E-Fuel Market Size and Forecast 2025 to 2035

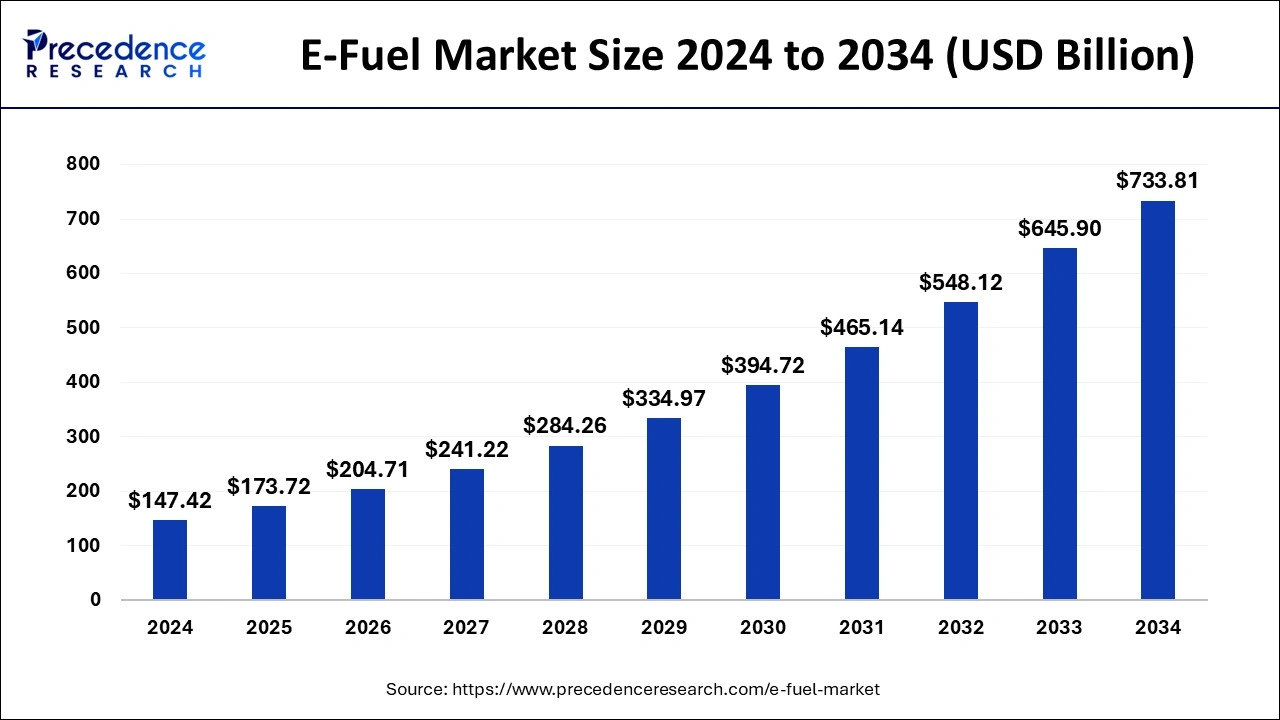

The global e-fuel market size was estimated at USD 147.42 billion in 2024 and is predicted to increase from USD 173.72 billion in 2025 to approximately USD 733.81 billion by 2034, expanding at a CAGR of 17.41% from 2025 to 2034. Rising concerns for higher rates of carbon emissions around the globe and their detrimental effects on the environment led to the transition towards sustainable energy sources, thus driving the global market.

E-Fuel MarketKey Takeaways

- The global e-fuel market was valued at USD 147.42 billion in 2024.

- It is projected to reach USD 733.81 billion by 2034.

- The e-fuel market is expected to grow at a CAGR of 17.41% from 2025 to 2034.

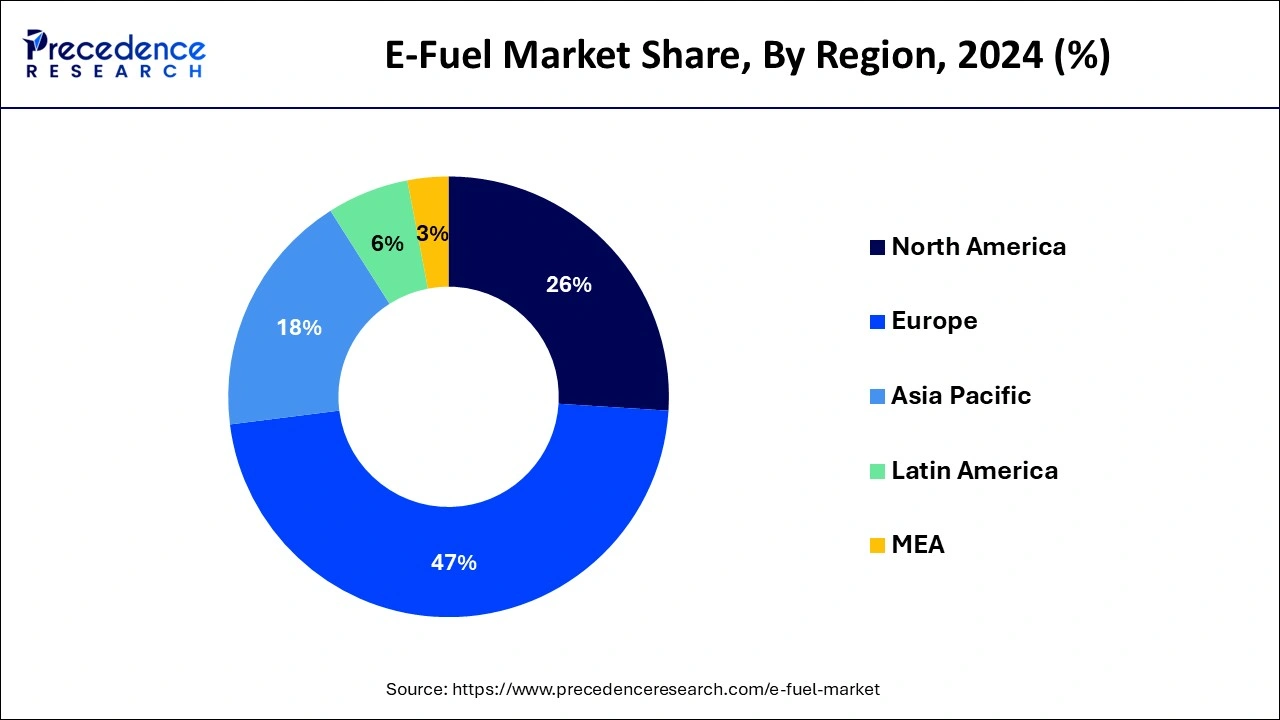

- In Europe, the e-fuel market is experiencing rapid growth and significant momentum, dominating the global market with a 47% revenue share in 2024.

- Germany has accounted market share of over 22% in 2024.

- North America is expected to witness the fastest growth in the global market during the projected period.

- Based on a product, in 2024, the ethanol segment has dominated the market with market share of 27% in 2024.

- Based on state, the liquid segment held the largest market share of 77% in 2024.

- Based on production method, the market was dominated by the power-to-liquid segment in 2024 with market share of 39%.

- Based on technology, the hydrogen technology segment has contributed the largest revenue share of around 59% in 2024.

- Based on a carbon source, the point source segment accounted for the largest market share of over 82% in 2024.

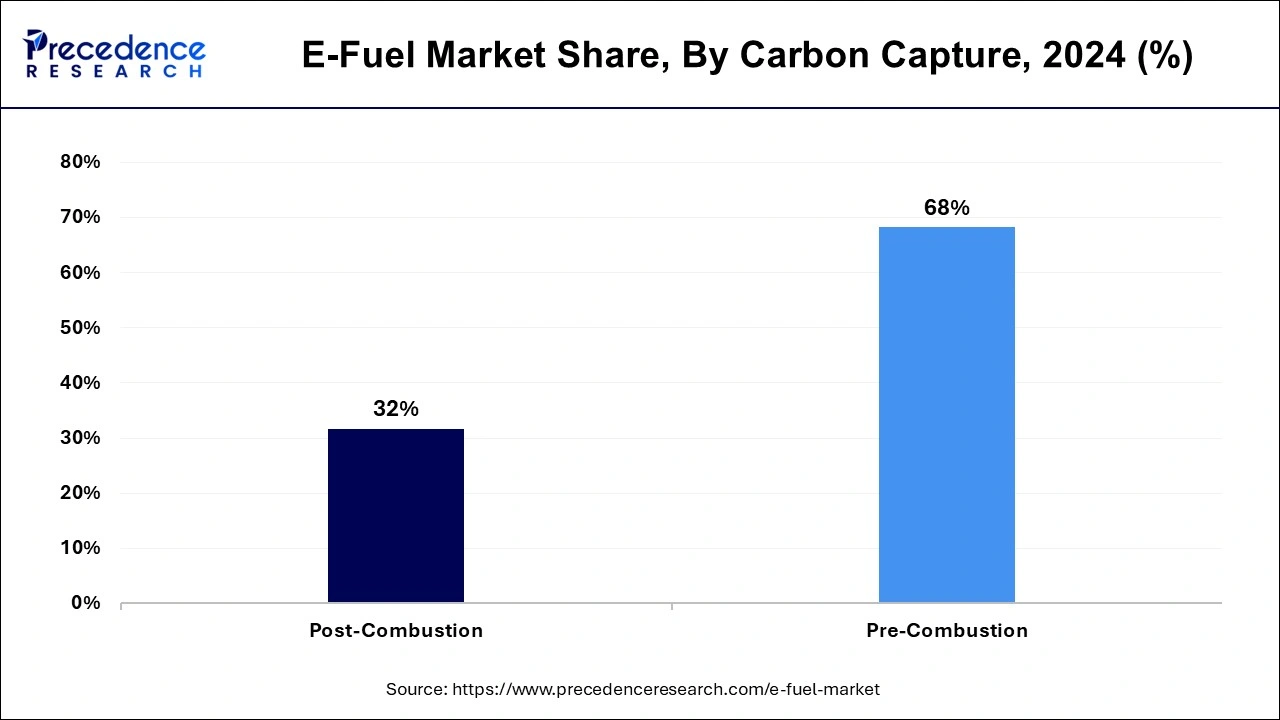

- Based on carbon capture, the pre-combustion segment has held the largest market share of 68% in 2024.

- Based on end use, the automotive segment dominated the market of around 29% in 2024.

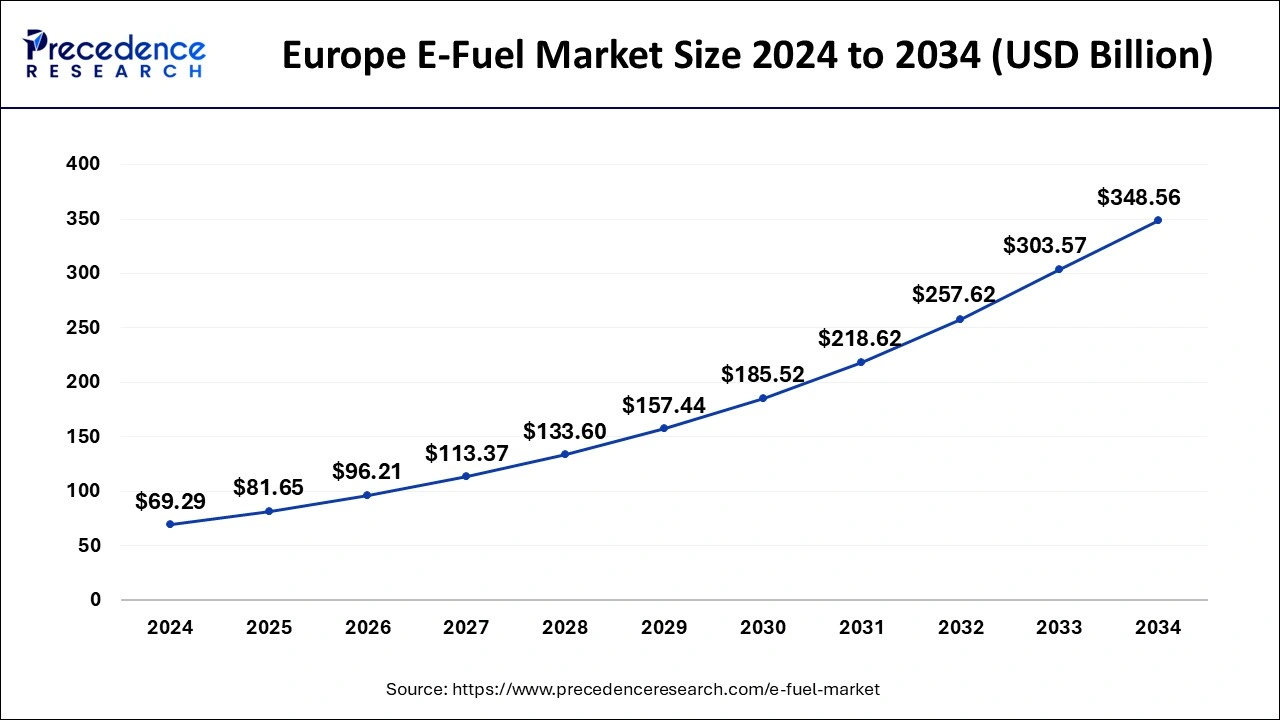

EuropeE-fuel Market Size and Growth 2025 to 2034

The Europe e-fuel market size was estimated at USD 69.29 billion in 2024 and is projected to surpass around USD 348.56 billion by 2034 at a CAGR of 17.53% from 2025 to 2034.

In Europe, the e-fuel market is experiencing rapid growth and significant momentum, dominating the global market. This growth is driven by ambitious climate goals and stringent regulations aimed at reducing carbon emissions. The European Union's commitment to achieving carbon neutrality by 2050, as mentioned in the European Green Deal, provides a strong vision for the adoption of e-fuels as a key component of the region's energy transition strategy.

EU's Renewable Energy Directive sets binding targets for renewable energy use in transportation, creating a market demand for low-carbon alternatives such as e-fuels. Additionally, the EU Emissions Trading System (EU ETS) imposes a carbon price on fossil fuel emissions. As a result, industries are compelled to switch to cleaner fuel options.

Moreover, European countries are investing heavily in renewable energy infrastructure, particularly wind and solar power, which can be beneficial for e-fuel production through processes like electrolysis. This abundance of renewable energy resources positions Europe as a global leader in e-fuel production and innovation. Therefore, Europe presents a promising market landscape for e-fuels. Major European auto-component suppliers such as Mahle, Bosch, and ZF are members of the eFuel Alliance industry coalition, as are oil and gas majors from ExxonMobil to Repsol and energy developers such as Siemens Energy.

North America is expected to witness the fastest growth in the global market during the projected period. The growth has been driven by a combination of factors, including environmental regulations, technological advancements, and increasing awareness of the need for sustainable energy solutions. Many countries in North America, including the United States, Canada, and Mexico, are actively contributing to the expansion of the e-fuel market. North America presents a promising market for e-fuels, with supportive regulatory frameworks, technological innovation, and a growing demand for clean energy solutions driving market growth across the region.

In the United States, there is a growing inclination towards renewable energy and clean transportation initiatives. Policies such as the Renewable Fuel Standard (RFS) and various state-level Low Carbon Fuel Standards (LCFS) provide incentives as support to the production and use of e-fuels, driving the market growth. Additionally, the administration's focus on climate change and infrastructure investments further propels the prospects for e-fuels in the country.

- In April 2022, HIF announced a site in Matagorda County, Texas, for its first North American e-fuels facility. The company projected that some 200 million gal. of e-fuel-derived gasoline would be produced annually when the production site, which represents a USD 6-billion investment, is fully operational. Construction was scheduled to begin in 2023.

Canada is also making a significant contribution to the e-fuel market, with a strong emphasis on reducing carbon emissions and transitioning towards cleaner energy sources. The Canadian government has introduced initiatives such as the Clean Fuel Standard (CFS) to promote the adoption of low-carbon fuels like e-fuels. These initiatives will help to create opportunities for market expansion and investment in the country.

Moreover, In Mexico, there is increasing recognition of the importance of transitioning to sustainable energy solutions to address environmental challenges and enhance energy security. The government has announced plans to invest in renewable energy infrastructure and promote the use of alternative fuels, including e-fuels, as part of its aim to reduce carbon emission.

Market Overview

The e-fuel market is experiencing notable growth, driven by increasing concerns over carbon emissions and the transition towards sustainable energy sources. E-fuels, synthesized from renewable energy sources like wind or solar power, offer a promising alternative to traditional fossil fuels. They present a solution for decarbonizing the transportation and industrial sectors. Government initiatives promoting clean energy adoption, along with stringent regulations on emissions, further propel market expansion.

Key players are investing in research and development to enhance production efficiency and reduce costs, fostering market competitiveness. Technological advancements in electrolysis and synthetic fuel production methods are expected to drive the growth of the e-fuel market in the forecasted years, positioning e-fuels as a crucial component in achieving carbon neutrality all over the world.

E-Fuel MarketGrowth Factors

- Rising awareness about climate change and the need to reduce carbon emissions drive the demand for cleaner fuel alternatives.

- Supportive regulations and incentives from governments worldwide encourage the adoption of renewable energy sources and e-fuels.

- Ongoing research and development efforts lead to improvements in production processes, making e-fuels more cost-effective and efficient.

- Collaborations between energy companies, automobile manufacturers, and research institutions facilitate innovation and scale-up of e-fuel production.

- E-fuels offer a sustainable solution to reduce dependence on imported fossil fuels, enhancing energy security for countries.

- Increasing competition among e-fuel producers drives innovation and cost reduction, making e-fuels more attractive compared to conventional fuels.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.41% |

| Market Size in 2025 | USD 173.72 Billion |

| Market Size by 2034 | USD 733.81 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By State, By Production Method, By Technology, By End-use, By Carbon Source and By Carbon Capture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Demand for carbon neutrality

A significant driver for the e-fuel market is the global demand for carbon neutrality and the need to reduce climate change impacts. With rising concerns over greenhouse gas emissions and their detrimental effects on the environment, there's a growing urgency to transition away from fossil fuels towards renewable energy sources. Achieving these targets requires significant reductions in carbon emissions, which e-fuels can help accomplish by providing a clean energy alternative to traditional fossil fuels.

E-fuels, synthesized from renewable electricity through processes like electrolysis and synthetic fuel production, offer a promising solution to decarbonize key sectors such as transportation, industry, and heating. As governments worldwide implement stricter regulations on emissions and promote renewable energy adoption through incentives and subsidies, the demand for e-fuels is on edge to rise. Moreover, increasing consumer awareness about environmental sustainability and corporate responsibility is driving industries to seek greener fuel alternatives.

Major key players are increasingly seeking alternatives to reduce their carbon footprint, further stimulating the demand for e-fuels as a viable pathway towards achieving carbon neutrality. Consequently, the e-fuel market is experiencing rapid growth as it aligns with global efforts to fight against climate change and build a more sustainable future.

Restraint

Efficiency of e-fuel production

A significant restraint for the e-fuel market is the high initial investment and production costs associated with establishing e-fuel production facilities. The infrastructure required for large-scale production of e-fuels, such as electrolyzers and synthetic fuel plants, demands substantial capital investment. Additionally, the cost of renewable energy sources like wind or solar power, which are used to produce e-fuels, can be high compared to conventional fossil fuels.

The current efficiency of e-fuel production processes is relatively lesser as compared to conventional fossil fuel extraction and refining methods. This inefficiency causes higher production energy output, making e-fuels less economically competitive in the short term. Moreover, the scalability of e-fuel production to meet global energy demands remains a challenge. While advancements in technology are improving production efficiency, scaling up e-fuel production to replace a major portion of fossil fuel consumption worldwide requires further innovation and investment.

Opportunity

Renewable energy growth

The rapid expansion of renewable energy sources such as wind and solar power provides abundant and sustainable energy inputs for e-fuel production, driving down production costs and increasing market productivity. Continued advancements in electrolysis, carbon capture, and synthetic fuel production technologies will improve the efficiency and scalability of e-fuel production, making it more cost-effective and competitive with conventional fuels.

Growing global commitments to carbon neutrality with emission reduction targets will create a favorable regulatory environment for e-fuels, with governments implementing policies and mandates to promote their adoption. Because fuels can be seamlessly integrated into existing transportation, industry, and heating sectors, offering a versatile solution for decarbonization across multiple industries. The combination of technological innovation, supportive policies, and market demand for e-fuels acts as a key driver of the transition to a cleaner and more sustainable energy future.

Therefore, collaboration between energy companies, technology providers, and governments will foster innovation and investment in e-fuel infrastructure, driving market growth and facilitating the transition to a low-carbon economy. Moreover, as consumer awareness and demand for sustainable energy solutions continue to grow, there will be increasing market opportunities for e-fuels, both domestically and internationally. It aids in driving investment and expansion in the sector.

Product Insights

The ethanol segment dominated the market share in 2024. Key players are making many investments to scale up ethanol production worldwide, and they are supported by government policies as well. In the U.S., the ethanol blending process has been adopted and encouraged by the government's renewable fuel standard program. Such a determined effort in the U.S. promotes the higher use of ethanol and its production in the country.

The e-kerosene segment is anticipated to grow at the fastest rate in the foreseen years. The growth of this segment is attributed to the initiatives that have been taken in the European region on a broader scale and to spreading awareness for the highest benefits that could be derived from the use of e-kerosene. For instance, the European Commission agrees to adopt a blending of e-kerosene fuel with existing traditional fuel to increase its sustainability, specifically in the aviation industry in Europe.

State Insights

The liquid segment held the largest market share in 2024. Due to the lesser possibility of reactive nature, liquid state e-fuel has been used in several industries, and thus, they have a wide application in several sectors, including powering generators, powering vehicles, and many industrial applications. The best part is that liquid fuel does not require a change in the industry's existing setup as it has high scalability and thus can be adjusted by blending it into conventional fuels.

In the e-fuel market, the gas state segment is anticipated to grow at a faster rate in the upcoming future. This is due to the increasing demand from several industries. There are many gaseous fuels required to operate a system in the industry, such as the power generation field.

Production Method Insights

The market was dominated by the power-to-liquid segment in 2024. Utilizing renewable energy and acknowledging Environmental concerns are the primary factors in reducing carbon emissions from conventional fuels. Hence, this segment has a strong hold over the e-fuel market.

The gas-to-liquid segment is projected to grow at the highest rate over the study period. Gas-to-liquid is a novel production method that aids in converting natural gas into its liquid state of hydrocarbons through the synthesis process. This technology works on the utilization of primary gas feedstocks like natural gas. Hence, this contributes to the higher growth rate of the gas-to-liquid segment.

Technology Insights

The hydrogen technology segment contributed the largest market share in 2024. It is a reliable method to generate hydrogen without the emission of carbon. This can be achievable by using renewable and nuclear sources. There are two main types of technologies called electrolysis, which are used to generate renewable fuels: polymer electrolyte membranes and alkaline electrolyzers.

The reverse water gas shift segment is projected to witness the fastest growth over the forecast period. Using renewable hydrogen and captured carbon dioxide to produce carbon monoxide is immensely useful and sustainable. Compared to conventional fossil fuels, this leads to a decreasing dependency on carbon sources for energy generation.

Carbon Source Insights

The e-fuel market is bifurcated into direct air capture and point source segments. The point source segment accounted for the highest market share in 2024. The growth of this segment is attributed to its capability to capture the emissions that happen from industrial sites and available carbon dioxide in the atmosphere.

The direct air capture segment is expected to grow at the highest CAGR during the forecast period. The direct air capture method is one of the most adaptable methods to receive carbon from the atmosphere. This segment's growth involves a special facility known as DAC plants. These are customized to derive CO2 from the surroundings. These plants used an advanced method of condensation, which aids in capturing the CO2 molecules from the air and making them frizzed or in a condensed state.

Carbon Capture Insights

The pre-combustion segment held the largest market share in 2024. The growth of this segment is due to its wide application in the gasification process. The gasification process involves the primary carbon-containing material being converted into a gas-type mixture, which is made up of hydrogen and CO2 molecules.

On the other hand, the post-combustion segment is expected to be the fastest-growing segment over the forecast period. The growth of this segment is related to its wider applications in power plants and industries. During the combustion process of gaseous mixtures, only CO2 is derived from it using the post-combustion process. Chemical absorbents or chemical solvents are some of the innovative techniques that are used to separate CO2 from these combusted gases.

End-use Insights

The automotive segment dominated the market in 2024. The growth of this segment is attributed to the seamless replacement that can be done by e-fuel for conventional fossil fuels. E-diesels and e-gasoline can easily replace petroleum-based fuels in internal combustion engines of vehicles without making considerable changes. Synthetic and bio-based liquid “e-fuels” have, in various forms, enjoyed fits and starts of industry attention and R&D investment in recent years.

- In March 2023, a politically charged deal between the European Union and Germany was held. According to this, in the EU's mandate for sales, only when Electronic Vehicles start in 2035. The agreement allows manufacturers to continue selling internal combustion models after 2035. but only if they run on carbon-neutral e-fuels.

E-Fuel Market Companies

- Archer Daniels Midland Co.

- Ballard Power Systems, Inc.

- Ceres Power Holding Plc

- Clean Fuels Alliance America

- Climeworks AG

- E-Fuel Corporation

- eFuel Pacific Limited

- Hexagon Agility

- Neste

- Norsk e-Fuel AS

Recent Developments

- In March 2024, indiaOil launched ETHANOL 100 as an alternative automotive fuel. The Indian government made this courageous move in the automotive sector to reduce its dependency on fossil fuels, thus contributing to the global target of seizing carbon emissions and making the climate free from environmental toxication by internal combustion of conventionally working vehicles.

- In April 2023, Norwegian Air Shuttle ASA collaborated with Norsk e-fuel in Norway. The target of launching this new plant is to cater to the aviation industry by producing sustainable e-fuels by 2026. Through this collaboration, enterprises are expected to scale up their e-fuel production while holding high positions in the global market.

Segments Covered in the Report

By Product

- E-diesel

- E-gasoline

- Ethanol

- Hydrogen

- E-kerosene

- E-methane

- E-methanol

- Others

By State

- Liquid

- Gas

By Production Method

- Power-to-liquid

- Power-to-gas

- Gas-to-liquid

- Biologically derived fuels

By Technology

- Hydrogen technology (Electrolysis)

- Fischer-tropsch

- Reverse-water-gas-shift (RWGS)

By End-use

- Automotive

- Marine

- Industrial

- Railway

- Aviation

- Others

By Carbon Source

- Point source

- Smokestack

- Gas well

- Direct air capture

By Carbon Capture

- Post-combustion

- Pre-combustion

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa