March 2025

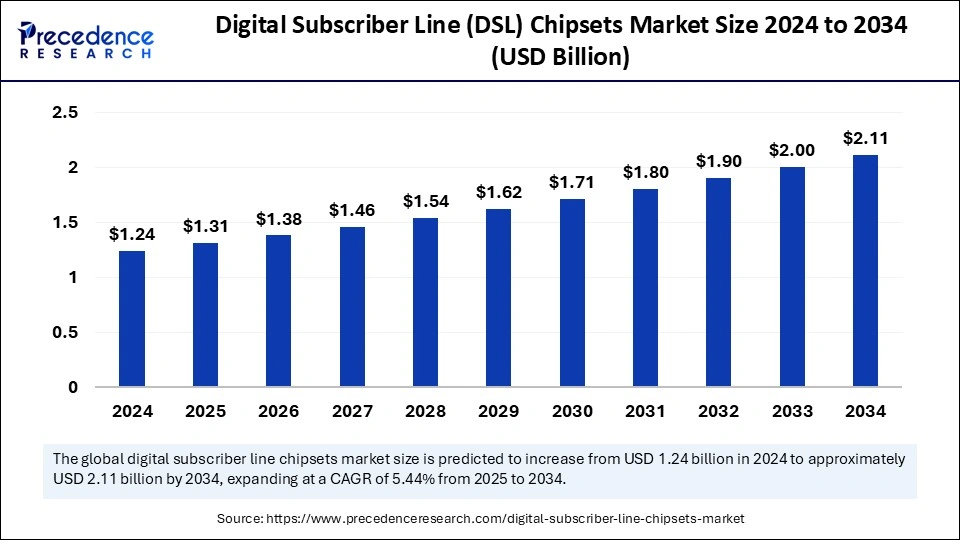

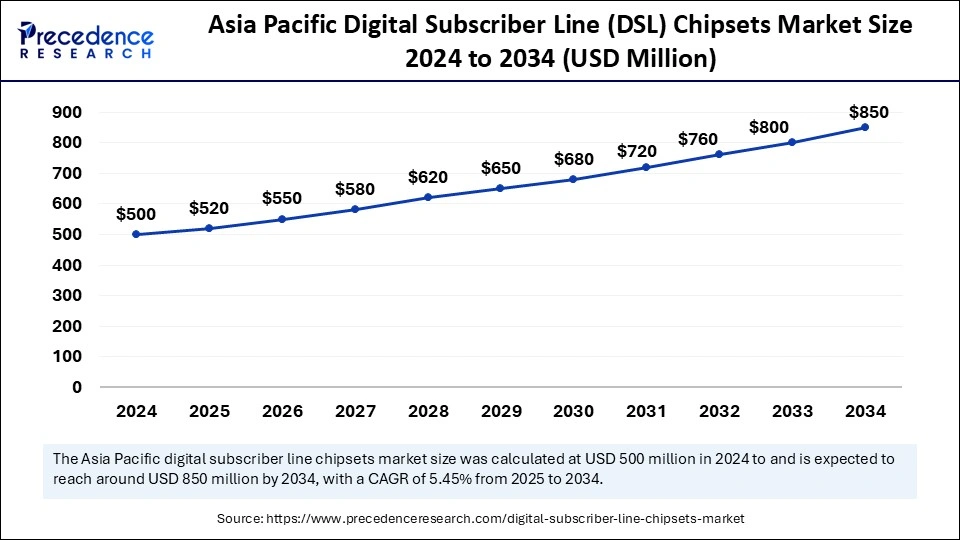

The global digital subscriber line (DSL) chipsets market size is calculated at USD 1.31 billion in 2025 and is forecasted to reach around USD 2.11 billion by 2034, accelerating at a CAGR of 5.44% from 2025 to 2034. The Asia Pacific market size surpassed USD 500 million in 2024 and is expanding at a CAGR of 5.45% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital subscriber line (DSL) chipsets market size accounted for USD 1.24 billion in 2024 and is predicted to increase from USD 1.31 billion in 2025 to approximately USD 2.11 billion by 2034, expanding at a CAGR of 5.44% from 2025 to 2034. The market is growing because of rapid internet access and affordable broadband options. Improvements in DSL technology, broadband access in rural and underserved regions, along with government efforts to enhance digital connectivity, are fueling market expansion.

Artificial Intelligence (AI) is transforming the digital subscriber line (DSL) chipsets market by enhancing network efficiency, streamlining operations, and facilitating proactive diagnostics. It tackles issues such as inadequate line performance and inefficiencies in DSL networks that rely on copper. AI employs deep learning techniques and sophisticated analytics to observe, diagnose, and enhance connections in real time, optimizing physical network capacity. The incorporation of AI in DSL systems facilitates real-time data evaluation, anticipatory maintenance, and effective resource distribution, leading to improved and quicker broadband services.

The Asia Pacific digital subscriber line (DSL) chipsets market size was exhibited at USD 500 million in 2024 and is projected to be worth around USD 850 million by 2034, growing at a CAGR of 5.45% from 2025 to 2034.

The Emergence of DSL Technology in Asia Pacific

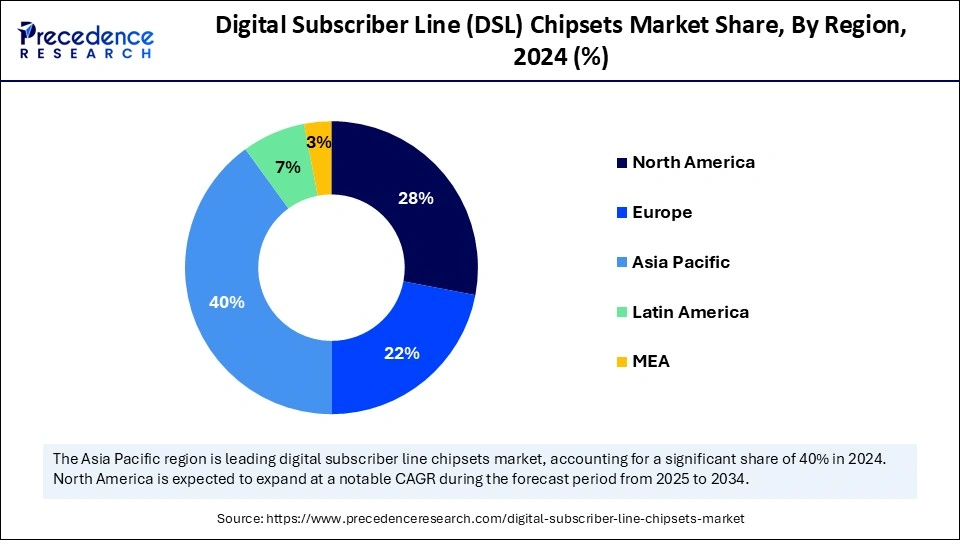

Asia Pacific held a significant share of the digital subscriber line (DSL) chipsets market in 2024, owing to its vast population, swift urban growth, evolving infrastructure, and rising internet usage. Nations such as China, India, and those in Southeast Asia seek affordable broadband options, which DSL technology offers by utilizing current copper infrastructure.

Government efforts to boost digital connectivity and assist rural broadband access have stimulated market expansion. Policies put in place to improve digital inclusion and economic development are propelled by swift industrialization and urban growth. DSL technology provides an affordable alternative that does not require extensive fiber-optic installations, making it a practical choice for enhancing broadband accessibility.

Government Initiatives Driving the Market Expansion

India plays an important role in the digital subscriber line (DSL) chipsets market because of its large population, increasing internet access, and dependence on affordable broadband options. Both nations utilize DSL technology to enhance connectivity in rural and semi-urban regions, like the Digital India program of India. The National Broadband Policy of 2004 prompted state-owned companies such as BSNL and MTNL to introduce broadband services via DSL technology, while private ISPs like VSNL broadened DSL-based offerings of Tata by enhancing broadband access nationwide.

China Trades Copper to Expand Broadband

The leading position of China in the digital subscriber line (DSL) chipsets market is due to its large broadband user base, efficient use of infrastructure, and initiatives from the government. China Telecom, working with Alcatel, has swiftly implemented DSL technologies, facilitating quick broadband growth without major new investments. The swift growth of the nation and considerable funding in DSL infrastructure have further accelerated the uptake of DSL technologies. The increase in broadband uptake is due to swift growth and the tactical utilization of the current copper wire infrastructure of the country.

DSL is Broadening Connectivity Across North America

North America is anticipated to grow at the fastest rate in the market during the forecast period, fueled by the need for dependable, affordable broadband in areas with limited fiber-optic infrastructure. This expansion is driven by technological innovations, alliances between chipmakers and telecom companies, and governmental efforts focused on improving broadband access in rural areas. Modernizing infrastructure, especially in neglected regions, is essential. Moreover, governmental initiatives that aid semiconductor production and broadband availability greatly enhance the growth of the market, facilitating faster data transmission across copper lines.

The U.S. digital subscriber line (DSL) chipsets market Trends

The U.S. market is expanding owing to technological innovations, the need for high-speed internet, and affordable infrastructure. Advanced DSL technologies enhanced data transfer speeds, positioning them as a strong broadband option. The growing dependence on bandwidth-heavy applications like streaming platforms and online gaming has heightened the need for DSL. Using current copper telephone lines for DSL services provides a budget-friendly option compared to establishing new fiber-optic networks.

Europe: A Notable Region in the digital subscriber line (DSL) chipsets market

Europe is growing at a notable rate due to its strong telecommunications infrastructure and continuous technological progress. Nations such as Germany, the UK, and Belgium have adopted sophisticated DSL technologies like VDSL2 and G.fast to enhance broadband speeds. This has resulted in a considerable need for broadband services in both residential and industrial areas. Furthermore, the area gains from state-supported programs aimed at improving digital connectivity, particularly in rural and neglected regions.

DSL chipsets are the key elements in modems and gateways that facilitate high-speed internet connectivity through standard copper telephone lines. They encode and decode digital signals, enabling broadband access while maintaining uninterrupted voice services. They are commonly utilized in home internet, business networking, and telecommunications systems.

The DSL chipset market is the worldwide market dedicated to developing, manufacturing, and distributing these chipsets. Even with the rising demand for fiber-optic and wireless technologies, DSL chipsets continue to be essential for delivering cost-effective broadband options, particularly in rural and developing areas where fiber deployment is limited.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.11 Billion |

| Market Size in 2025 | USD 1.31 Billion |

| Market Size in 2024 | USD 1.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.44% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End User, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Demand for high-speed internet connectivity

The demand for high-speed internet connectivity, particularly in underserved areas lacking fiber-optic infrastructure, is driving the digital subscriber line (DSL) chipsets market. This demand is fueled by the increasing number of internet users, the growth of broadband services, and the necessity for dependable communication infrastructure. DSL technologies, such as G.fast, enable telecom providers to offer gigabit speeds over existing copper lines, providing an economical solution to address the increasing bandwidth demands of consumers.

Fierce competition from fiber-optic networks

The digital subscriber line (DSL) chipsets market encounters a considerable restraint due to fierce competition from fiber-optic networks, which provide superior data rates and dependability relative to DSL. This rivalry restricts the growth potential of DSL technologies, particularly in areas where fiber installation is viable. Different broadband technologies, like fiber-optic networks and 5G wireless systems, provide faster data transmission speeds and reduced latency, resulting in a decrease in demand for DSL-based options.

Integration of DSL technology with hybrid network solutions

The market for DSL chipsets is set to expand by the Integration of DSL technology with hybrid network solutions. This method integrates DSL with fiber-optic technology, improving broadband services and optimizing infrastructure investments. This enables operators to provide faster speeds and enhanced reliability, particularly in regions where complete fiber installation may not be economically feasible. Technologies such as VDSL2 and G.fast provide economical options to satisfy the rising need for high-speed connections over existing copper lines.

The ADSL (Asymmetric Digital Subscriber Line) segment dominated the digital subscriber line (DSL) chipsets market with the highest share in 2024 because of its affordability and compatibility with the current telephone infrastructure. ADSL offers dependable internet connectivity in regions where fiber-optic installation is scarce by using copper telephone lines. It provides essential voice, video, and data services for residential and small business customers, featuring faster download speeds compared to upload speeds. Being a well-established technology, extensive use of ADSL guarantees dependability and works well with a variety of consumer devices. This renders it an appealing choice in situations where fiber networks are not feasible.

The VDSL (Very High-Speed Digital Subscriber Line) segment is expected to grow at a notable rate in the upcoming period due to its superior data transfer speeds compared to older technologies, such as ADSL. VDSL offers speeds as high as 52 Mbps for downloading and 16 Mbps for uploading, making it ideal for streaming high-definition videos, gaming online, and telehealth services. Its alignment with current copper infrastructure makes it economical for broadband providers, particularly in locations where fiber-optic installation is impractical. VDSL technology utilizes current copper phone lines, minimizing crosstalk and enhancing data speeds.

The residential segment held a dominant presence in the digital subscriber line (DSL) chipsets market in 2024 because of the rising need for high-speed internet access in homes, driven by smart home gadgets, online learning, remote employment, video streaming, and gaming. DSL technologies, such as VDSL and G.fast, leverage the current copper infrastructure, making them available in areas where fiber-optic installation is minimal. This expansion is fueled by increasing internet access, affordability, and efforts toward digital inclusion. DSL provides faster download speeds compared to upload speeds, making it a favored option for home broadband.

The industrial segment is projected to expand rapidly in the digital subscriber line (DSL) chipsets market because of automation and smart manufacturing. DSL chipsets provide cost-effective connections via copper infrastructure, ideal for scenarios where fiber is not an option. Factors propelling growth encompass Internt of Things integration, remote monitoring, and budget-friendly improvements. DSL technologies offer bandwidth for overseeing and controlling industrial machinery, lowering infrastructure expenses. Industries such as manufacturing, logistics, and utilities need dependable internet connections for process automation, remote monitoring, and data analysis.

The telecommunications segment captured the biggest market share in 2024 by enabling broadband infrastructure for ISPs and telecom providers. DSL chipsets provide fast Internet through current copper lines, making them crucial in locations where fiber is unfeasible. This technology offers affordable solutions to address increasing internet demand without significant investments in new infrastructure. Improved DSL technologies such as VDSL2 and G.fast enable telecom companies to deliver quicker broadband speeds through existing lines, facilitating hybrid networks and enhancing performance and coverage.

The IT and networking segment is expected to experience the fastest growth during the forecasted timeframe, driven by the demand for high-quality connectivity, cloud services, and data transfer. Businesses need high-speed internet connections for data center integration, cloud services, and network infrastructure administration. The reliability and high performance of DSL technology are fueling market expansion. Cost-effective DSL technologies such as VDSL and G.fast are becoming popular in regions where it is challenging to install fiber optics. Factors propelling growth consist of robust business connectivity, a rise in cloud services and IoT, along the incorporation of DSL into comprehensive networking solutions.

By Product Type

By Application

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

July 2024