List of Contents

Elevator Components Market Size and Growth 2025 to 2034

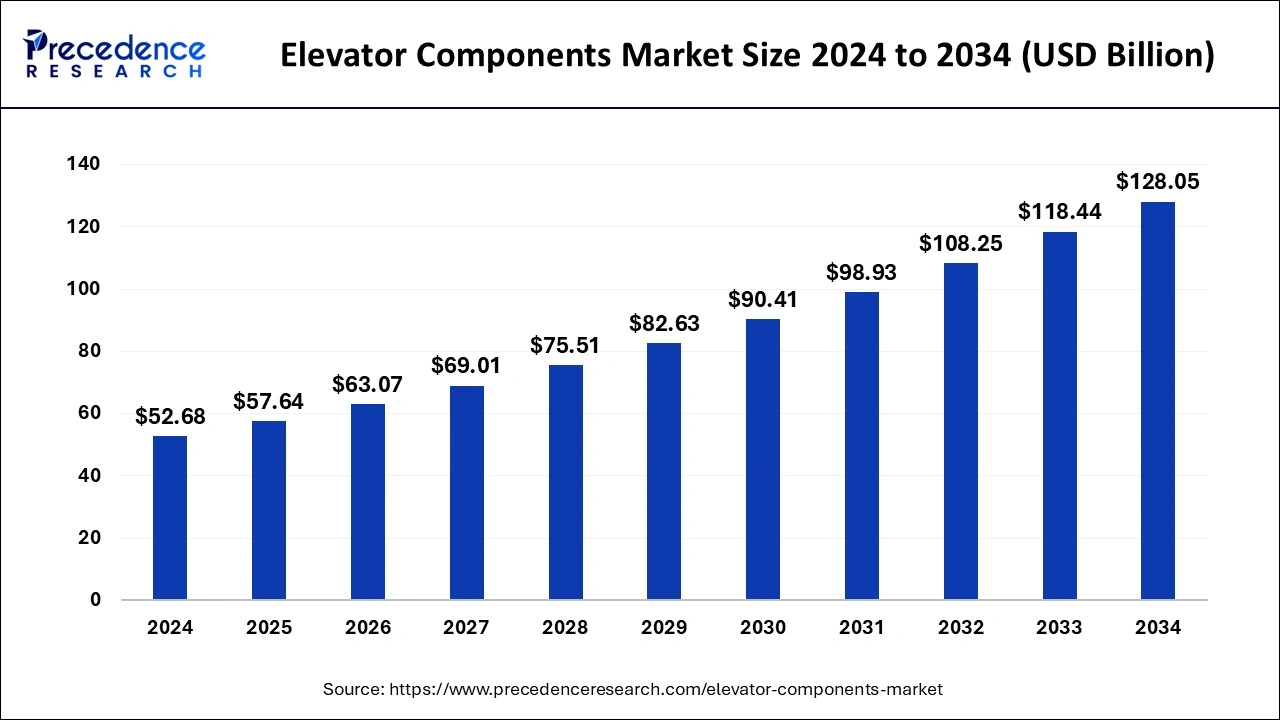

The global elevator components market size was estimated at USD 52.68 billion in 2024 and is predicted to increase from USD 57.64 billion in 2025 to approximately USD 128.05 billion by 2034, expanding at a CAGR of 9.28% from 2025 to 2034. The rapid growth rate for urbanization includes high-rise infrastructure is a major factor propelling the market growth globally.

Elevator Components Market Key Takeaways

- In terms of revenue, the global elevator components market was valued at USD 52.68 billion in 2024.

- It is projected to reach USD 128.05 billion by 2034.

- The market is expected to grow at a CAGR of 9.28% from 2025 to 2034.

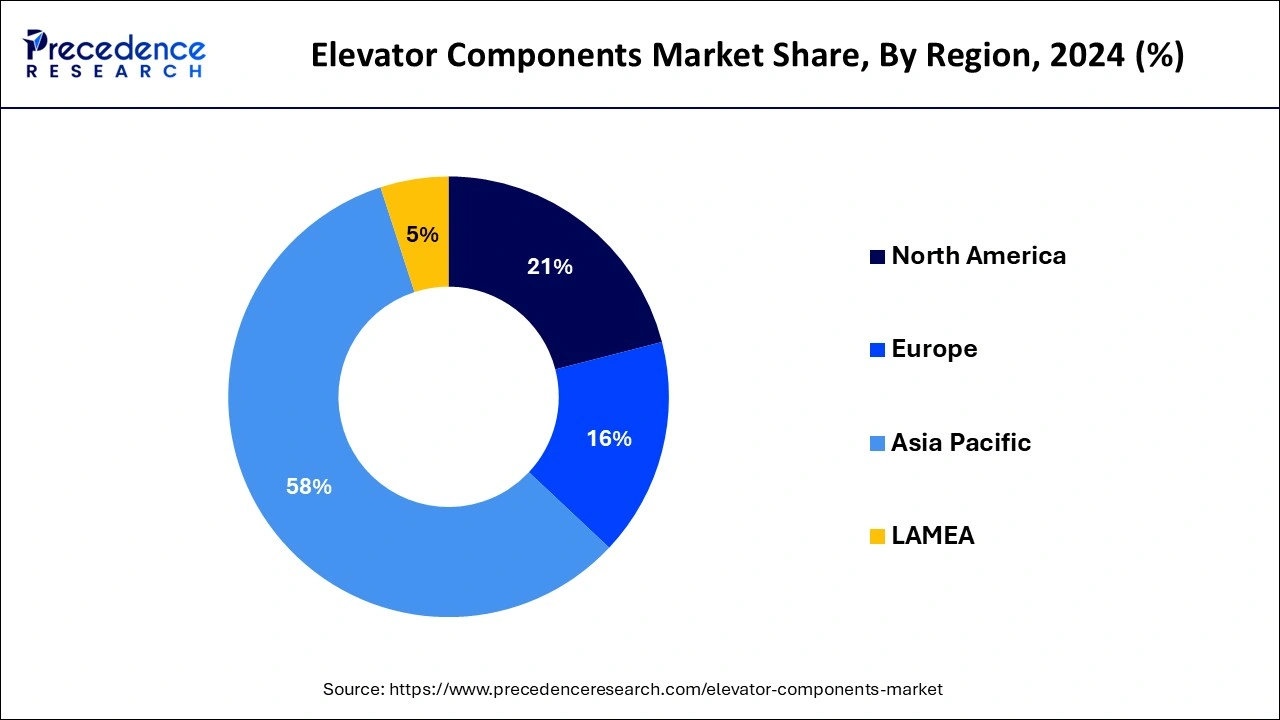

- Asia Pacific dominated the market with the largest revenue share of 58% in 2024.

- North America is expected to witness significant growth in the market in the foreseeable period.

- By component, the motors segment has contributed more than 35% of revenue shares in 2024.

- By elevator technology, in 2023, the machine room-less elevator segment held a significant share of the market.

- By load capacity, the 650kg to 1000kg segment will witness a notable growth in the global market.

- By speed, the 4 to 6 m/s segment led the market in 2024.

- By end-use application, elevators for passenger segment has held a major revenue share of 82% in 2024.

Asia Pacific Elevator Components Market Size and Growth 2025 to 2034

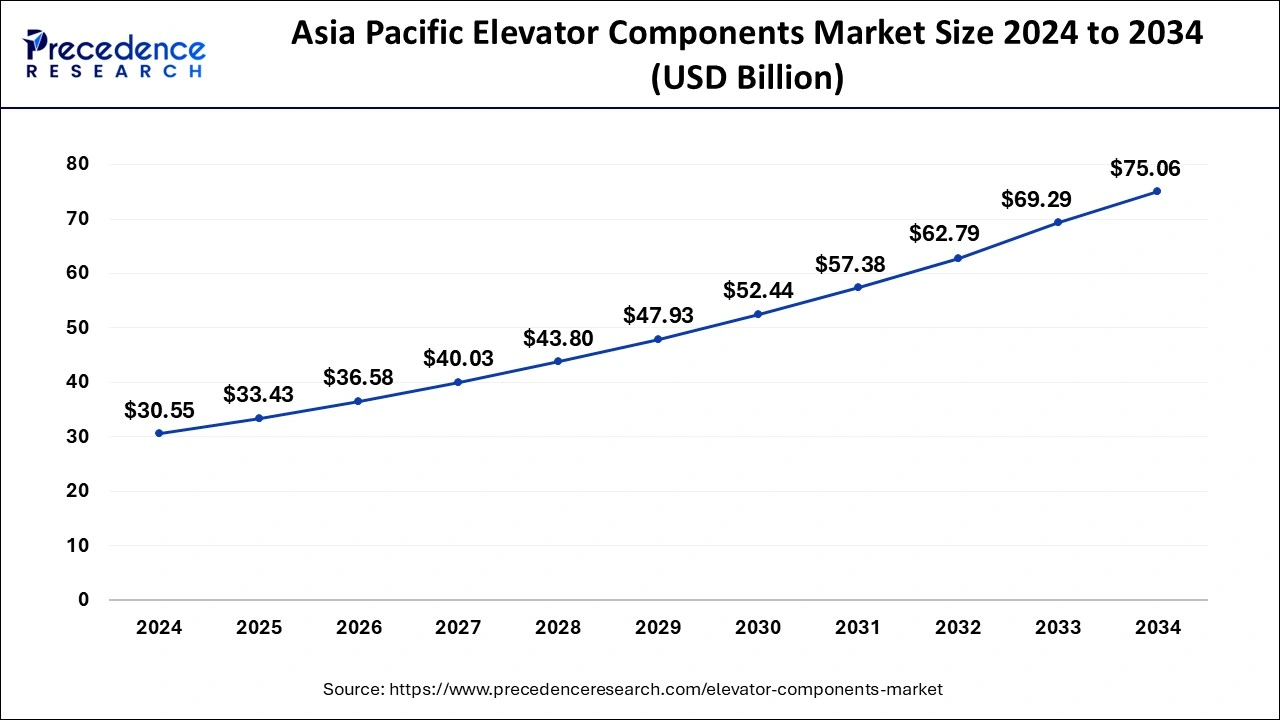

The Asia Pacific elevator components market size was valued at USD 30.55 billion in 2024 and is predicted to be worth around USD 75.06 billion by 2034, at a CAGR of 9.40% from 2025 to 2034.

Asia Pacific held the highest share of the global elevator components market in 2024. The dominance of this region is due to the dense population found in Asian countries like India and China. A huge population needs to be managed by providing optimal resources in every aspect, including building an infrastructure that is space-friendly and ventilated. Thus, by acknowledging this, government and private authorities take the initiative to provide sustainable high-rise and mid-rise residential buildings equipped with technically advanced elevators, which is the major factor that propels the exponential growth of the elevator components market in Asia Pacific.

- According to the statistics, India's population is estimated to surpass the population of China by the end of 2024. Both countries have nearly 1.44 billion population, while India has a population growth rate of 1.13%.

The government authorities in China are aiming to enhance the country's infrastructure by approving numerous projects and increasing the sales of elevator components through substantial investments. The ongoing urbanization and expansion of the commercial sector in China are expected to be key drivers for the elevator component market. The government is projected to implement policies to regulate the real estate sector in the near future, which is anticipated to result in more affordable property prices and a more balanced land distribution. These initiatives are expected to further boost the demand for elevator components and, consequently, the market in the Asia Pacific region.

- The Chinese government has started a plan called build-reconstruct-renovate and revitalize, which helps a buyer with lower incomes. The government has a strategy to build more than 2 million rental houses in the affordable range.

North America is expected to witness significant growth in the elevator components market in the foreseeable period. The growth of this region is due to the deteriorating high-rise infrastructure in the major countries of the region, like the U.S., and the necessity to revamp them by installing technically advanced features like smart elevators with IoT sensors and remote monitoring systems having energy-efficient techniques to operate seamlessly. Since North America already has developed countries with robust and advanced infrastructure, it does not exhibit any potential growth possibilities for expanding the elevator component market. Only by replacing methods for elevators and providing innovative options in the elevator structure can manufacturers strengthen their portfolio in North America.

Market Overview

The global elevator components market has seen exponential growth over the forecasted years and continues its growth due to increasing demand for versions of elevators in the global market. The availability of highly advanced elevator plans, and design has an important role to increase the demand for elevators and its components in the market.

The major components of the elevators include a hoistway, elevator car, guide rails, hoisting cables, pulley system, and a safety net called a buffer. Buffers are safety providers, and they are designed to absorb the extra energy, which prevents damage to the whole system of the elevator, including its components. Elevators create a revolutionary way of transportation in high-rise and mid-rise infrastructure and thus provide larger space to live. Due to the increased urbanization and industrialization, the elevator component market is poised to showcase exponential growth in the global market. Despite the numerous benefits of elevators, stringent regulations for safety purposes and substantial maintenance costs may deter the market race at some scale. However, by providing an innovative option with technically advanced systems, these setbacks can be mitigated.

Elevator Components Market Growth Factors

- Rising urbanization and commercial development continue to expand globally, thus increasing market growth.

- In high-rise commercial buildings, there is an increased need for efficient vertical transportation solutions.

- Rapid technological advancement in elevator technology.

- Regions with dense populations and limited space need more space to function and perform daily tasks.

- Increasing shift towards energy-efficient elevator components.

- Integration of highly advanced technologies such as IoT sensors, remote monitoring, and predictive analytics to improve the function of elevators.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 57.64 Billion |

| Market Size in 2034 | USD 128.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.28% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Load Capacity, Speed, End-use Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Proliferation of vertical elevator solution

The major driver for the elevator components market is the increasing usage of vertical elevator solutions across the global construction industry. Developed economies such as the UK and U.S. Arab countries have increasingly adopted elevators as a vertical solution due to lesser space to accommodate and the dense population around these parts of the globe. Construction enterprises and policymakers are continuously looking for innovative solutions to make optimum use of confined space within a construction site.

Urbanization is a constant process that leads to inevitable changes in every sector, including building construction, industrial construction, residential accommodations, and other types of construction used for businesses. To complete these changes, construction companies concentrate on the development of vertical transportation solutions for low, medium, and high-level buildings owing to the rapid expansion of population rate in the urban and suburban areas. Along with developed countries, developing countries such as China, Japan, and India are also experiencing a surge in the demand for elevator components in the market. The growth of this market in the developing regions is due to the high-rise building construction, since without an elevator, these constructions are useless, just like concrete structures.

Restraint

Fluctuating cost

The major restraining factors for the elevator components market are higher costs with a fluctuating market, supply-chain disturbances, stringent regulatory compliance, and fragmentation of the market. Increasing competition among major market players and price-sensitive consumers led to a challenging situation in the elevator components market, which directly affects the profit margin for suppliers and manufacturers of elevator components. Also, the small and medium-sized players are present with the established multinational key players responsible for the uneven competition and creating fragmentation in the market, which further leads to the loss of profitability for small firms resting near the multinational companies.

Furthermore, supply chain disturbances include geopolitical warfare and uncertainties created along with it, shortages of raw materials needed to build robust elevators, and delays in on-time supply, which can adversely affect the market growth globally. Additionally, meeting regulatory compliance, especially for SMEs are hectic process as it encompasses environmental standards, safety protocols, and certifications from authorities, making it further a complex and time-consuming process that acts as a restraining factor for the global elevator components market.

Opportunity

Rising development of technically advanced construction

The significant opportunity for the elevator components market is rapid urbanization with increased development of technically advanced infrastructure. The rising adoption of smart buildings with technically sound features within them creates a lucrative opportunity for the expansion of the market globally. It creates opportunities for elevator component suppliers and manufacturers to provide innovative vertical transportation solutions encompassing advanced technologies such as data analytics, predictive maintenance, and connected devices, as well as networks.

For instance, in recent days, an innovative structure has gained traction, which is twin elevators. It refers to the advanced system of two different elevators that have a similar shaft, the same guide, and exterior doors. Both elevators have independent cabins and separate motors that move automatically. At present, such twin elevators are installed in the National Bank of Kuwait, which is made of 63 floors and 300 meters in height. Moreover, technically advanced systems like the disinfection of elevators by using ultraviolet rays are an intelligent way to clean them for safety purposes. The installation of a hidden ramp is, again, an innovative way to make vertical transportation hassle-free as it provides multiple benefits since it unfolds on its own and thus requires less space.

Component Insights

The motors segment dominated the elevator components market globally in 2024. Motors are the crucial component of elevators; hence, one-third part of elevators are made up of motors, which gives hype to this segment further in the global elevator components market. Energy consumption is an important aspect of any mechanical and electrically operated systems like elevators; manufacturers in the market always try to offer compact, energy-efficient, and high-performance basis motors since the energy consumption rate changes over time. Around 8 to 10% of total energy is consumed by a motor component of the elevator, so it's essential to make it highly efficient in terms of energy and for its saving purpose. To remain energy efficient consumers, choose to replace the motors over a specific period, which propels the growth of this segment.

Elevator Technology Insights

The machine room-less elevator segment held a significant share of the elevator components market in 2024. These elevators are well suited for low-rise towers or buildings since they are known for their space-saving features, straight design, and lower complex systems to lift the elevator. Moreover, it is energy efficient as it requires less electricity consumption to operate. As per the data, it can lower electricity use by up to 30% to 80%, which in turn lowers its overall maintenance and cost as well. Hence, the future of machine roomless elevators is quite promising due to their sustainability, cost-effective nature, easy installations, and flexibility in designs.

Load Capacity Insights

The 650kg to 1000kg segment will witness notable growth in the global elevator components market. Load capacity refers to the maximum weight an elevator can bear for lifting. However, the load capacity of the elevator can be decided based on the purpose it is going to serve. For residential, business, or commercial purposes, the elevators come with a range of different load capacities.

Elevators' size and load capacity directly affect each other; as the size of the elevator is large, it can carry a maximum load. It consists of the height of the infrastructure, the material that is used to build an elevator, and the force by which the elevator is lifted. Since, for safety purposes, it is crucial to calculate the maximum load capacity of the elevator and meet the regulatory requirements for safety standards, the load capacity segment holds the utmost significance in the elevator components market, further fueling market growth on a larger scale.

Speed Insights

The 4 to 6 m/s segment led the elevator components market in 2024. Elevator speed depends upon factors such as the height of the infrastructure, the total load an elevator can carry, the type of elevator and material it is built from, and the number of components required to lift the elevator. Since speed is a relative concept, the speed of an elevator defines its quality and standard of maintenance. According to the data, the fastest elevator is installed in the Shanghai tower, which reaches a speed of 67 feet in a second or, in other words, covers more than 73 Kilometers in one hour.

End-use Application

The elevators for passenger segment dominated the elevator components market globally in 2024. The growth of this segment is attributed to factors such as the increasing adoption of high-rise infrastructure, as it has wide applications for commercial and residential use in developed regions and sub-urban areas. The global population has increased by up to 8 billion, according to data, so it's essential to save space and resources as well.

More than 60% of the population lives in urban and suburban regions or countries like the UAE, the U.S., India, and China. Hence, the infrastructure in these countries is mainly space-saver, and the amenities they provide are technically well suited to such buildings as passenger elevators, which can be either operated automatically or manually. Hence, the increasing population in urban areas is leading the passenger elevator segment in the global elevator components market.

Elevator Components Market Companies

- Adams Elevator Equipment Company

- Avire Ltd

- DMG

- Bohnke and partner GmbH

- Elevator equipment corporation

- Elevator products corporation

- EMI/porta Inc.,

- Fermator group

- GAL Manufacturing Corp.

- Hans and Jos. Kronenberg

- Hissmekano AB

- Hydroware

- Kinds Teknik AB

- Nidec Kinetek elevator technology

- Wittur Group

Recent Development

In July 2022, Wittur launched a revamped model named semantic-C mode doors, including high technical functionalities that improve the overall performance of the motors of the elevators, which in turn helps to consume less electricity and improve cost-effectiveness.

Segments Covered in the Report

By Component

- Elevator Car and Shaft

- Landing Door

- Motor

- Machine Drive

- Tension Pulley

- Controller

- Counterweight Frame

- Guide Rails

- Car guide Rail

- Speed Governor

- Car Buffer

- Others

By Elevator Technology

- Hydraulic Elevators

- Traction Elevators

- Machine-room-less Elevators

- Pneumatic Elevators

By Load Capacity

- Below 650 kg

- 650-1000 kg

- 1000-1600 kg

- 2500-5000 kg

- Above 5000 kg

By Speed

- Less than 1m/s

- 1 to 3m/s

- 4 to 6 m/s

- 7 to 10m/s

- Above 10m/s

By End-use Applications

- Elevators for Passenger

- Elevator for Freight/load

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client