November 2024

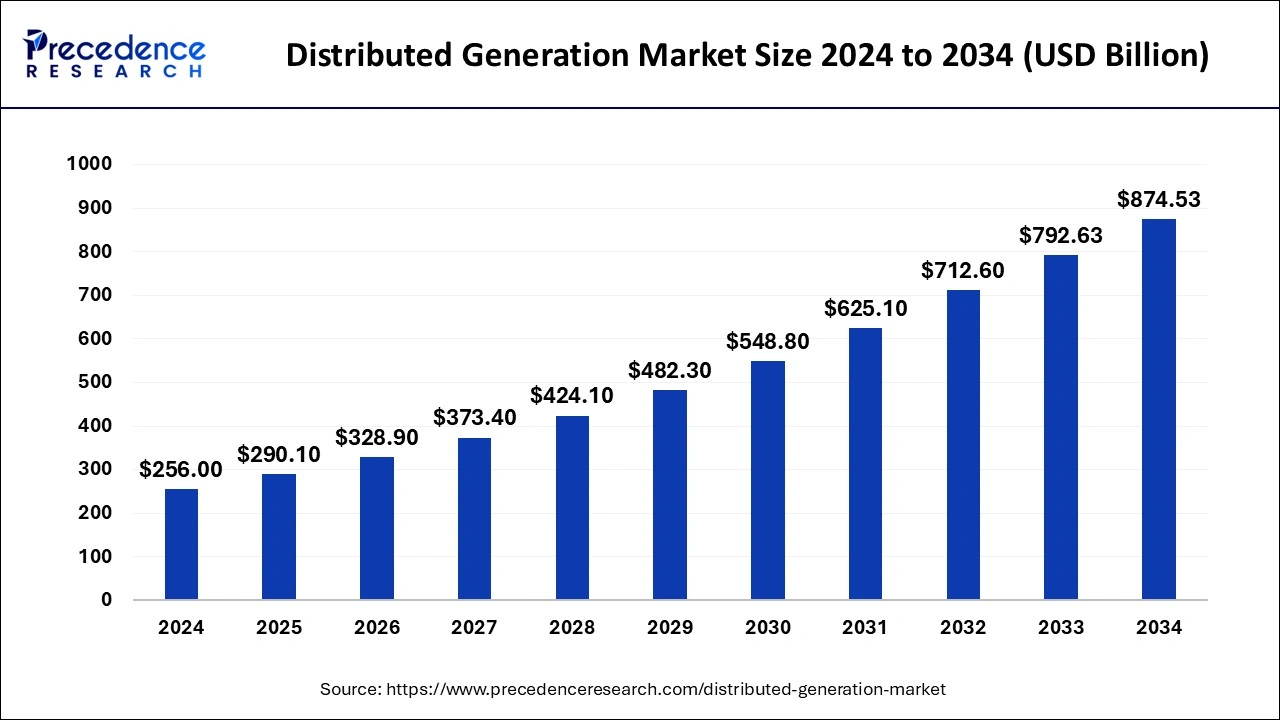

The global distributed generation market size is calculated at USD 290.1 billion in 2025 and is forecasted to reach around USD 874.53 billion by 2034, accelerating at a CAGR of 13.07% from 2025 to 2034. The Asia Pacific distributed generation market size surpassed USD 130.55 billion in 2025 and is expanding at a CAGR of 13.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global distributed generation market size was estimated at USD 256 billion in 2024 and is anticipated to reach around USD 874.53 billion by 2034, expanding at a CAGR of 13.07% from 2025 to 2034. The growth of the distributed generation market is driven by the rising demand for electricity and the increasing adoption of renewable energy sources.

Artificial intelligence (AI) has a notable impact on the market for distributed generation. AI algorithms help analyze energy consumption and generation patterns. This allows distributed generation systems like solar panels and wind turbines to optimize their output. AI also monitors energy storage systems by processing data in real-time, further helping efficiently store and distribute energy. AI also improves the efficiency of distributed generation systems by detecting potential failures.

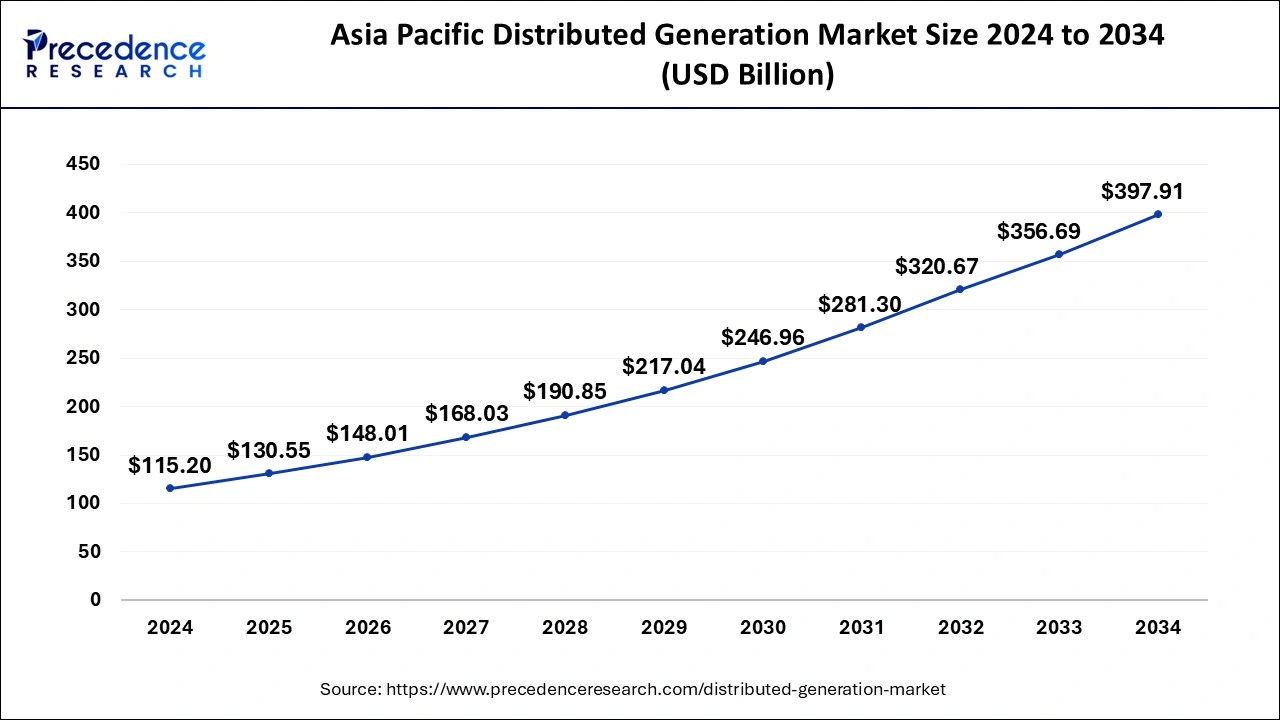

The Asia Pacific distributed generation market size was evaluated at USD 115.20 billion in 2024 and is predicted to be worth around USD 397.91 billion by 2034, rising at a CAGR of 13.20% from 2025 to 2034.

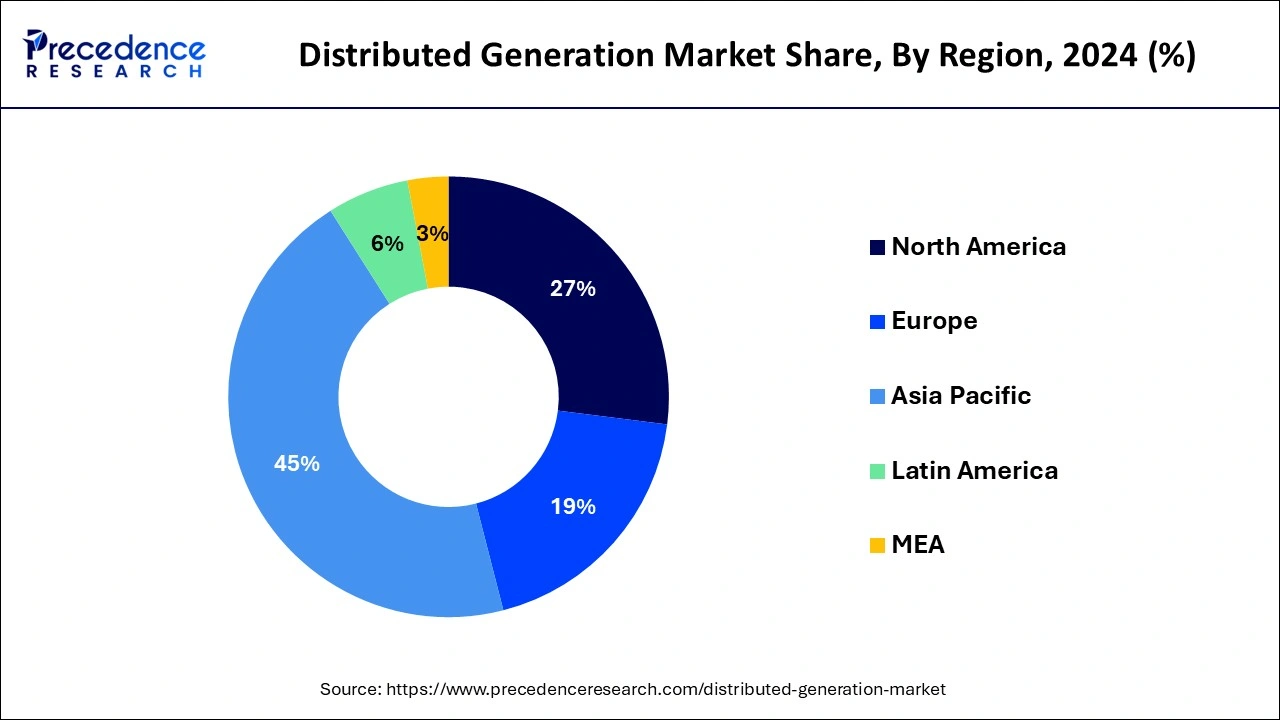

Asia Pacific dominated the global distributed generation market with the largest market share of 45% in 2024. This is simply attributed to the increased adoption of renewable energy sources, rising investments in the industrialization and urbanization, rapidly growing infrastructural developments, and increasing government initiatives to encourage the deployment of renewable and green & clean energy sources. Moreover, with the growing industrialization, the demand for the efficient and uninterrupted power supply is growing significantly, which is fueling the growth of the distributed generation market in Asia Pacific.

North America is estimated to witness a significant growth rate during the forecast period. The huge demand for the wind energy in North America and rapidly growing demand for the solar energy across the commercial and industrial units is expected to fuel the demand for the distributed generation technologies.

The European countries such as Germany and Italy have huge demand for the wind and solar energy. This is attributed to the strict government norms regarding the use of renewable energy. The fuel cells are witnessing huge demand in overall Europe owing to its higher energy efficiency. The increased awareness regarding the climate change and negative effects of carbon emission has resulted in the huge demand for the clean and green energy in Europe. The government has strict regulations regarding the industrial and commercial use of energy pertaining to the renewable sources, which has fueled the growth of the distributed generation market in Europe.

Distributed generation is an electricity generation system that generates electricity at or near the point of use. Distributed generation technology is more affordable and cheaper than traditional energy generation systems, which favors the adoption of distributed generation. Moreover, the availability of a wide variety of sources such as wind, solar, microturbines, gas turbines, reciprocating engines, and fuel cells further promotes the adoption of distributed generation systems across commercial and residential sectors. Rapid industrialization and rapid urbanization are among the major factors that are estimated to drive the growth of the distributed generation market in the coming years.

| Report Coverage | Details |

| Market Size in 2025 | USD 290.1 Billion |

| Market Size by 2034 | USD 874.53 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.07% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, End User, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Electricity Demand

The need for electricity is increasing due to rapid industrialization and urbanization. As nations expand their industries and urban areas grow to accommodate increasing populations, the demand for electricity surges. The costs of renewable energy technologies, such as solar and wind power, have been reduced over the past decade. This decline in cost has made these alternatives more accessible and affordable. In addition, increasing awareness of the adverse

effects of fuel-based energy generation systems on the environment prompts governments, organizations, and individuals to seek cleaner and more sustainable energy sources.

Power Generation Fluctuations

Solar and wind power generation are inherently intermittent energy sources, meaning their output can vary significantly depending on weather conditions. For instance, solar energy production highly depends on sunlight availability, while wind energy relies on wind speed and direction. This variability poses challenges when integrating large amounts of distributed generation into the existing electrical grid. Such integration can lead to technical difficulties, including voltage fluctuations, that can disrupt the stability of the grid and create issues related to power quality.

Technological Advancements

Advancements in energy storage technologies, such as lithium-ion and solid-state batteries, create immense opportunities in the market. These innovations play a crucial role in efficiently integrating renewable energy sources into the existing power grid. These technologies improve

energy storage capabilities, addressing the intermittent issues associated with renewable power generation and ensuring a more reliable and stable energy supply.

The fuel cell segment contributed the highest market share in 2024. The increased adoption of the fuel cells in the distributed generation system owing to various benefits such as high efficiency, lower emissions, and capability of converting chemical energy into electrical energy has fostered the growth of this segment. The fuel cells provide 60% higher efficiencies, which is a major driver of the fuel cell segment.

The solar PV segment is expected to be the fastest-growing segment during the forecast period. The government subsidies for the adoption of solar energy and declining costs of the solar equipment over the past few years has increased the demand for the solar PV distributed generation market. Moreover, the rising government and corporate efforts to reduce carbon footprint and achieve sustainability in the long term, majority of the industries are shifting towards the adoption of solar sources of energy.

The commercial and industrial segment captured the biggest market share in 2024. This is attributed to the increased government initiatives to promote the adoption of the renewable energy sources across the commercial and industrial sectors in the form of subsidies and incentives. Moreover, the reducing equipment costs and increased demand for the uninterrupted power supply has fostered the growth of this segment. Moreover, the increased efforts of the government to industrialize and urbanize the rural regions are supporting the growth of the commercial & industrial segment and hence this segment is expected to dominate throughout the forecast period.

On the other hand, the residential segment is estimated to be the most opportunistic segment during the forecast period. The rising number of big residential complexes and rapid urbanization of the rural regions are the most prominent factors that drive the growth of the residential segment. The increasing adoption of the distributed generation systems for heating, ventilation, cooling, and cooking applications is expected to spur the demand in the residential segment.

By Technology

By End User

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

May 2024

January 2025