August 2024

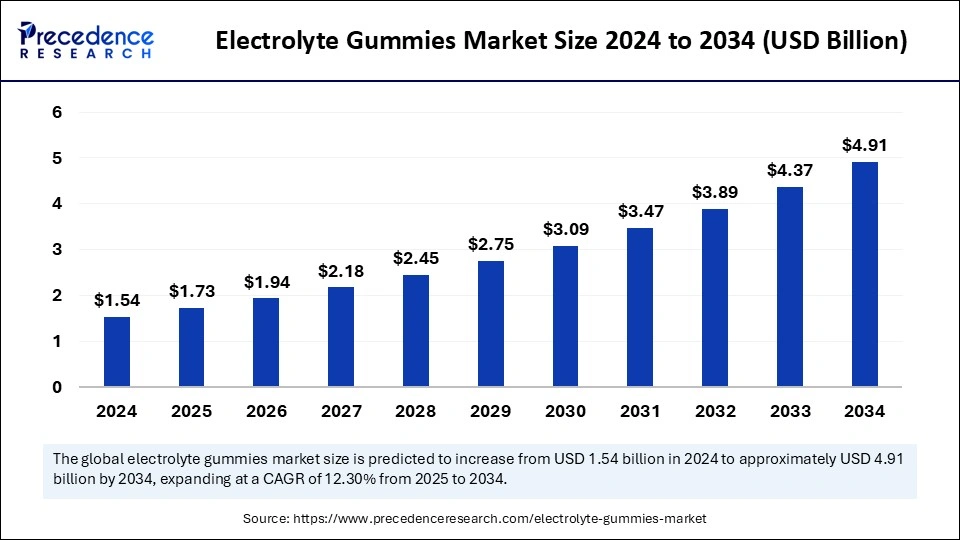

The global electrolyte gummies market size is calculated at USD 1.73 billion in 2025 and is forecasted to reach around USD 4.91 billion by 2034, accelerating at a CAGR of 12.30% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electrolyte gummies market size accounted for USD 1.54 billion in 2024 and is predicted to increase from USD 1.73 billion in 2025 to approximately USD 4.91 billion by 2034, expanding at a CAGR of 12.30% from 2025 to 2034. Rising consumer demand for convenient food products is the key factor driving market growth. Also, growing awareness among consumers regarding the importance of hydration coupled with innovations in nutritional science can fuel market growth further.

Artificial intelligence is substantially impacting the electrolyte gummies market by streamlining different operational aspects. Innovative data analytics facilitated by AI optimize better market forecasts, individualized marketing strategies, and consumer behavior analysis. Furthermore, AI improves manufacturing efficiency, reducing human error and decreasing overall production costs.

Electrolytes play an important role in keeping the healthy functioning of the human body. Vegetables and fruits are ample sources of electrolytes. Electrolyte gummies are a sophisticated and tasty way to fulfill the nutritional demands of the body, which may lost during high-intensity physical activities or dehydration. These chewable supplements are rich in essential electrolytes like potassium, calcium, sodium, and magnesium, which can help to control the body's muscle function, fluid balance, and nerve activity.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.91 Billion |

| Market Size in 2025 | USD 1.73 Billion |

| Market Size in 2024 | USD 1.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.30% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Yea | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Ingredient Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing trend towards on-the-go health options

The major factor fueling the growth of the electrolyte gummies market is the rising trend towards on-the-go health solutions. Hectic lifestyles have impelled consumers to seek portable and convenient options that fit their schedules. In addition, the growing participation in fitness and sports activities has created a huge demand for electrolyte replenishment solutions. Health-conscious consumers are also seeking substitutes for unhealthy beverages.

High production costs

The production of electrolyte gummies includes innovative manufacturing strategies utilizing various elements that contribute to the surge in production costs. These costs further convert into higher retail fees for clients, which can pose a constraint to broader market adoption. Moreover, stringent regulatory challenges can also impact market growth negatively. In some countries, the addition of gummies as dietary supplements can necessitate adherence to strict regulations.

Increasing demand for clean label and natural products

Consumers are rapidly seeking clean labels and natural products, which is creating lucrative opportunities for the electrolyte gummies market. The demand for these products is increasing because consumers are prioritizing transparency, health, and sustainability, which leads to a shift towards less processed, recognizable elements and avoiding other additives. Furthermore, consumers are demanding transparency regarding what they eat, which can lead to a preference for natural and clean-label products.

The hydration gummies segment led the electrolyte gummies market in 2024. The dominance of the segment can be linked to the main role of hydration gummies in replenishing lost electrolytes during intense workouts. These gummies are especially favored by individuals and athletes who engage in rigorous exercises, as they offer a convenient and rapid hydration solution.

The energy gummies segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the increasing popularity of energy gummies, as they offer fast sources of energy through ingredients such as carbohydrates and caffeine, which are gaining traction among the majority of health health-conscious population.

In 2024, the sodium segment dominated the electrolyte gummies market by holding the largest share. The dominance of the segment can be linked to the crucial role of sodium in muscle contraction and smooth nerve function. Sodium is the commonly utilized ingredient in electrolyte gummies because it is important for preventing dehydration and maintaining fluid balance.

The Potassium segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the growing awareness regarding the potential benefits of potassium for maintaining cardiovascular health. Potassium helps prevent muscle cramps by keeping proper cellular function. This gummy is favored by those who are doing high-intensity workouts.

The sports nutrition segment dominated the electrolyte gummies market in 2024. The dominance of the segment can be attributed to the growing number of people participating in fitness and sports activities. Additionally, electrolyte gummies offer an effective and easy way to maintain electrolyte balance, which is important for maximum athletic performance.

The general health segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the growing trend towards preventive healthcare. Also, consumers are increasingly seeking solutions that can support wellness and overall health; hence, electrolyte gummies fit well into this domain.

The online stores segment held the largest electrolyte gummies market share in 2024. The dominance of the segment is owing to the convenience offered by this segment, along with the surging trend of e-commerce across the globe. However, the growing number of online shopping by consumers for health and wellness solutions has boosted the sales of these gummies through online platforms.

The supermarkets and hypermarkets segment is estimated to grow at a significant rate during the projected period. The growth of the segment is due to the benefits such as immediate purchase provided by this segment, which also gives the opportunity to physically assess products. Furthermore, this format is especially famous for strategic placement and impulse purchases of electrolyte gummies, leading to Segment's growth shortly.

North America dominated the electrolyte gummies market in 2024. The dominance of the segment can be attributed to the increasing incidence of fitness culture coupled with the significant disposable income levels in the region. Furthermore, health-aware individuals and sports enthusiasts are using demand for powerful and handy solutions along with electrolyte gummies.

The U.S. Electrolyte Gummies Market Trends

In North America, the U.S. led the electrolyte gummies market . The dominance of the country is owing to the presence of a large number of health-conscious consumers who seek balanced nutrition and hydration. Also, the strong presence of established brands can drive this growth further.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be credited to rising sports participation, increasing health awareness, and growing middle-class populations in developing economies such as China and India. Moreover, the surge in investments by key players in the market can propel regional growth soon.

China Electrolyte Gummies Market Trends

In Asia Pacific, China dominated the electrolyte gummies market by holding the largest share. The dominance of the country is due to the growing emphasis on sports and fitness activities and the surge in the trend of preventive healthcare in the country. The rising popularity of e-commerce platforms in China is also impacting the market growth positively.

By Product Type

By Ingredient Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

May 2024

February 2024