January 2025

E-commerce Automotive Aftermarket (By Vehicle Powertrain: Internal Combustion Engine (ICE) Vehicles, Battery Electric Vehicles; By Replacement Parts: Engine Parts, Transmission and Steering, Braking Systems, Lighting, Electrical Parts, Suspension Systems, Wipers, Others; By End-Use: D2B, B2C, D2C) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

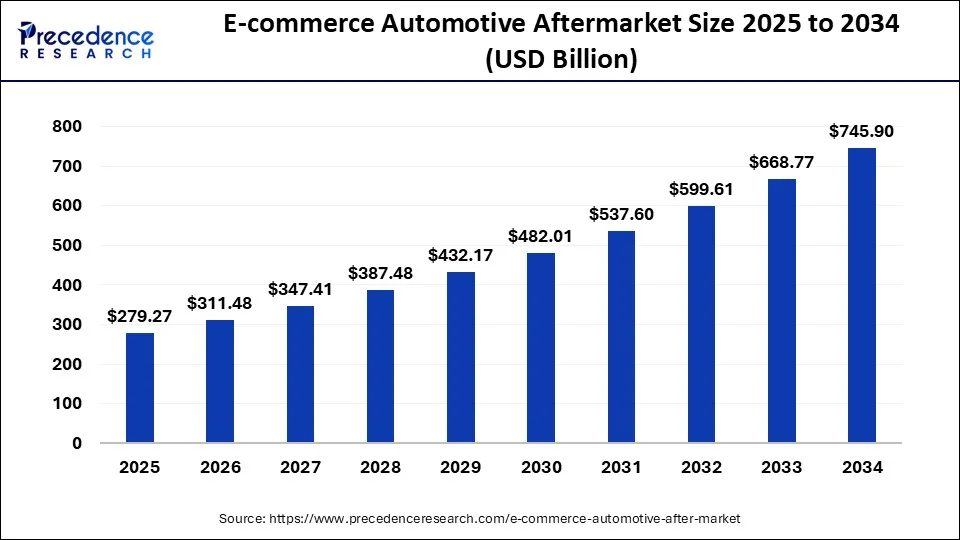

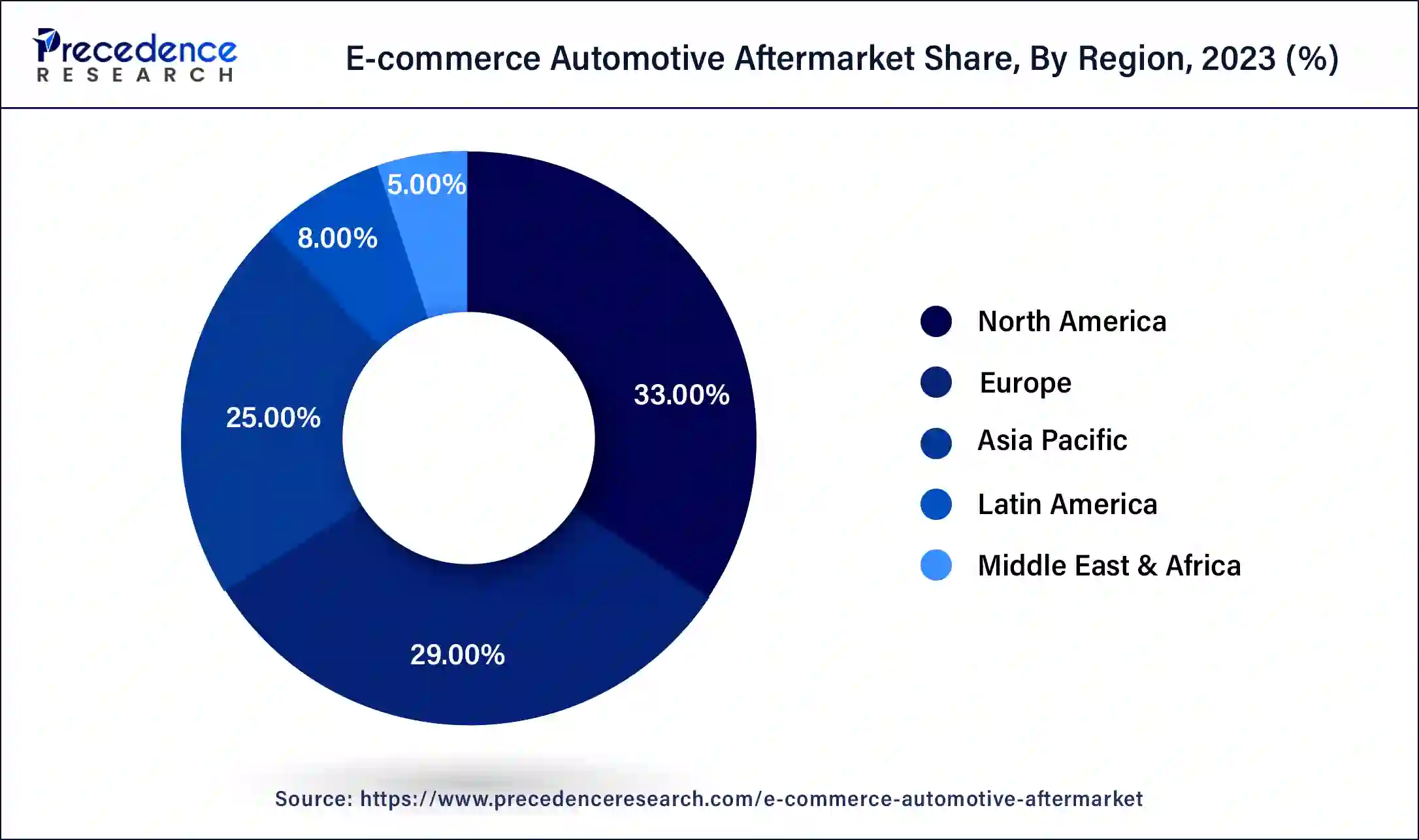

The global e-commerce automotive aftermarket size was USD 224.5 billion in 2023, calculated at USD 250.39 billion in 2024 and is expected to reach around USD 745.90 billion by 2034. The market is expanding at a solid CAGR of 11.53% over the forecast period 2024 to 2034. The North America e-commerce automotive aftermarket size reached USD 74.09 billion in 2023. The rising demand for online shopping across the world is driving the growth of the e-commerce automotive aftermarket.

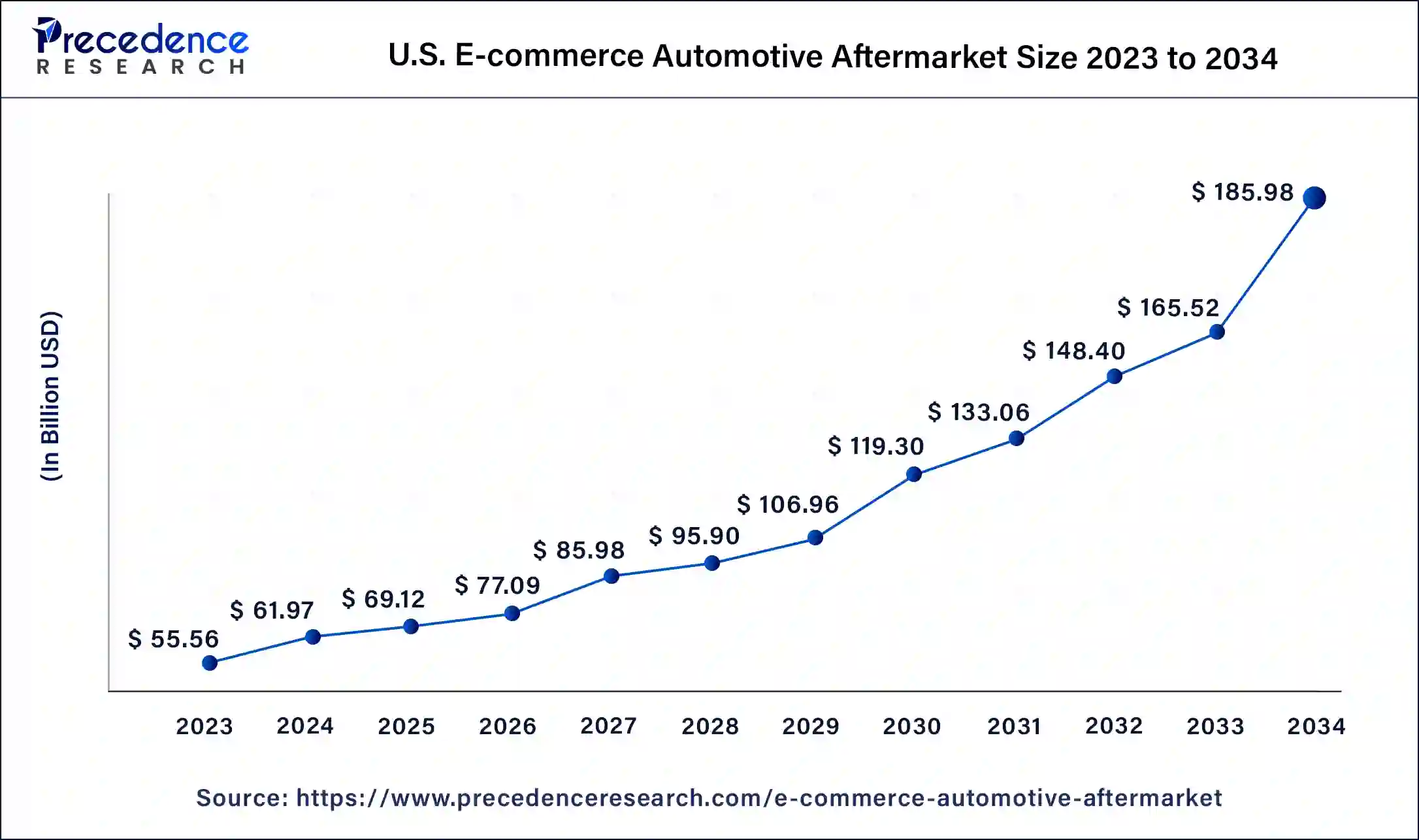

The U.S. e-commerce automotive aftermarket size was exhibited at USD 55.56 billion in 2023 and is projected to be worth around USD 185.98 billion by 2034, poised to grow at a CAGR of 11.60% from 2024 to 2034.

North America held the largest share of the e-commerce automotive aftermarket in 2023. The market's growth in this region is mainly driven by the rising technological advancements in the automotive industry and several government initiatives to develop the e-commerce sector in countries such as the U.S. and Canada. The growing developments in the automotive industry in countries such as the U.S. and Canada, along with rising government funding for developing the EV industry across this region, have helped the industry to grow in this region.

Moreover, the presence of several local market players in the market, such as Advance Auto Parts, Inc., Amazon, RockAuto LLC, TecAlliance TecCom, and some others, are continuously engaged in providing automotive aftermarket products for the automotive industry and adopting several strategies such as partnerships, launches, and business expansions, which in turn drives the growth of the e-commerce automotive aftermarket in this region.

Europe is expected to be the fastest-growing region during the forecast period. The rising trend of SUV vehicles, along with growing advancements in automotive technologies, has increased the demand for the e-commerce automotive aftermarket industry across the region, boosting the market growth. Moreover, the presence of automotive companies such as BMW, Ferrari, Stellantis, Volvo, Lamborghini, Xpeng, Mercedes Benz, and some others has increased the demand for automotive spare parts through online platforms in several countries such as Italy, Germany, France, Netherlands, and some others, has boosted the market growth to some extent in the European region.

Additionally, the presence of various local companies in the market, such as Alliance Automotive Group, ORAP, Autozilla Solutions, and some others, are offering automotive aftermarket components across the European region, which, in turn, is expected to drive the growth of the e-commerce automotive aftermarket industry in this region.

The e-commerce automotive aftermarket market is one of the important industries in the automotive domain. This industry mainly deals in delivering automotive aftermarket parts to people and companies across the world. The growing developments in the automobile industry, along with the integration of modern technologies in vehicles, drive the growth of the aftermarket. This industry comprises replacement parts that mainly include engine parts, braking parts, electronics, steering and controls, suspension systems, lightning parts, and some others. The end-users of this industry mainly include business-to-business (B2B) and business-to-customer (B2C). The e-commerce automotive aftermarket industry is expected to grow exponentially with the growth in e-commerce and automotive industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 745.90 Billion |

| Market Size in 2023 | USD 224.50 Billion |

| Market Size in 2024 | USD 250.39 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle Powertrain, Replacement Parts, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for unique automotive accessories

The craze for modern cars has increased due to changes in lifestyles and growing disposable incomes in developed nations. With the rising trend of luxurious cars, the demand for suitable accessories to enhance the looks and uniqueness of the vehicles increases. Some car accessories are easily available in the offline market, but a few accessories might not be found easily in the local shops, which in turn increases the demand for e-commerce platforms among people as most of the accessories are easily available in such online platforms. Thus, the growing demand for unique car accessories is expected to drive the growth of the e-commerce automotive aftermarket industry during the forecast period.

Delivery issues and fraudulent activities

The trend of purchasing car accessories and spare parts from online platforms is increasing rapidly with the growing sales of cars around the world. Although there are numerous benefits associated with it, there are also several difficulties associated with it. Firstly, the delivery time of car components by e-commerce platforms might get delayed due to logistics and stock-related issues. Secondly, there is a growing number of fraudulent activities from scammers posting false car components on their platforms and delivering low-grade automotive components to customers. Thus, delivery-related issues, along with problems associated with fraudulent activities, are expected to restrain the growth of the e-commerce automotive aftermarket industry during the forecast period.

Increasing demand for ADAS components to reshape the industrial landscape

The sales of automobiles have increased rapidly across the world in recent times. The trend of autonomous vehicles is increasing rapidly due to driving convenience along with safety features. With the rising trend of autonomous vehicles, the demand for ADAS components has increased among people and car makers across the world. Thus, the growing availability of ADAS components in e-commerce platforms is likely to create ample growth opportunities for the market players in the coming years.

The transmission and steering segment dominated the market in 2023. The growing demand for transmission and steering components such as clutch assembly systems, gearboxes, axles, wheels, tires, and some others drive the market growth. Also, the rising preference for garages and workshops to purchase transmission and steering from e-commerce platforms is likely to boost the market growth to some extent. Moreover, the availability of discontinued automotive spare parts in e-commerce platforms is expected to propel the growth of the e-commerce automotive aftermarket during the forecast period.

The electrical parts segment is expected to grow with the fastest CAGR during the forecast period. The demand for car electrical components such as starter motors, spark plugs, batteries, and others has driven the market growth. Also, the availability of electrical components in e-commerce platforms, along with the ongoing trend of online shopping worldwide, is likely to boost the market growth. Moreover, the availability of large stocks in e-commerce automotive aftermarket companies allows people to choose from a wide variety of options according to their requirements. This, along with the offers and discounts that e-commerce platforms provide to customers, is expected to drive the growth of the e-commerce automotive aftermarket during the forecast period.

The business to business segment held a dominant share in 2023. The growing demand for automotive spare parts by car companies and distributors of aftermarket components has driven the market growth. Also, the increased sales from B2B systems are significantly higher than those from B2C systems, which is likely to propel the market growth. Moreover, rising productivity and efficiency in B2B systems, along with the availability of flexible payment options, are expected to drive the growth of the e-commerce automotive aftermarket industry during the forecast period.

The business to customers segment is expected to attain significant growth during the forecast period. The growing proliferation of smartphones among people, along with the development of internet facilities in several countries across the world, strengthens the B2C system, thereby driving market growth. Also, the advantages of B2C systems, such as direct communication with customers and far-reaching marketing/advertising campaigns for gaining consumer attraction, have driven the market growth. Moreover, the rise in the number of DIY (Do It Yourself) consumers across the world is expected to propel the growth of the e-commerce automotive aftermarket industry during the forecast period.

Segments Covered in the Report

By Vehicle Powertrain

By Replacement Parts

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025