May 2024

E-bike Drive Unit Market Size, Share By Product (Mid-Drive Motors and Hub Motors), End-User (OEMs and Aftermarket) - Global Industry Analysis, Trends, Segment Forecasts, Regional Outlook 2024 - 2033

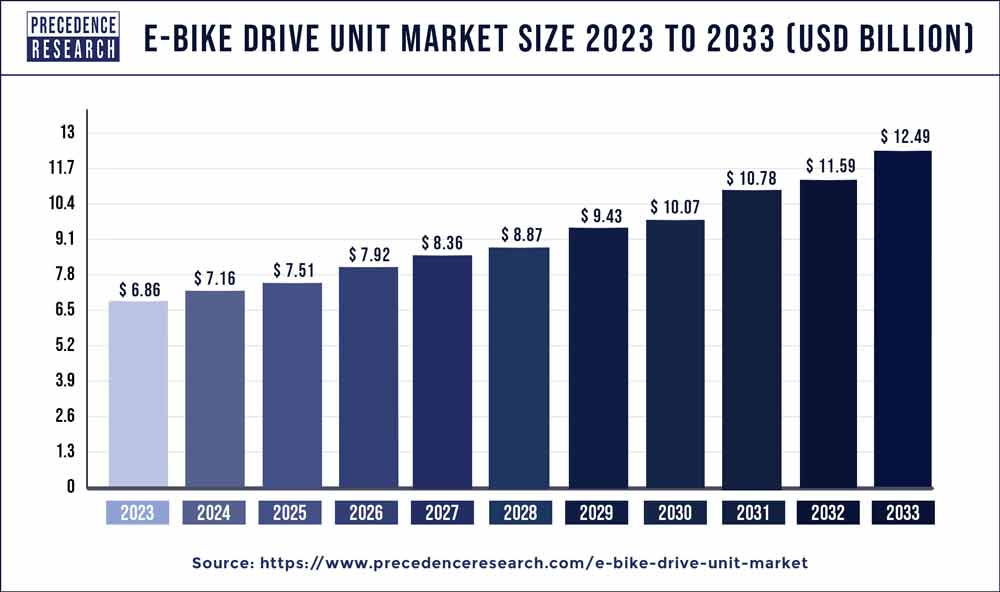

The global E-bike drive unit market was valued at USD 6.86 billion in 2023 and is predicted to reach over USD 12.49 billion by 2033, with a registered CAGR of around 6.38% during the forecast period 2024 to 2033.

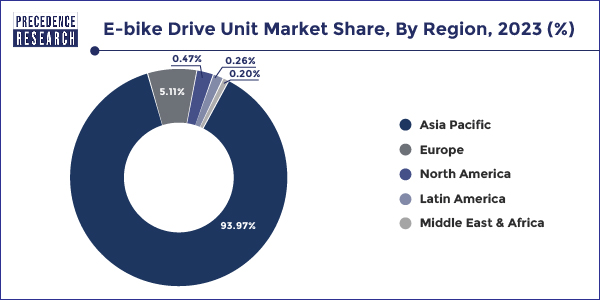

The Asia Pacific E-bike drive unit market size was valued at USD 6.44 billion in 2023 and is anticipated to reach around USD 11.73 billion by 2033, poised to grow at a CAGR of 6.36% from 2024 to 2033.

Asia Pacific accounted for foremost portion of revenue and consumption share of more than 93.97% in the year 2023. Substantial production of e-bikes in China is the major factor that fuels the market growth in the region. China alone subsidizes nearly 90% of the global production of e-bikes and this trend expected to endure over the forthcoming years. Large consumer base and early adoption of the technology in the region are the key influences contributing towards the attractive growth of the region. Apart from China, other Asian nations such as Japan, India, South Korea, Taiwan, and many others are also anticipated to exhibit promising growth for e-bikes and its components over the estimate period.

Europe is the other key region that follows China in terms of e-bike production and exhibit attractive growth for its implementation over the upcoming years. Snowballing trend for shared e-bikes in Spain, Germany, Belgium, the Netherlands, and many other nations in EU-27 predicted to be the key aspect that spurs the growth of this region. Furthermore, increasing public awareness along with snowballing penetration of e-bike drive unit manufacturers in the region again uplifts the overall market demand. Besides, North America displays stable growth in the e-bike drive unit market with significant adoption of the technology in the region.

Cumulative urbanization along with a need for alternative mode of transportation for cars are generating fascinating opportunities for the e-bike sector. Besides, light weight, and low-cost benefits in comparison with electric cars are suggestively driving the market growth for e-bikes and thus e-bike drive units. Foremost market manufacturers for e-bike drive units are continually focusing towards the product innovation and development to reduce the overall weight and cost of the drive system that improves the performance of e-bike as well as make it cost-effective for consumers. Drive unit is the most indispensable component of an e-bike that holds noteworthy importance in the performance of bicycle. Hence, the market growth of drive unit is mainly governed by the e-bike sale and its growth prospects. Cumulative concern about environmental protection has triggered the battery research that extensively drives the electric mobility across the globe. Among other electric vehicles, electric bicycles (e-bikes) sustained to be the highest selling vehicles across the globe since past decade with a registered sale of more than 30 Million in the year 2016. Improvement in the lithium ion battery technology has resulted in lighter and cost-effective e-bikes further aids to the increasing demand for e-bikes.

With snowballing necessity of environment-friendly transportation, popularity of bicycles is booming across numerous parts of the globe. This is mostly because of numerous benefits offered by the cycling such as decreases CO2 emission, reduced noise pollution from other transportation modes, reduces air pollution, saves fuel cost, advances public health, less congestion on roads, and also saves construction and maintenance cost of road infrastructure.

| Report Highlights | Details |

| Market Size by 2033 | USD 12.49 billion |

| Growth Rate from 2024 to 2033 | CAGR of 6.38% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product Type, Application Type, Region Type |

| Companies Mentioned | Robert Bosch GmbH, Continental AG, Yamaha Motor Corporation, Panasonic, Shimano, MAHLE GmbH, Giant Bicycles, Bafang Electric (Suzhou) Co., Ltd, Brose Fahrzeugteile SE & Co. KG |

Market Opportunities

Rising Trend of Bike Sharing

In order to reduce the traffic congestion, bike sharing is a healthy and sustainable choice. With the advent of bike sharing, the mobility sector expected to reshape its business model. As per a study released by Roland Berger, bike sharing has grown stupendously in the recent past and is now available in more than 70 countries with a continuous growth of nearly 20% over the analysis years.

The new trend of e-bike is significantly transforming the bike sharing industry. As per the study published by Roland Berger in 2018, the total number of bike sharing schemes across the globe were more than 1,250 and the total number of bikes shared was over 10 Million in the year 2017. Further, the number is expected to rise up to 20 Million by the end of the year 2021. Out of this, nearly shared e-bikes expected to hold around 0.5% globally in the year 2019. Key factor behind the prominent growth include rising investment for the new product development for example e-bikes.

Several e-bike manufacturers have also enrolled themselves in the e-bike sharing scheme in order to promote sustainable and healthier transport infrastructure. For instance, in February 2018, LimeBike, a smart mobility solution provider announced to deploy large amount shared e-bike, Lime-E in Europe. With this strategy, the company aims to strengthen its foothold in the smart mobility solutions. Similarly, in 2019, a e-bike drive unit manufacturer, Giant Bicycles announced to collaborated with a B2B platform, ConnectBike. Under this project the company aims to provide 300,000 e-bikes in order to assist the bike sharing platform in Belgium and the Netherlands by the end of 2022.

Limitation of Distribution Channel

Distribution channel is a vital component in the supply chain of the e-bikes and their components. E-bike refers to a technically advanced product that requires proper demonstration to the customers about their features and technology that fulfills the need of the customer. Lack of technically trained representatives along with exclusive distribution channel for e-bikes are likely to hinder the market growth for e-bike and thus the growth of e-bike drive unit market. Some of the dealers and independent retailers deal in the e-bike market but their lack of expertise along with maintenance facility fails to support the growth of the global e-bike market. To overcome this, some of the manufacturers have collaborated with the independent retailers and dealers in the e-bike market to provide external support for the technical guidance.

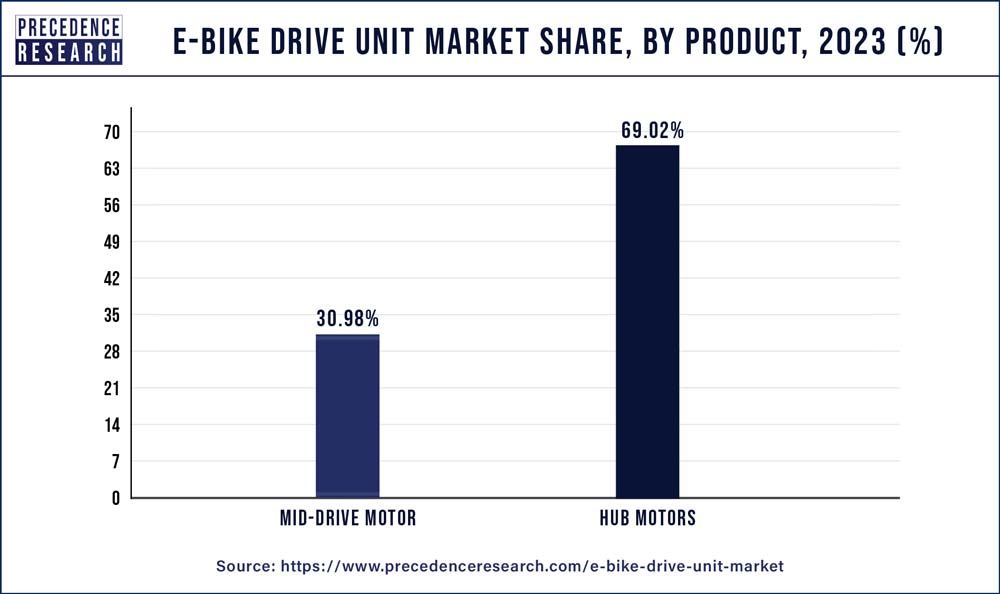

There are two types of drive units utilized in the e-bike that include mid-drive motors and hub motors. Hub motors capture a major revenue share of almost 69.02% in the year 2023. Hub motors are simple in construction, lighter in weight, and inexpensive to the manufacturers due to which it is the most commonly found motors in the e-bike.

Mid-drive motors are electric motors that are mounted closer to the center of the bicycle. The directly connects to the gears and cranks of the bike thus offer higher torque and performance compared to hub motors. It powers through the drivetrain of the bike that assist in running on long and steep hills along with high power that offers high speed on flat roads. The position of the motor is at the center of gravity of the bike touching the ground that further provides better handling to the user, thus are largely preferred for off-road mountain biking. Further, these motors offer easy maintenance compared to hub motors. They can be easily replaced by removing few nut-bolts.

Beside advantages, they provide more stress on the drivetrain of the bicycle as they transfer power through these systems, thus users need to replace these components and parts frequently that triggers their maintenance cost. Moreover, many of the mid-drive motors offer single chainring that limits their range of gear and thus speed. These types of motors are largely preferred for the racing as they provide high gear ratio.

However, mid-drive motors expected to register the fastest growth of 5% over the forthcoming years. Leading influences driving the growth of mid-drive motors over hub motors include their capability to improve torque and speed of the bicycle and improved handling. Besides this, high cost of mid-drive motors than hub motors is one of the chief concerns in its adoption.

Hub motors are the electric motors that are placed inside the hub of wheels i.e. either the front or rear wheels of the bike. They are the most common type of motors found in the e-bikes. The main factor driving their demand is less or minimum maintenance required as they do not exert pressure on the drivetrain and operate independently. Hub motors are further classified into geared and gearless hub motors. Geared motors have internal planetary gears that reduce the speed of a higher Rotation per Minute (RPM) motor whereas a gearless motor have no gearing and are directly connected to the lower RPM. Gearless motors have zero moving part, thus they don’t rust out and provides longer life. Moreover, hub motors are less costly compared to mid-drive motors that cost 3 to 4 times higher.

Apart from benefits, hub motors are heavier in weight than mid-drive motors as well as they are not preferable to run on hills as they offer single gear ratio. Further, they apply their weight is on the wheels that also provides difficulty in handling of the bicycle.

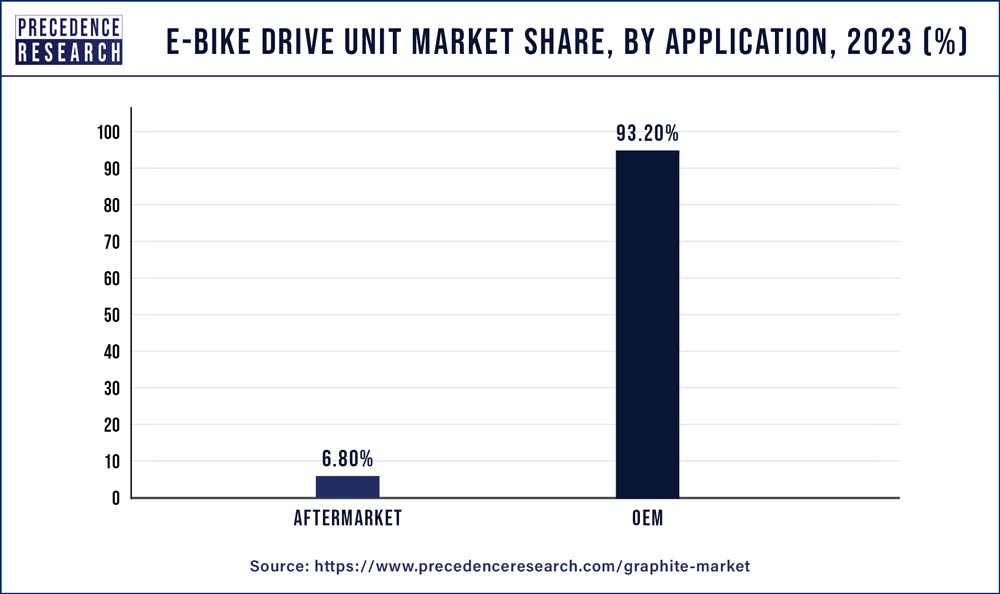

In 2023, OEM dominated the market with around 93.2% share in terms of revenue of the total market and is projected to grow at the highest CAGR during the forecast period. As the e-bike is an innovative and emerging market in the bicycle sector, the OEM occupy major portion of the global e-bike drive unit market revenue.

OEMs in the sector include major automotive parts manufacturers that have renowned brand name and recognition across the globe such as Giant Bicycle, Robert Bosch GmbH, Yamaha Motor Corporation, Panasonic Industries, Continental AG, Shimano, and many others. Further, the rate of competition among these companies very high as they all invest suggestively on the product innovation and development.

Aftermarket for the e-bike drive units holds less revenue share compared to OEMs as the technology is new and in its nascent phase thus has under-developed aftermarket in every region. However, in Europe, and China the aftermarket for e-bike and its components is stronger as these region have strong production base as well as significant demand for the e-bikes. Europe is considered as the bicycle friendly county promoting the adoption of bicycle among users that provides them numerous benefits in achieving CO2 emission norms as well as it boost their economy by reducing spending on the fuel and road infrastructure maintenance. Besides this, less technical knowledge regarding e-bike features restrict its dealers and retailer to contribute prominently towards the growth of the e-bike market.

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2016 to 2027. This report includes market segmentation and its revenue estimation by classifying it on the basis of product, application and region as follows:

By Product

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

February 2025

September 2024

January 2025