January 2025

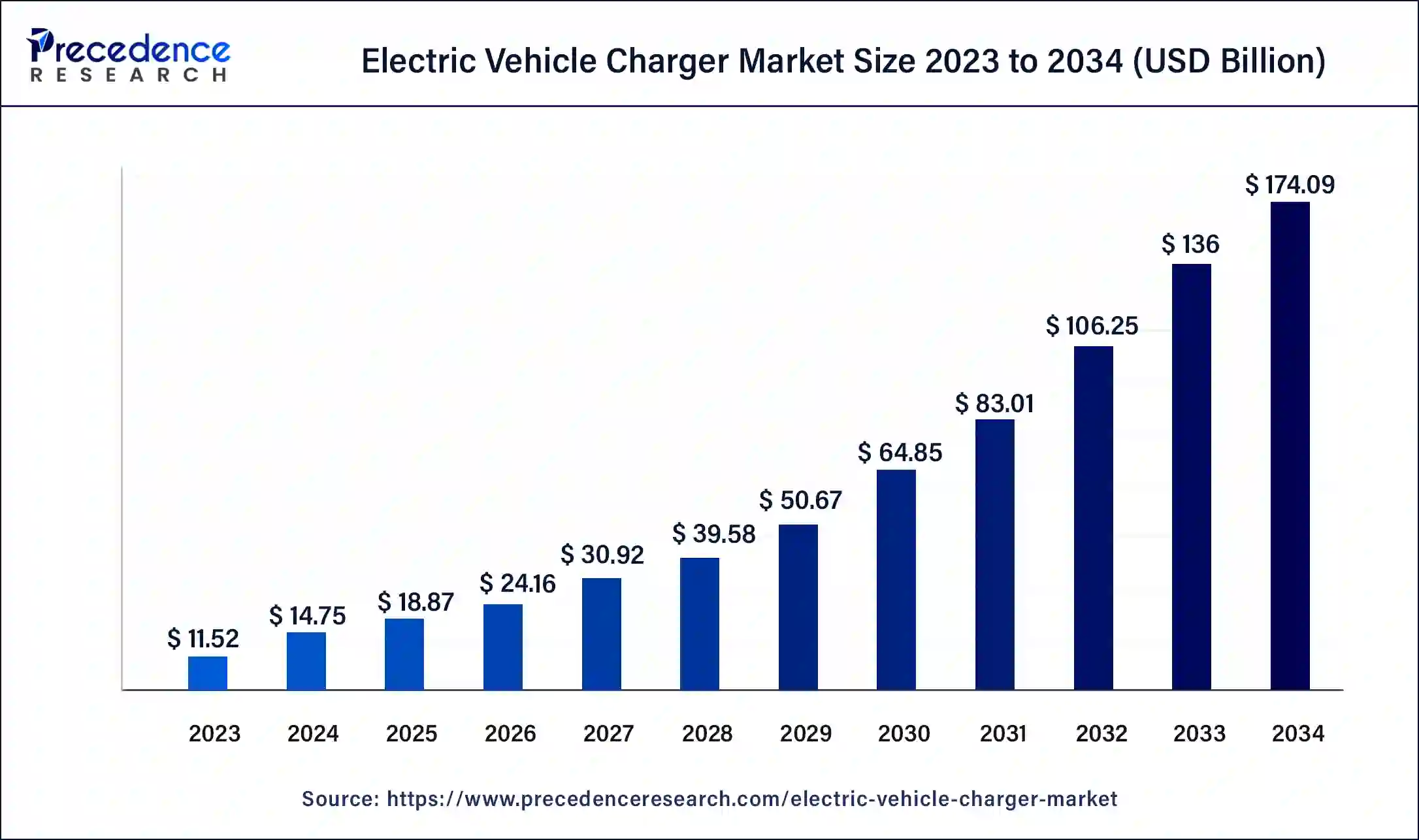

The global electric vehicle (EV) charger market size was USD 11.52 billion in 2023, calculated at USD 14.75 billion in 2024 and is expected to reach around USD 174.09 billion by 2034, expanding at a CAGR of 28% from 2024 to 2034.

The global electric vehicle (EV) charger market size accounted for USD 14.75 billion in 2024 and is expected to reach around USD 174.09 billion by 2034, expanding at a CAGR of 28% from 2024 to 2034.

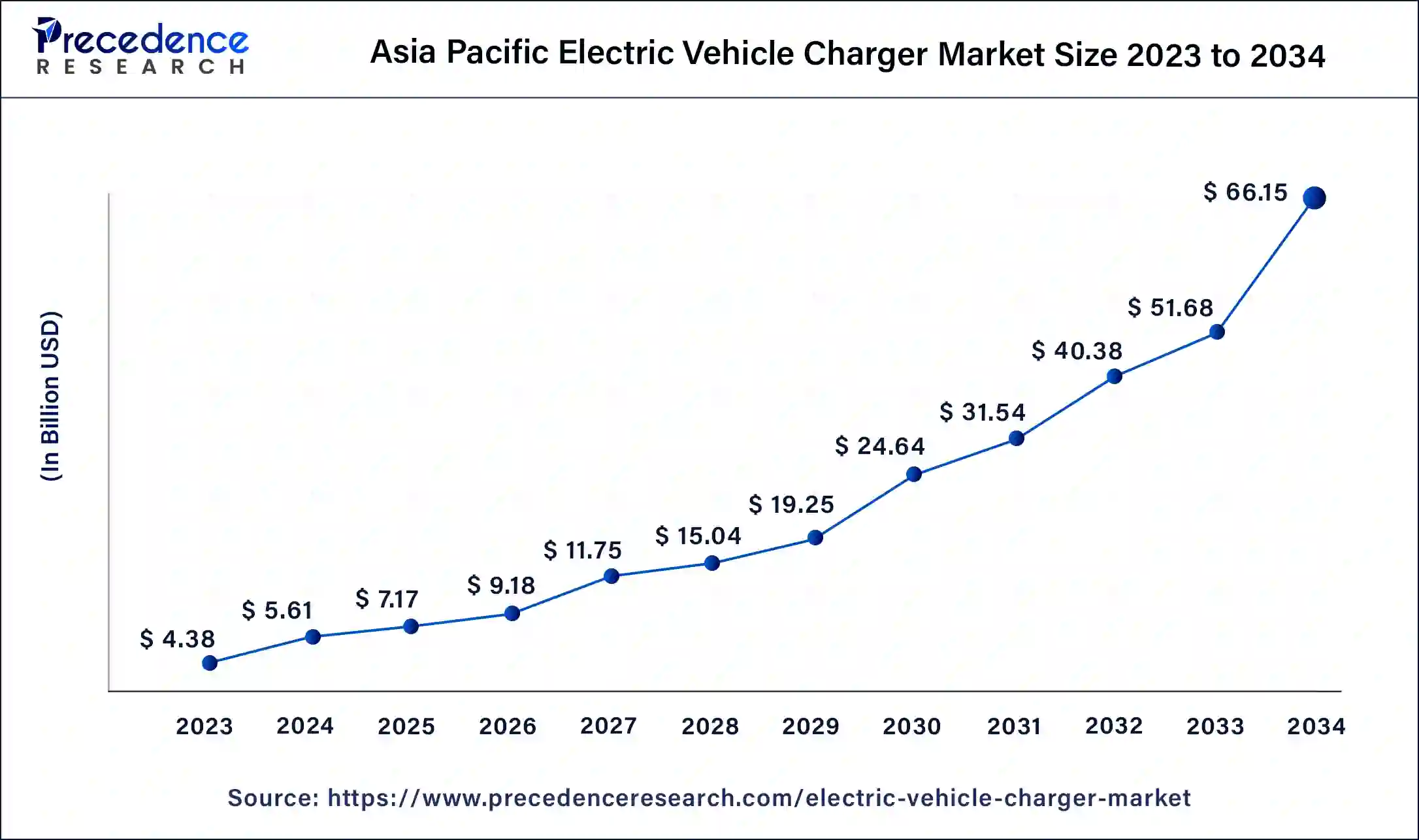

The Asia Pacific electric vehicle (EV) charger market size was estimated at USD 4.38 billion in 2023 and is predicted to be worth around USD 66.15 billion by 2034, at a CAGR of 28.2% from 2024 to 2034.

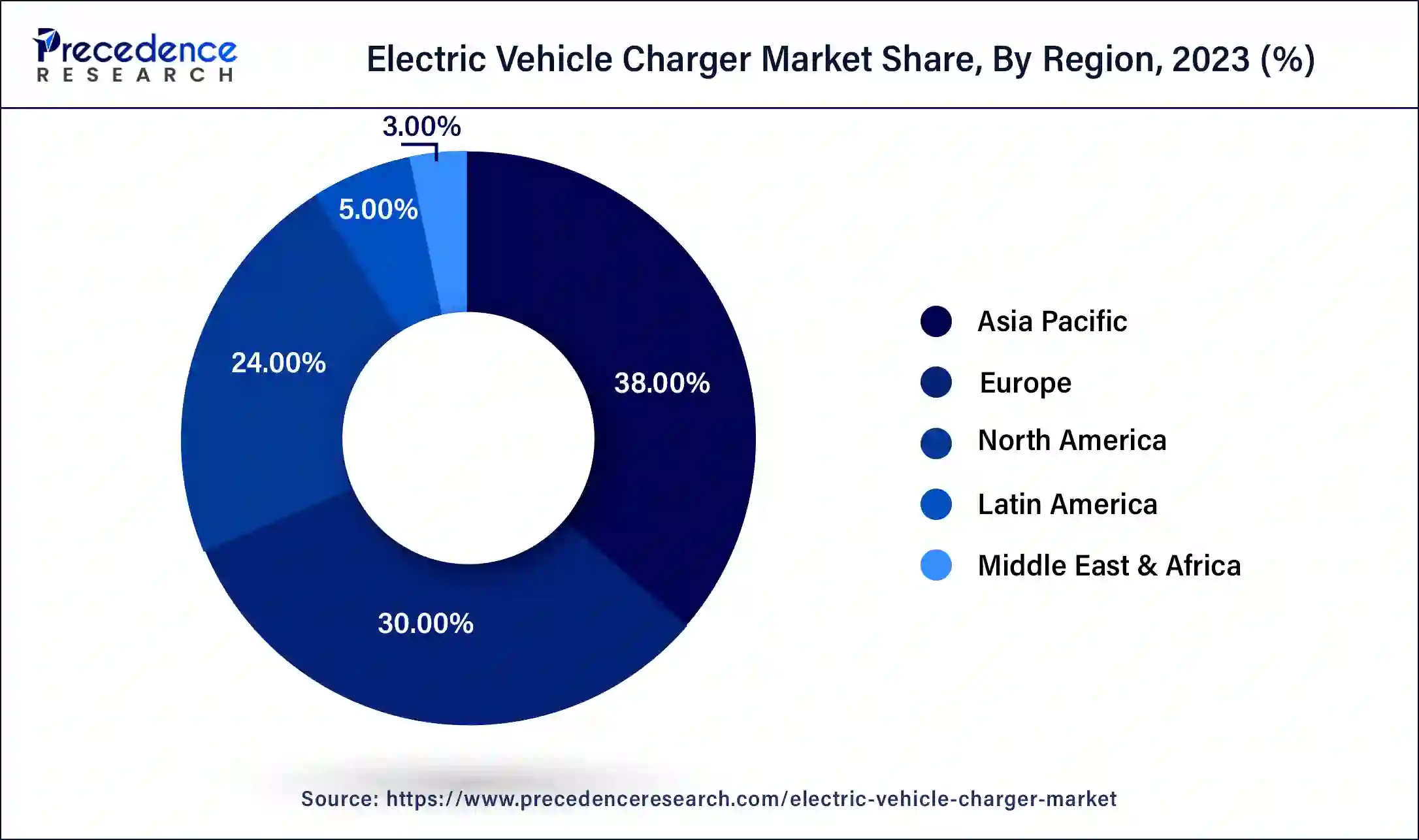

Asia Pacific is estimated to be the dominant EV charger market in 2023. The Asia Pacific EV charger market is primarily driven by the increasing adoption of the EV charging infrastructure and growing demand for the electric vehicles. The surge in the adoption of EVs for public transport in the developing and highly populated countries like China and India is supporting the growth of the EV charger market. The developing economies like China, South Korea, and Japan are planning to increase the number of charging stations to promote the adoption of the electric vehicles in the country.

Europe was the second-largest EV charger market in 2023. The government regulations pertaining to pollution is strict and the adoption rate of EVs among the European consumers is also high. The increased awareness regarding the carbon emission, high disposable income of the consumers, and improved living standards are fueling the sales of the EVs, which is expected to fuel the growth of the EV charger market in Europe.

The global EV charger market is expected to witness a burgeoning growth in the forthcoming years owing to the various factors such as surging sales of electric vehicles across the globe, rising demand for zero emission vehicles, and growing government initiatives to foster the adoption of electric vehicles. The government in various developed and developing nations such as Canada, Japan, and India are offering subsidies to the consumers to boost the adoption of electric vehicles. The Canadian government provides a subsidy of around US$3,700 for buying electric vehicles in Canada. Further, the government of Japan offers a subsidy of around US$3,700 for purchasing BEV and a subsidy of around US$1,800 for buying PHEV. The technological developments in the electric vehicle and charging infrastructure such as ultra-fast chargers, portable charging station, load management with smart charging, automated payment systems for charging, and bi-directional charging are some of the prominent factors that are expected to foster the growth of the EV charger market across the globe.

The EV industry is foreseeing an incredible growth in the developed and developing regions around the globe. The higher dependence on the biofuels has resulted in increased levels of air pollution and as a consequences, the prevalence of various respiratory and other diseases is surging among the global population. To curb the carbon footprint and shift towards the clean and green energy are the major factors that are expected to drive the growth of the global EV charger market. The increasing consumer awareness regarding carbon emission from vehicles, increased environmental consciousness, improvements in the standard of living, and growing adoption of advanced technologies are altogether propelling the growth of the global EV charger market.

| Report Coverage | Details |

| Market Size in 2023 | USD 11.52 Billion |

| Market Size in 2024 | USD 14.75 Billion |

| Market Size by 2034 | USD 174.09 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 28% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle Type, Charging Type, End User, Geography |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Based on the vehicle type, the plug-in hybrid vehicle (PHEV) segment led the global EV charger market in 2023. The increasing government initiatives to encourage the sales of the electric vehicles are a key driver that led to the dominance of the PHEV segment in the global market. The increased demand for the alternative fuel vehicles across the globe has fostered the sales of the PHEV segment. The rising production capacities of the top EV manufacturers and the resulting increased production and deployment of the EV charging stations are together fueling the sales of the PHEVs and hence the growth of this segment in the global EV charger market is expected to continue throughout the forecast period. For instance, in January 2020, Volkswagen Group announced to boost its production of PHEVs by 60% as compared to the PHEVs production in the year 2018.

The battery electric vehicle (BEV) segment is anticipated to foresee the highest growth rate during the forecast period. The presence of BEVs is higher than the PHEVs in the market. The technological advancements in the batteries and the declining battery prices over time is expected to drive the sales of the BEVs in the forthcoming years, which will spur the demand for the EV chargers. For example, in October 2021, Tesla announced to use the lithium iron phosphate batteries to reduce the battery costs and increase profit margins. The prices of the EV batteries declined from US$1,100 per kWh in 2010 to US$137 per kWh in 2020, which has resulted in the reduction in the fuel prices and hence the demand for the BEVs is expected to grow at a significant pace.

The on-board chargers segment dominated the global EV charger market in 2023. The increased adoption of the on-board chargers owing to its ability to be used with the readily available AC power has led to its increased demand across the globe. The AC charging is more flexible, easily available, and can fulfill almost all the need of certain users based on their EV vehicle uses. The adoption of EVs among the urban consumers is high and the easy availability of the AC power in the urban areas has resulted in the dominance of the on-board chargers across the globe.

Off-board chargers are gaining traction owing to its ability to quickly charge the batteries of the electric vehicles. The growing number of public charging stations is expected to boost the growth of the off-board charger in the forthcoming years. The off-board chargers receive the AC power and convert it into DC power to charge the batteries of the EVs. The off-board chargers can recharge approximately around 250 miles of range in about 30 minutes of time. The busy and hectic lifestyle of the people in the modern day world is expected to boost the demand for the off-board chargers in the upcoming future.

The residential was the most dominant segment in the global EV charger market in 2023. The higher adoption of the on-board chargers in the residential units across the globe has resulted in the growth of the residential segment in the EV charger market. Most of the consumers opt for charging their vehicles at night and use the vehicles during day time for various purposes. The rising investments in the development of modern day residential infrastructures and growing adoption of the BEV charging infrastructure in the parking spaces of the residential units is expected to further boost the growth of this segment in the forthcoming years.

The commercial is expected to be the fastest-growing segment during the forecast period. This is attributable to the increasing number of charging stations at public spaces. The growing government initiatives and rising corporate investments in the development of EV charging infrastructure across the globe are the major factors that are expected to drive the growth of this segment in the upcoming future.

The EV charger market is moderately fragmented owing to the presence of several top market players. These market players are constantly involved in the various developmental strategies such as partnerships, mergers, acquisitions, collaborations, new product launches, and various others to strengthen their position and increase their market share.

Segments Covered in the Report

By Vehicle Type

By Charging Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

September 2024