April 2025

Electric Vehicle Fluids Market (By Product: Engine Oil, Coolant, Transmission Fluids, Greases; By Propulsion Type: Battery Electric Vehicles (BEV’s), Hybrid Electric Vehicles (HEV’s)/ Plug-in Hybrid Electric Vehicles (PHEV’s); By Vehicle Type: Commercial, Passenger) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

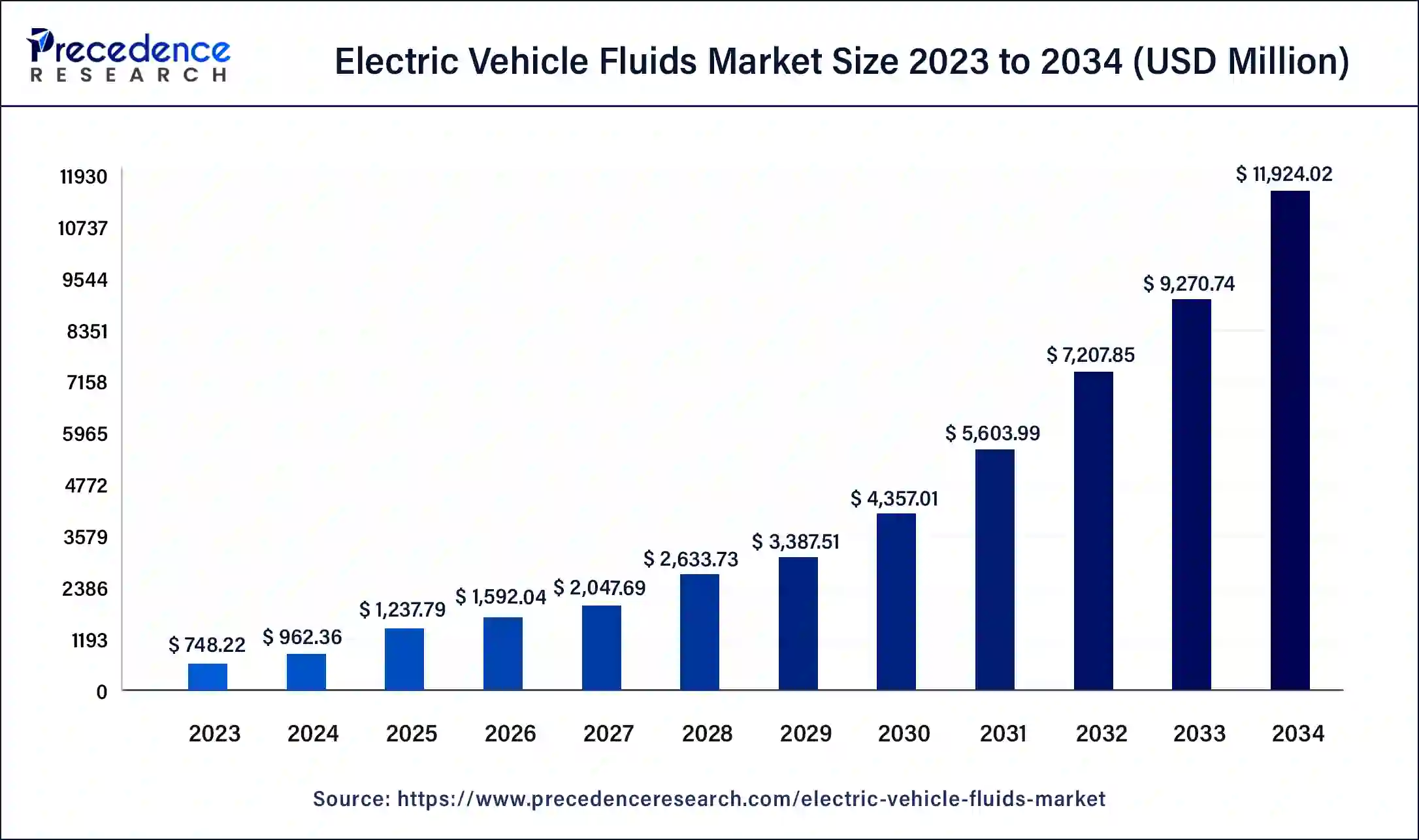

The global electric vehicle fluids market size was USD 748.22 million in 2023, calculated at USD 962.36 million in 2024 and is expected to reach around USD 11,924.02 million by 2034. The market is expanding at a solid CAGR of 28.62% over the forecast period 2024 to 2034. Rising inclination towards electric vehicles worldwide to combat environmental changes and governments increasing approvals for electric vehicles (EVs) are the major factors driving the electric vehicle fluids market globally.

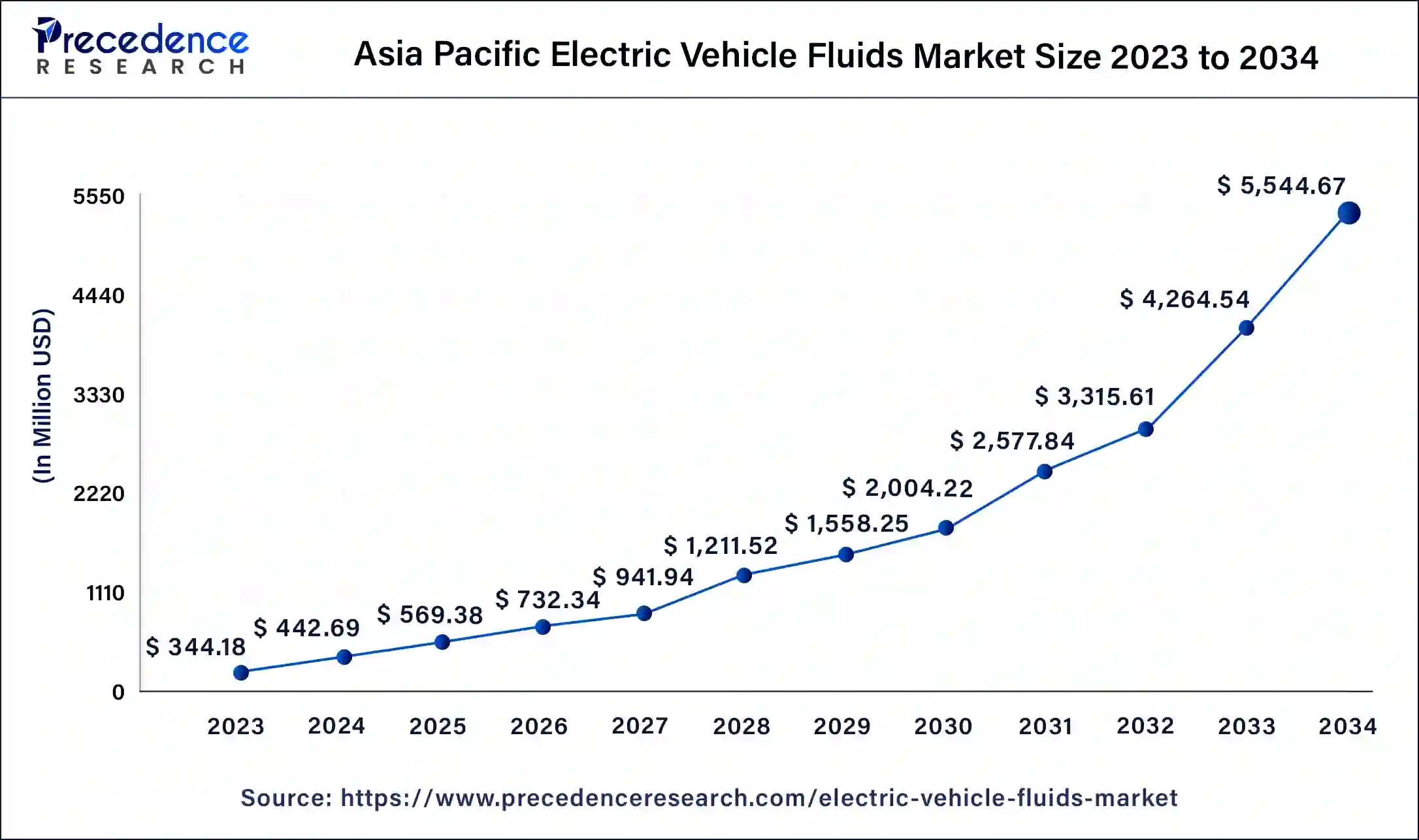

The Asia Pacific electric vehicle fluids market size was exhibited at USD 344.18 million in 2023 and is projected to be worth around USD 5,544.67 million by 2034, poised to grow at a CAGR of 28.74% from 2024 to 2034.

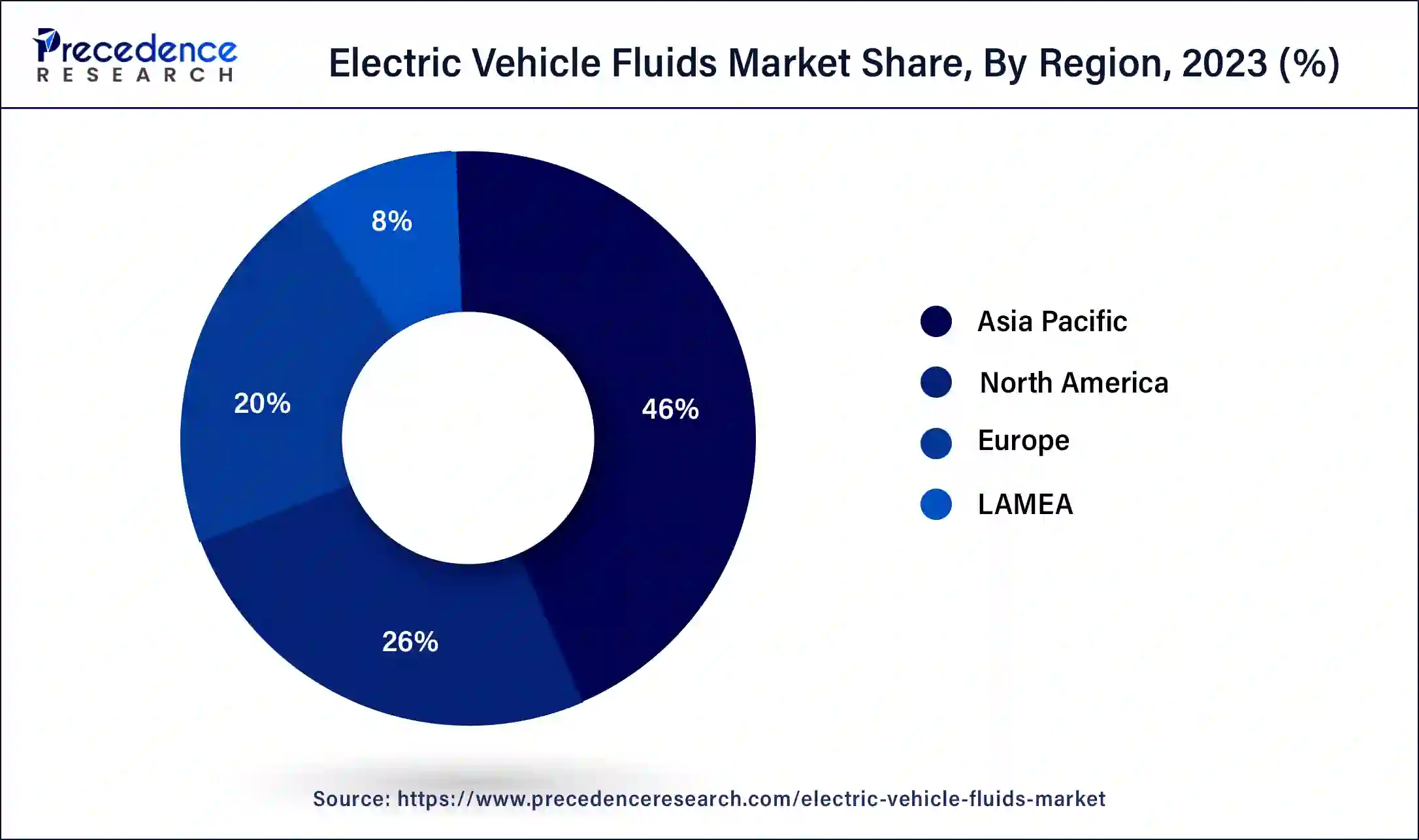

Asia Pacific led the electric vehicle fluids market in 2023 with the largest share. Asia Pacific is emerging as the fastest-growing region in the electric vehicle fluids market, fuelled by rapid industrialization, increasing urbanization, and supportive government policies. Countries like China and India are leading the charge with ambitious plans to reduce carbon emissions and promote sustainable transportation solutions.

Moreover, the Asia Pacific’s robust manufacturing base and growing consumer awareness about environmental sustainability are further propelling market growth. Local and international automotive manufacturers are expanding their EV production capacities in Asia Pacific, creating a substantial electric vehicle fluids market that enhance vehicle performance and efficiency.

Europe is observed to grow at a notable rate in the global electric vehicle fluids market during the forecast period, leaving behind a notable trail of advancement in the global electric vehicle fluids market. Europe is emerging as a notably growing region in the electric vehicle fluids market, driven by stringent emissions regulations and a strong push towards sustainable transportation.

Countries within the European Union are increasingly adopting policies to phase out internal combustion engine vehicles, accelerating the shift towards electric mobility. This transition is creating a robust demand for the electric vehicle fluids market, including coolants and lubricants, which are essential for maintaining EV performance and longevity. Moreover, European automakers and fluid manufacturers are investing heavily in research and development to innovate and meet the evolving needs of the expanding EV market in the region.

The electric vehicle fluids market is experiencing rapid growth, driven by the increasing adoption of EVs worldwide. These specialized fluids, including coolants, lubricants, and transmission fluids, are essential for maintaining EV performance and efficiency. With rising environmental concerns and stringent emission regulations, the demand for EVs and, consequently, EV fluids is surging. Major players are innovating to develop advanced, eco-friendly fluids to enhance battery life and vehicle efficiency.

Asia Pacific, particularly China and India, is leading the market due to high EV adoption rates. The electric vehicle fluids market is also expanding in Europe and North America, driven by government incentives and growing consumer awareness. Overall, the EV fluids market is set for significant expansion in the coming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 11,924.02 Million |

| Market Size in 2023 | USD 748.22 Million |

| Market Size in 2024 | USD 962.36 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 28.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Propulsion Type, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Governments worldwide are offering incentives to promote EV

The major driver for the electric vehicle fluids market is the accelerating global shift towards electric mobility, driven by environmental concerns and stringent emission regulations. Governments worldwide are implementing policies and offering incentives to promote EV adoption, which in turn boosts the demand for EV-specific fluids. These fluids, such as coolants, lubricants, and transmission fluids, are crucial for maintaining the efficiency and longevity of EV components, especially the battery and powertrain.

Advancements in EV technology, such as improved battery efficiency and thermal management systems, are driving the need for innovative and specialized fluids. Developing nations like China are also witnessing substantial growth in EV adoption, further propelling the electric vehicle fluids market.

Limited availability of advanced EV fluids

A significant restraint for the electric vehicle fluids market is the high cost and limited availability of advanced EV fluids. Developing specialized fluids that meet the unique requirements of EVs involves extensive research and development, leading to higher production costs. These costs are often passed on to consumers, making EV fluids more expensive compared to traditional automotive fluids. This price disparity can deter some consumers and smaller automotive service providers from adopting these specialized products.

The limited infrastructure for EV maintenance and servicing poses a challenge. Many regions still lack the necessary facilities and trained personnel to handle EV-specific fluids properly. This gap can hinder the widespread adoption of advanced EV fluids, as consumers may face difficulties finding reliable service centers equipped to manage their vehicles' fluid needs. In addition, fluctuating raw material prices and supply chain disruptions can impact the availability and cost of EV fluids, further restraining the electric vehicle fluids market growth. These factors collectively pose significant challenges to the widespread adoption of EV fluids.

Innovations in fluid formulations

The electric vehicle fluids market significant opportunities for growth, driven by technological advancements and increasing investments in EV infrastructure. One key opportunity lies in the development of high-performance, eco-friendly fluids that enhance the efficiency and lifespan of EV components. Innovations in fluid formulations, such as improved thermal management solutions and longer-lasting lubricants, can address the specific needs of EVs, offering manufacturers a competitive edge.

Another significant opportunity in the electric vehicle fluids market is the expansion of EV charging infrastructure. India also offers vast growth potential. With increasing government incentives and a developing EV market, companies have the chance to tap into this emerging market. Collaborations with local manufacturers and service providers can help establish a strong foothold. As governments and private entities invest in building more charging stations, the demand for EV maintenance services, including specialized fluids, is set to rise.

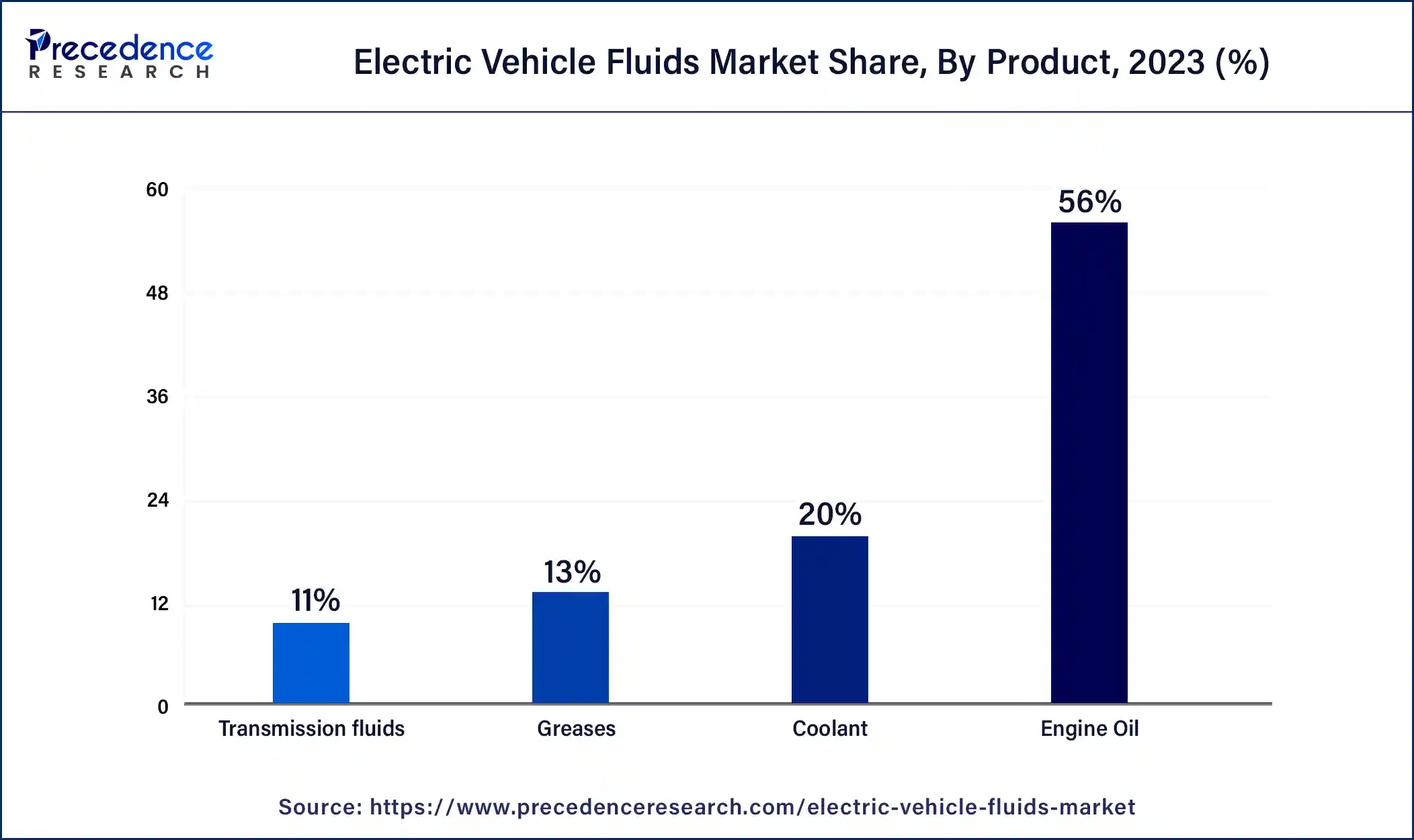

The engine oil segment registered with the largest share of the electric vehicle fluids market in 2023. Engine oil continues to hold the largest market share in the automotive fluids sector, driven by its critical role in maintaining engine performance and longevity. Recent advancements include synthetic oils that offer superior protection and efficiency. Despite the growth in electric vehicles, internal combustion engines still dominate the market, sustaining demand for engine oils globally. The ongoing innovation in oil formulations underscores its enduring importance in automotive maintenance and performance.

The coolant segment is expected to witness promising future growth in the electric vehicle fluids market. These specialized fluids are crucial for maintaining optimal operating temperatures in EV batteries and powertrains, enhancing overall vehicle efficiency and longevity. With advancements in coolant technology and rising EV production, the demand for high-performance coolant fluids is expected to continue growing, catering to the specific needs of modern electric and hybrid vehicles.

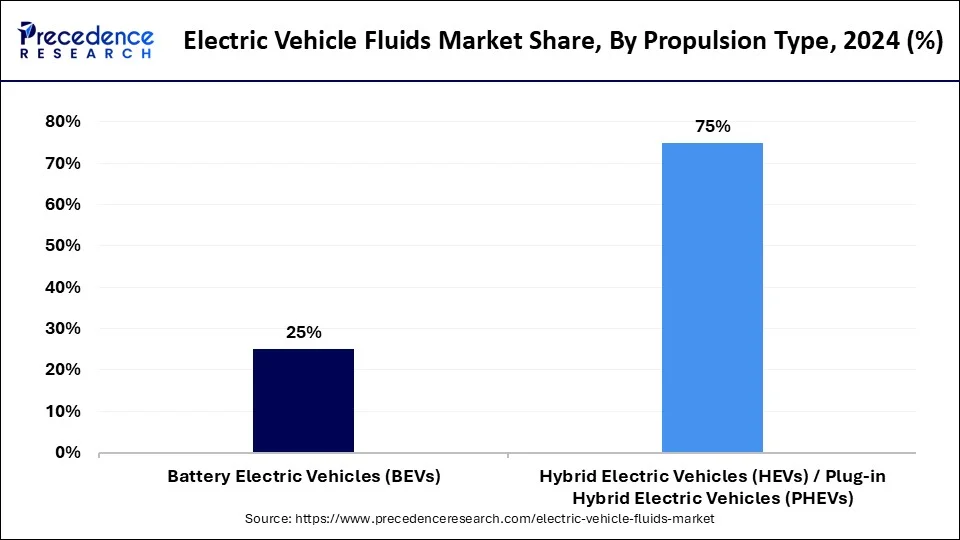

The hybrid electrical vehicles (HEV's)/plug-in hybrid electrical vehicles (PHEV's) segment accounted for a substantial share of the electric vehicle fluids market in 2023. Hybrid electric vehicles (HEVs) offer several benefits, making them a popular choice for environmentally conscious consumers. HEVs combine an internal combustion engine with an electric motor, providing improved fuel efficiency and reduced emissions compared to traditional vehicles. This dual-power system allows HEVs to operate on electric power at lower speeds, minimizing fuel consumption in urban traffic and stop-and-go conditions.

Additionally, HEVs produce lower greenhouse gas emissions, contributing to cleaner air and reduced environmental impact. They also offer an increased driving range compared to pure electric vehicles, alleviating range anxiety. HEVs are seen as a transitional technology towards fully electric vehicles, offering a practical solution for consumers looking to reduce fuel costs and environmental footprint.

The battery electric vehicles (BEV) segment is expected to show significant growth in the global electric vehicle fluids market in the upcoming years. Battery electric vehicles (BEVs) are experiencing notable growth due to advancements in battery technology, expanded charging infrastructure and increasing consumer adoption. Governments worldwide are promoting electric vehicle adoption through incentives and regulations, further driving demand for BEVs. Automakers are expanding their BEV offerings with models that offer longer ranges and faster charging capabilities, enhancing their appeal to a broader audience.

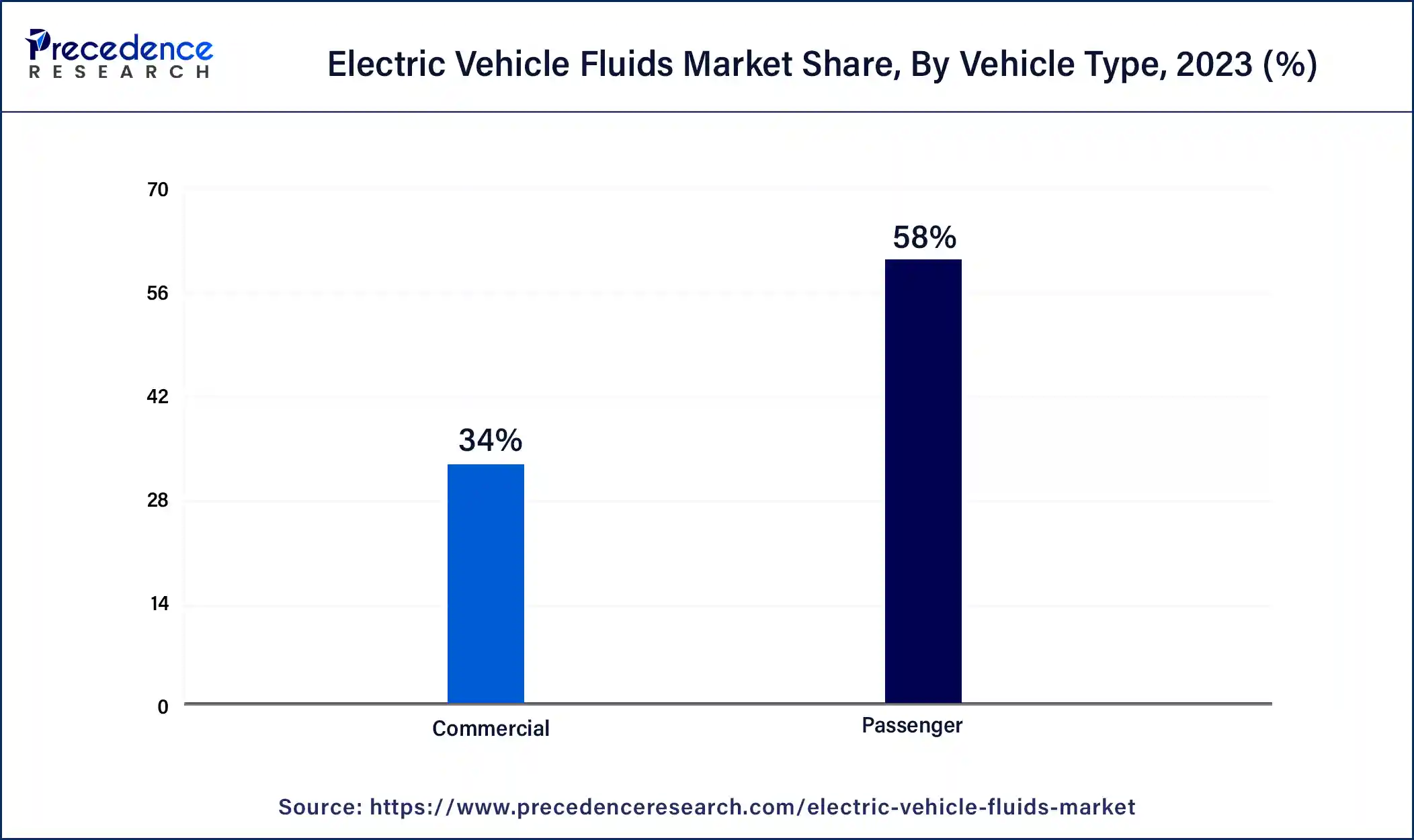

The passenger segment is estimated to hold the highest share of the electric vehicle fluids market in 2023. Major automakers like Volkswagen and BMW are also aggressively expanding their EV lineups to meet rising demand. The appeal of passenger EVs lies in their environmental benefits, lower operating costs, and advancing technology, such as longer battery ranges and improved charging infrastructure. Governments globally are incentivizing EV adoption, further boosting market penetration. As consumer preferences shift towards greener mobility solutions, passenger EVs continue to lead the charge in reshaping the automotive industry towards a more sustainable future.

The commercial segment is expected to witness notable growth in the electric vehicle fluids market in the forecast period. Commercial electric vehicles are experiencing notable growth as businesses seek to reduce operating costs and carbon footprints. Companies like Amazon and UPS are expanding their fleets of electric delivery vans and trucks. With advancements in battery technology and government incentives, commercial EVs offer a practical solution for logistics and transportation sectors aiming to achieve sustainability goals.

Segments Covered in the Report

By Product

By Propulsion Type

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024