April 2025

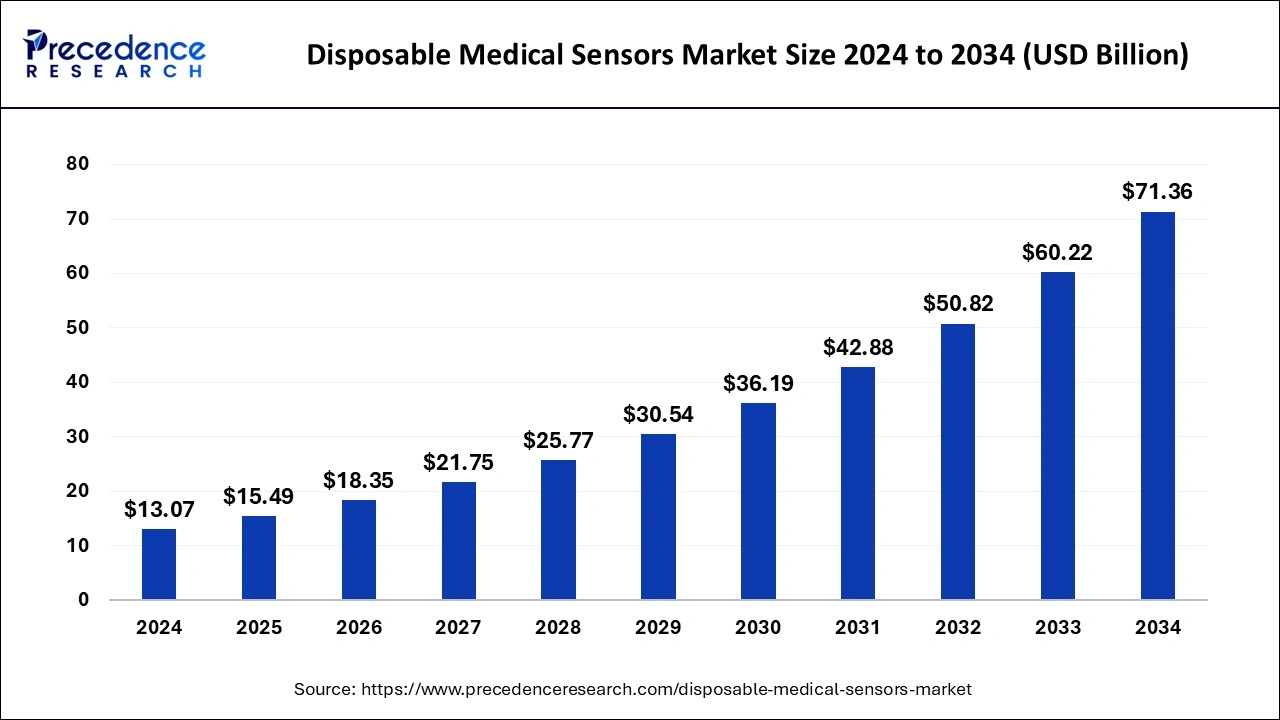

The global disposable medical sensors market size is calculated at USD 15.49 billion in 2025 and is forecasted to reach around USD 71.36 billion by 2034, accelerating at a CAGR of 18.50% from 2025 to 2034. The North America disposable medical sensors market size surpassed USD 5.36 billion in 2024 and is expanding at a CAGR of 18.63% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global disposable medical sensors market size was estimated at USD 13.07 billion in 2024 and is anticipated to reach around USD 71.36 billion by 2034, expanding at a CAGR of 18.50% from 2025 to 2034. The demand for medical sensors has risen due to the increased prevalence of chronic disease in the globe, which is leading to a boost in the disposable medical sensors market. The growing demand for low-cost medical devices is fueling the growth of the disposable medical sensors market.

Integrating modern technologies like AI with medical devices is spectacularly changing the game of the healthcare expenditure. The AI integration with disposable medical sensors helps to improve its accuracy and efficiency from their data interpretation. The accurate real-time monitoring has been possible thanks to the automation. Additionally, AI algorithms are also helping to advance manufacturing, streamline, and reduce overall production and maintenance costs. The scalability of production has improved due to AI. To improve scalability, accuracy, efficiency, and cost-effectiveness of medical devices, AI integration is playing a favorable role.

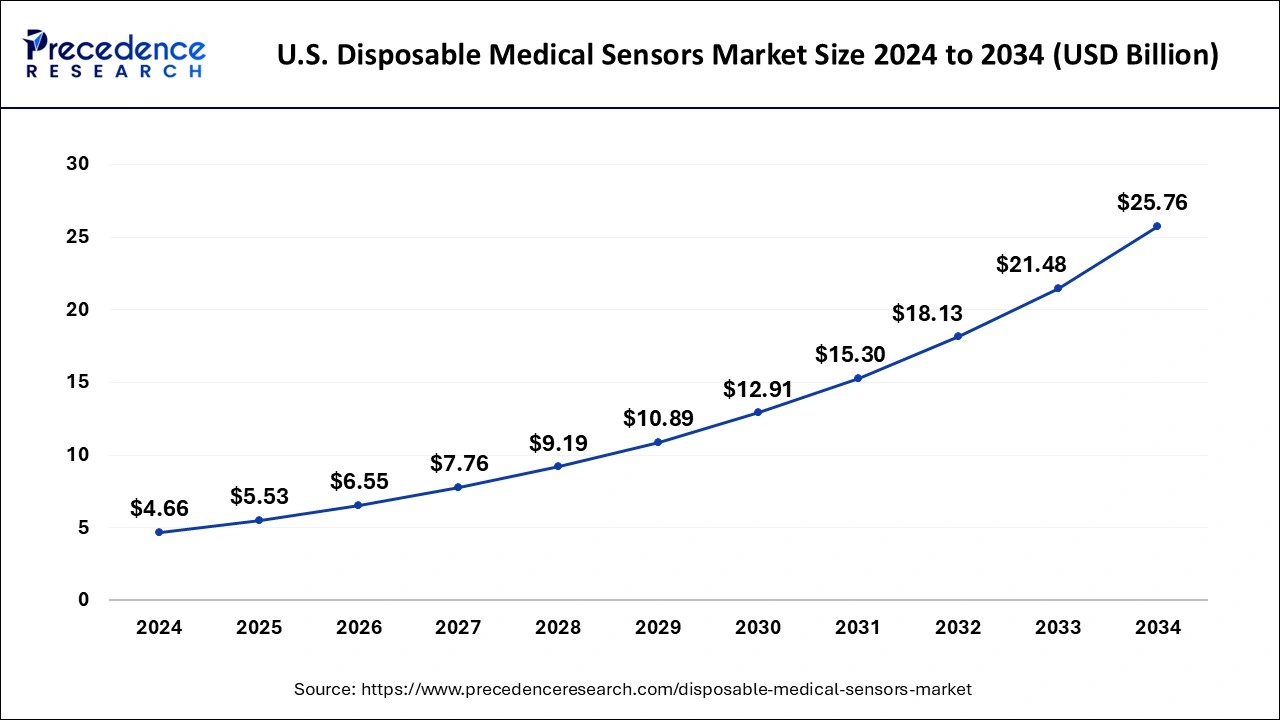

The U.S. disposable medical sensors market size was evaluated at USD 4.66 billion in 2024 and is predicted to be worth around USD 25.76 billion by 2034, rising at a CAGR of 18.64% from 2025 to 2034.

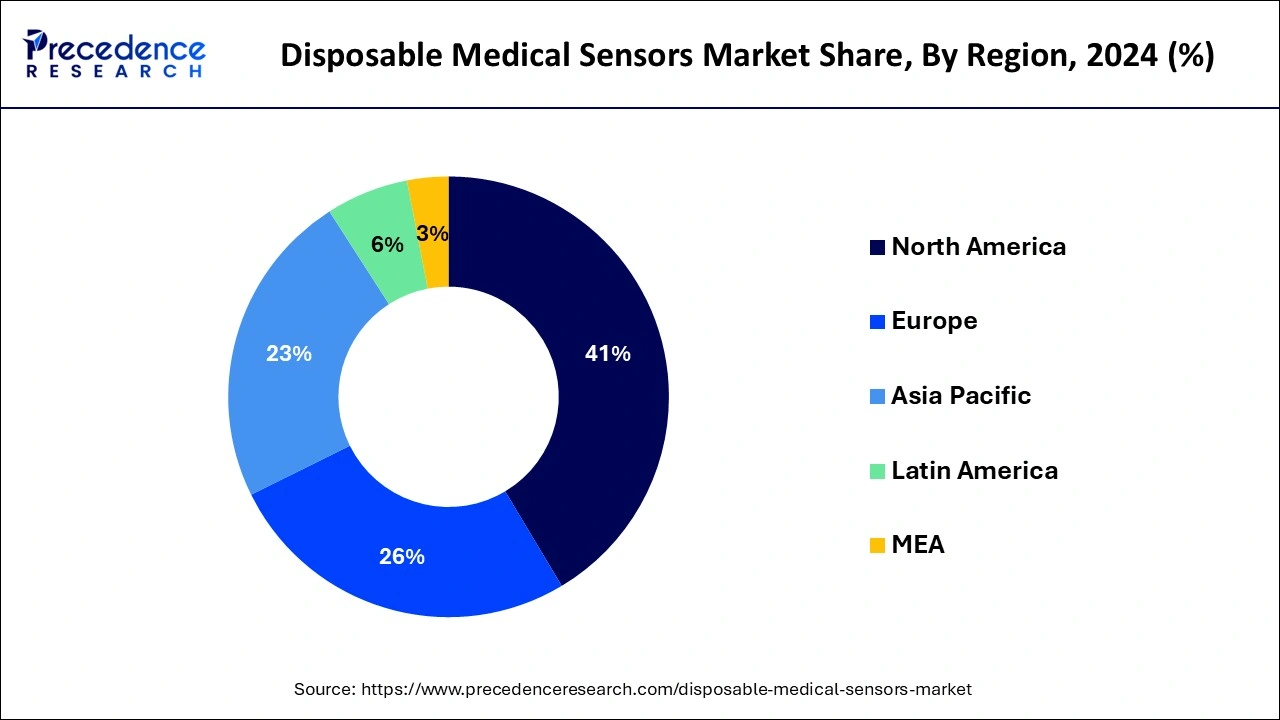

The disposable medical device sensors market has been categorized geographically into Asia-Pacific, North America, Latin America, Europe, the Middle East, and Africa. Throughout the projection period, North America dominated the disposable medical sensors market with the largest market share of 41% in 2024. Diagnostic applications frequently employ disposable wearable sensors due to their numerous advantages, including cost-effectiveness, the convenience of use, non-infectious nature, and speedier findings, which further add to market expansion. Developing sensors and better healthcare I.T. infrastructure will help drive this market. The European market, dominated by Germany, France, and the United Kingdom, makes up a sizeable percentage of the disposable medical device sensors market after North America.

Due to the increased frequency of chronic illnesses and patient pools, Asia-Pacific will likely experience a significant growth rate during the projected period. Another factor contributing to the region's economy is medical tourism and improved healthcare infrastructure. The market is anticipated to grow due to the early adoption of new technologies in biomedical device sensors.

The introduction of implantable sensors and ongoing technological developments in medical sensors such as wireless, disposable, and biosensors used in various monitoring and diagnosing systems are likely to propel the disposable medical sensors market over the forecast years.

Additionally, the market will likely grow in the next years due to the rising incidence of chronic diseases and the rising need for medical sensors for at-home treatment. Additionally, government initiatives to promote R&D and the increased adoption of biosensors will likely fuel the market during the anticipated period.

Some limitations and difficulties may prevent the market from expanding. Strict government rules on validation, safety standards for diagnostic medical sensors certification, and unfavorable reimbursement practices are likely to impede market expansion.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.50% |

| Market Size in 2025 | USD 15.49 Billion |

| Market Size by 2034 | USD 71.36 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application, By Product, and By Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The market will grow as sensing devices become more widely used in daily healthcare requirements at homes and hospitals to diagnose and cure various illnesses and conditions. Additionally, the market for disposable medical device sensors is likely to grow due to the rise in chronic diseases like cancer and cardiovascular disease and other conditions like diabetes and new infectious diseases. The players will have a tremendous opportunity for growth due to the developing world's burgeoning economies. Smart pill technology sensors will offer immense growth opportunities for businesses as numerous top industry players collaborate and invest to launch cutting-edge products.

Consumers also chose contact-free testing and treatment technology, as well as healthcare options offered in the comfort of their own homes. A study predicts that the usage of at-home diagnostic tools will triple in 2020 compared to 2019. The number of incidents and worst-case scenarios grew, along with the demand for medical instruments, including pulse oximeters, monitors of blood pressure, digital thermometers, glucometers, and IoT devices for the healthcare industry.

The diagnostic segment contributed the highest market share of 41% in 2024. Various diagnostic tools, including surgical instruments, spirometry, endoscopy, and medical imaging devices, use disposable medical sensors. The sensors improve the diagnostic tools and catch the disease early on. For instance, biosensors based on carbon nanotubes are used to find microbes like S. aureus and E. coli. Because of the sensors' technological advancements, which include high speed and low cost, results are now quicker and more accurate. Additionally, the diagnostic industry is experiencing growing potential because of wireless connectivity and integrated biosensors.

Diagnostic testing is necessary to look for symptoms and illness signs in people with chronic diseases like diabetes. Many tools are available for tracking activities and keeping an eye on patient health hazards. For example, in October 2020, STMicroelectronics and AlifaxS.r.l., a producer of clinical diagnostic equipment, collaborated to develop a cost-effective and speedy portable solution to boost genetic material (DNA1 and RNA) for diagnostic detection that is molecular point-of-care in patient samples using extremely reliable real-time Polymerase Chain Reactions (PCR). Alifax will make this solution available.

The patient monitoring segment will likely grow at the greatest CAGR during the forecast period. Blood pressure monitors, pulse oximeters, and other patient monitoring devices use medical sensors. The demand for medical sensors is growing due to improved technology and a growing need for better monitoring tools. New product introductions are also raising the standard of care. For instance, Philips is planning to introduce a biosensor of the next generation for monitoring that would continually and automatically record vital indications, including heart rate, skin temperature, and breathing rate.

Furthermore, demand for these devices will likely rise during the forecast period due to the numerous benefits of these sensors. Collaboration between businesses and increased R&D spending is likely to spur industry expansion. For instance, Rockley Photonics Holdings Limited recently declared that it would collaborate with Medtronic on future projects in March 2022. Together, the two companies hope to apply Rockley's recently unveiled Bioptx biomarker detection technology with Medtronic's solutions in various healthcare contexts.

Based on products the market is segmented into Pressure Sensors, Biosensors, Temperature Sensors, Accelerometers, and Image Sensors, Others owing to surging demand for a rapid and reliable diagnosis. These sensors are widely used in the diagnosis and monitoring of the patient. The biosensors segment contributed the largest market share of 52% in 2024. Moreover, surging innovation and an increasing need for quick diagnosis are propelling the growth of the segment.

The image sensor is also likely to acquire the highest growth during the upcoming years. These sensors are widely used in endoscopy as it uses light waves and converts it into signals in order to form an image. The image sensors are further bifurcated into two types’ charge-coupled devices (CCD) and complementary metal oxide semiconductors (CMOS). The CMOS are preferred over CCD as it requires less power. CMOS is commonly used in x-ray imaging, minimally invasive surgery, endoscopy, and ocular surgery. Furthermore, the surging advancement of technology coupled with the growing requirement for higher resolution is propelling the development of the industry.

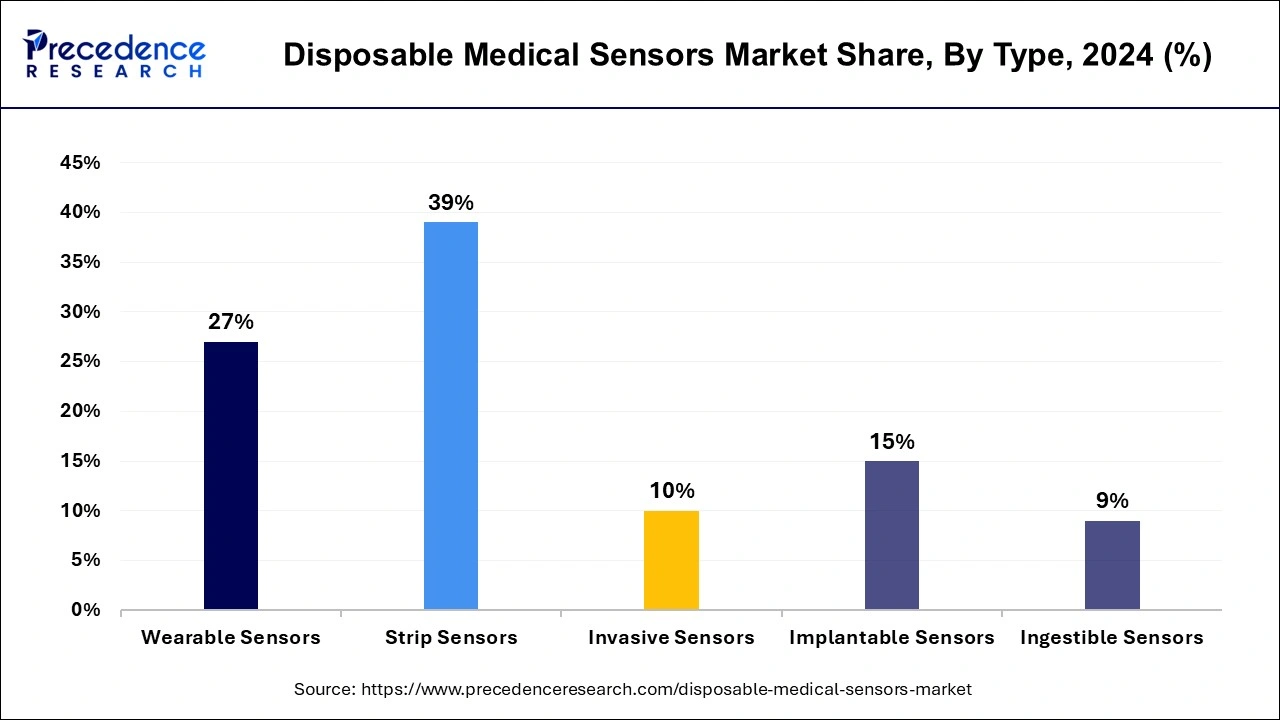

The strip sensors segment recorded the highest market share of 39% in 2024. The main applications for strip sensors are magnetic nanoparticles, illness diagnosis, and blood glucose monitoring. Due to rising demand and its use in diagnostic applications, the strip sensors category has the biggest market share. Utilizing strip sensors has the added advantage of producing results more quickly. Additionally, the industry is being driven by consumer demand for home-based medical gadgets and self-diagnosis tools.

During the forecast period, the ingestible sensors market is anticipated to grow at the greatest CAGR. The term "ingestible sensor" refers to a tiny chip that is swallowed in the form of a capsule. The chip records any anomalies in the body and sends the information to an external device. These sensors are mostly employed in endoscopy, carefully regulated drug administration, and patient observation. Ingestible sensors are expanding due to the rising incidence of chronic diseases and the demand for invasive diagnostic procedures. Additionally, ingestible sensors produce more accurate data, which is projected to drive the market even further.

Ingestible sensors have many benefits, which will likely lead to an increase in demand over the forecast period. Market expansion is anticipated to be fueled by rising R&D expenditures and corporate partnerships. The FDA approved the use of two LINQ II implantable cardiac monitors with the AI algorithms AccuRhythmin in July 2021, according to Medtronic plc. All LINQ II implants in the United States will be able to employ the AI AccuRhythm algorithms once they are made available on the CareLink Network later this year.

By Application

By Product

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

January 2025