May 2025

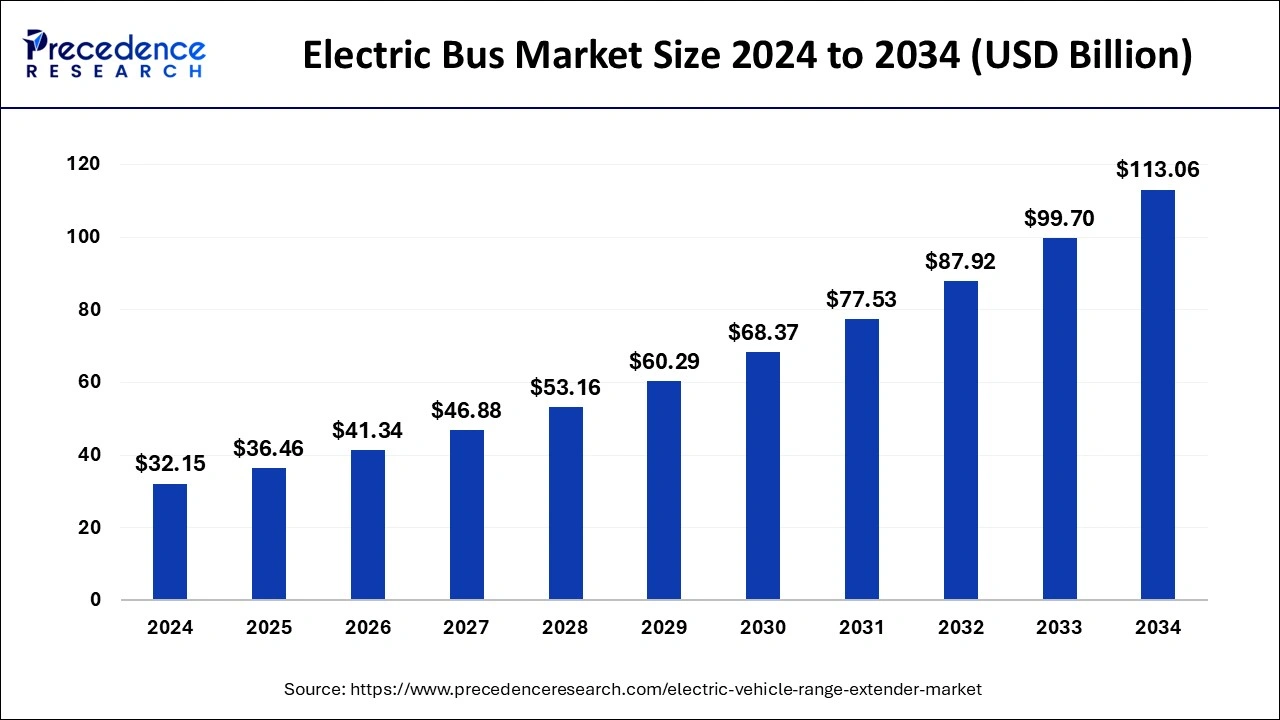

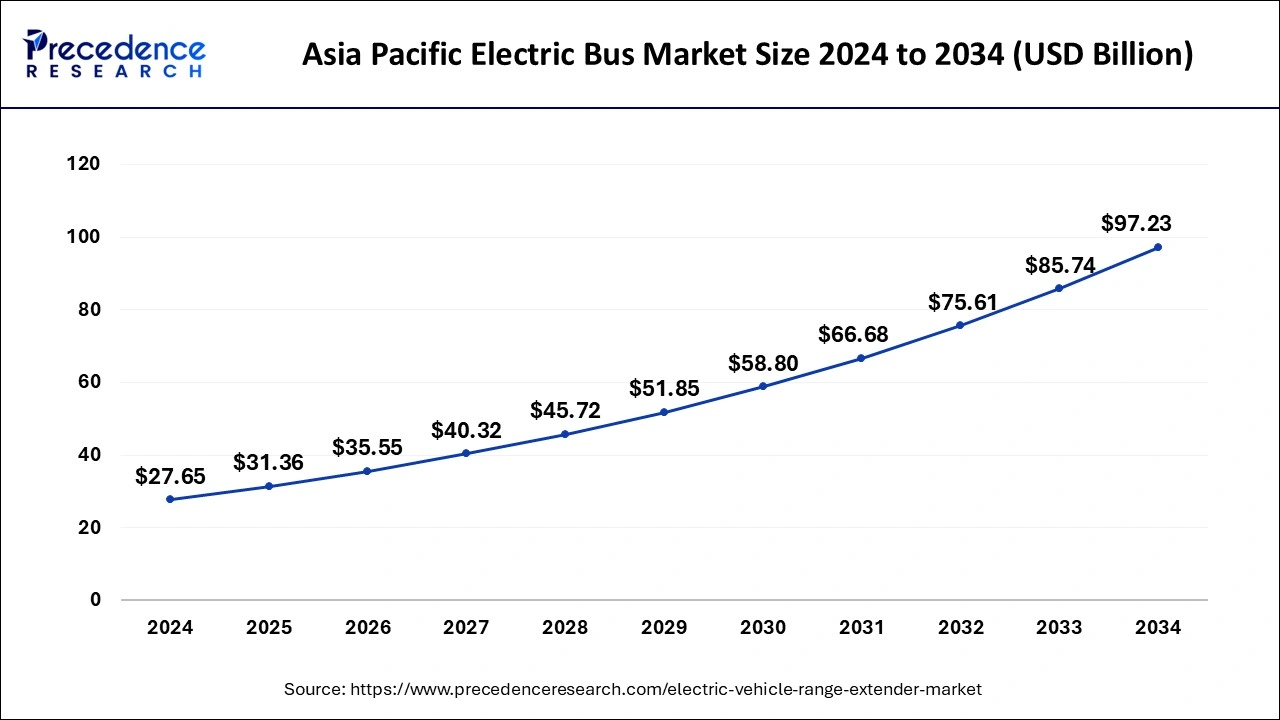

The global electric bus market size was is calculated at USD 36.46 billion in 2025 and is expected to reach around USD 113.06 billion by 2034, expanding at a CAGR of 13.40% from 2024 to 2034. The Asia Pacific electric bus market size surpassed USD 31.36 billion in 2025 and is expanding at a CAGR of 13.60% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric bus market size accounted for USD 32.15 billion in 2024 and is expected to reach around USD 113.06 billion by 2034, expanding at a CAGR of 13.40% from 2025 to 2034.

The Asia Pacific electric bus market size was estimated at USD 27.65 billion in 2024 and is predicted to be worth around USD 97.23 billion by 2034, at a CAGR of 13.60% from 2025 to 2034.

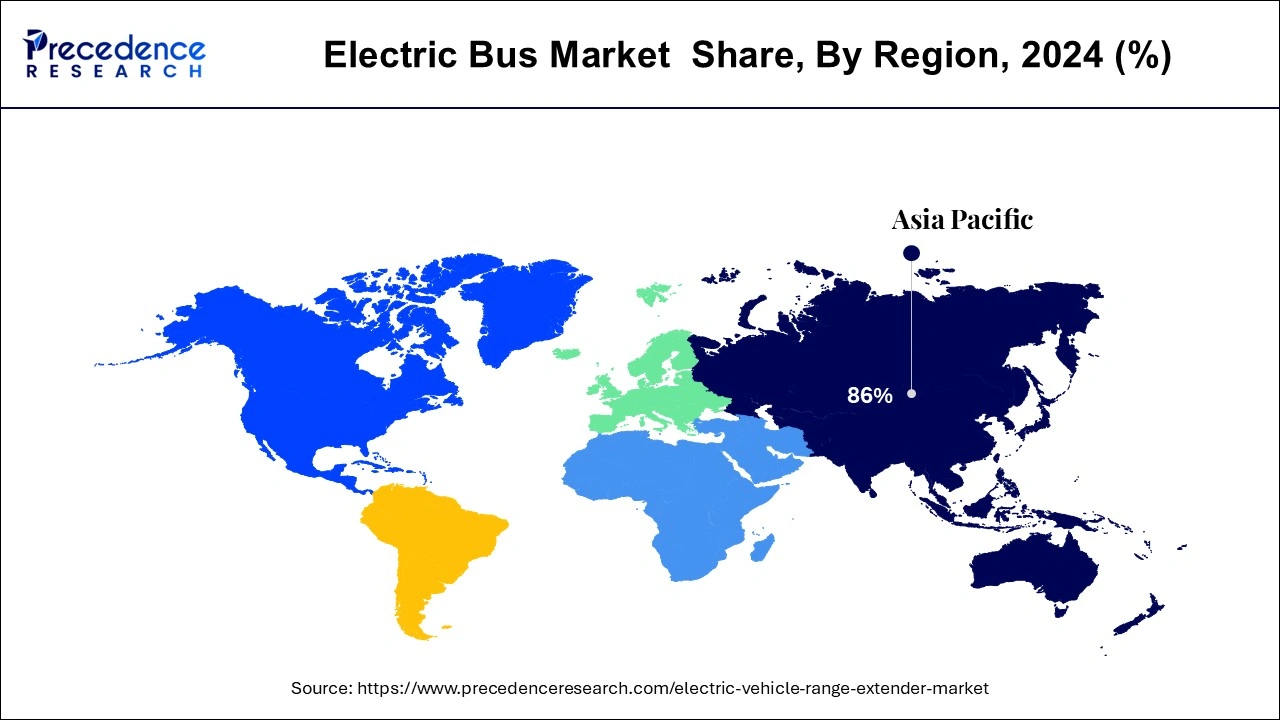

Asia-Pacific dominated the electric bus market in 2024 with highest revenue share of 86%. The China dominates the electric bus market in Asia-Pacific region. The Asia-Pacific region comprises of large number of market players operating in electric bus market. The electric bus market is growing in developing and developed countries such as China, Japan, South Korea, and India. In addition, the Asia-Pacific region has vast number of original equipment manufacturers (OEMs). Furthermore, the factors such as favorable government regulations regarding electric buses and the expansion of the electric vehicle infrastructure are propelling the growth of the electric bus market in the Asia-Pacific region during the forecast period.

North America is expected to develop at the fastest rate during the forecast period, due to increasing research and development investments in the development of electric buses. The major market players of the region are collaborating with government to increase their market share in the region. This is also helping them to increase their geographical presence in developed and developing nations. In addition, the growing number of infrastructural development projects is also driving the expansion the electric bus market in the region.

Europe is expected to grow significantly in the electric bus market during the forecast period. The demand as well as the use of electric buses in Europe are increasing for reducing the environment pollution. This, in turn, is supported by the government policies as well as investments. Thus, this, promotes the market growth.

The use of electric buses in the UK is increasing, due to increasing awareness about air pollution. At the same time, the investment by the government is also encouraging the development process of these buses with additional safety features.

In Germany, the demand for the use of electric buses is increasing due to their affordability as well as efficiency. Furthermore, to reduce the pollution, different polices laid down by the government are encouraging their use as well.

The electric bus is a vehicle that do not require internal combustion engine. The electric buses are considered as environmentally friendly. The electric bus does not emit any kind of toxic gases in the environment. As a result, the growing environmental concerns are driving the growth of the global electric bus market. In addition, the electric bus also helps in saving of fuel and gasoline. The use of electric bus benefits end user in each and every way. The surge in government initiatives is also driving the expansion of the electric bus market. The government of established and emerging nations is mainly investing in the development of electric bus. The electric bus also helps end users to save time of their passengers. Due to ongoing trend of clean energy, the major countries have started using electric bus on a large scale. The electric bus is also helping government in reduction of noise pollution levels. Moreover, the utilization of solar powered electric bus charging stations is creating growth prospects for the electric bus market expansion.

The highly populated regions require good vehicles for public transportation. The electric bus is changing the face of public transportation in a different way. The electric bus helps in reduction of pollution which is helping in the reduction of global warming. The utilization of electric buses has helped government in saving costs. The launch of self-driving electric bus is boosting the growth and development of the global electric bus market. One of the prominent factors that drive the growth of the global electric bus market is technological developments. The new and advanced features deployed in the electric bus are creating lucrative opportunities for the growth of the electric bus market. The electric buses are largely used in the developed regions. Additionally, the electric bus manufacturers are adding additional features to the bus such as additional seating capacity and lane keep assist system. The lane keep assist technology will help drivers to drive efficiently by reducing the chances of accidents. The electric bus is also helping in the reduction of road accidents. Thus, all of these factors are propelling the growth of the global electric bus market.

Globally, there has been a significant increase in the electrification of public transportation. This has resulted into low maintenance expenses for using electric buses. In addition, the government is significantly investing in the development of charging infrastructure in all developed regions. Moreover, the research and development expenditure in battery technology is also increasing. The electric bus is considered as environmentally friendly option all over the globe. In the developing regions such as Latin America and Asia-Pacific, there is surge in demand for environmentally friendly transportation and mobility solutions. Furthermore, the transportation companies are shifting their focus to sustainable energy. Thus, this has created significant demand for electric bus since few years. As a result, all of these aforementioned factors are driving the expansion and development of the global electric bus market over the projected period.

| Report Coverage | Details |

| Market Size in 2025 | USD 36.46 Billion |

| Market Size by 2034 | USD 113.06 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.40% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Propulsion, Consumer Segment, Application, Length of Bus Type, Vehicle Range, Battery Capacity, Power Output, Battery Type, Component, Seating Capacity, Level of Autonomy, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

The battery electric bus segment dominated the electric bus market in 2024. The electric bus that runs on batteries is known as battery electric bus. The battery electric bus is an ideal option for no emission or zero emission vehicles. As compared to traditional buses, the battery electric buses are very efficient in nature. The battery electric bus enables drivers to drive fast as compared to fuel or gasoline-based buses. The charging of battery electric buses is quite easy and cost effective then diesel or petrol-based buses. The electric bus manufacturers are deploying supercapacitors in the battery electric bus. This factor is driving the growth of the segment during the forecast period.

The hybrid electric bus segment is fastest growing segment of the electric bus market in 2024. The hybrid electric bus includes electric propulsion and internal combustion engine propulsion system. The hybrid electric bus helps in the reduction of the greenhouse gases emissions and air pollution levels. The growing government efforts to curb the carbon emissions and for the safety of environment are contributing towards the growth of the segment. Furthermore, the growing technological advancements and adoption of advanced technologies is creating growth prospects for the segment. All of these aforementioned factors are propelling the growth and development of the global electric bus market over the projected period.

By Propulsion

By Consumer Segment

By Application

By Length of Bus Type

By Vehicle Range

By Battery Capacity

By Power Output

By Battery Type

By Component

By Seating Capacity

By Level of Autonomy

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

January 2025

September 2024