September 2024

Electronic Health Record Software Market (By Type: Ambulatory, Acute, Post-Acute; By Product: Web Based, Client-Server Based; By End-User: Hospital, Ambulatory) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

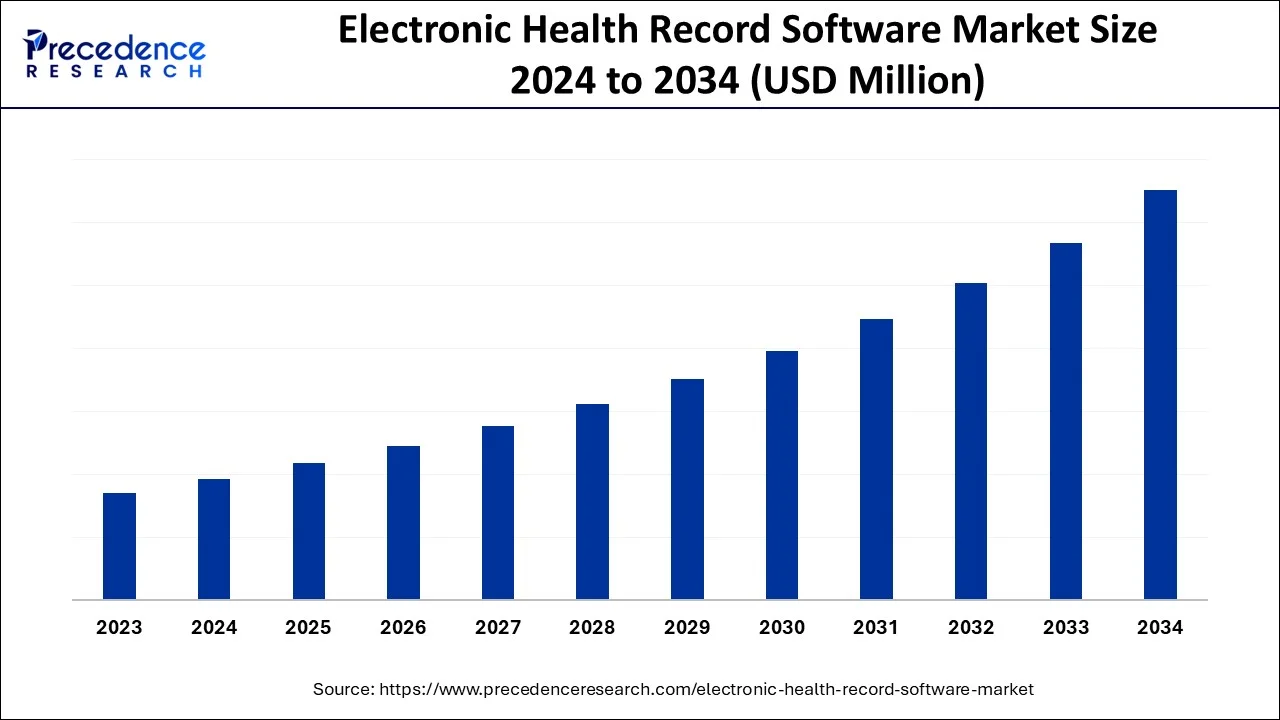

The global electronic health record software market is surging, with an overall revenue growth expectation of hundreds of millions of dollars during the forecast timeframe 2024 to 2034.

Electronic health record software (EHR) is primarily used for the structured collection of patients' medical data in electronic form and stored in digital form. This software helps to increase access to patient data and thus improves the overall productivity and efficiency of patient care. With various features, operability, and applications, of EHR in many healthcare settings, its increasing utilization is expected to grow in the forecast period. The essential components of electronic health record software include lab systems, clinical documentation, administrative functions, and pharmacy systems. In addition, stores information such as gender, age, health history, ethnicity, allergies, medicines, test results, instructions, and billing information are also some of the vital components. The growth of the electronic health record software market is due to the growing adoption of innovative technologies to meet the growing needs of end users.

In addition, the penetration of artificial intelligence (AI) to expect clinical outcomes based on HER has helped to influence the patient experience through better care, and the contribution of AI in the development of EHR software leads to the growth of the market. Moreover, electronic health record software played vital role in the management of patient data during the COVID-19 outbreak, in addition to these advances and factors, government-supported initiatives and investments will drive market growth in future. North America is anticipated to hold a large revenue share of the electronic health record software market in the forecast period.

| Report Coverage | Details |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Largest Market | North America |

| Second Largest Market | Europe |

| Segments Covered |

By Type, By Product, By End-User |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Technological advancements in electronic health record software driving the market growth.

The technological advancement in the electronic health record software market is expected to drive the market during the forecast period. The AI-sourced software integrates flawlessly and provides solutions with diverse features. Machine learning and natural language processing can help in documenting a patient's medical experience, organizing large databases to find important documents,and assessing patient satisfaction. Machine learning mode is combined with NLP which can help healthcare providers translate speech from speech-to-text recognition systems. Algorithms can be well-trained on large volumes of patient data about the patient's course of treatment, the device used for the treatment, and the respective physician, and neatly segmented based on the individual patient, disease, and disease treatment. This will improve the search for documents and information in large databases.

Not only medical transcription and document search, but predictive analytics and machine learning models also provide healthcare providers with analytics on patient satisfaction or help predict patient risk which supports driving the market growth. For instance, In October 2019, Northwell health collaborated with All Scripts, and presented an innovative agreement to create the next-generation electronic health record, the launch of this artificial intelligence (AI)-sourced EHR will support to the growth of the market.

The high cost of electronic health record software’s hampering the growth of the market

The high cost of electronic health record software is hindering market growth. The high cost is associated with the implementation, development, and maintenance of electronic health record software. Various emerging economies are facing problems in the adoption of EHR due to its high price. Also, the cost of AI to develop algorithms and programs is expensive for underdeveloped regions which slightly restrained the market. Also, the lack of skilled professionals and information about how to use complex AI and machine learning algorithms, Lack of IT infrastructure in low economic countries is expected to hinder the electronic health record software market. Thus, the high costs with EHR technology is restraining market growth.

Increasing government initiatives and collaborations creating new opportunities

Increasing government initiatives, company acquisitions, collaborations, and implementation of electronic health record software across the world is a major factor creating new opportunities for players owing to the growing initiatives by the governments to implement plans for reducing administrative burdens on healthcare providers relating to the use of EHR.

For instance, My Health Record is a national digital health record platform in Australia region. Every Australian resident has a “My Health Record” application. The Australian Digital Health Agency (ADHA) claims that by the end of 2022, all healthcare providers in Australia will be able to contribute to and use healthcare information available on the platform. Such initiatives by governments are boosting the market growth of the electronic health record software market.

COVID-19 Impact

The COVID-19 outbreak is an incomparable global public health emergency that has obstructed most sectors and the long-term impacts are expected to hamper industry growth over the upcoming years. COVID-19 has caused destruction on global markets and has also caused severe blocks in many clinical studies aimed at bringing novel treatments to market. Additionally, labor cutting, supply chain disruptions, and other constraints have intensified the situation. Limitations and boundaries have impacted several ongoing clinical research studies in different areas of treatment. The COVID-19 pandemic is not just a short-term pandemic. This has long-lasting suggestions for how people work, how we should treat patients, and how industries will operate and be seen by the world.

The Covid-19 outbreak has a positive effect on the healthcare industry. The urgency to stop the outbreak of COVID-19 and the growing dependence on healthcare workers is on the rise. The covid-19 pandemic has changed insights about technology adoption and increased demand for digital tools in a wide range of non-tech industries. Due to the pandemic, medical records must now be stored digitally and accessible to clinicians globally for emergency use.

The COVID-19 pandemic positively impacted the electronic health record market. Increasing adoption of advanced technology solutions for software development and recruited patient data study are the key factors for the rise in the infiltration of EHR. The COVID-19 pandemic has increased the opportunities for the electronic health record market as the pandemic has additionally initiated an increase in the deployment of analytical software technologies. However, the growing demand for software services from the healthcare sector is driving the growth of the EHR market.

Based on type insights, the global electronic health record software markets is segmented into Ambulatory, acute, and post-acute. The acute EHR segment is expected to hold the major market revenue share in 2023. The growth of this segment is due to the implementation of electronic health records in small-scale services. For instance, acute care clinics in the United States, covered by the Prospective Inpatient Billing System (IPPS) eligible for the Medicare incentive payment system. The acute care electronic health record generates patient information that can provide all the clinical details. These details can also be used for intensive care, emergency services, hospitalization, and operating room purposes.

The ambulatory type is expected to hold a significant revenue share in the Electronic Health Record Market. The Emergency Electronic Health Record is designed for ambulatory care settings and small operations usage. Government support towards ambulance electronic health record adoption especially during the COVID-19 pandemic is expected to drive market growth. Ease of use compared to inpatient electronic health records is expected to drive market growth.

The Post-acute EHR is primarily used to provide recovery services that patients receive after an acute care hospital stay. Post-acute care services include inpatient rehabilitation centers and hospitals, home care agencies, and long-term care hospitals.

Based on product insights, the global electronic health record software markets is segmented into web-based, and client-server-based. The web-based EHR segment is expected to lead the major market revenue share in 2023. The growth of this segment is owing to its popularity amongst healthcare providers and physicians which work on a small scale. Web-based EHRs can be installed without the obligation of in-house servers and can also offer wide customization and enhancements. The client-server-based electronic health record software segment is expected to hold a significant revenue share during the forecast period. This segment does not need an internet connection to operate as compared to web-based EHR which led the segment's growth.

Based on End-User insights, the global electronic health record software market is segmented into Hospitals, and Ambulatory. The Hospital EHR segment is expected to hold a large market revenue share in 2021. The growth of this segment is attributed to a huge amount of medical data gathered in hospitals. In addition, the cost of installation in EHR software is low as compared to ambulatory service centers which help to drive the market.

The ambulatory care centers segment holds a significant market revenue share. It includes laboratories, pharmacies, and physicians clinics. The increasing number of ambulatory service centers in the developed regions is anticipated to drive market growth.

North America dominated the global electronic health record software market and accounted for the largest revenue share in 2023. The growth is credited to the government policies that helps to adopt the EHR software and the availability of developed healthcare infrastructure with high digital literacy. For instance, in March 2021, TELUS HealthCare announced the next advancement in the digital integration of its employer-focused virtual care service, Akira by TELUS Health, with its electronic medical records.

Europe holds the second largest revenue share for the electronic health record software market following North America. Increasing research and development events in the healthcare sector and rising demand for EHR market. The Digital Single Market policy by the European Commission provides customers and industries with access to online services and goods across Europe, thus providing essential conditions for the growth of the digital network and allied services, which is expected to expand the growth of the European economy. For instance, In February 2022, The European Commission announced to investment €292 million in digital technologies. Such as, European blockchain infrastructure, digital solutions for better government services, Artificial Intelligence (AI) to fight crime, and AI testing facilities.

In Asia Pacific, the market for electronic health record software is predicted to have lucrative growth over the forecast period due to rising demand for quality services and standards which helps to boost the digitalization of healthcare in this region. In addition, the increasing infiltration of AI-sourced tools and favorable government initiatives for the adoption of artificial intelligence (AI) in various pharmaceutical fields is growing the EHR market.

Segments Covered in the Report

By Type

By Product

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

February 2025

March 2025