May 2024

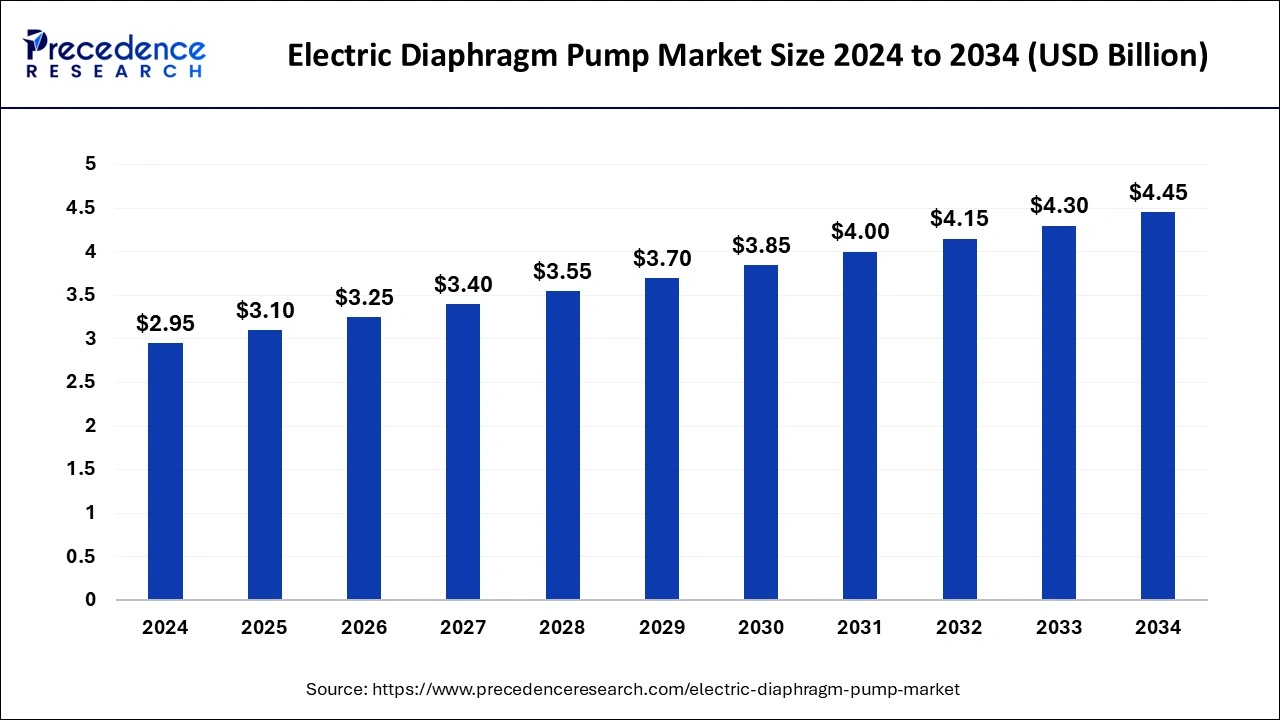

The global electric diaphragm pump market size is accounted at USD 3.10 billion in 2025 and is forecasted to hit around USD 4.45 billion by 2034, representing a CAGR of 4.20% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric diaphragm pump market size was estimated at USD 2.95 billion in 2024 and is predicted to increase from USD 3.10 billion in 2025 to approximately USD 4.45 billion by 2034, expanding at a CAGR of 4.20% from 2025 to 2034.

Electric diaphragm pump is a type of positive displacement pump that utilizes a diaphragm to move fluid. The diaphragm is typically powered by an electric motor, causing it to flex and create a pumping action that moves the fluid through the pump. These pumps are often used for various applications, including transferring liquids, chemicals, and other materials in industries such as agriculture, automotive, manufacturing, and others.

The market involves the buying and selling of electric diaphragm pumps, as well as related products and services. The market may also encompass various types of electric diaphragm pumps designed for specific purposes or industries such as water & wastewater, oil & gas, chemicals & petrochemicals, pharmaceuticals, food & beverage and others.

Electric Diaphragm Pump Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2025 | USD 3.10 Billion |

| Market Size by 2034 | USD 4.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.20% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Operation, Discharge Pressure, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Increased industrialization

The increased pace of industrialization globally is a significant driving force behind the burgeoning demand for electric diaphragm pumps. As industries expand and diversify, there arises a heightened need for efficient and reliable fluid handling solutions, a demand that electric diaphragm pumps adeptly fulfill. These pumps find extensive application across various industrial sectors, including manufacturing, chemicals, and pharmaceuticals, where the transfer of liquids, chemicals, and abrasive fluids is a critical operational requirement.

Moreover, in industrial processes, electric diaphragm pumps offer a versatile and resilient solution, capable of handling a wide range of fluids and substances. The robust construction of these pumps makes them well-suited for the challenging environments often encountered in industrial settings. Furthermore, as manufacturing facilities scale up production and chemical processes become more intricate, the demand for precise and durable pumping systems escalates. Electric diaphragm pumps, with their ability to handle corrosive materials and maintain consistent flow rates, become indispensable assets in the industrial landscape.

High maintenance and operating costs

The electric diaphragm pump market faces a notable challenge due to the high maintenance and operating costs associated with these pumps, potentially restraining their widespread adoption. While electric diaphragm pumps offer efficient fluid handling solutions, the ownership costs, including regular maintenance and operational expenses, can be substantial. The intricate design of diaphragm pumps, comprising multiple components such as diaphragms and valves, requires meticulous maintenance to ensure optimal performance.

Moreover, the operational costs, including energy consumption, can be relatively high compared to alternative pumping solutions. This factor is particularly critical for industries striving to optimize operational expenses and enhance cost-effectiveness. As businesses across various sectors prioritize economic efficiency, the comparatively elevated lifetime costs associated with electric diaphragm pumps may lead some potential users to explore alternative, more cost-effective pumping technologies. Efforts to develop pumps with longer service intervals and lower energy consumption can mitigate concerns about high maintenance and operating costs, making electric diaphragm pumps more appealing to a broader range of industries and applications.

Rising focus on water treatment

The electric diaphragm pump market stands at the forefront of significant opportunities, driven by the escalating global focus on water treatment. As concerns over water scarcity and environmental conservation intensify, there is an increased demand for effective water and wastewater treatment solutions. Electric diaphragm pumps, renowned for their versatility and ability to handle fluids with solids and chemicals, find a pivotal role in water treatment processes. These pumps are adept at facilitating the transfer and circulation of various liquids, making them invaluable in applications such as sewage treatment, desalination, and industrial effluent management.

The expansion of municipal water treatment plants and the growing need for decentralized water treatment systems further amplify the opportunities for electric diaphragm pumps. With their robust construction and resistance to corrosive substances, these pumps offer reliability in diverse water treatment environments. As the water treatment sector continues to evolve and expand globally, the electric diaphragm pump market is poised to capitalize on these opportunities, providing essential solutions for efficient fluid handling in the critical domain of water treatment.

The double acting segment dominated the electric diaphragm pump market in 2024; the segment is observed to continue the trend throughout the forecast period. Double acting diaphragm pumps feature bidirectional diaphragm movement, experiencing both suction and discharge strokes in each cycle. This design allows for enhanced efficiency and the ability to handle higher flow rates compared to single acting pumps. Double acting pumps are commonly employed in applications requiring a more forceful and continuous fluid transfer, making them suitable for industrial processes such as paint and coating applications, where a consistent and pulsation-free flow is critical.

The single acting segment is expected to generate a notable revenue share in the market. Single acting diaphragm pumps operate with a unidirectional movement, where the diaphragm undergoes a single stroke during each cycle. These pumps typically utilize a single diaphragm and are known for their simplicity in design. Single acting pumps are often employed in applications where a consistent and controlled flow of fluid is required. Their straightforward operation makes them suitable for various industries, such as agriculture for spraying pesticides or fertilizers, and in chemical processing for metered fluid transfer.

The up-to-80-bar segment is observed to hold the dominating share of the electric diaphragm pump market during the forecast period. Electric diaphragm pumps in this segment are designed to handle applications with lower discharge pressure requirements. These pumps are often utilized in industries where moderate pressure is sufficient, such as in certain chemical transfer processes, agricultural spraying, or general fluid transfer tasks. Their versatility makes them suitable for applications that do not demand extremely high pressure but still require reliable and efficient pumping.

The above 200 bar segment is expected to generate a notable market share in the market. The segment of electric diaphragm pumps operating above 200 bar is tailored for applications demanding elevated discharge pressures. These pumps are ideal for specialized industries, including high-pressure cleaning, water jet cutting, or processes that require the conveyance of fluids with significant resistance. Their robust construction and capability to handle extreme pressure conditions make them crucial in environments where precision and efficiency are paramount.

The water & wastewater segment dominated the electric diaphragm pump market in 2024. The water and wastewater segment encompasses electric diaphragm pump applications in municipal water treatment plants, industrial water processing, and wastewater treatment facilities. These pumps are crucial for tasks such as pumping sludge, handling chemicals in water treatment, and managing various fluids in the overall water and wastewater management processes.

The oil & gas segment is expected to generate a notable revenue share in the electric diaphragm pump market. In the oil and gas industry, electric diaphragm pumps are utilized for various applications, including chemical injection, fluid transfer, and crude oil processing. These pumps play a vital role in maintaining efficient operations and ensuring the proper flow of fluids in upstream and downstream processes.

Asia-Pacific dominates the electric diaphragm pump market and is poised for rapid growth in the electric diaphragm pump market due to countries such as China, India, Japan, Australia, and others, is a significant and growing market for electric diaphragm pumps. The rapid industrialization and economic growth in countries like China and India drive the demand for various industrial equipment, including electric diaphragm pumps. Industries such as manufacturing, chemicals, and water treatment have substantial requirements for these pumps.

North America, including the United States and Canada, is a mature and well-established market for various industrial equipment, including electric diaphragm pumps. The region has a diverse industrial landscape, with sectors such as manufacturing, chemicals, oil and gas, and water treatment driving the demand for electric diaphragm pumps.

Meanwhile, Europe is growing at a notable rate in the electric diaphragm pump market due to Electric diaphragm pumps are widely used in industrial processes for transferring fluids, chemicals, and various viscous materials across Europe. Stringent environmental regulations may influence the choice of pumping equipment, with a focus on efficiency and compliance.

By Operation

By Discharge Pressure

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

February 2025

August 2024

February 2025