January 2025

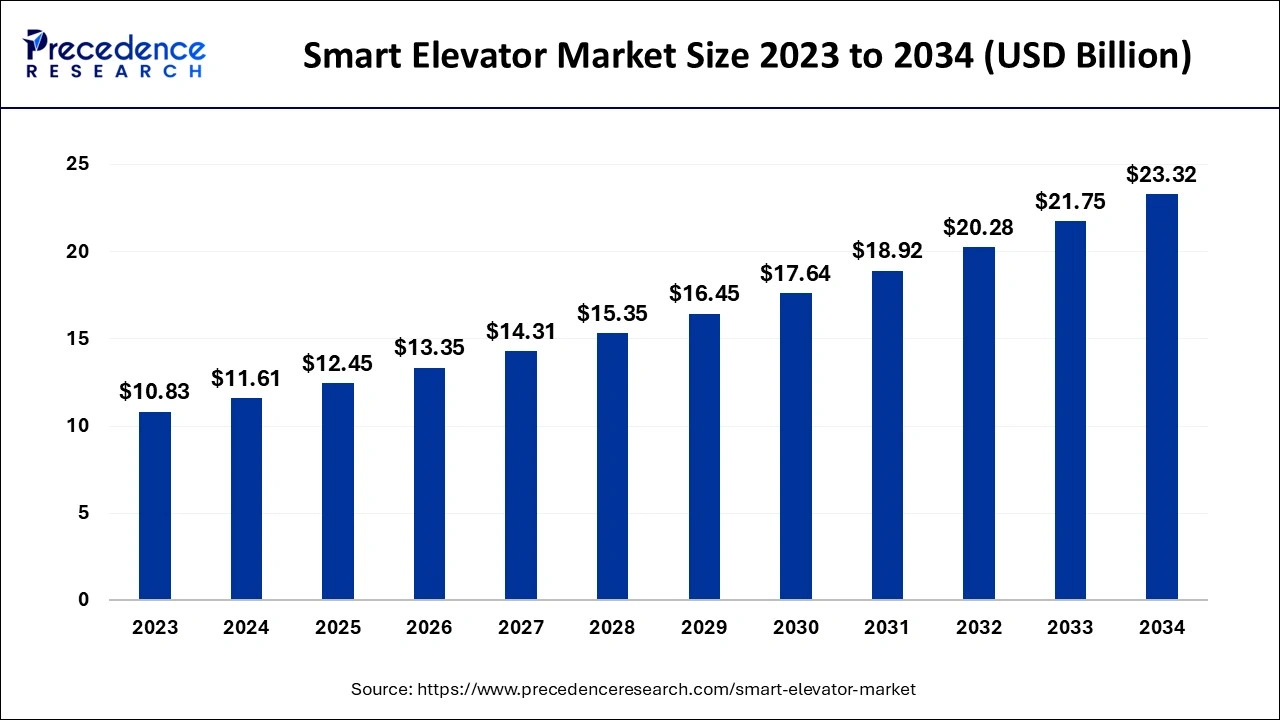

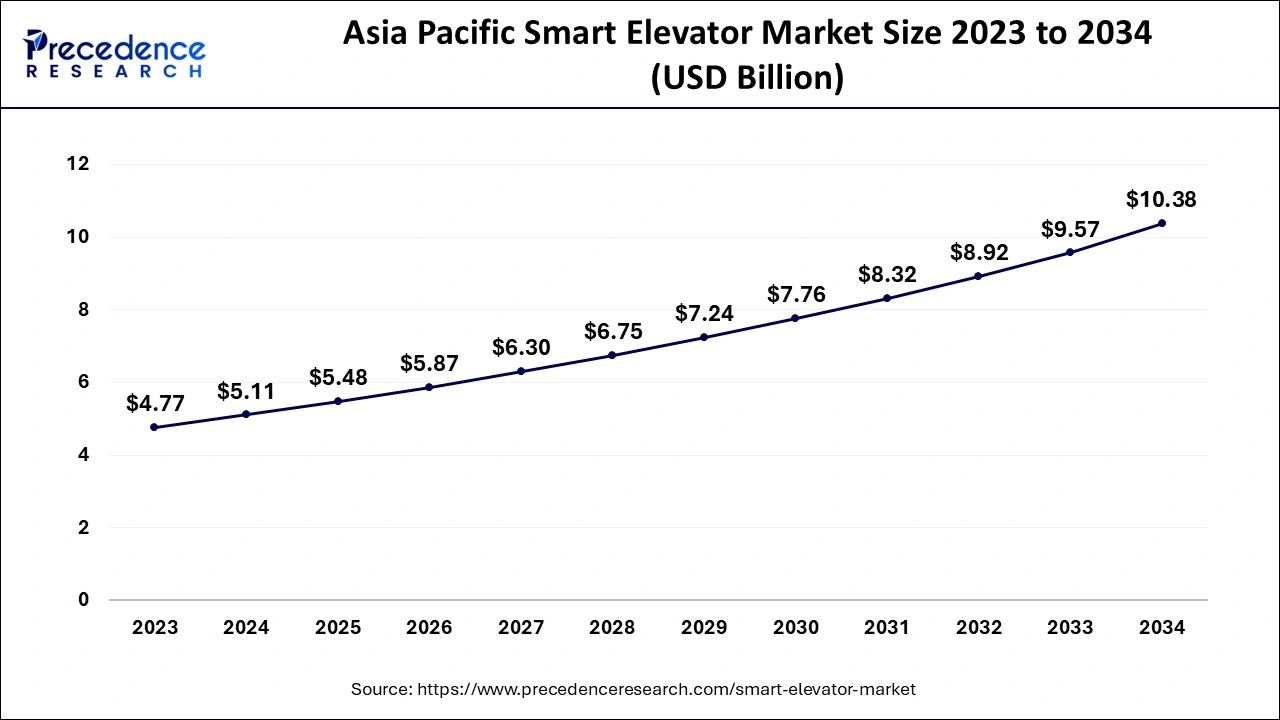

The global smart elevator market size is calculated at USD 11.61 billion in 2024, grew to USD 12.45 billion in 2025 and is projected to hit around USD 23.32 billion by 2034. The market is expanding at a solid CAGR of 7.22% between 2024 and 2034. The Asia Pacific smart elevator market size is evaluated at USD 5.11 billion in 2024 and is expected to grow at a fastest CAGR of 7.32% during the forecast year.

The global smart elevator market size accounted for USD 11.61 billion in 2024 and is predicted to be worth around USD 23.32 billion by 2034, growing at a CAGR of 7.22% from 2024 to 2034. The increasing awareness about the need for energy transitions from conventional sources to smart renewable sources and their applications, like smart elevators, creates a lucrative opportunity in the smart elevator market, further driving its growth.

The Asia Pacific smart elevator market size is exhibited at USD 5.11 billion in 2024 and is anticipated to reach around USD 10.38 billion by 2034, growing at a CAGR of 7.32% from 2024 to 2034.

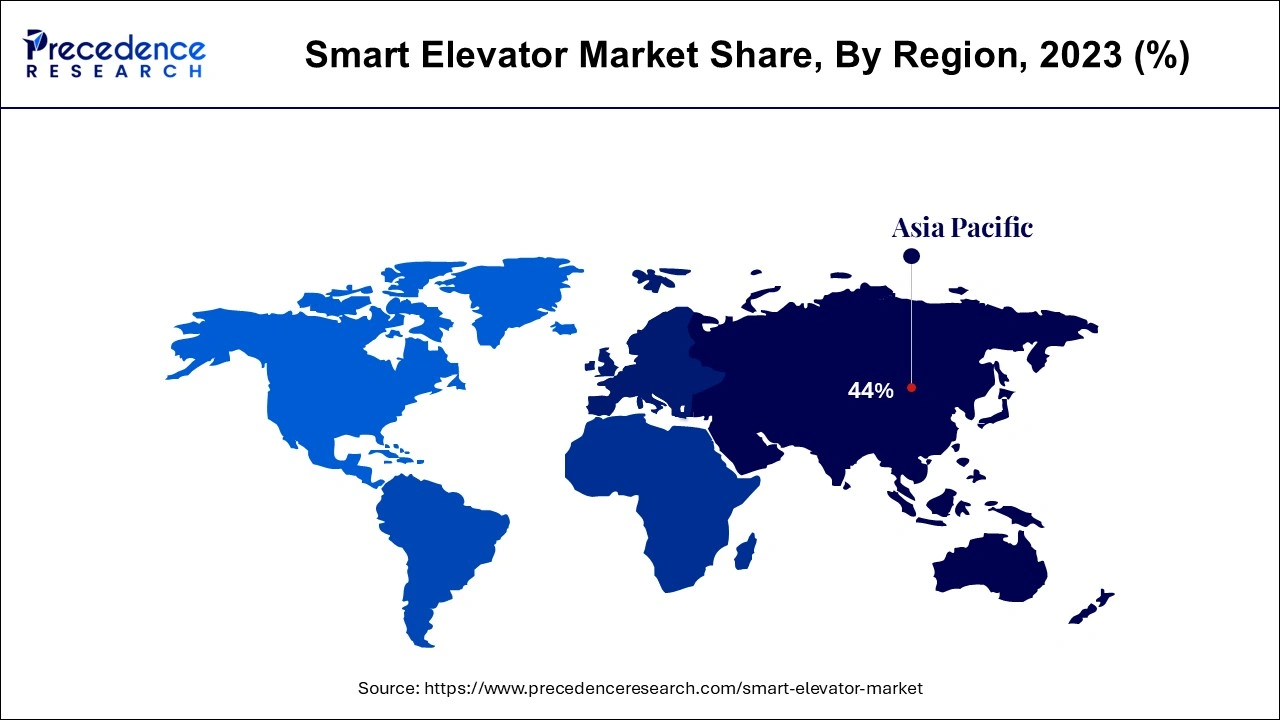

Asia Pacific accounted for the largest share of the smart elevator market in 2023. The growth of this region is due to economically evolving countries like India, Japan, and China, where the urbanization rate is increasing, and the population of young and adult people is substantial, which helps to develop the country. Along with this, due to the rapid urbanization in the major cities, the prevalence of high-rise buildings is notable, and they need smart elevators to manage such a huge amount of passengers safely and follow the government's mandate for energy use.

North America is expected to host the fastest-growing smart elevator market during the forecasted years. The growth of this region is due to the strong and strategic economy, infrastructure development, and rapid urbanization, which further fuel the region's growth. The increasing demand for efficient vertical transportation solutions and following the government's mandate for energy usage and safety protocols are helping the adoption of smart elevators in the region. According to the countries, the U.S. dominates the market as it is a highly technologically advanced nation among the countries in North America. It has a robust and developed infrastructure that helps integrate innovative technology and its various applications.

The smart elevator market is expanding globally due to various reasons, including awareness about energy usage and the transition of main conventional elevators into smart elevators. Due to the efficiency and benefits, the installation of gearless permanent magnet synchronous traction machines is gradually increasing in major cities. The advantage of smart technology in elevators, like virtual reality diagnostic, artificial intelligence, and cloud predictive maintenance, is that it allows us to measure future predictions accurately and work on some aspects remotely. The increasing heights of the buildings, increasing concern of the security and adoption to modern digital security solutions are creating a potential to proliferate the market. Additionally, smart elevators help passengers to move freely, especially during hours of high traffic.

AI Impact on the Smart Elevator Market

AI is significantly transforming the smart elevator market as it provides substantial promise for time and energy management applications with the help of AI technology. The more intelligent system for the smart elevator can create significant changes for more intelligent building management. The successful implementation of AI technology, along with image processing in elevator systems, provides a robust foundation for future research and development. Integrating smart elevators with internet of things (IoT) systems and building management systems could enhance the comprehensive energy management solutions. Also, exploring adaptive user interfaces and customized scheduling algorithms can again elevate the consumer's satisfaction.

| Report Coverage | Details |

| Market Size by 2034 | USD 23.32 Billion |

| Market Size in 2024 | USD 11.61 Billion |

| Market Size in 2025 | USD 12.45 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.22% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Urbanization and high-rise construction

The major driving factors for the smart elevator market are the increasing urbanization and the high-rise construction. Rising urbanization worldwide has led to the rapid construction of more high-rise buildings, increasing the demand for smart elevators. Moreover, technological advancements in IoT, cloud computing, and AI help elevators provide features like predictive maintenance, real-time monitoring, and customized user experiences.

Stringent government regulations for safety also promote high-rise buildings to incorporate smart elevators with energy-saving modes like LED lighting and regenerative lights. Moreover, the demand for improved user experience like touchless controls, access to biometrics, and destination control systems are some of the reasons that are driving the demand for smart elevators further.

Integration complexity

The major restraining factors for the smart elevator market are the high initial cost and the integration complexity. Integration of the smart elevator with the existing building structure creates technical challenges and requires expertise and coordination between multiple stakeholders. The initial investment to install a smart elevator is substantial due to the installation of systems like IoT sensors and connectivity infrastructure. Along with this, security concerns also create challenges in adopting this technology since it collects every bit of information. Adhering to the cyber laws is also an important aspect to consider while integrating the smart elevator into existing infrastructure.

Proliferation in the hospitality sector

The major opportunity that the smart elevator market holds is the proliferation of smart elevators in the hospitality sector worldwide. Install smart elevators with advanced guest management systems and customized service options to help enhance consumer experience, which further increases operational efficiency. Such a strategic growth opportunity underscores the different applications of smart elevators across different sectors, which are driven by technological advancements and a rising focus on sustainability, efficiency, and user experience in the advanced building structure.

The communication system segment accounted for the largest share of the smart elevator market in 2023. The growth of this segment is due to various factors like enabling real-time monitoring, data acquisition, and data analysis, which make communication easier. Also, connectivity increases predictability, helps issue diagnosis, and optimizes overall operations. Also, the advanced communication system in smart elevators ensures safety by using enhanced threat detection systems with emergency response capabilities.

The maintenance system segment will witness the fastest growth in the smart elevator market during the foreseeable years. A maintenance system is necessary to ensure seamless operations. It encompasses the proactive and ongoing process of collecting data about transactions. For the passenger safety approach, regular check-ups, and maintenance, proper monitoring is required by skilled ones. Advanced diagnostics tools are required to do regular check-ups, which enable early problem detection and avoid any downtime in the elevator services.

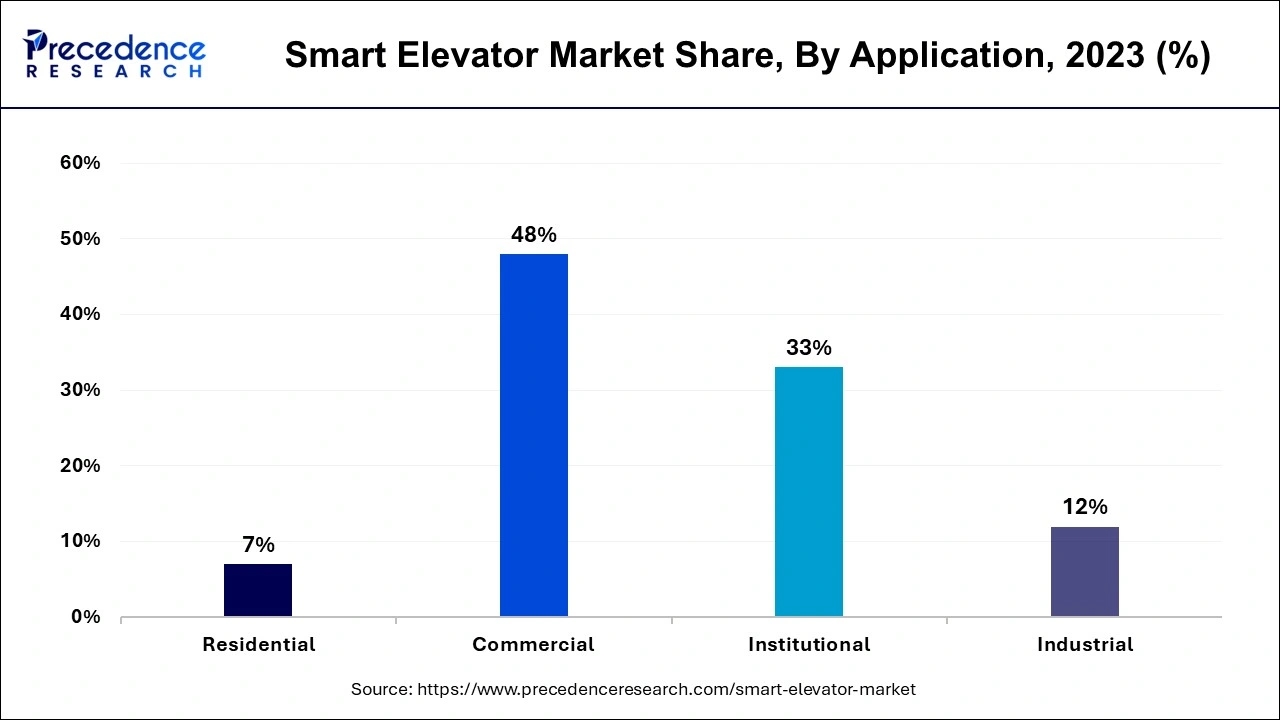

The commercial segment dominated the global smart elevator market in 2023. The segment is incorporated with shopping malls, hotels, office buildings, and other complex properties. High-capacity smart elevators boost the productivity and satisfaction of the passenger by providing features like a destination control system with sensors and managing traffic flow while traveling from one place to another. Energy-efficient components and sensors also help reduce costs and achieve sustainability goals, which in turn benefit the building owners and managers.

The industrial segment will grow at the fastest rate in the smart elevator market over the studied period. In the industrial sector, smart elevators increase productivity by helping the goods movements in manufacturing plants, warehouses, and logistics spaces. Smart elevators in industrial applications are designed for heavy-duty usage, such as automated loading and transportation of heavy goods and materials safely, to ensure seamless operations. Major factors driving this segment include integration with telemonitoring and predictive maintenance to increase the efficiency and reliability of the industrial sector with the help of smart elevators.

Segments Covered in the Report

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

July 2024