December 2024

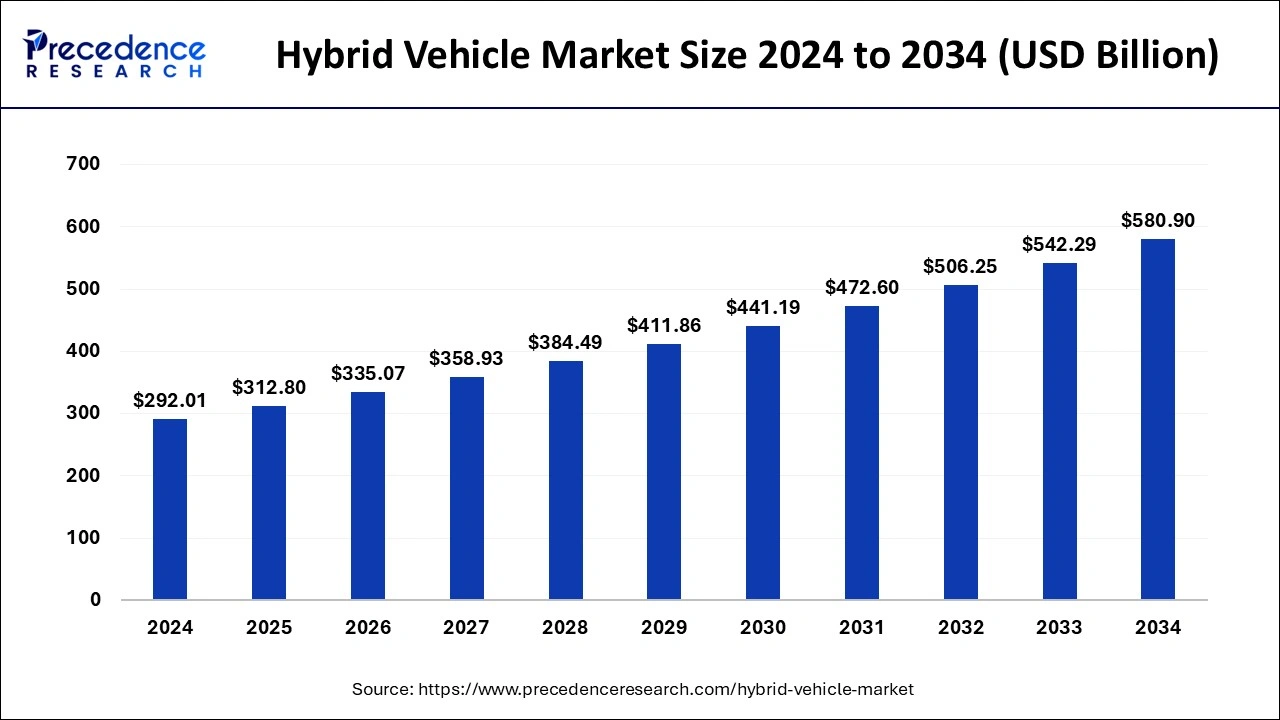

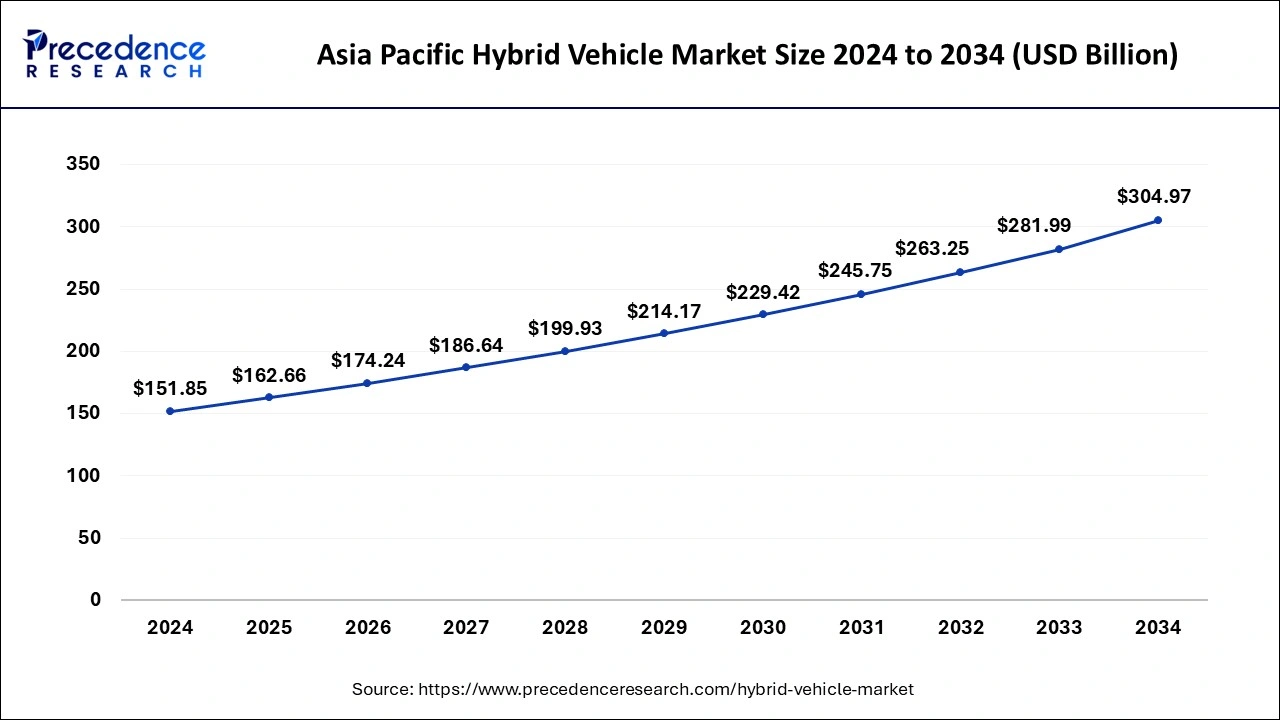

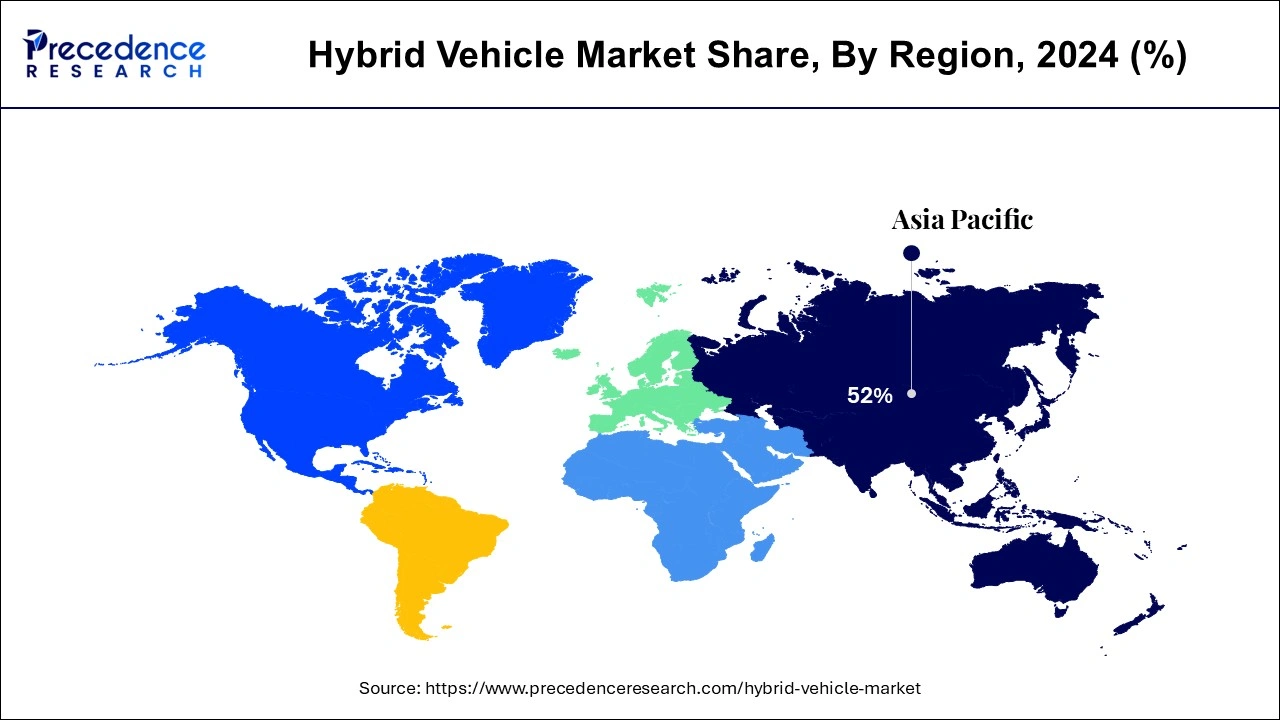

The global hybrid vehicle market size is estimated at USD 312.80 billion in 2025 and is predicted to reach around USD 580.90 billion by 2034, accelerating at a CAGR of 7.12% from 2025 to 2034. The Asia Pacific hybrid vehicle market size surpassed USD 162.66 billion in 2025 and is expanding at a CAGR of 7.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hybrid vehicle market size was estimated at USD 292.01 billion in 2024 and is anticipated to reach around USD 580.90 billion by 2034, growing at a CAGR of 7.12% from 2025 to 2034. A growing focus on sustainability is driving the growth of the hybrid vehicle market.

Designing and modifying algorithms and datasets to enable advancements in automotive technology that would have been unachievable for humans is the primary focus of artificial intelligence's use in hybrid and electric cars. Using information from past and present circumstances, machine learning, an AI system, can accurately forecast future driving and environmental situations.

These projections for the future may result in more precise RE, which would enhance the optimization of the EV range. The best location for electric vehicle charging stations (EVCs) is made possible by the ongoing advancement of AI technology. To precisely forecast charging demand estimation, artificial intelligence (AI) systems, such as machine learning, monitor important characteristics from journey history, car recharging data, and other environmental (including geographic) aspects.

The Asia Pacific hybrid vehicle market size was estimated at USD 151.85 billion in 2024 and is anticipated to be surpass around USD 304.97 billion by 2034, rising at a CAGR of 7.22% from 2025 to 2034.

Asia Pacific is going to be the fastest growing market for Hybrid vehicles. In regions like Japan, South Korea. China there has been an increase in the sales of hybrid cars. Many key market players like the Hyundai, Nissan, Honda, Toyota are all from Asia Pacific. The countries like Japan and China have given a major boost to the market as there is a mass adoption of the hybrid cars.

As customers in China move away from gas-only automobiles, hybrids are becoming more and more popular than battery-only vehicles. In 2024, the market leader, BYD, reported selling around 4.3 million passenger cars. Of those, over 2.5 million were hybrids, which is a flip from 2023, when BYD sold somewhat fewer hybrid cars than battery-only models. The automobile industry in China is still changing quickly. By July 2024, electric or hybrid cars accounted for over half of all sales. 945,000 hybrid vehicles were sold, up 27.6% from the year before, according to the China Federation of Individual Car Manufacturers (CPCA).

North America is expected to host a significantly growing hybrid vehicle market during the forecast period. Hybrid car adoption has accelerated throughout the continent due to strict pollution laws and rising customer awareness of environmental issues. The U.S. Department of Energy reports that sales of hybrid cars in North America hit a record 1.2 million units in 2023, a 17% increase over the previous year. The region's strong charging infrastructure and the presence of large automakers making significant investments in hybrid technology serve to further solidify this supremacy. The market attractiveness has increased due to the growing variety of hybrid vehicles that buyers can now choose from, ranging from SUVs to small automobiles.

The hybrid vehicles are made with a combination of an electric motor which uses the energy which is stored in the batteries along with the internal combustion engine. The energy which is stored in the batteries is produced with the use of regenerative breaking system. Owing to the pandemic, since there was a major delay in the supply chain and logistics, many producers were forced to stop their production there are a variety of hybrid engine vehicles giving different functionalities. Depending upon the various technologies used, there are different benefits provided by the hybrid electric vehicles. The global increase in petroleum prices have caused automakers to come with the new technology of hybrid vehicles they are now seen as a core segment of the automobile industry future. First, hybrid vehicle made by Toyota was available in Japan in 1997, followed by Honda Insight. Over 17 million hybrid electric vehicles have been sold over the world owing to its production in 1997.

By turning the ICE off, it helps in reducing the wasted energy during idle, so this is one benefit of hybrid electric cars. The regenerative breaking system helps in recapturing the wasted energy. The new technologies have also helped in reducing the power and size of the ICE and in turn they have added extra power to the electric motors to compensate for the loss during the peak power output. These vehicles are more fuel efficient than the diesel or gasoline vehicles. They can reduce the fuel costs dramatically because of their high efficiency. The price of the battery is reducing and hence the market shall flourish.

All the nations across the world are trying to improve their emission norms to make their nation greener and cleaner with the use of more technologically advanced automobiles that emit less pollutants. There is a good demand for electric and hybrid cars. But soaring prices of gasoline poses a challenge to this market. US Has planned the launch of many new hybrid vehicles in the year 2022 for promoting the purchase and adoption of these vehicles. Governments across the world are making more stringent laws for the emissions. Major players in the hybrid vehicles market are mostly from Asia Pacific region, the Asia Pacific region is expected to grow abundantly during the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 312.80 Billion |

| Market Size by 2034 | USD 580.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.12% |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Hybrid, Vehicle, Type of Propulsion Insights, Type of Drivetrain Insights, Type of Drivetrain Insights, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Environmental sustainability

The need for more environmentally friendly modes of transportation has increased as worries about climate change and environmental sustainability grow on a worldwide scale. For drivers who wish to lessen their carbon footprint without compromising the comfort and familiarity of gasoline-powered automobiles, hybrid vehicles—which combine the finest features of internal combustion engines with electric power—offer an alluring alternative.

Initial and maintenance cost

Hybrid cars are costlier than their internal combustion engine (ICE) counterparts because of their increased complexity. In addition to raising the total cost of purchase, more technology in a hybrid vehicle may have an impact on maintenance expenses. In particular, if the components of the hybrid system are damaged, the upkeep might out to be very expensive.

Better vehicle ranges and charging capabilities

Longer electric-only ranges are expected to be a feature of plug-in hybrid car development. Future plug-in hybrids are expected to have longer electric-only driving ranges due to developments in battery technology, enabling drivers to use electric power for longer periods of time before switching to an internal combustion engine. In addition, plug-in hybrids will soon have improved fast-charging capabilities. Users will find these cars more convenient with faster charging times, which will also provide drivers more control over how they manage their hybrid power sources and fit in with the rising trend of expanded charging infrastructure.

Depending upon the extent of the hybrid, vehicles can be classified as micro hybrid, Fully hybrid or Mild hybrid. The fully hybrid segment of the vehicles shall hold the largest market share during the forecast. It provides better fuel efficiency and reduced emissions. Also, there are continuous technological changes in this domain. The mild hybrid segment is also expected to grow during the forecasted. Followed by the fully hybrid segment.

Hybrid vehicles can be passenger cars of commercial vehicles. Since the government of various nations is making more stringent laws, the commercial hybrid vehicles are expected to grow during the forecast. Growing awareness about the environment and since the Hybrid vehicles provide fuel efficiency people are purchasing more and more cars for their personal use.

It includes the hybrid electric vehicles, plug in hybrid electric vehicles and natural gas vehicles out of the three, the market size of EV is increasing continuously due to the high volume sales in China, Japan and US. Data developing nations are also. Improving the emission standards there is a growth in the market of the hybrid vehicles. Compared to the natural gas vehicle and the PHEV, the has a better share in the market.

The functioning of the engine and the motor together to power the car determines the type of drivetrain. The Electric Motor Acts as a generator in the parallel hybrid and in the series hybrid cars, a separate generator is attached to the engine. In both the parallel and series hybrid regenerative breaking system is used. For the city drive, the series, hybrid cars are more efficient. And when it comes to driving on a highway at constant speeds, the parallel hybrids are more efficient. The parallel hybrid segment is estimated to increase during the forecast.

Some of the prominent players in the global hybrid vehicle market include:

By Hybridization

By Drivetrain

By Vehicle

By Propulsion

By Component Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

November 2024

February 2025