September 2024

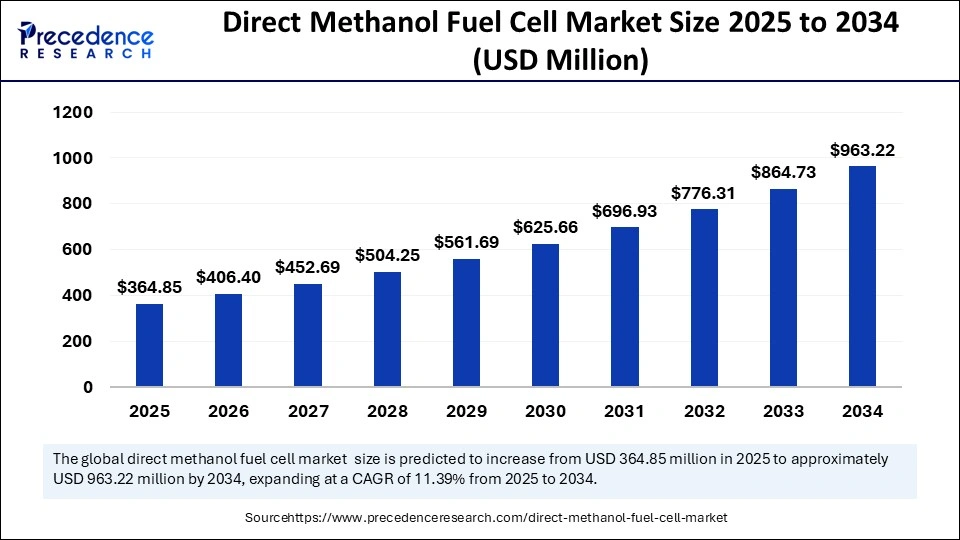

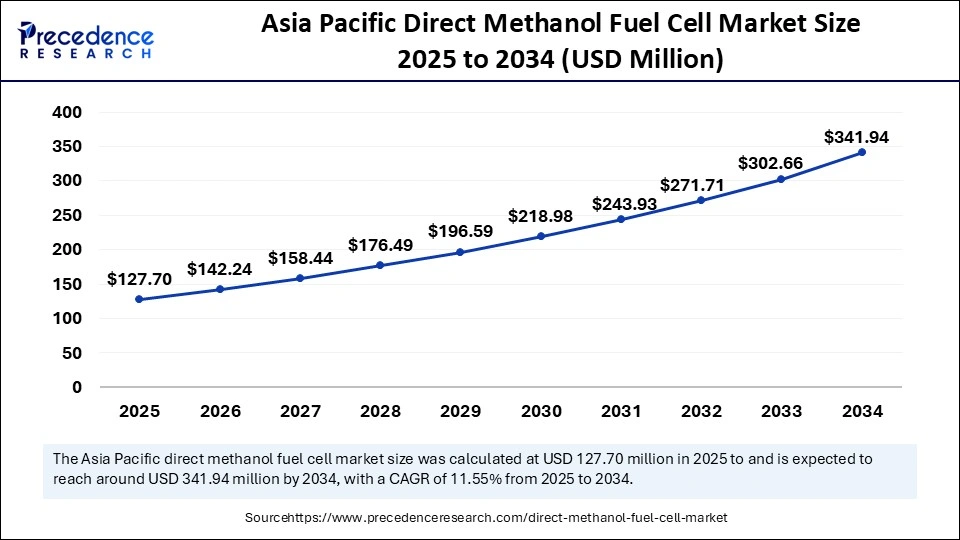

The global direct methanol fuel cell market size accounted for USD 364.85 million in 2025 and is forecasted to hit around USD 963.22 million by 2034, representing a CAGR of 11.39% from 2025 to 2034. The Asia Pacific market size was estimated at USD 127.70 million in 2025 and is expanding at a CAGR of 11.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global direct methanol fuel cell market size was estimated at USD 327.54 million in 2024 and is predicted to increase from USD 364.85 million in 2025 to approximately USD 963.22 million by 2034, expanding at a CAGR of 11.39% from 2025 to 2034. The market growth is attributed to the increasing demand for clean and efficient energy solutions across various applications, including transportation, portable devices, and off-grid power systems.

The energy sector is witnessing rapid transformation through artificial intelligence, as it streamlines operations, enhances system efficiency, and speeds up research and development processes. The implementation of AI algorithms optimizes fuel cell designs and enhances predictions regarding cell performance. Furthermore, AI provides different methods to meet worldwide clean energy requirements. AI also helps in the development of fuel cells, optimizes performance, and reduces waste generation.

The Asia Pacific direct methanol fuel cell market size was exhibited at USD 127.64 million in 2025 and is projected to be worth around USD 341.94 million by 2034, growing at a CAGR of 11.55% from 2025 to 2034.

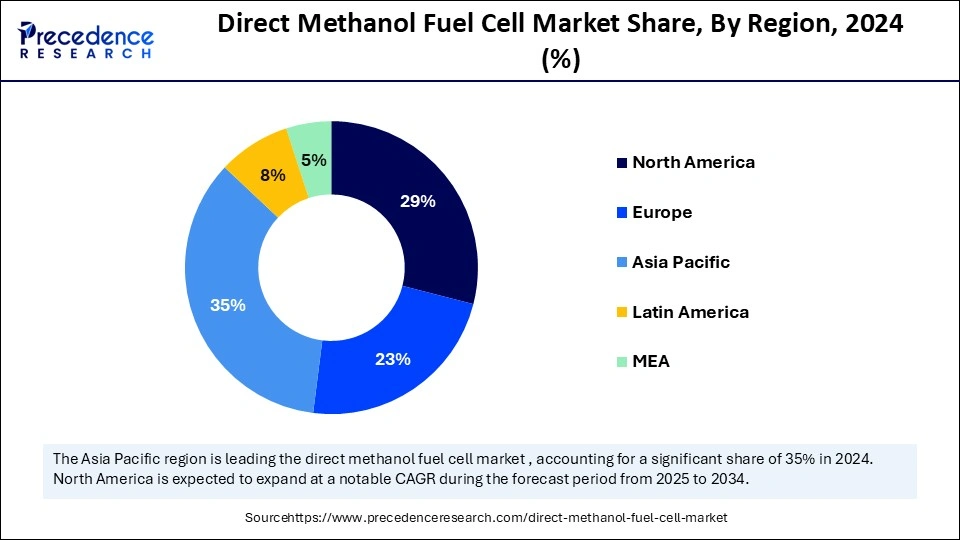

Asia Pacific led the direct methanol fuel cell market by capturing the largest share in 2024. This is mainly due to the powerful governmental backing and improved technologies with escalating funding for clean energy technology. Countries like Japan, China, and South Korea are investing in fuel cell technologies, especially DMFCs. Chinese government’s target to reduce carbon emissions by 2024 further boosted the demand for alternative energy solutions, like DMFCs. The increased production of consumer electronics and electric vehicles further contributed to region's dominance.

North America is projected to witness rapid growth during the forecast period. This is mainly due to the increasing demand for portable power and government efforts to reduce emissions. In the last few years, fuel cell technology research received strong backing from the U.S. Department of Energy (DOE) with significant financial commitments to create efficient, affordable technologies using methanol fuel cells. Furthermore, the expansion of the electric vehicle industry and the focus on developing off-grid energy solutions are boosting the adoption of DMFCs.

Europe is seen to grow at a notable rate in the foreseeable future. The growth of the direct methanol fuel cell market in Europe can be attributed to strict environmental regulations and carbon neutrality targets. This creates a favorable environment for DMFCs. The European Union’s Green Deal has set a 2050 deadline to reach net-zero emissions, making alternative energy solutions, including fuel cells, more appealing. There is a rise in the adoption of fuel cells in commercial vehicles. The rising demand for portable power solutions further contributes to regional market growth.

The direct methanol fuel cell market is experiencing rapid growth due to the rising global interest in clean energy solutions. Direct methanol fuel cells (DMFCs) develop into an attractive power technology, as their operation with liquid methanol enables convenient transportability and high energy density. Methanol conversion into electricity occurs directly through electrochemical processes in this technology. This delivers better efficiency and low pollution output than traditional combustion engines. The rising funding for fuel cell research further supports market growth. In 2023, the U.S. DOE funded over USD 150 million in fuel cell research. Furthermore, the rising government efforts to promote renewable energy are expected to boost the adoption of DMFCs, thus fuelling the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 963.22 Million |

| Market Size in 2025 | USD 364.85 Million |

| Market Size in 2024 | USD 327.54 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.39% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Demand for Reliable Portable Power in Critical and Remote Applications

The rising demand for better portable power systems leads to greater adoption of DMFCs, which further drives the growth of the direct methanol fuel cell market. Portable electronic devices, including military-grade communication tools, medical devices, and remote sensors, require energy solutions that are lightweight. DMFCs deliver high energy capacity for easy fuel refill capabilities that enable their use in military or off-the-grid deployments. These cells can be used at low temperatures, making them attractive solutions. The WHO documented a 20% rise in portable medical diagnostics tool deployments to remote areas in 2023, as reliable mobile power is essential for medical operations. Furthermore, the rising production and adoption of portable electronics are driving the growth of the market, as DMFCs provide consistent power to these devices.

Methanol Toxicity and Handling Concerns

The high methanol toxicity and handling concerns are expected to hinder the growth of the direct methanol fuel cell market. Methanol is flammable and toxic, requiring careful handling and storage. Moreover, the hazardous nature of methanol can pose several health risks, like creating problems in breathing or causing skin irritations. This forces regulatory entities to enforce strict safety protocols throughout their shipping and storage phases and operational periods. The U.S. CDC recognizes methanol as a dangerous material, which exposes damage to the nervous system, leading to death. The management of this hazardous material adds operational expenses and demands unique safety tools with trained professionals for proper control. Thus, the safety concerns related to using methanol limit the widespread adoption of DMFCs.

Technologies Improvements in Fuel Cell Components

Technological innovations in fuel cell components lead to the development of superior direct methanol fuel cells, creating immense opportunities for the players competing in the market. The enhancements in proton exchange membranes combined with nanostructured catalysts and decreased methanol crossover have improved DMFC performance. This increases their usage potential across various fields. Furthermore, rising investments in R&D to develop enhanced DMFCs for both low-power and mid-power applications create lucrative growth opportunities. The US DOE’s published report indicates that there was 18% growth in 2023 in funding provided for low-temperature fuel cell materials research, owing to the heightened efforts to resolve performance and durability problems. Next-generation fuel cells, including methanol-based systems, received substantial funding from the ‘Clean Hydrogen Partnership,' which operates under the fuel cells and Hydrogen Joint Undertaking (FCH JU) through its €300 million in 2023-24 R&D budgets.

The electrode segment led the direct methanol fuel cell market in 2024, as electrodes are essential components in DMFCs. They convert chemical energy into electrical energy. Electrochemical reactions within fuel cells depend heavily on electrodes, as their performance influences the system’s efficiency and operational lifespan. Technological innovations focusing on electrode catalysts increased efficiency levels.

The balance of stacks segment is projected to grow at the highest CAGR in the coming years. Balance of stack (BOS) contains important parts that include power conditioning systems with cooling elements and monitoring devices. This enables the efficient operation of the fuel cell stack. The BOS segment expands because industrial and military sectors with portable applications need systems with high reliability and high performance. Furthermore, the rising need for durable, scalable, and affordable solutions in BOS components supports segmental growth.

The membrane segment is projected to grow at a significant rate in the future years. Membranes represent the essential element in fuel cells, as they enable ion movement and stop harmful methanol leakage that decreases efficiency. Proton exchange membrane (PEM) facilitates the transport of protons between anode and cathode, improving the performance of DMFCs. Rising improvements in membrane materials contribute to segmental growth. The U.S. Department of Energy (DOE) directed USD 50 million of financial support in 2023 for improving membrane materials, specifically to extend PEM functionality while cutting operating costs. Additionally, scientists are developing composite membranes to improve durability and reduce the degradation of fuel cells, further boosting the segment.

The portable segment held a considerable share of the direct methanol fuel cell market in 2024. DMFCs are suitable for portable applications like consumer electronics, backup power devices, and military communication equipment. Superior characteristics of these fuel cells, including small size and high power density, allow them to work efficiently in mobile or independent power systems. The rise in the demand for portable electronic devices further bolstered the segment’s growth.

The transportation segment is expected to grow at the fastest rate during the projection period, owing to the increasing preferences for pollution-free mobility solutions. The use of DMFCs enables viable static and portable range extenders/auxiliary power units, which operate quietly with lower emissions. Public transit agencies and automakers are investing in developing fuel cell-powered systems to reduce their fossil fuel dependency. The European Commission dedicated funds through its Horizon Europe program in 2024 to conduct multiple testing initiatives for DMFCs in light-duty or last-mile delivery vehicles, further fueling the segment.

By Component

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

December 2024