March 2025

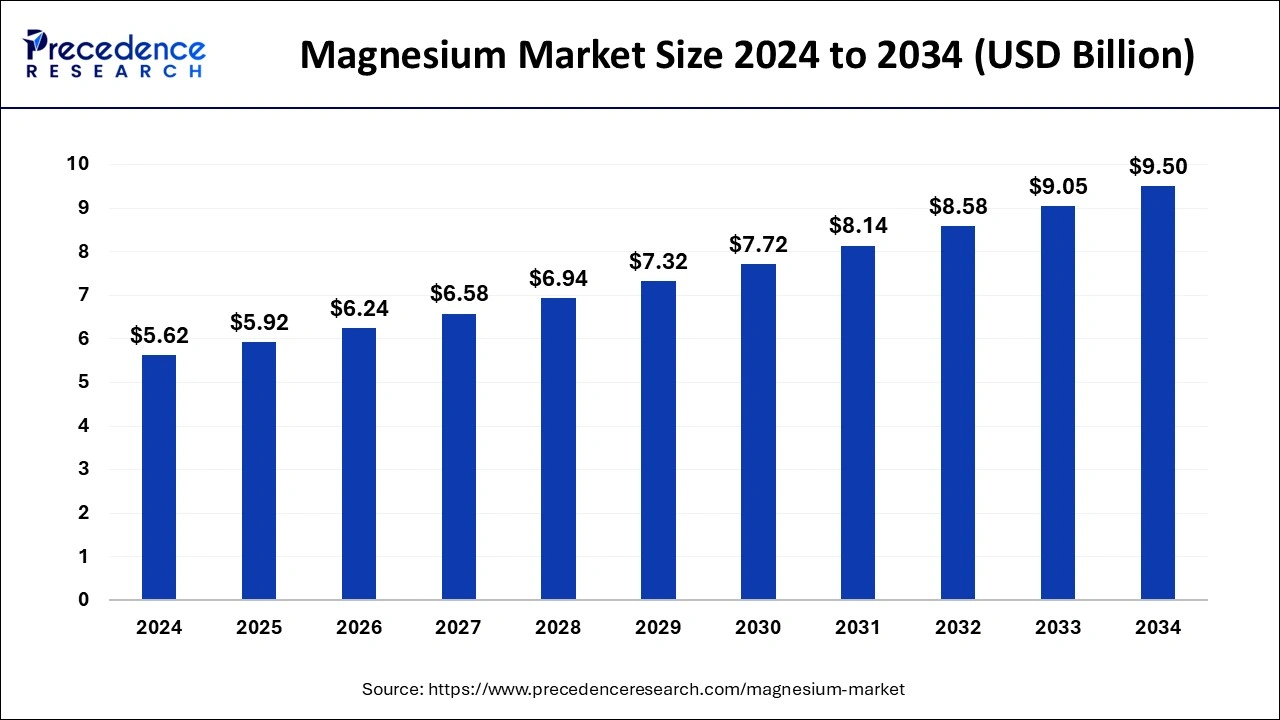

The global magnesium market size is calculated at USD 5.92 billion in 2025 and is forecasted to reach around USD 9.50 billion by 2034, accelerating at a CAGR of 5.39% from 2025 to 2034. The Asia Pacific magnesium market size surpassed USD 2.07 billion in 2025 and is expanding at a CAGR of 5.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global magnesium market size wwas estimated at USD 5.62 billion in 2024 and is predicted to increase from USD 5.92 billion in 2025 to approximately USD 9.50 billion by 2034, expanding at a CAGR of 5.39% from 2025 to 2034. The increase in product demand for various applications, such as die-casting and aluminum alloy for varied industrial purposes, is causing the global magnesium market to grow.

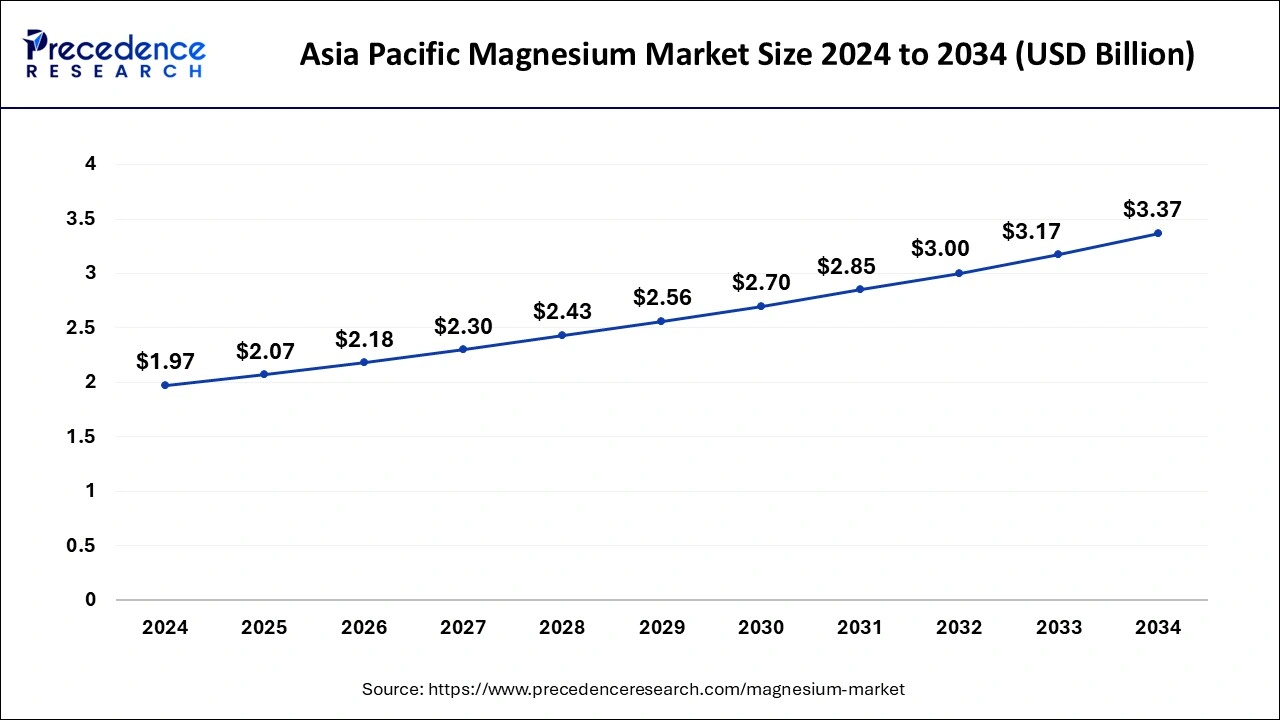

The Asia Pacific Magnesium market size was estimated at USD 1.97 billion in 2024 and is projected to surpass around USD 3.37 billion by 2034 at a CAGR of 5.52% from 2025 to 2034.

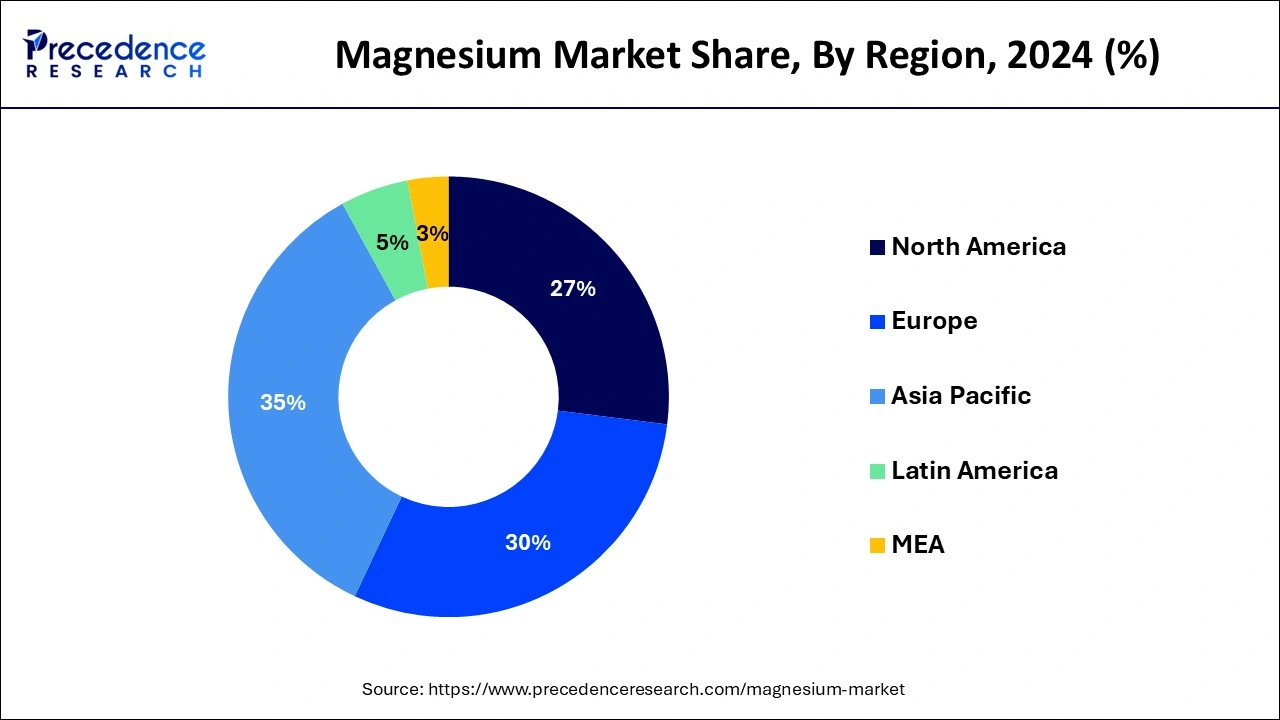

Asia Pacific dominated the global magnesium market in 2024, accounting for over the market revenue, and is expected to maintain its dominance in the forecast period. Countries like India and China have seen increased spending on electric automotive projects, while rapid growth in military aviation, aerospace, and space ventures is also driving magnesium market growth. Additionally, the importance of steel industries in countries like India and Japan is further contributing to the growth of the global market throughout the forecast period.

Europe is projected to witness significant growth in the magnesium market over the estimated period. Germany is the world's biggest consumer of aluminum casting, largely due to the automotive sector's high demand for aluminum parts. The increasing need for lightweight components, driven by fuel efficiency and aerodynamic advancements, is boosting the market for aluminum alloys, consequently increasing magnesium consumption.

As Europe's leading automobile producer, Germany boasts 41 assembly and engine production facilities. It dominates the European automotive market and manufactures one-third of all cars sold on the continent. It is a top manufacturing hub for the automotive industry, housing various manufacturers across different segments, including equipment producers, material and component suppliers, engine manufacturers, and system integrators. This will help the region to gain a foothold in the global magnesium market.

Magnesium possesses electromagnetic properties, high thermal heat capacity, and strength, making it suitable for various industrial applications. Its lightweight nature makes it particularly valuable in the automotive, aerospace, and electric vehicle sectors. Magnesium can store energy and is considered more stable than lithium-ion. It also plays a significant role in electronic devices like televisions and laptops.

Initiatives are promoting the alloying of aluminum and magnesium for beverage can manufacturing, contributing to rapid growth in the magnesium market share. Its electromagnetic screening property and heat conductivity make it ideal for such applications while also enhancing the strength of aluminum, which is widely used in these industries. The growing demand for lightweight components, especially in the automotive and aerospace sectors, is expected to drive market growth in the coming years.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.39% |

| Market Size in 2025 | USD 5.92 Billion |

| Market Size by 2034 | USD 9.50 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing need for alloy metals

In the magnesium market, the demand for magnesium for alloying with different metals is growing due to various applications of magnesium alloys. The lightest structural alloys are extensively used to be those made from magnesium.

Magnesium is also combined with other metals to enhance its physical properties. The elements used as alloys are copper, zinc, aluminum, manganese, and rare earth metals. This magnesium property, along with its physical property, is expected to boost the magnesium market shortly.

Enhanced manufacturing projects for aircraft spacecraft and missiles

Magnesium's ability to withstand harsh conditions makes it ideal for constructing ballistic missiles and spacecraft, which require lightweight materials capable of resisting electromagnetic waves encountered at close range. Additionally, growing environmental concerns regarding fuel emissions have led to increased efforts to reduce pollution worldwide. With the global atmospheric concentration of carbon dioxide reaching the highest in recent years, initiatives and expenditures toward electric vehicles and automotive alternatives are driving the demand for magnesium.

Environmental policies about damage posed by magnesium mining

The construction process can be slowed down by metals' tendency to react with oxygen, causing damage to surface and under-surface areas. This poses challenges for industries like aerospace and automobiles, where efficiency is crucial. Additionally, environmental concerns surround magnesium mining, which can harm soil and biodiversity.

To mitigate these risks associated with mining activities, limitations have been imposed to protect ecosystems and indigenous species. Governmental policies and initiatives aimed at environmental protection are expected to limit the growth of the magnesium market.

Possible increase in the use of magnesium metals in electric vehicles

Products of the magnesium market are lightweight yet strong, making them increasingly favored for use in electric vehicles (EVs). Their use in EVs is expected to grow, enhancing the vehicles' overall range capacity and improving mileage per battery charge due to their lighter weight. As the EV market expands, various vehicle components such as brake pads, brake drums, driveshafts, and engine parts are likely to incorporate magnesium metal.

With consumers increasingly favoring vehicles with lower emissions, changes in emission policies and stricter regulations are expected to drive further growth in the magnesium market. Recent developments and government initiatives, such as France's tax reductions on electric trucks to promote their purchase and the goal of achieving carbon neutrality in the road freight industry by 2050, are likely to further boost demand for EVs in the coming years.

The aluminum alloying segment dominated the magnesium market in 2024. This is attributed to the property of Mg to enhance the strength of the alloy when mixed with other metals. These alloys are primarily used in the manufacturing of beverages. Other than this, they can be used in buildings, pressure vessels, and chemical tankers. Also, growing investments in the beverage industry are supporting the market growth further.

In the magnesium market, the die casting segment is anticipated to witness substantial growth during the forecast period. During a certain period, all manufacturing units and OEM plants were forced to stop production due to various reasons. As economies started recovering, the demand for die-cast parts in the automotive industry surged significantly, mainly because consumers preferred lightweight vehicles. This trend is expected to continue, fueling market growth.

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025