August 2024

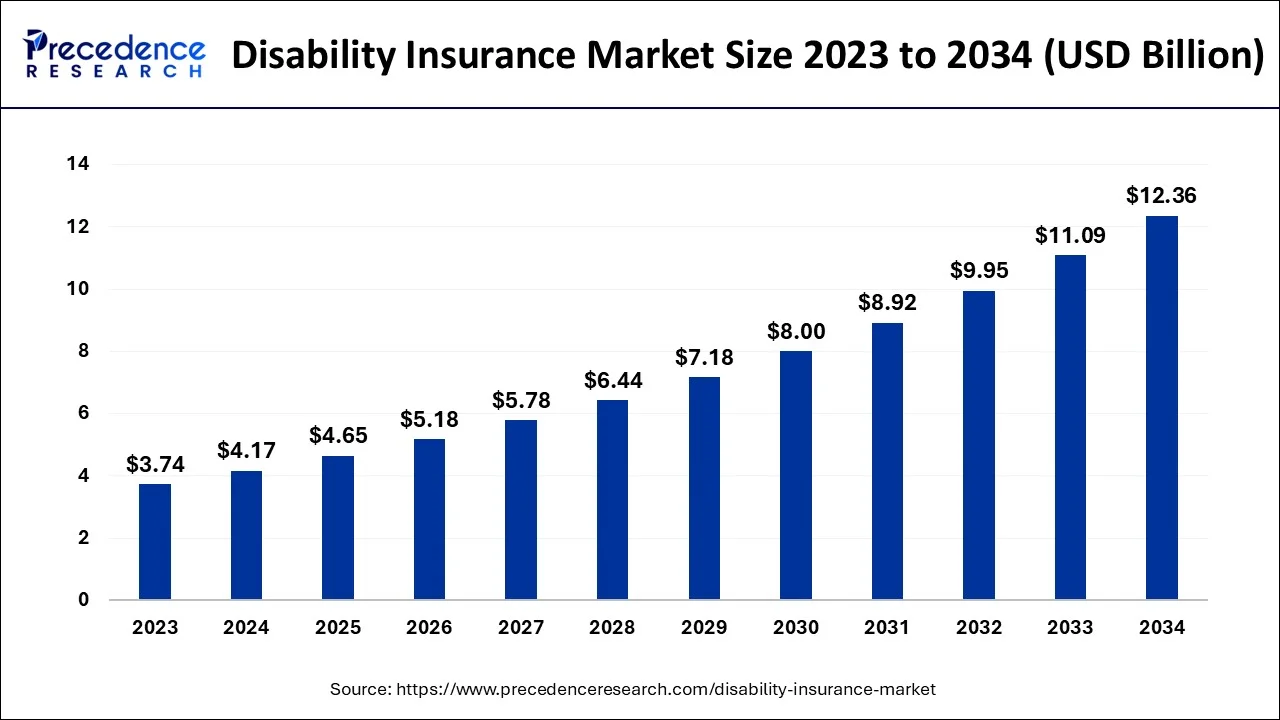

The global disability insurance market size is calculated at USD 4.17 billion in 2024, grew to USD 4.65 billion in 2025 and is predicted to surpass around USD 12.36 billion by 2034, expanding at a CAGR of 11.48% between 2024 and 2034. The North America disability insurance market size accounted for USD 1.92billion in 2024 and is anticipated to grow at a fastest CAGR of 11.60% during the forecast year.

The global disability insurance market size accounted for USD 4.17 billion in 2024 and is anticipated to reach around USD 12.36 billion by 2034, growing at a CAGR of 11.48% between 2024 and 2034.

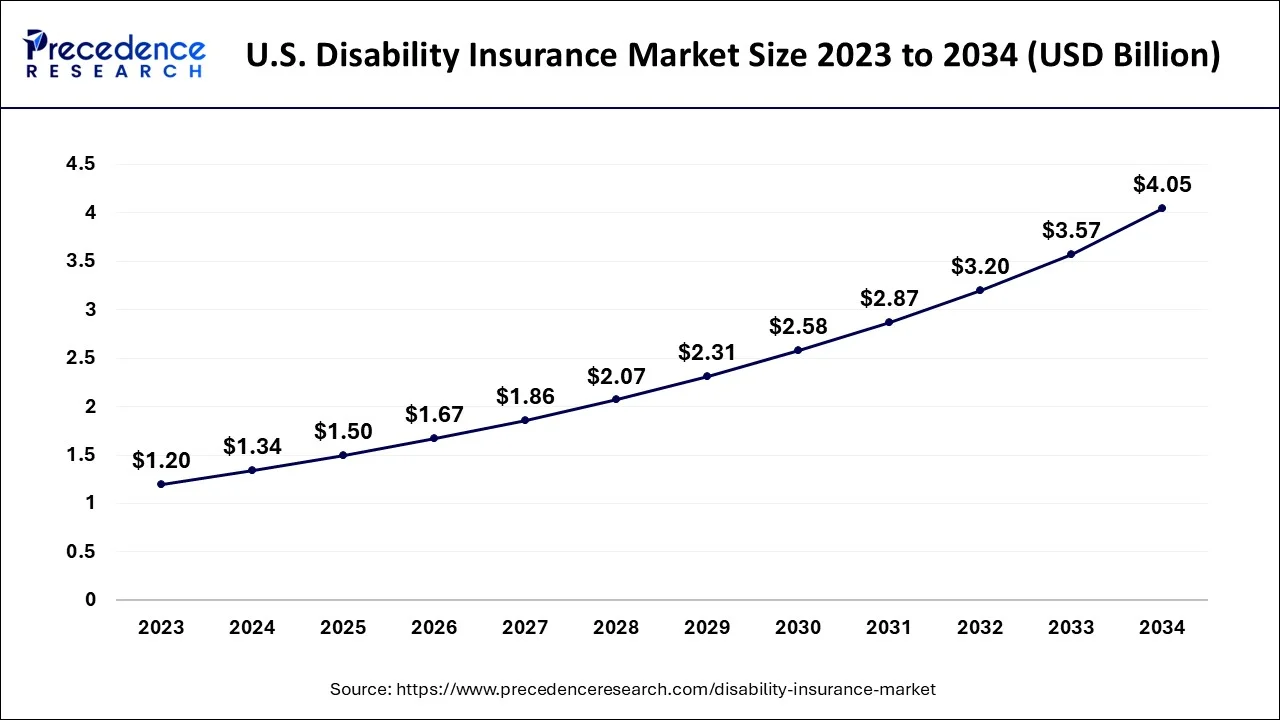

The U.S. disability insurance market size is calculated at USD 1.34 billion in 2024 and is predicted to attain around USD 4.05 billion by 2034, rising at a CAGR of 11.69% between 2024 and 2034.

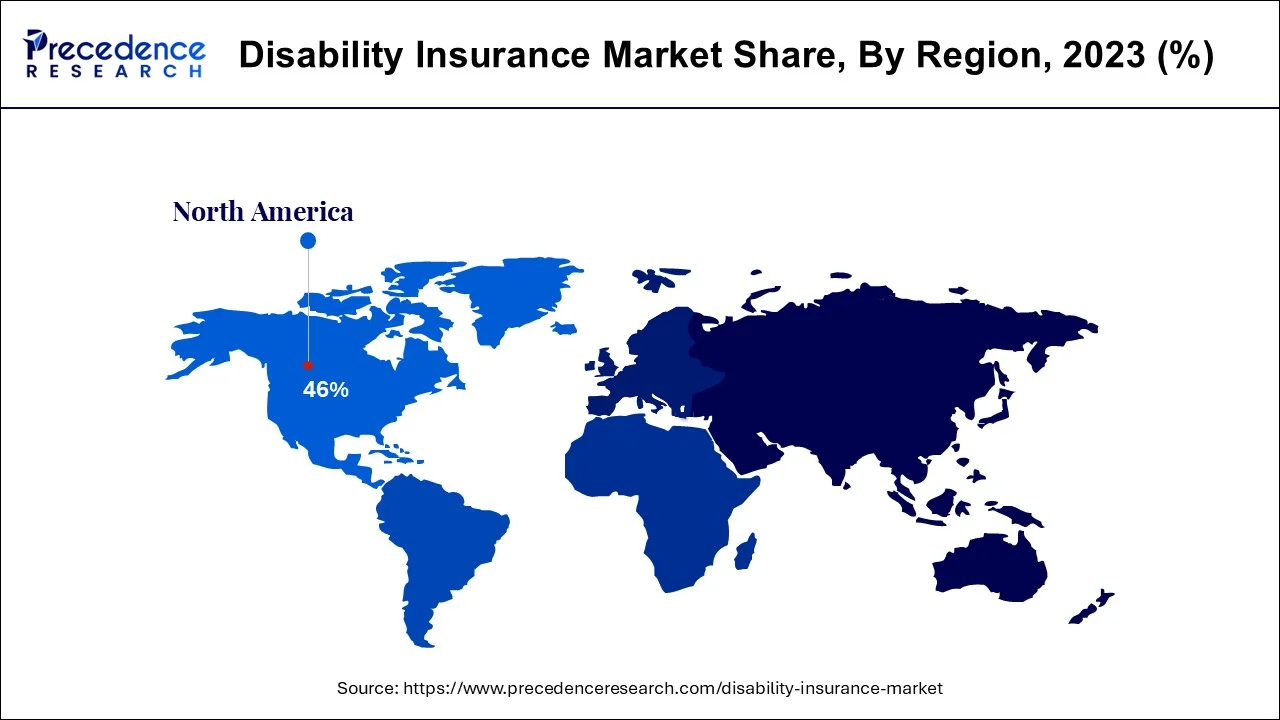

North America dominated the disability insurance market in 2023. In North America, plans for disability insurance differ in terms of benefits, coverage, and cost. The expansion of the insurance industry in North America is being driven by the growing usage of technology and the significance of understanding user requirements and available solutions. The market is being driven by an increase in government efforts that are beneficial to people with disabilities and social security benefits for workers.

For instance, in the United States, the government administers the Social Security Disability Insurance (SSDI), a disability insurance program that pays benefits to qualified workers who have paid into the Social Security system. Benefits under the SSDI program are paid to eligible family members. This indicates they paid social security taxes on their profits and worked for a sufficient amount of time. Thus, this is expected to drive the market growth in the region.

Disability insurance, also known as disability income insurance or disability income protection, is a type of insurance coverage that provides financial protection to individuals in the event they become unable to work due to a disability. This disability could result from an illness, injury, or any other condition that prevents the insured person from performing their regular job duties. The primary purpose of disability insurance is to replace a portion of the insured individual's income, helping them meet their financial obligations such as living expenses, medical bills, and other financial responsibilities, during the period of disability.

Disability insurance can be especially important as it provides a source of income when the individual is unable to earn wages due to their disability. The disability insurance market offers different types of disability insurance policies that can vary in terms of coverage, waiting periods, benefit amounts, and duration of coverage. Some policies may cover short-term disabilities, while others focus on long-term disabilities. It's essential for individuals to carefully review and understand the terms and conditions of their disability insurance policy to ensure it meets their specific needs and circumstances.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 11.48% |

| Global Market Size in 2024 | USD 4.17 Billion |

| Global Market Size by 2034 | USD 12.36 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Insurance Type, By Coverage Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing knowledge of the advantages of disability insurance plans

The disability insurance sector is expanding as more people become aware of the advantages of having a policy. This is explained by increased information openness, which encourages customers to take a more active role in the disability insurance purchase process. Furthermore, because disability insurance takes a long time to process claims, the market for speedier claim processing is growing due in large part to the introduction of automated claim technologies. In addition, lowering operating costs and improving overall client experiences are both having a beneficial effect on the expansion of the disability insurance market.

In addition, the industry is expanding due to consumer preferences for technology and the value of understanding user needs and accessible insurance products. In a market where competition is fierce, brokers must take the time to get to know their clients personally and understand their true needs. It leads to the proper fit being found, which significantly boosts market growth.

Cost and complex underwriting process

Some people may find it very difficult to pay the payments for disability insurance, particularly those with modest incomes. The market penetration may be restricted if prospective consumers choose not to purchase disability insurance due to affordability concerns. Furthermore, the disability insurance underwriting procedure can be difficult and entails several steps, including thorough medical exams and evaluations of past medical history. Some people could be discouraged from applying for disability insurance due to the perceived difficulty of doing so. Thus, this is expected to hamper the disability insurance market over the forecast period.

Advantages under different parts of the Income Tax Act

An essential element, taxes make up a significant portion of the revenue that the government receives and uses to fund the provision of some essential services to its inhabitants. Furthermore, people who make more than a particular amount are required to pay taxes by the current tax slabs. The government also offers several tax-saving options. Additionally, a person can save money on taxes by reducing their taxable income, which lowers their overall tax burden. Numerous variables affect the tax deduction, and several thresholds are established for various uses.

In addition, under Section 80C of the Income Tax Act, people can deduct payments for tuition, residential property purchases, fixed deposits, superannuation funds, disability insurance, and other insurance policies. Because of this, the state of Rhode Island's Department of Labor and Training declared that Temporary Disability Insurance (TDI) pays benefits to covered employees for weeks of unemployment brought on by a temporary accident or disability. Consequently, the opportunity for disability insurance market is being driven by rising tax benefits.

The employer supplied disability insurance segment held the largest share of the disability insurance market and is observed to sustain the position during the forecast period. Employer supplied disability insurance, often referred to as group disability insurance or employer-sponsored disability insurance, plays a significant role in the overall market.

This type of coverage is provided by employers to their employees as part of their employee benefits package. This insurance offers disability insurance as part of the benefits package and can be a strategic tool for employers to attract and retain top talent. It demonstrates a commitment to employees' well-being and financial security, contributing to job satisfaction and loyalty.

Besides, the business overhead expense disability insurance segment is expected to grow at the highest CAGR during the forecast period. Business Overhead Expense (BOE) Disability Insurance is a specific type of disability insurance designed to protect small business owners by covering the essential operating expenses of a business in the event the owner becomes disabled and is unable to work. The primary purpose of BOE Disability Insurance is to cover the regular and necessary business expenses incurred during the disability of the business owner. This can include rent or mortgage payments, utilities, salaries of non-owner employees, insurance premiums, and other fixed operational costs. Thus, driving the segment growth.

The long-term disability insurance segment dominated the disability insurance market in 2023. Long term disability insurance is designed to provide income replacement for an extended period, typically ranging from a few years until the individual reaches retirement age. This extended coverage distinguishes it from Short-Term Disability Insurance, which typically covers a shorter duration. The primary purpose of LTD insurance is to replace a portion of the insured individual's income if they become unable to work due to a covered disability. The benefit amount is often a percentage of the individual's pre-disability income, providing financial stability during a more extended period of incapacity.

The short-term disability insurance segment is expected to grow at the highest CAGR in the disability insurance market over the projected period. Short term disability insurance is well-suited for disabilities with a rapid onset, such as illnesses, injuries, or surgeries that require a temporary recovery period. The coverage addresses immediate financial needs during the early stages of a disability. Thereby, driving the segment growth.

The enterprise segment held thwe largest share of the disability insurance market in 2023. Many enterprises, large and small, include disability insurance as a crucial component of their employee benefits packages. Offering disability insurance helps attract and retain talent by demonstrating a commitment to the financial well-being and security of employees. Additionally, disability insurance is often integrated into a broader suite of employee benefits, including health insurance, retirement plans, and wellness programs. This integrated approach enhances the overall value of the benefits package for employees.

Besides, the individual segment is expected to grow at the highest CAGR in the disability insurance market during the forecast period. Individual consumers have the flexibility to customize their disability insurance coverage based on their specific needs, preferences, and financial circumstances. They can choose benefit amounts, waiting periods, and benefit durations that align with their unique requirements. Thereby, driving the segment growth.

By Insurance Type

By Coverage Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

September 2024

July 2024

January 2025