August 2024

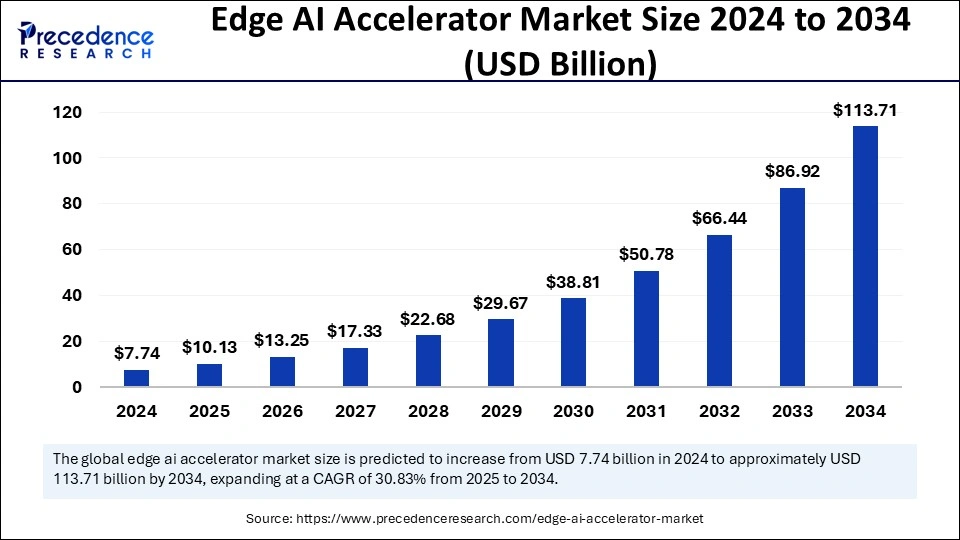

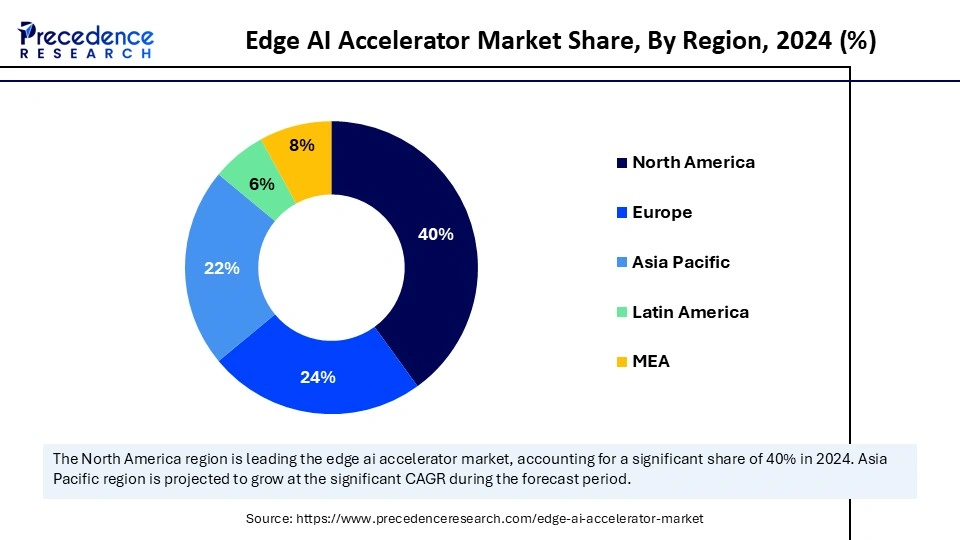

The global edge AI accelerator market size is calculated at USD 10.13 billion in 2025 and is forecasted to reach around USD 113.71 billion by 2034, accelerating at a CAGR of 30.83% from 2025 to 2034. The North America market size surpassed USD 3.10 billion in 2024 and is expanding at a CAGR of 30.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global edge AI accelerator market size accounted for USD 7.74 billion in 2024 and is predicted to increase from USD 10.13 billion in 2025 to approximately USD 113.71 billion by 2034, expanding at a CAGR of 30.83% from 2025 to 2034. The growth of the edge AI accelerator market is driven by the growing need for immediate data processing. As the number of connected devices increases, the necessity for swift analysis becomes crucial across multiple sectors, boosting the demand for edge AI accelerators.

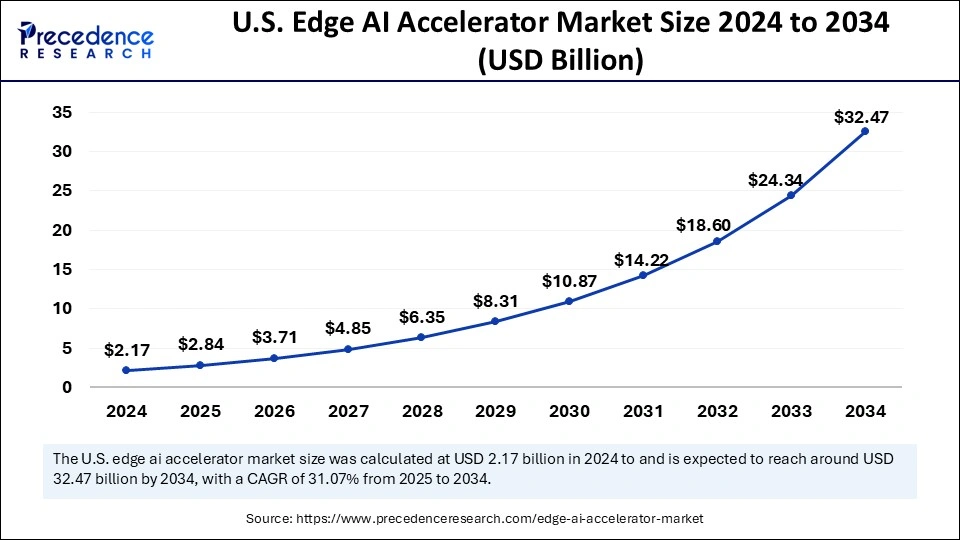

The U.S. edge AI accelerator market size was exhibited at USD 2.17 billion in 2024 and is projected to be worth around USD 32.47 billion by 2034, growing at a CAGR of 31.07% from 2025 to 2034.

North American Edge AI Accelerator Market Trends

North America dominated the market with the largest share in 2024 due to its robust technological framework, early adoption of AI, and significant investments in AI-driven solutions. The region hosts prominent semiconductor and AI technology firms that are actively creating next-generation AI accelerators for edge computing. Sectors such as automotive, healthcare, and industrial automation heavily use edge AI for real-time decision-making and predictive analysis. Government efforts promoting AI innovation, smart infrastructure, and 5G implementation are additionally fortifying North America's market position. The growing use of AI-powered IoT devices, intelligent surveillance, and AI-enhanced cloud-edge hybrid systems also contributes to regional market growth.

United States

The U.S. represents the largest market for edge AI accelerators, with major corporations like NVIDIA, Intel, Qualcomm, and Google investing in AI-driven edge computing solutions. Policies introduced by the U.S. government aim to enhance AI research and development, facilitating adoption in sectors such as autonomous vehicles, defense, and healthcare. The development of AI-powered smart cities, industrial automation, and real-time edge analytics is driving market growth. Furthermore, the increasing presence of AI-enabled consumer electronics, security systems, and predictive maintenance solutions is raising the demand for efficient, low-latency edge AI accelerators.

Canada

Canada plays a major role in the regional market growth due to the rising adoption of edge artificial intelligence and Internet of Things, especially in healthcare and manufacturing. Government-supported initiatives like the Pan-Canadian AI Strategy are encouraging advancements in AI-driven automation, robotics, and energy-efficient edge computing. Industries in Canada are integrating edge AI into predictive maintenance, cybersecurity, and smart infrastructure initiatives. Additionally, the country's focus on sustainability and eco-friendly AI computing is promoting the development of low-power AI accelerators for IoT and industrial uses.

Asia Pacific Edge AI Accelerator Market Trends

The market in Asia Pacific is projected to expand at the fastest rate during the forecast period due to the rising smartphone usage, rapid industrialization, and robust governmental initiatives promoting AI implementation. There is an increasing demand for AI-based IoT applications, smart city developments, and AI-enhanced consumer electronics throughout the region. Leading countries like China, Japan, and South Korea are making significant investments in AI-driven edge computing, semiconductor production, and AI-powered automation. Moreover, the growing rollout of 5G networks is improving the scalability of edge AI solutions across sectors such as automotive, healthcare, and industrial IoT.

China

China plays a crucial role in the Asia Pacific edge AI accelerator market, backed by substantial investments in AI-oriented smart infrastructure, self-driving vehicles, and AI-powered surveillance technologies. Government strategies like the Made in China 2025 initiative and AI-centric policies are driving the adoption of edge AI in sectors such as industrial automation, healthcare, and smart city projects. Major technology companies in China, including Huawei, Alibaba, and Baidu, are crafting custom AI chips and AI-driven edge computing platforms, which further contribute to market advancement.

Japan

Japan is becoming a significant market for edge AI accelerators due to the rising use of AI in the automotive, robotics, and industrial automation sectors. Companies in Japan, such as Sony, NEC, and Fujitsu, are investing in low-power AI chips for edge devices. The nation’s strong emphasis on robotics, smart manufacturing, and AI-driven healthcare solutions is propelling the need for real-time edge AI processing. Furthermore, Japan’s rollout of 5G technology and growth in AI-powered IoT applications are enhancing adoption in smart cities, industrial automation, and AI-infused security systems.

European Edge AI Accelerator Market Trends

Europe is considered to be a significantly growing area. Stringent government regulations regarding AI ethics, initiatives promoting smart manufacturing, and the rising development of AI-driven healthcare solutions are expected to support the market. European industries are allocating resources to AI-powered industrial automation, edge computing for cybersecurity, and automotive applications driven by AI. The European Union’s AI strategy, along with digital transformation programs, are promoting the integration of AI into IoT, robotics, and edge AI processors. Additionally, the emphasis on energy-efficient AI chip development is gaining momentum due to Europe’s commitment to green computing and sustainable AI implementations.

Germany

Germany is expected to have a stronghold on the market due to the rising focus on developing AI-driven industrial automation. The rising usage of edge AI accelerators for predictive maintenance, factory automation, and AI-enhanced robotics further supports regional market growth. The country’s Industry 4.0 initiative fosters AI-enabled smart manufacturing, energy-efficient computing, and AI-integrated cyber-physical systems. Major automotive manufacturers in Germany, such as BMW, Volkswagen, and Mercedes-Benz, are adopting edge AI for autonomous driving and AI-boosted safety technologies, which further drives the demand for AI accelerators.

United Kingdom

The UK is a major contributor to AI research, AI-powered healthcare advancements, and AI-enhanced cybersecurity solutions. UK-based startups and technology firms are creating low-latency AI accelerators designed for smart surveillance, detection of financial fraud, and medical imaging. Government-led AI initiatives are fueling investment in AI-powered IoT applications and AI-driven automation in urban areas. In addition, the UK’s commitment to ethical AI and regulatory adherence is influencing the development of reliable and transparent AI-based edge computing solutions.

Conventional cloud computing approaches encounter issues such as latency, bandwidth constraints, and concerns about data privacy, prompting organizations to look for localized alternatives. The rising adoption of smart technologies in the consumer electronics and automobile sectors and intelligent industrial automation are boosting the edge AI accelerator market growth. In consumer-focused applications like smartphones, wearables, and smart appliances, Artificial Intelligence accelerators are used to balance high processing power. There is a demand for high-speed processing and energy efficiency in various industrial applications. Many chip manufacturers are facing challenges in enhancing processing speeds while lowering power consumption. To address these challenges, companies are investing in creating application-specific chips, efficient chip designs, innovative algorithms, advanced memory solutions, and alternative materials.

The rise of deep learning, neural networks, computer vision, generative artificial intelligence, and neuromorphic computing has opened up new prospects for edge inferencing applications. As businesses rapidly shift toward decentralized computing architecture, they are also discovering new strategies to employ this technology to enhance productivity and reduce costs. Developers of AI chips must concentrate on creating solutions that cater to these specific use case requirements. The proliferation of Internet of Things devices is boosting the need for edge computing, which further propels the demand for edge AI accelerators.

| Report Coverage | Details |

| Market Size by 2034 | USD 113.71 Billion |

| Market Size in 2025 | USD 10.13 Billion |

| Market Size in 2024 | USD 7.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 30.83% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Processor, Device, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing Need for Low-Latency AI Processing

The rising demand for immediate data processing and instantaneous decision-making is a significant factor driving the growth of the edge AI accelerator market. Applications such as self-driving vehicles, industrial automation, advanced surveillance, and medical diagnostics necessitate rapid AI-driven insights without depending on cloud computing. Edge AI accelerators minimize latency and improve security by facilitating on-device AI processing. With the swift growth of the Internet of Things devices and smart city initiatives, businesses and governments are heavily investing in edge computing solutions to boost operational efficiency, enhance user experiences, and safeguard data.

High Costs and Complexity of Implementation

The high costs and intricacies associated with deploying edge AI accelerators restrain the growth of the edge AI accelerator market. Edge AI solutions necessitate specialized hardware, energy-efficient AI chips, and sophisticated software optimizations, resulting in significant initial expenses for small and medium-sized enterprises. Furthermore, integrating AI models with various edge devices requires tailored solutions, a skilled workforce, and ongoing maintenance, which adds to operational expenses. The absence of standardized frameworks and compatibility creates challenges across different hardware platforms, further hindering the widespread adoption of edge AI technology and limiting market growth.

Implementation of AI in Edge IoT and Smart Devices

The rising implementation of AI-enabled IoT devices offers a significant opportunity for the edge AI accelerator market. Healthcare, automotive, and manufacturing sectors are incorporating edge AI solutions to enhance predictive analytics, boost automation, and improve decision-making. AI-enabled smart sensors, health monitoring wearables, and industrial IoT devices require edge AI accelerators for effective data processing with minimal delays. Additionally, progress in AI chipsets, neural processing units, and tailored AI processors makes edge AI solutions more cost-effective and energy-efficient, driving adoption across consumer electronics, enterprise IT, and security sectors.

The central processing unit (CPU) segment dominated the edge AI accelerator market with the largest share in 2024. This is mainly due to its extensive use in computing devices and enterprise applications. CPUs are vital for AI processing, data computation, and real-time analytics across a variety of devices, including smartphones, laptops, and industrial automation systems. The high compatibility of CPUs with numerous AI software frameworks positions them as the preferred option for general-purpose AI applications. Moreover, improvements in multi-core processing and AI-optimized CPU designs have bolstered their capacity to efficiently support edge computing applications.

The application-specific integrated circuits (ASICs) segment is expected to grow at a significant rate during the forecast period due to the escalating requirement for high-performance, low-power AI processing at the edge. ASICs are custom-designed chips tailored for specific AI tasks, resulting in greater efficiency and energy savings compared to general-purpose processors. Industries such as automotive, healthcare, and IoT are progressively utilizing ASIC-based accelerators to attain ultra-low latency and real-time AI inference. The rising trend of custom AI chip development by leading semiconductor firms is also further propelling the demand for ASICs.

The smartphones segment held the largest share of the edge AI accelerator market in 2024 due to the widespread use of AI-enabled smartphones that incorporate on-device processing capabilities. AI-powered features like facial recognition, real-time translation, voice assistants, and augmented reality applications significantly depend on edge AI acceleration to provide smooth user experiences. Leading smartphone manufacturers are incorporating dedicated AI accelerators, neural processing units, and AI-enhanced imaging processors to boost efficiency, extend battery life, and increase security. The rollout of 5G networks and supporting frameworks for edge computing further facilitates AI adoption in smartphones.

The IoT devices segment is projected to expand at a significant rate during the projection period. The segment growth can be attributed to the rise of smart homes, industrial IoT, and interconnected devices. Real-time AI inference at the edge is essential for IoT devices, such as smart sensors, wearable health monitors, and security cameras, as it minimizes latency, improves decision-making, and enhances energy efficiency. AI-driven IoT accelerators are transforming predictive maintenance, intelligent automation, and smart energy management.

The automotive segment dominated the edge AI accelerator market with the largest share in 2024. This is mainly due to the growing integration of AI in autonomous driving technology, advanced driver-assistance systems, and in-vehicle infotainment solutions. In the automotive realm, AI accelerators facilitate immediate image processing, object detection, and navigation improvements, thereby reducing dependence on cloud-based AI systems. Automotive manufacturers are implementing AI-powered edge processors for features like lane departure warnings, automatic braking, and collision avoidance systems, which enhance both safety and the driving experience. The increase in investments in electric vehicles and connected car technology further boosted the demand for edge AI accelerators in the automotive industry.

The manufacturing segment is likely to witness the fastest growth during the forecast period, driven by the advancement of smart factories, AI-powered automation, and industrial IoT applications. Edge AI accelerators are transforming predictive maintenance, real-time quality management, and robotic process automation within manufacturing facilities. AI-driven computer vision systems and robotics equipped with AI are improving efficiency on assembly lines and enhancing defect detection. The movement toward Industry 4.0 and the implementation of AI-powered digital twins are further promoting AI utilization in manufacturing, cutting down downtime, optimizing resource usage, and boosting operational efficiency across various manufacturing industries.

By Processor

By Device

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

September 2024

September 2024

April 2025