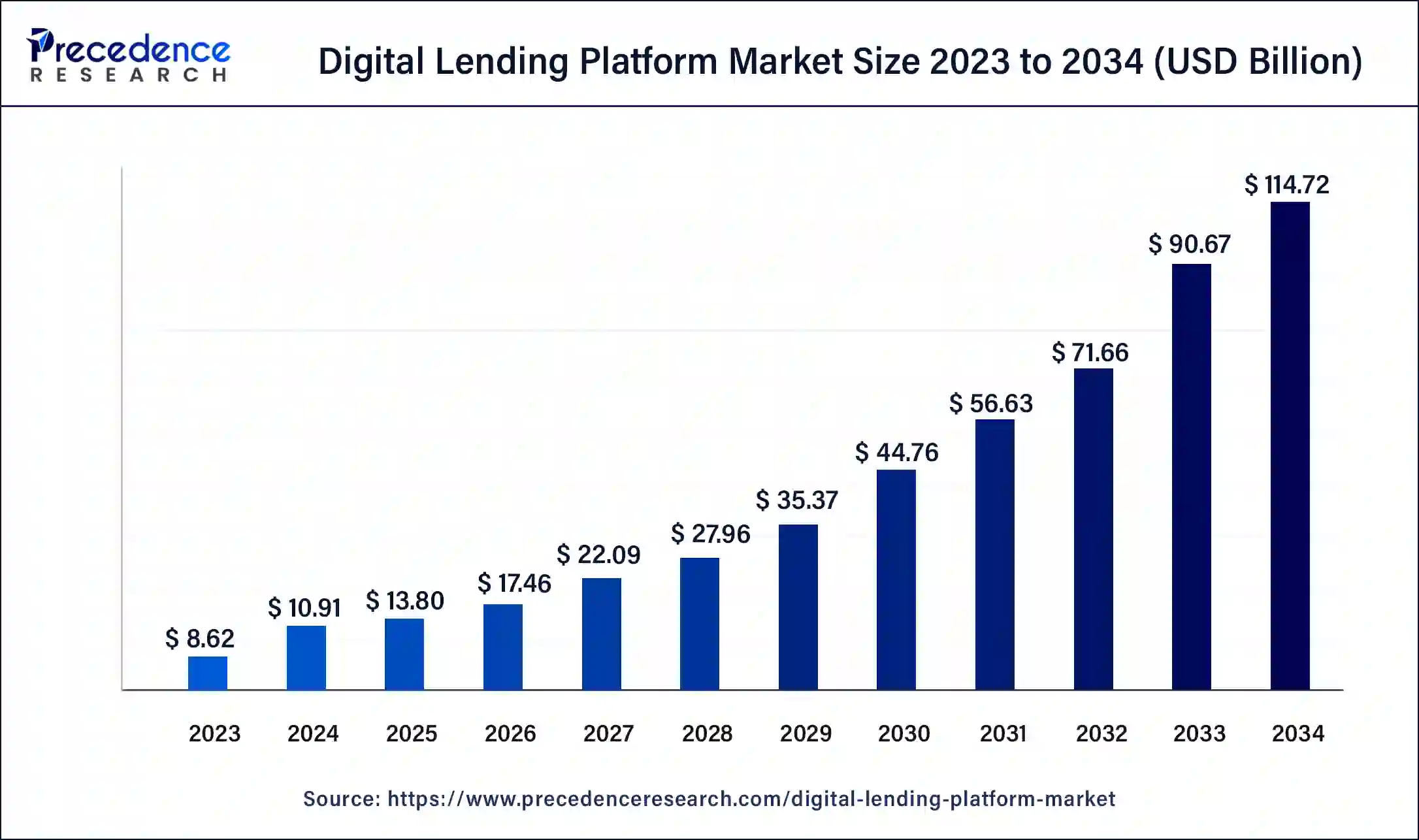

The global digital lending platform market size is expected to be worth USD 10.91 billion in 2024 and is anticipated to reach around USD 114.72 billion by 2034. The market is expanding at a solid CAGR of 26.53% over the forecast period 2024 to 2034. The North America digital lending platform market size reached USD 3.02 billion in 2023. The benefits offered by digital lending platforms, such as enhanced loan-optimized loan processes, can drive the digital lending platform market growth.

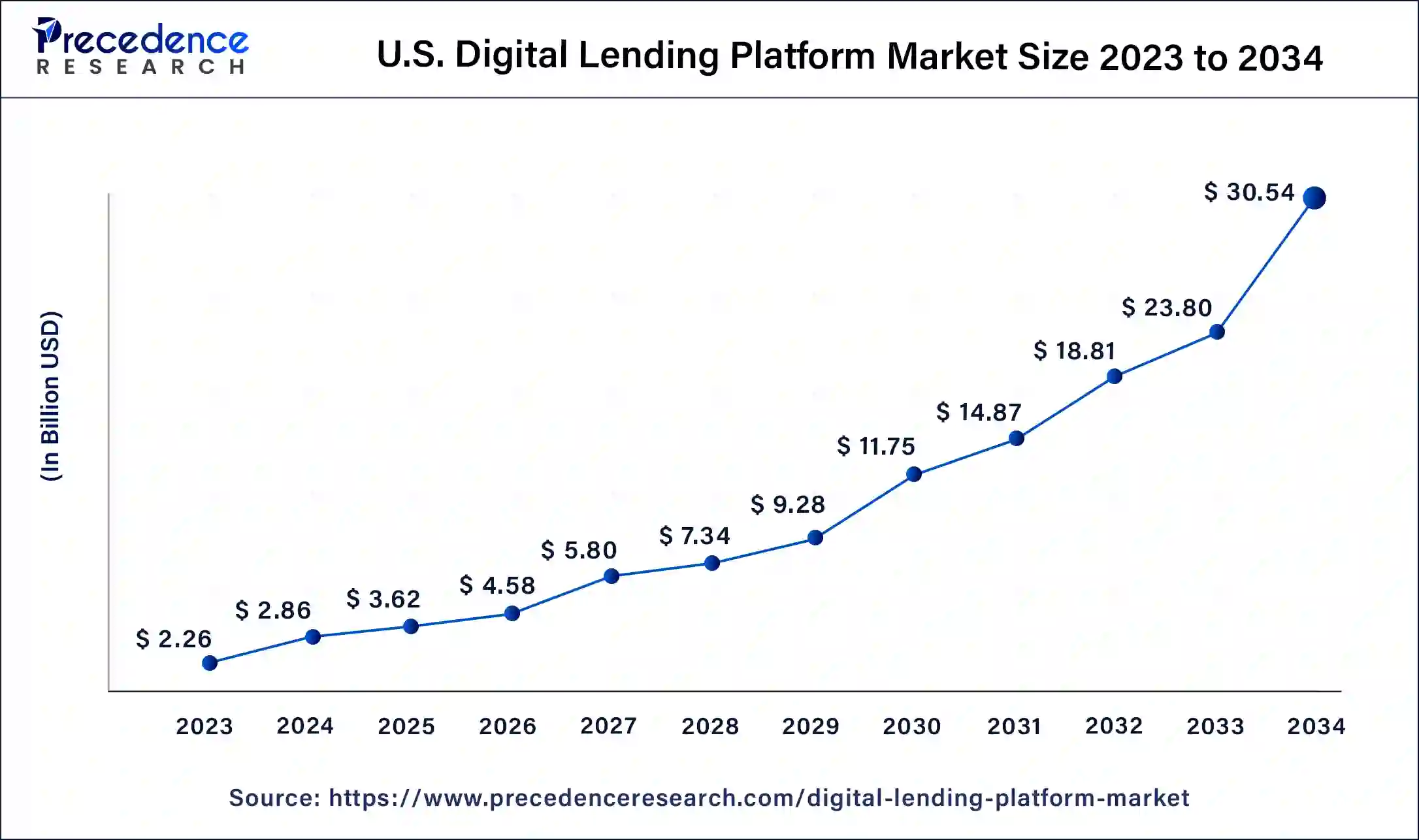

The U.S. digital lending platform market size was exhibited at USD 8.62 billion in 2023 and is projected to be worth around USD 114.72 billion by 2034, poised to grow at a CAGR of 26.53% from 2024 to 2034.

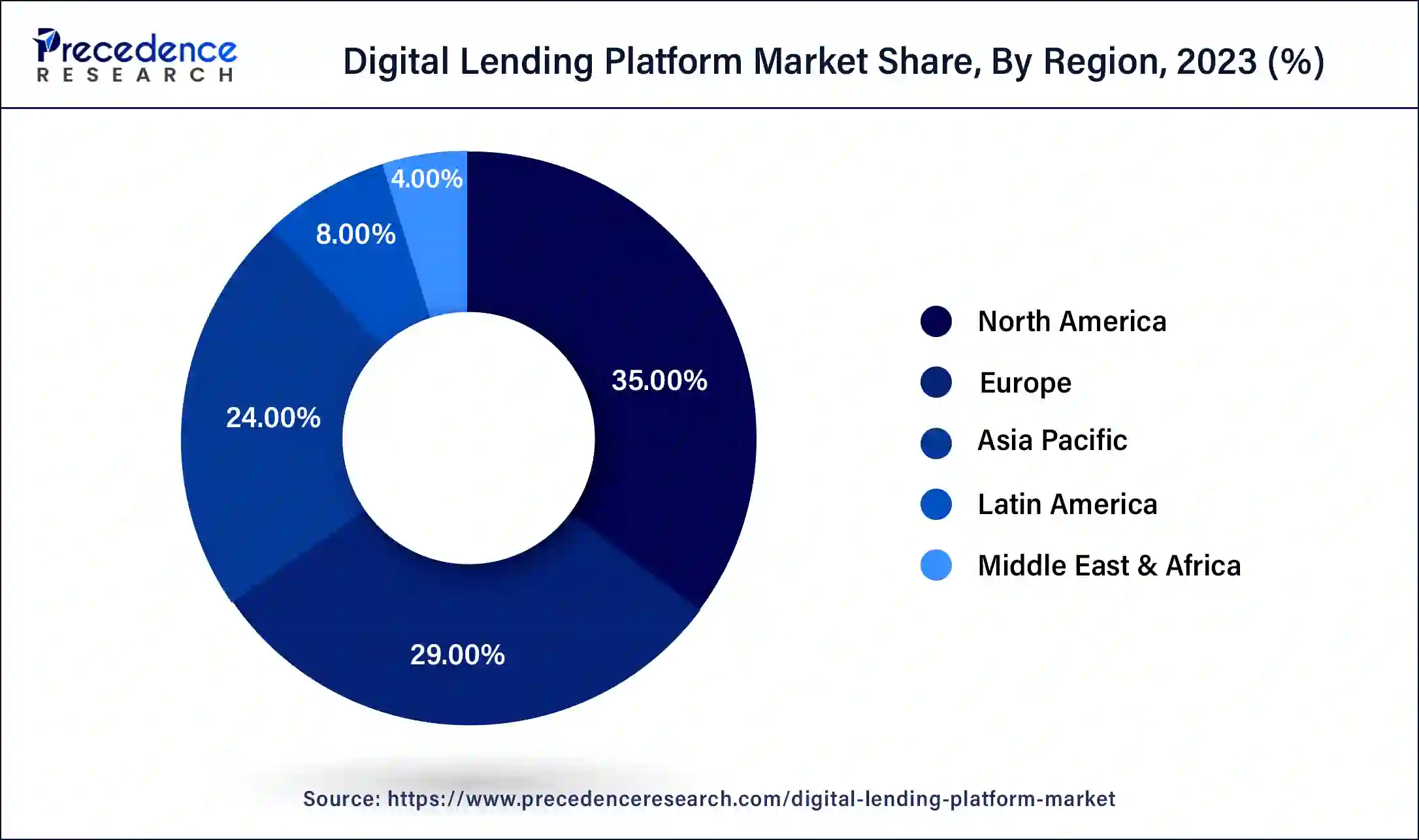

North America dominated the digital lending platform market in 2023. The region has been an early adopter of cutting-edge technologies, leading to a robust demand for digital, end-to-end financial solutions in North America. Moreover, the sizable mobile workforce in the area is prompting financial institutions to digitize their services and enhance customer experience. To gain a significant competitive edge, financial institutions are striving to differentiate themselves by introducing innovative digital services.

Asia Pacific is expected to show the fastest growth in the digital lending platform market through the forecast period. The region has a substantial population with a notable proportion of individuals who are unbanked or underbanked, driving a significant demand for alternative lending solutions. Digital lending platforms offer accessible and convenient avenues for these individuals to obtain credit. In certain Asian countries, regulatory frameworks have been supportive in fostering innovation and advancing digital financial services.

A digital lending platform offers borrowers a seamless and convenient experience for applying for loans, uploading necessary documents, receiving instant approvals, and managing their loan accounts online. Lenders use these platforms to automate the underwriting process, evaluate credit risk with advanced algorithms and machine learning models, and efficiently handle loan portfolios. Digital Lending Platforms allow consumers to apply for personal loans, auto loans, or credit lines entirely online, significantly reducing the time and effort needed for loan processing. Traditionally a complex and paper-intensive procedure, mortgage lending is now being revolutionized by digital platforms that provide online applications, document uploads, and real-time status updates.

| Report Coverage | Details |

| Market Size by 2034 | USD 114.72 Billion |

| Market Size in 2023 | USD 8.62 Billion |

| Market Size in 2024 | USD 10.91 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 26.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Solution, Service, Deployment, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of online banking services

Globalization and the increasing use of online banking services are accelerating the shift toward digitalization in lending processes in the digital lending platform market. This shift is a key factor influencing the adoption of digital lending platforms (DLP) in the banking, financial services, and insurance (BFSI) sector, as these platforms enable better decision-making, improved client experiences, and significant cost savings. Additionally, financial institutions worldwide are swiftly embracing digital channels for lending and managing pandemic-related challenges in response to the coronavirus (COVID-19) outbreak.

Challenges with infrastructure and network connectivity

In the digital lending platform market, outdated telecom infrastructures fall short of providing high-capacity connectivity and low latency, which results in unsatisfactory customer experiences and reduced service quality. Hence, digital lending companies that depend on high-speed internet and online services are expected to face challenges in implementing these solutions. Due to prolonged approval processes, businesses in these regions continue to rely more heavily on offline lending solutions to ensure better understanding and customer satisfaction.

Integration of AI into the banking system can create market opportunities

Many firms are collaborating with traditional banks to bring digital lending solutions to underserved markets. They focus on small businesses by providing specific lending solutions to support their growth. In the digital lending platform market, the advancements in the market include integrating AI-driven credit scoring for quicker loan approvals, partnering with e-commerce platforms to offer instant financing options at checkout, and utilizing blockchain technology to ensure secure and transparent credit transactions. Furthermore, the expansion of the gig economy through small loans to freelancers and gig workers is poised to create opportunities for companies.

The business process management segment dominated the digital lending platform market in 2023. Business process management has surged in popularity due to its capacity to cut operational costs and significantly increase productivity. The advantages of business process management in lending, such as improved customer satisfaction, increased employee efficiency, minimized errors, and reduced paper usage, are also expected to be the main factors driving market growth.

The lending analytics segment is anticipated to grow at the fastest rate in the digital lending platform market over the forecast period. This is because lending analytics enable lenders to conduct customer segmentation analysis and enhance customer acquisition efforts. Additionally, these analytics aid businesses in achieving faster and more efficient customer onboarding, ultimately improving the customer experience. Many companies providing lending analytics solutions are adopting strategies such as mergers, acquisitions, and strategic partnerships to strengthen their offerings.

The design & implementation segment led the global digital lending platform market in 2023. The design and implementation segment provides benefits such as operational cost savings and a flexible, agile management approach. Financial institutions need a design and implementation framework to enable the use of digital lending platforms. This framework can also help financial institutions to conduct their lending activities more efficiently.

The consulting segment is projected to witness the fastest growth in the digital lending platform market during the forecast period. Consulting services help digital lending service providers enhance operational speed and efficiency. Many companies consulting for digital lending platform providers concentrate on strategies like partnerships, mergers, and other approaches to bolster their market positions.

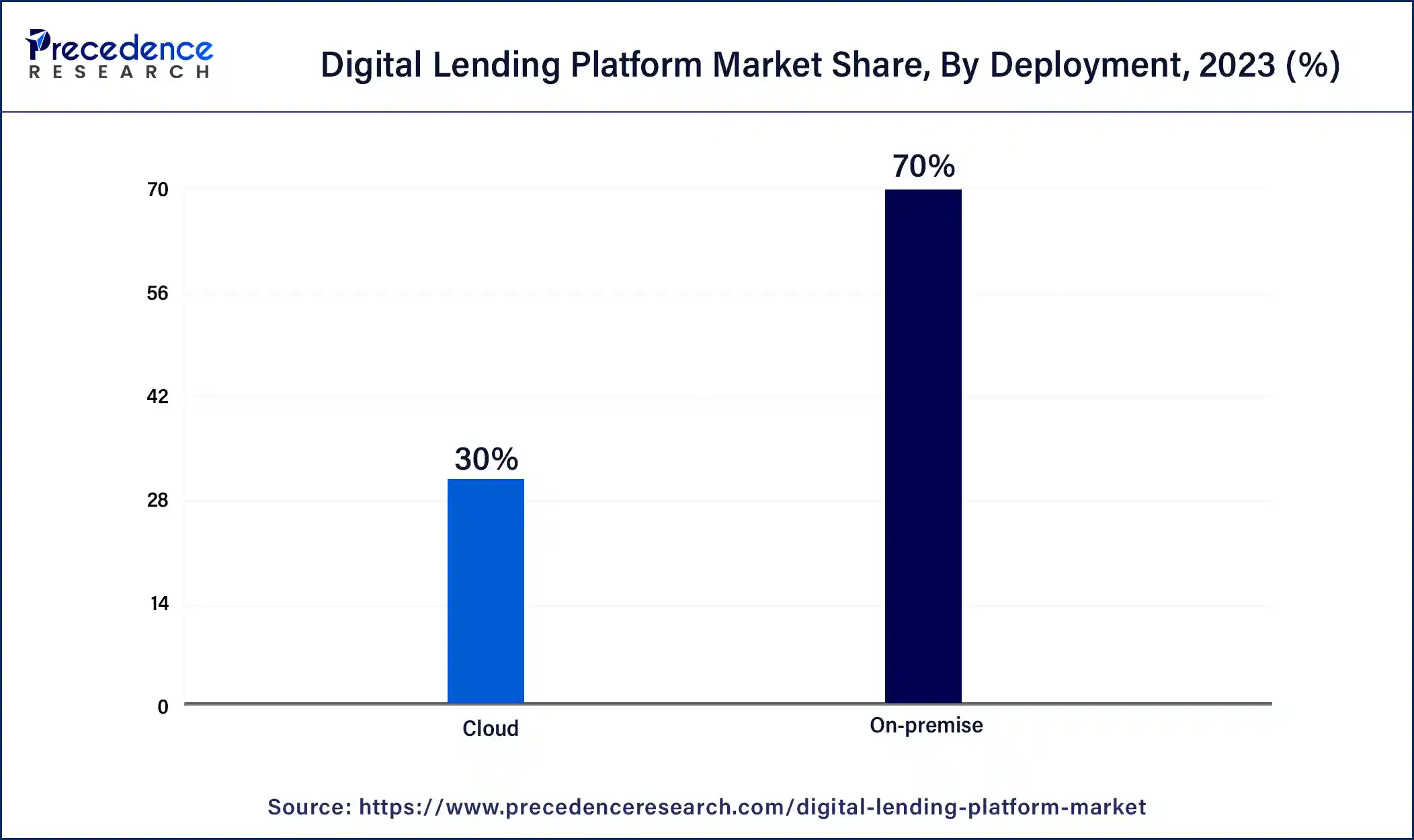

The on-premise segment dominated the global digital lending platform market. Ongoing costs cover maintenance, upgrades, security measures, and IT personnel needed for system management and support. On-premise platforms give organizations complete control over their records and the ability to decide on system upgrades and transformations. The total cost of ownership (TCO) for on-premise digital lending software includes initial expenses such as implementation, software licenses, hardware infrastructure, and customization.

The cloud segment is expected to expand at the fastest growing rate in the digital lending platform market over the forecast period. This can be attributed to the increasing preference for cloud-based platforms among digital lending providers to improve their offerings, which is propelling segment growth. Moreover, Fintech companies are concentrating on implementing cloud-based digital lending platforms and adopting the pay-per-use payment model, which helps to minimize operational costs. This trend is expected to drive the growth of the cloud segment during the forecast period.

The banks' segment led the global digital lending platform market in 2023. The expected growth of this segment will be fueled by banks' heightened focus on digitalizing their financial services. Additionally, banks often face stricter regulatory requirements, and digital lending platforms can aid in ensuring compliance and automating processes by reducing the risk of errors and non-compliance. Banks have also established long-standing trust and reputation with customers, and by providing digital lending services, they can capitalize on their brand recognition.

The credit unions segment is estimated to experience fast growth in the digital lending platform market during the forecast period. The e-signature feature can shorten processing times and improve the customer experience for credit union members. Features such as e-signature and cross-channel support, among others, provide significant benefits to credit unions. Credit unions utilize digital lending platforms to eliminate manual processes and reduce errors, enhancing lending efficiency.

Segments Covered in the Report

By Solution

By Service

By Deployment

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024