March 2025

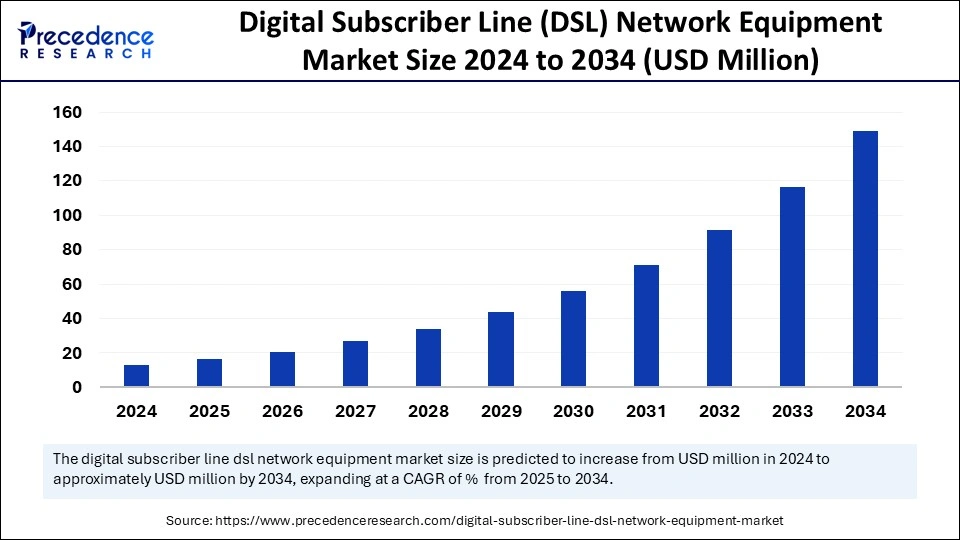

The digital subscriber Line (DSL) network equipment market is expected to grow by 2034, driven by demand for cost-effective broadband, technological upgrades (VDSL2, G.fast), and infrastructure expansion in emerging markets. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The DSL network equipment market focuses on advancing technologies like VDSL2 and G.fast to improve broadband speed and reliability over existing copper lines. The market is expanding because of the rise in broadband access in both residential and commercial areas, affordable network solutions, improvements in DSL technologies, and government programs.

Artificial Intelligence (AI) is transforming the digital subscriber line (DSL) network equipment market by improving performance optimization, streamlining operations, and facilitating proactive diagnostics. It can detect inefficiencies in links, enhance signal quality, and anticipate possible equipment malfunctions. AI-driven systems can perform real-time diagnostics on millions of DSL lines, resolving problems more quickly than conventional techniques. Furthermore, AI minimizes the need for manual input by automating network management activities, enhancing operational efficiency, and lowering expenses.

Digital subscriber line network equipment is the device that delivers high-speed internet connectivity through standard copper telephone lines, accommodating both symmetric and asymmetric transmission modes. It is commonly utilized in telecommunications, networks, and data centers because it is more cost-effective than deploying fiber optics. The market comprises DSL modems, digital subscriber line access multiplexers (DSLAM), and associated hardware or software, improving data transfer and facilitating broadband connectivity for residential, commercial, and industrial applications.

The digital subscriber line (DSL) network equipment market plays a crucial role in underdeveloped regions, offering affordable and accessible broadband services that connect advanced technologies and the underdeveloped population. Technological innovations such as Very High-Speed DSL and G. fast facilitate the increasing demand for streaming, gaming, and remote working solutions.

Increasing need for high-speed internet access

The digital subscriber line (DSL) network equipment market is propelled by the increasing need for high-speed internet access, especially in regions where fiber optic infrastructure is impractical. Applications such as high-definition video streaming, online gaming, and cloud services require strong and dependable internet connectivity. DSL technologies like VDSL and G FAST provide an economical means to enhance internet connectivity through current copper telephone lines, rendering it an appealing choice for service providers.

Technological limitations and rising rivalry from advanced broadband technologies

The digital subscriber line (DSL) network equipment market encounters technological challenges and reduced competitiveness relative to other broadband technologies. The dependence of DSL on current copper infrastructure restricts its speed and range, making it less adequate for fulfilling high-speed internet needs. This has resulted in a movement towards more sophisticated technologies such as fiber optics and wireless broadband. The scalability and performance of DSL are constrained by the proximity to telephone exchanges and the condition of copper lines, rendering it less competitive against modern technologies such as fiber to the home.

Rural broadband access through advanced technologies

The digital subscriber line (DSL) network equipment market is set to expand in rural broadband access because of the absence of fiber optic networks in less developed areas. DSL provides fast Internet connectivity for online education, telehealth services, and electronic governance projects. The market can utilize the current copper infrastructure to provide improved speeds through advanced technologies such as G FAST and vectoring, presenting a budget-friendly substitute to conventional fiber optic networks in areas that are economically and logistically difficult.

The asymmetric digital subscriber line (ADSL) segment dominated the digital subscriber line (DSL) network equipment market with the largest share in 2024, owing to its extensive use, affordability, compatibility with current telephone systems, and efficiency. ADSL technology offers fast Internet connectivity through current telephone lines, making it ideal for homes and small businesses. Its compatibility with current telephone systems enables simultaneous use of voice and data services over the same line. ADSL provides adequate bandwidth for typical home uses such as web surfing, streaming videos, and playing games online. Its asymmetric characteristics, providing faster download speeds, correspond nicely with user behavior trends. The cost-effectiveness of ADSL equipment and services renders it appealing to both service providers and consumers, particularly in budget-conscious markets.

The very high bit-rate digital subscriber line (VDSL) segment is predicted to grow at the fastest rate in the upcoming years, providing quicker data transfer speeds than previous technologies. VDSL employs sophisticated methods such as the Discrete Multitone Technique (DMT) for modulation, offering greater capacity than ADSL, particularly on shorter lines. It accommodates high-bandwidth applications such as HDTV, video on demand, and video conferencing, rendering it appropriate for contemporary internet usage trends. The incorporation of vectoring technology has enhanced VDSL performance, leading to faster downstream speeds. VDSL acts as a bridge between traditional DSL systems and fiber optic networks, providing a notable speed enhancement without requiring a total infrastructure replacement.

The residential segment held a significant share of the digital subscriber line (DSL) network equipment market in 2024 because of its affordability, economic efficiency, and the increasing use of smart devices and IoT applications. DSL technology, specifically ADSL and VDSL, offers fast Internet at home, delivering adequate bandwidth for multiple household uses. DSL technology makes use of existing copper telephone lines, rendering it an appealing choice for home users, particularly in regions where fiber optic installation is impractical. Improvements in DSL network technology, including Vectoring and G FAST, have boosted performance, allowing for faster speeds and greater reliability. Government efforts have also increased broadband availability in underserved locations, especially in rural areas.

The large enterprises segment is expected to witness the fastest growth during the predicted timeframe due to the need for fast connectivity, scalability, affordable solutions, and integration with advanced technologies. DSL network equipment provides scalable solutions for data-heavy applications such as cloud computing, unified communications, video conferencing, and big data analysis. DSL technology is frequently utilized as an economical substitute for fiber optics, particularly in areas where fiber installation is scarce or costly. Companies are progressively combining DSL with solutions such as Software-Defined Wide Area Networks and VPNs to improve network performance and security. Improving to advanced DSL technologies such as VDSL provides a compromise between performance and cost.

Broadband Investments in North America are Influencing the Future

North America dominated the digital subscriber line (DSL) network equipment market in 2024 because of its extensive internet access, developed infrastructure, robust demand from businesses and homes, and backing from the government. The copper line network of the region makes DSL an economical option for broadband access, particularly in suburban and rural regions. The increasing need for high-speed internet services like cloud computing and remote work propels investments in DSL infrastructure. The U.S. and Canada have established policies and funding initiatives to enhance broadband availability, especially in rural and underserved regions. The sophisticated telecommunications framework, strong broadband demand, and governmental backing of North America have greatly impacted its leading position in the market.

The U.S.: Bridging the Digital Divide

The U.S. leads the Digital Subscriber Line (DSL) network equipment market because of its sophisticated infrastructure, extensive internet penetration, and government efforts. Thanks to an established copper line network, DSL is an economical choice for broadband access, particularly in suburban and rural regions. The high internet penetration rate of the country is driven by a technology-oriented demographic and the extensive use of broadband services. The U.S. government backs initiatives for broadband expansion, such as DSL technology, to close the digital gap in underprivileged communities. Prominent American firms such as Cisco Systems have played a role in the progress of DSL technology.

Expanding Connectivity of Asia Pacific Across Emerging Markets

Asia Pacific is anticipated to grow at the fastest rate in the digital subscriber line (DSL) network equipment market during the forecast period, driven by factors such as internet accessibility, government efforts, urban development, and affordable connectivity solutions. Nations such as India and China are driving this expansion, as China, India, and Japan are increasing broadband access in rural and underserved regions. DSL technology continues to be a practical choice for economical Internet access in regions with minimal fiber optic availability.

Government programs such as the Palapa Ring Project of Indonesia, the National Broadband Plan of the Philippines, and the Jalinan Digital Negara initiative of Malaysia are improving broadband connectivity. Funding is being directed toward undersea cable initiatives to enhance global connectivity and meet data requirements, while partnerships among major internet entities seek to boost internet accessibility and dependability.

China: Driving Digital Subscriber Line Expansion Across the Nation

China is building momentum in the market in the region due to large investments in telecommunications infrastructure, government programs such as the Broadband China initiative, and the implementation of advanced technologies, including 5G and hybrid networks. The emphasis of the government on enhancing telecommunications infrastructure has resulted in major investments in DSL and broadband technologies, aiding the swift expansion of China in this market. In November 2023, China deployed the Chinasat 19 communications satellite to enhance connectivity in remote regions, including sea routes, offering hybrid solutions for uninterrupted internet access.

Digital Subscriber Line Surge of India in a Digitally Shifting Economy

India is becoming the fastest-growing digital subscriber line (DSL) network equipment in Asia Pacific. This is driven by swift digitalization and a growing customer base. Government programs and funding for digital infrastructure have boosted the demand for DSL equipment. The BharatNet initiative in India delivers broadband access to every gram panchayat, with Tejas Networks supplying Gigabit Passive Optical Network (GPON) technology. Rapid urban growth and digital advancements have resulted in an increase in internet users, rendering DSL a budget-friendly option for enhancing connectivity. The telecommunications industry of India is expanding quickly, bolstered by initiatives backed by the government.

A Notable Position of Europe in Advanced Solutions for Broadband

Europe holds a crucial position in the global digital subscriber line (DSL) network equipment market, owing to its well-established infrastructure, high internet adoption rates, and emphasis on enhancing current networks with advanced technologies such as VDSL and G FAST. European nations possess extensive copper wire systems, enabling affordable broadband rollout without significant fiber optic expenditures. Technological progress, including VDSL and G.fast, improves data transfer rates through current copper lines, satisfying the increasing need for high-speed internet services. European firms have likewise undertaken strategic efforts to enhance their standings in the telecommunications industry.

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024