September 2023

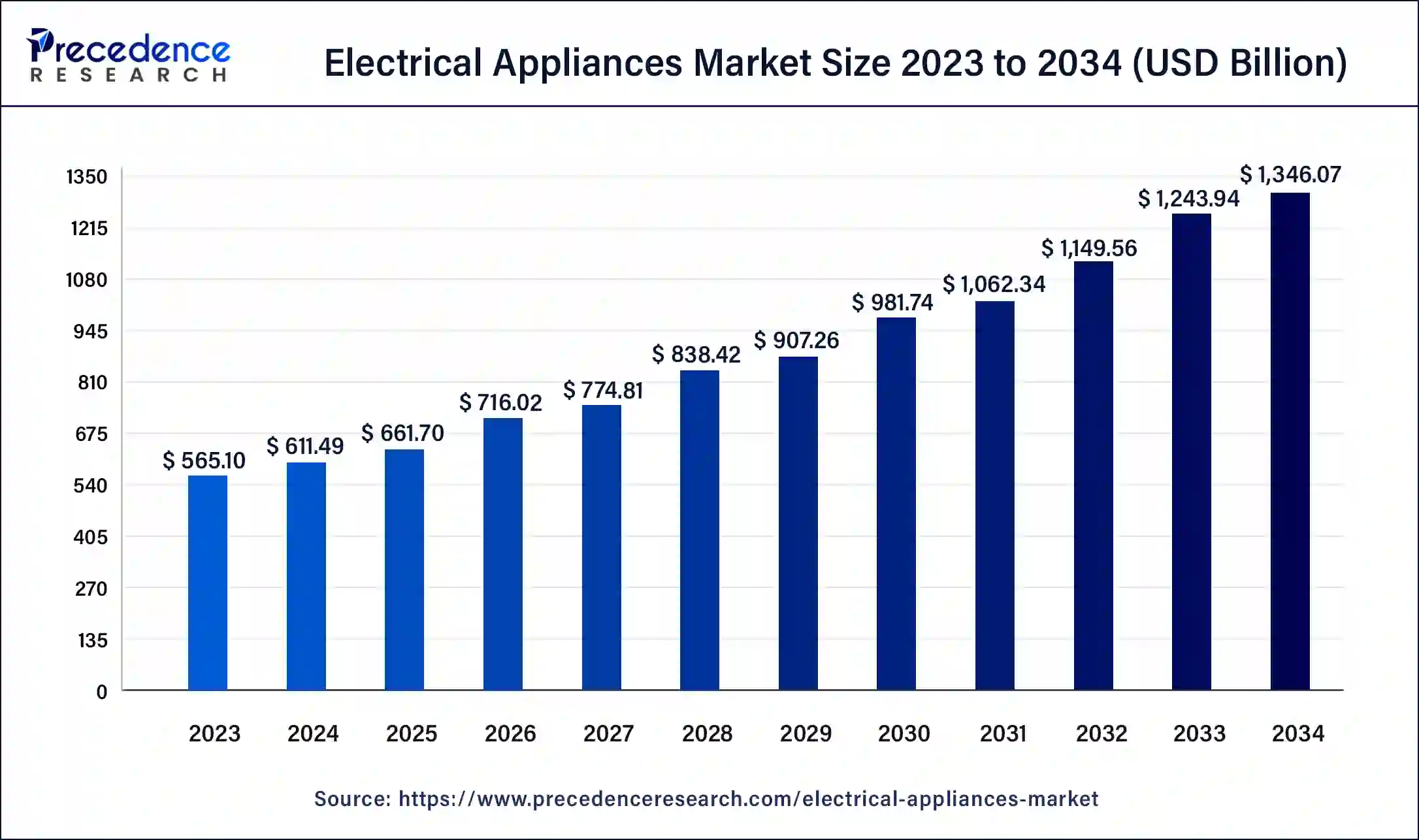

The global electrical appliances market size was USD 565.10 billion in 2023, calculated at USD 611.49 billion in 2024 and is expected to be worth around USD 1,346.07 billion by 2034. The market is slated to expand at 8.21% CAGR from 2024 to 2034.

The global electrical appliances market size is worth around USD 611.49 billion in 2024 and is anticipated to reach around USD 1,346.07 billion by 2034, growing at a CAGR of 8.21% over the forecast period 2024 to 2034. The rising investment in research and development by key prominent players to manufacture environment-friendly and reliable appliances is anticipated to boost the electrical appliances market during the forecast period.

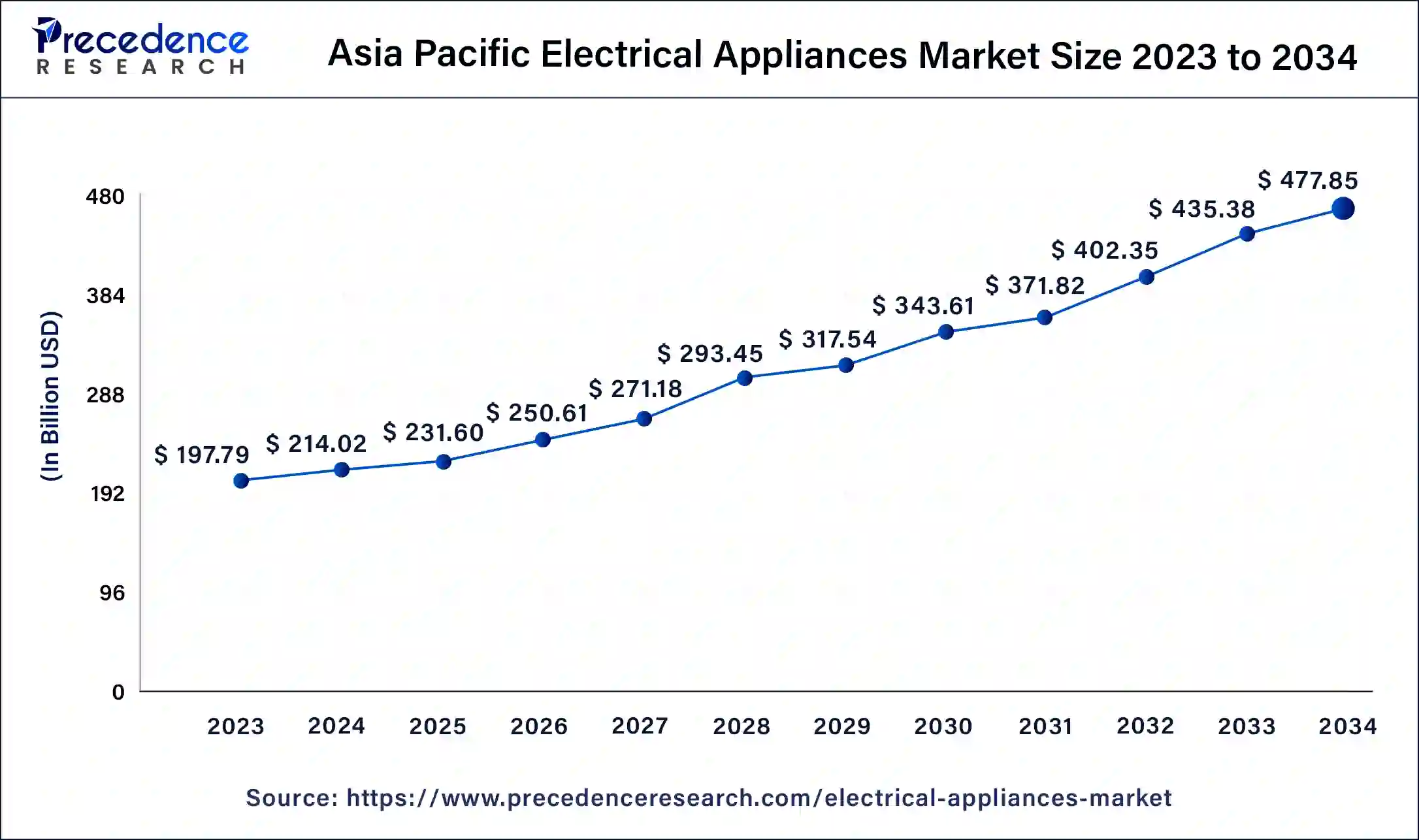

The Asia Paific electrical appliances market size was exhibited at USD 197.79 billion in 2023 and is projected to be worth around USD 477.85 billion by 2034, poised to grow at a CAGR of 8.34% from 2024 to 2034.

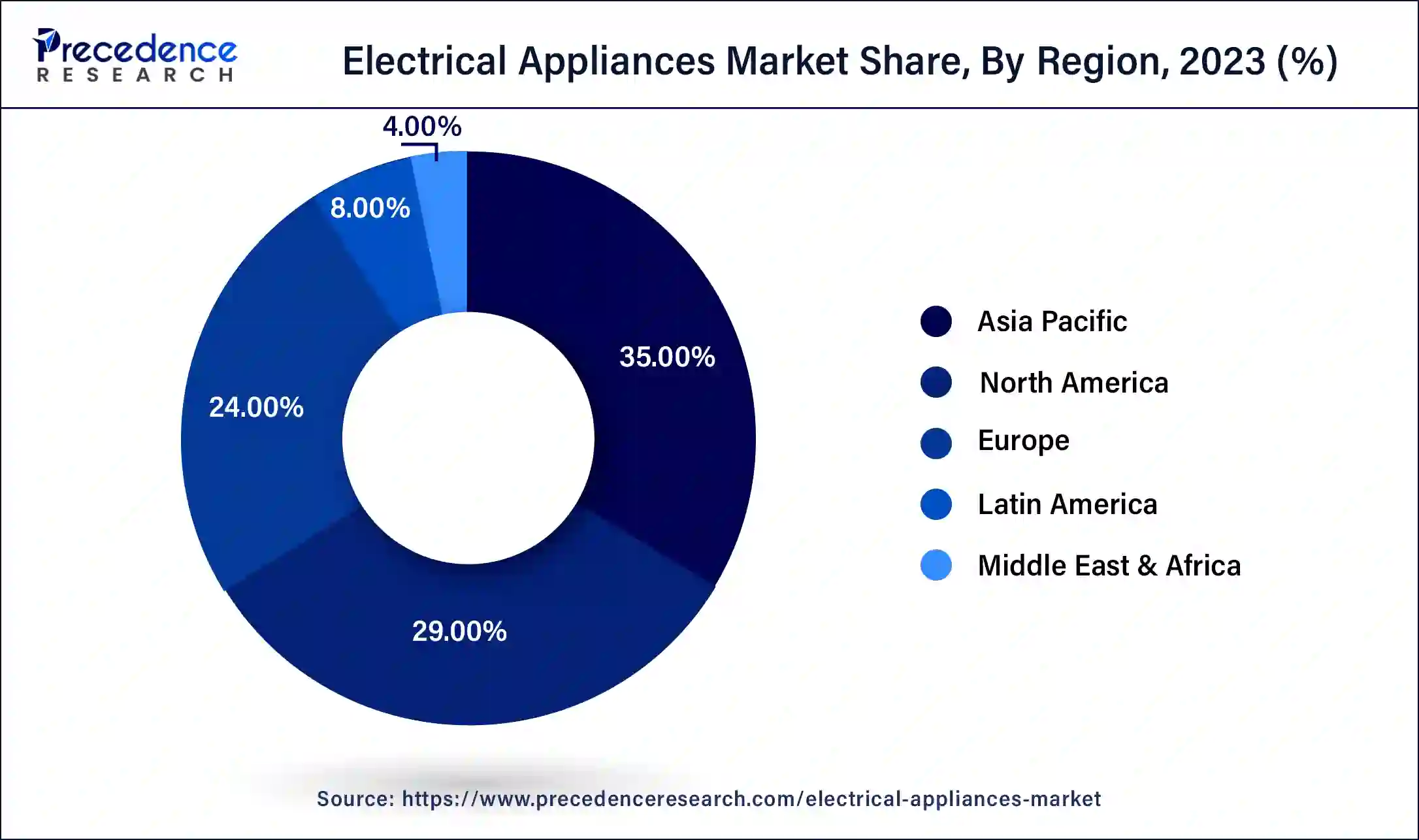

Asia Pacific held the dominant share of the electrical appliances market in 2023 and will witness prolific growth during the forecast period. The region’s growth is attributed to the presence of key market players, rise in disposable income, rapid urbanization, change in lifestyle, rising population, rising demand for smart energy-efficient appliances, rising expansion of the e-commerce sector and retail industry, and increasing production of innovative and technologically advanced electrical appliances.

Countries such as China, India, South Korea, and Japan are significant revenue contributors to the market owing to the presence of manufacturing hubs and a large consumer base. Asia Pacific is highly benefitted by efficient production capabilities, along with the rising middle-class population, which spurs the demand for electrical appliances. In addition, several smaller to medium-sized enterprises are increasing their market presence through entering new markets as a result of technological progress and product innovation.

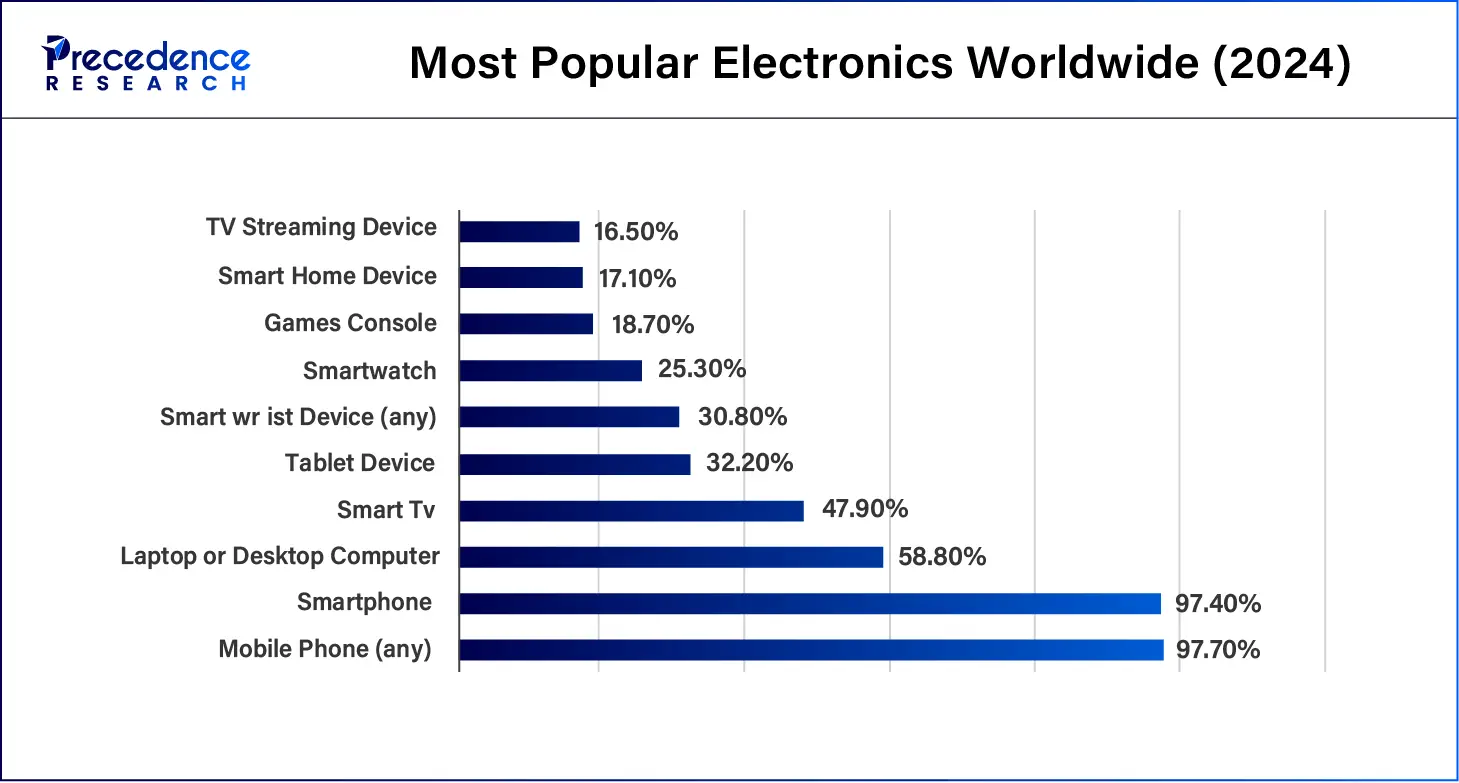

North America is observed to expand at a rapid pace in the electrical appliances market during the forecast period. The region is observed to witness prolific growth during the forecast period. The growth of the region is majorly driven by the rise in per capita disposable income, the rising implementation of smart home technology, the increasing popularity of smart energy-efficient appliances, the robust growth of the e-commerce sector, and the presence of a large customer base of electrical appliance products ranging such as refrigerators, heater, rice cooker, televisions, gaming consoles, audio systems, washing machines, fans, bread makers, toasters, irons, and other most popular electrical appliances.

North America’s electrical appliances market steady growth is driven by the increasing demand for home automation solutions and energy efficiency. The region has a robust economy and a strong emphasis on technological innovation. Furthermore, rapid modernization and demand for comfort have significantly increased with the use of advanced kitchens, including cordless induction, wireless electric kettles, dishwashers, smart blenders, and precision cookers.

In modern days, electricity has become the heart of mankind's survival. Electrical appliances are devices that are powered by electricity and built to perform particular tasks for commercial, domestic, and industrial uses. Electrical appliances are used in our day-to-day lives with the assistance of electricity. Electrical appliances have a large consumer population base around the world. They include a wide range of electrical appliances such as refrigerators, washing machines, coolers, hair dryers, steam mops, shavers, vacuum cleaners, trimmers, water heaters, fans, air conditioners, air coolers, juicers & mixers, rice cookers, bread makers, toasters, and many more electrical appliances. Electrical appliances placed within buildings may range from portable or handheld items to items that are designed for use in a fixed position.

Technological Innovation Continues to Drive the Evolution of the Electrical Appliances Market

As technological advancements evolve globally, the integration of smart technology and IoT connectivity stimulates the growth of the electrical appliances market. Artificial intelligence (AI) is assisting the market to shift toward a more sustainable and intuitive technological future. Artificial intelligence is revolutionizing the industry by creating more personalized experiences, automating processes, and enhancing efficiency. AI integration into IOT devices offers homeowners more security, convenience, and efficiency with electrical appliances.

The electrical appliances market, with robust automation and connectivity features, is among the new attractive devices that are in high demand. Features such as predictive maintenance, personalized user experiences, voice and gesture control, and enhanced safety features, such as artificial intelligence, enable appliances to operate more safely, smartly, and intuitively. The increasing integration of AI in electrical appliances boosts innovation and improves the quality of life, making this attractive to consumers.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,346.07 Billion |

| Market Size in 2024 | USD 611.49 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.21% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Operation, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rapid urbanization

The rapid urbanization is anticipated to drive the growth of the electrical appliances market during the forecast period. Electrical appliances are designed to perform various tasks using electricity and make daily life more convenient. Urbanization has brought about significant changes in living practices. As consumer lifestyles evolve, urbanization is expected to rise. Urban populations adopt these electrical appliances at higher rates to enhance comfort levels, save time, and streamline tasks. The urban population highly preferred value-added products that offer both affordability and convenience.

In commercial and industrial settings, electrical appliances comprise several devices such as power tools, printers, computers, and manufacturing machinery. The use of electrical appliances market services improves convenience, enhances productivity, and streamlines tasks. Therefore, the rising urbanization has resulted in increasing demand for electrical appliances, majorly driven by the rising standards of living, the rising need for convenience, and increasing disposable incomes.

Price competition

The rise in price competition is anticipated to hamper the growth of the electrical appliances market . The intense competition among prominent players has resulted in price wars and adversely impacting the profit margins. Additionally, the easy availability of electrical appliances at a lower cost hampers the profit margins of top manufacturers.

Rising consumer trends toward eco-friendly and energy-efficient appliances

The consumer trend toward eco-friendly and energy-efficient appliances around the world is projected to create a lucrative growth opportunity for the electrical appliances market during the forecast period. Energy-efficient appliances are gaining significant popularity in the market due to rising environmental concerns and rising energy costs. To reduce the impact of electric appliances on the environment, manufacturers are increasingly offering energy-efficient appliances equipped with more efficient technological solutions.

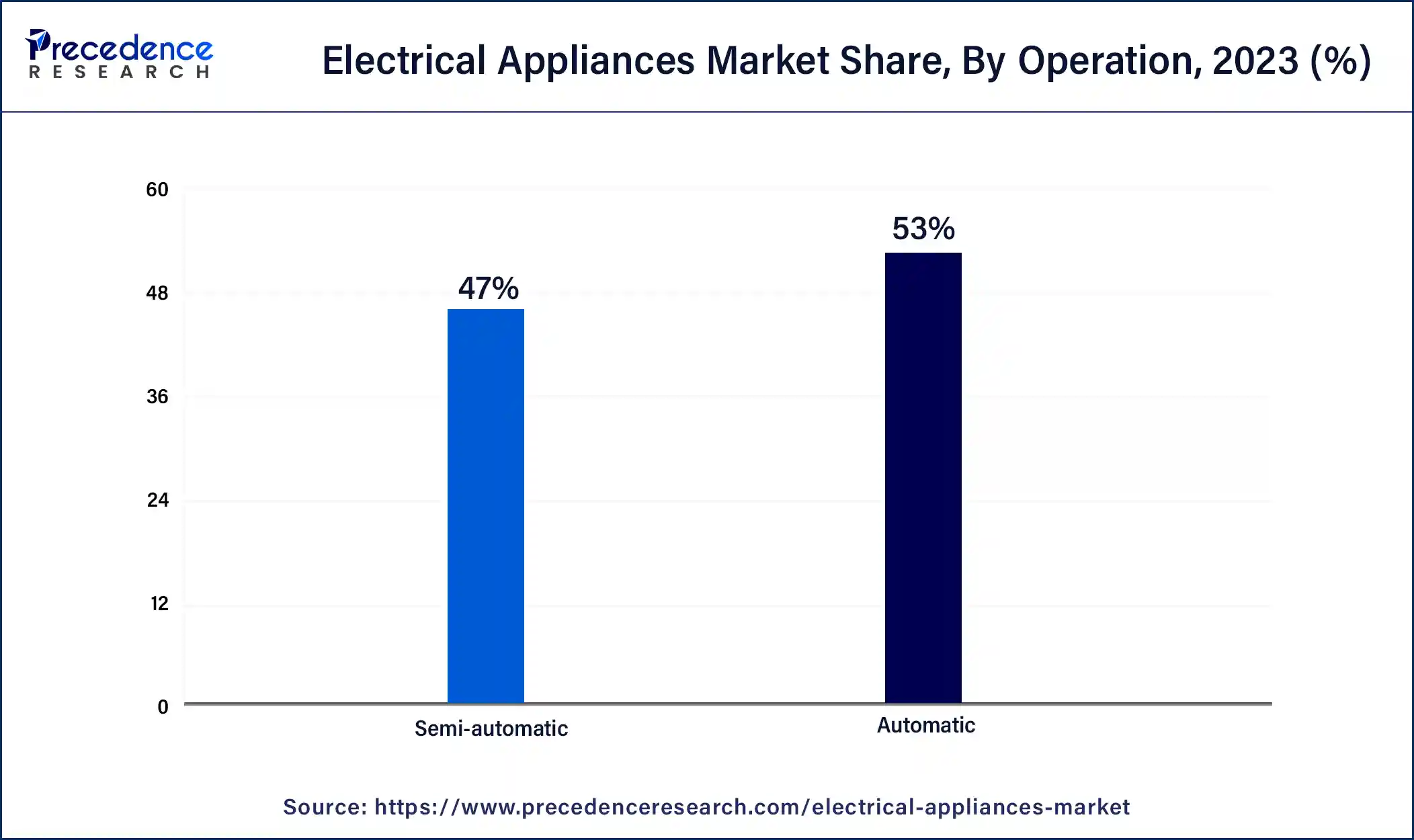

The automatic segment accounted for the dominating share of the electrical appliances market in 2023 owing to the rising modernization and hectic lifestyle routine. The increasing adoption of smart and IoT-based appliances has reshaped consumer preferences, which resulted in increasing demand for appliances that offer seamless operation with minimal manual intervention. Automatic appliances have become the preferred choice for consumers owing to their convenience, efficiency, and safety. Automatic appliances are equipped with advanced sensors and programmable settings, catering to the consumer demand for convenience, time-saving, and automated solutions.

The semi-automatic segment is expected to witness significant growth in the electrical appliances market during the forecast period. Semi-automatic electrical appliances use electric power to operate. Semi-automatic appliances require human intervention while performing their task.

The refrigerator segment held a dominant presence in the electrical appliances market in 2023. The segment’s growth is majorly driven by changing consumer lifestyles, rising disposable incomes, and rapid technological advancement. Consumers are increasingly seeking refrigerators with advanced features. Refrigerator manufacturers have addressed the evolving demand by innovating their product lines to meet the ongoing needs of consumers. Nowadays, refrigerators are equipped with the latest technologies to enhance food preservation, improve energy efficiency, and maximize storage space. From advanced cooling systems to smart connectivity features, refrigerators are gaining momentum in offering a standard of freshness in every aspect. Advanced air purification technologies in refrigerators actively eliminate odors and bacteria to maintain a hygienic environment for food storage. Moreover, technological innovations such as the integration of IoT capabilities and attractive designs are anticipated to fuel the growth of the refrigerator segment in the electrical appliances market.

The cooking appliances segment will witness considerable growth in the global electrical appliances market over the forecast period. The cooking appliances include products such as coffeemakers, food processors, microwaves, ovens, blenders, air fryers, and others. The growth of the segment is driven by the fast-paced and busy lifestyle, rising disposable income, and the increasing demand for high-quality cooking products. Cooking appliances save time and streamline complex cooking tasks. Such factors are expected to increase the adoption of advanced cooking appliances and propel the growth of the segment.

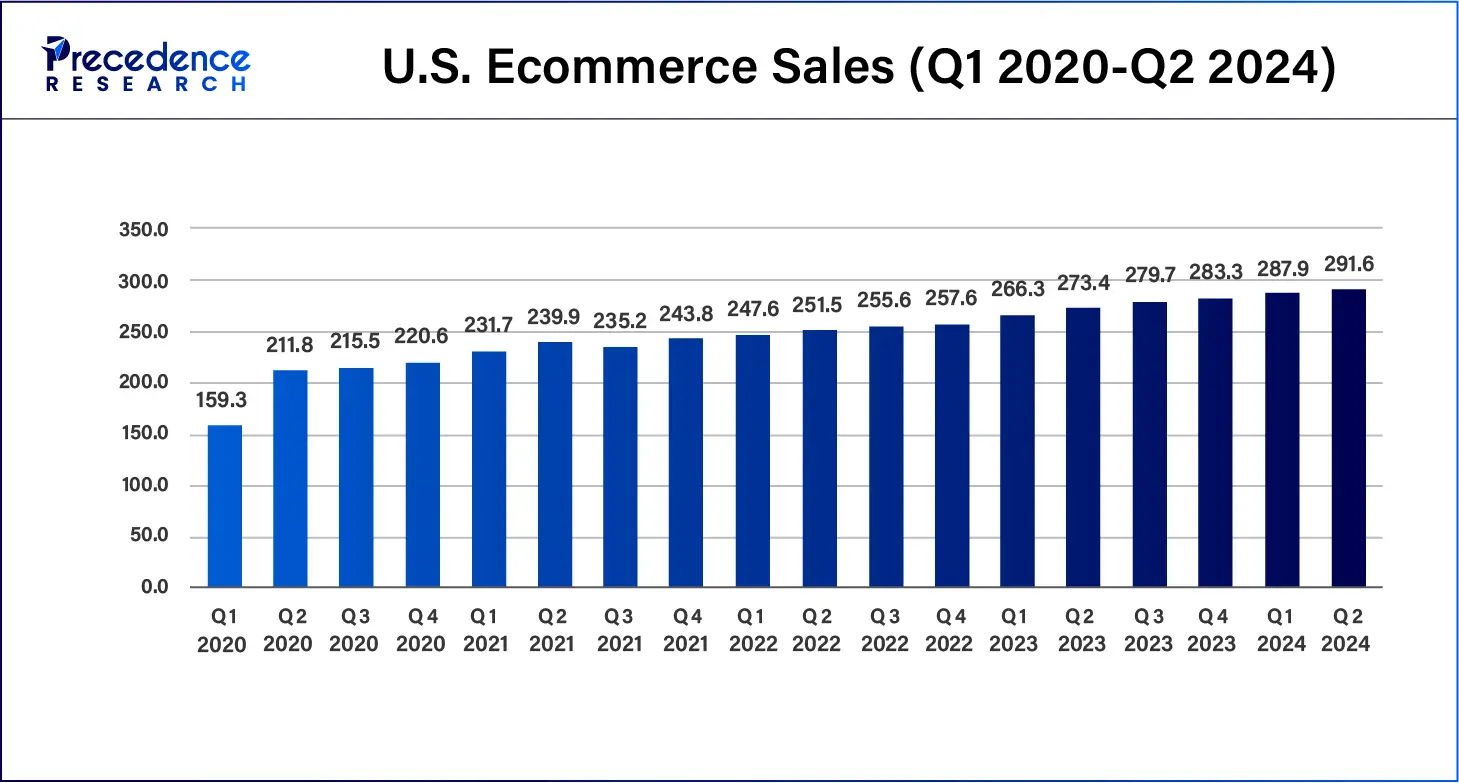

The online segment registered its dominance over the global electrical appliances market in 2023. The growth of the online segment is facilitated by the availability of a wide range of electrical appliances. E-commerce portals offer attractive discounts, particularly in festive seasons, which attracts a large base of consumers. In addition, manufacturers are also partnering with several other potential companies to ensure timely delivery and installation after the product is sold on the online platform. E-commerce service providers such as Myntra, Walmart, Inc., JD.com., eBay.com, Flipkart, Alibaba, Amazon, and others offer various value-added services such as coupon benefits, COD, no-cost EMI, free home delivery, and others. Such factors contribute to the growth of the online segment as a significant distribution channel during the forecast period.

The multi-branded stores segment is projected to expand rapidly in the electrical appliances market in the coming years owing to the accessibility of the wide range of good quality electrical appliances. Moreover, the presence of brand promoters in the stores helps to establish better interaction with the consumer as well as give better knowledge about the product.

Recent Developments

Segments Covered in the Report

By Product

By Operation

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2023

August 2023

July 2024

July 2024