January 2025

Emergency Department Information System Market (By Software Type: Enterprise Solutions, Best of Breed (B.O.B.) Solutions; By Application: Computerized Physician Order Entry (CPOE), Clinical Documentation, Patient Tracking & Triage, E-Prescribing, Others; By Deployment: On-Premises, Software-As-A-Services (SaaS)) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

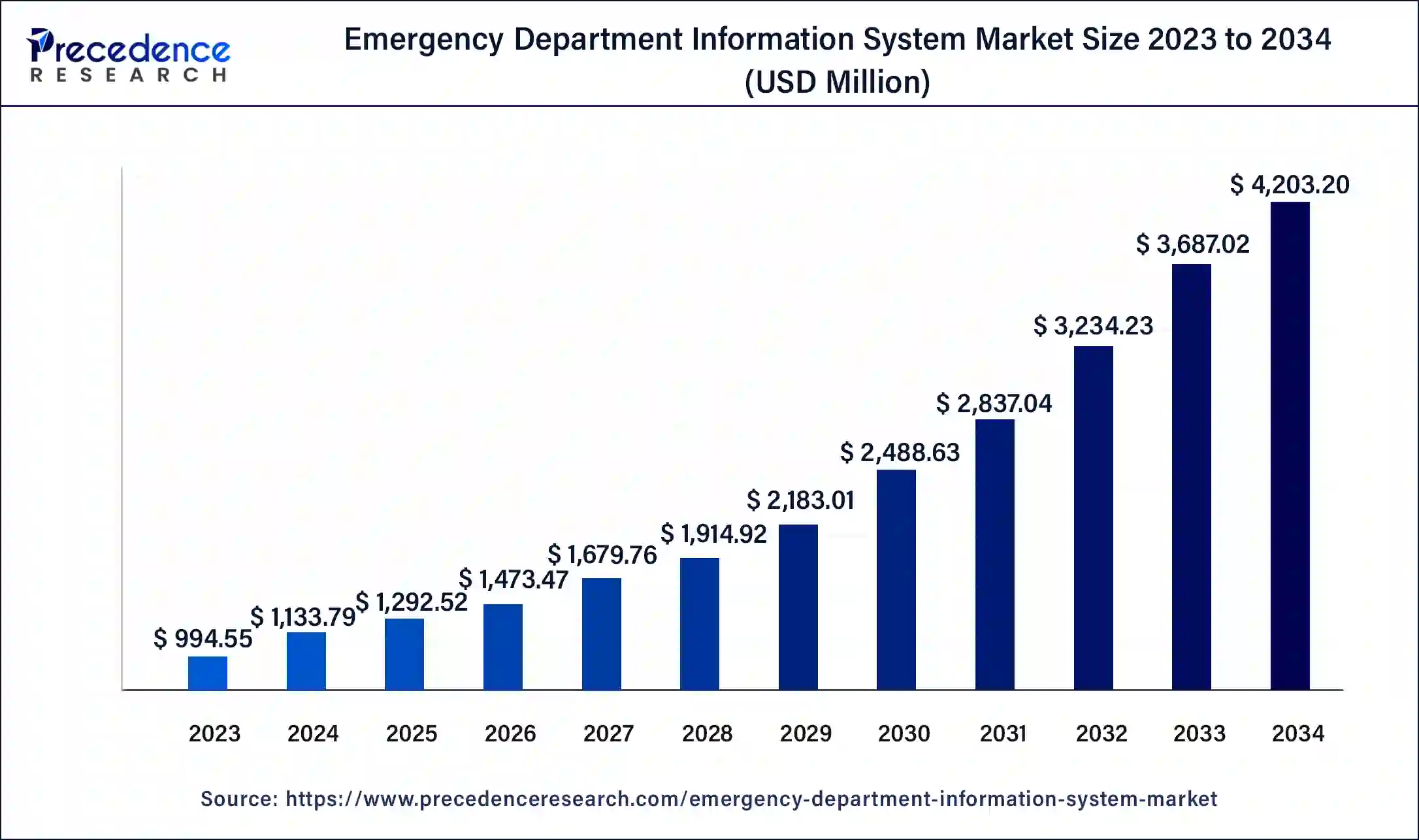

The global emergency department information system market size accounted for USD 1,133.79 million in 2024 and is expected to reach around USD 4,203.20 million by 2034, expanding at a CAGR of 14% from 2024 to 2034. The North America emergency department information system market size reached USD 447.55 million in 2023.

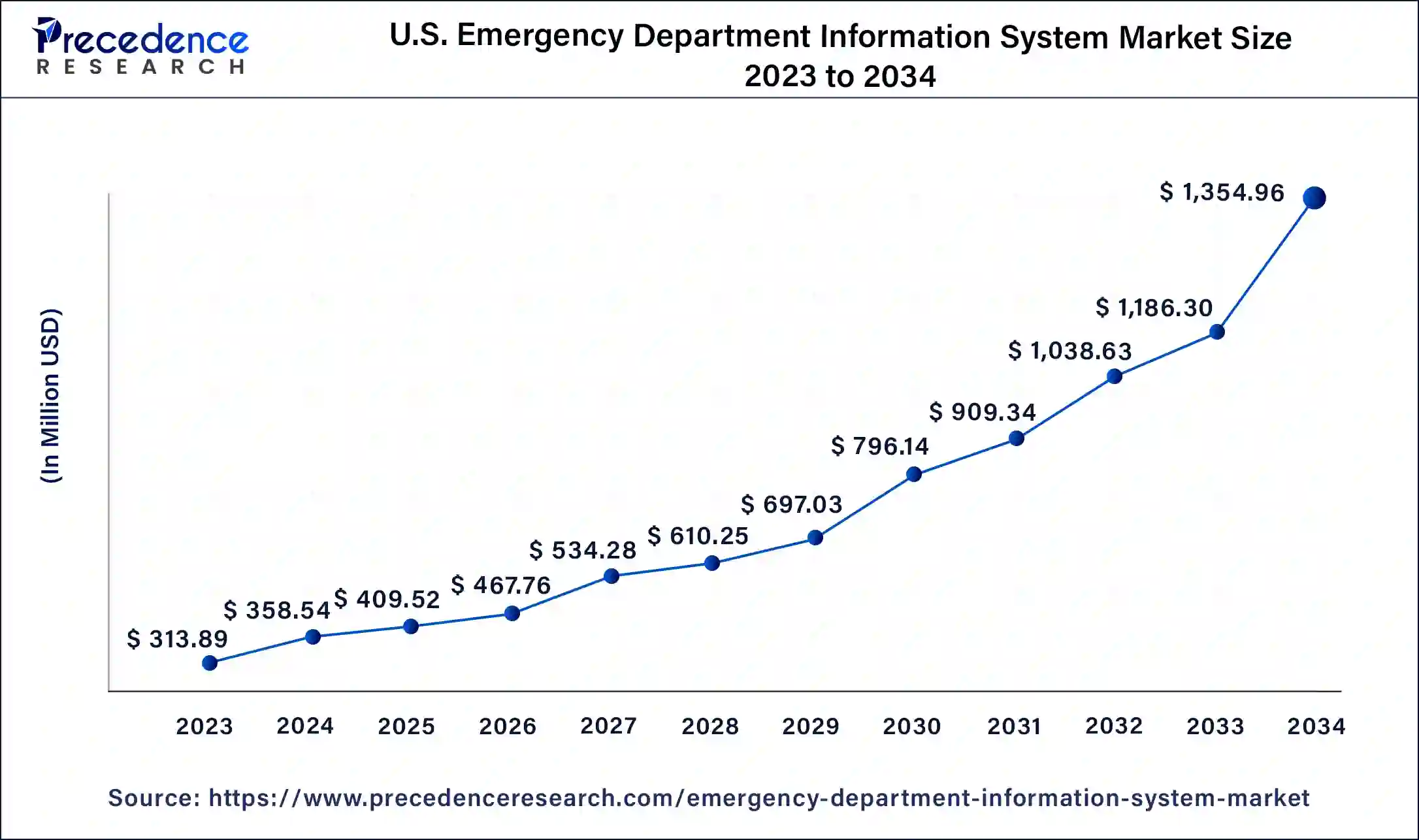

The U.S. emergency department information system market size was estimated at USD 313.89 million in 2023 and is predicted to be worth around USD 1,354.96 million by 2034, at a CAGR of 14.2% from 2024 to 2034.

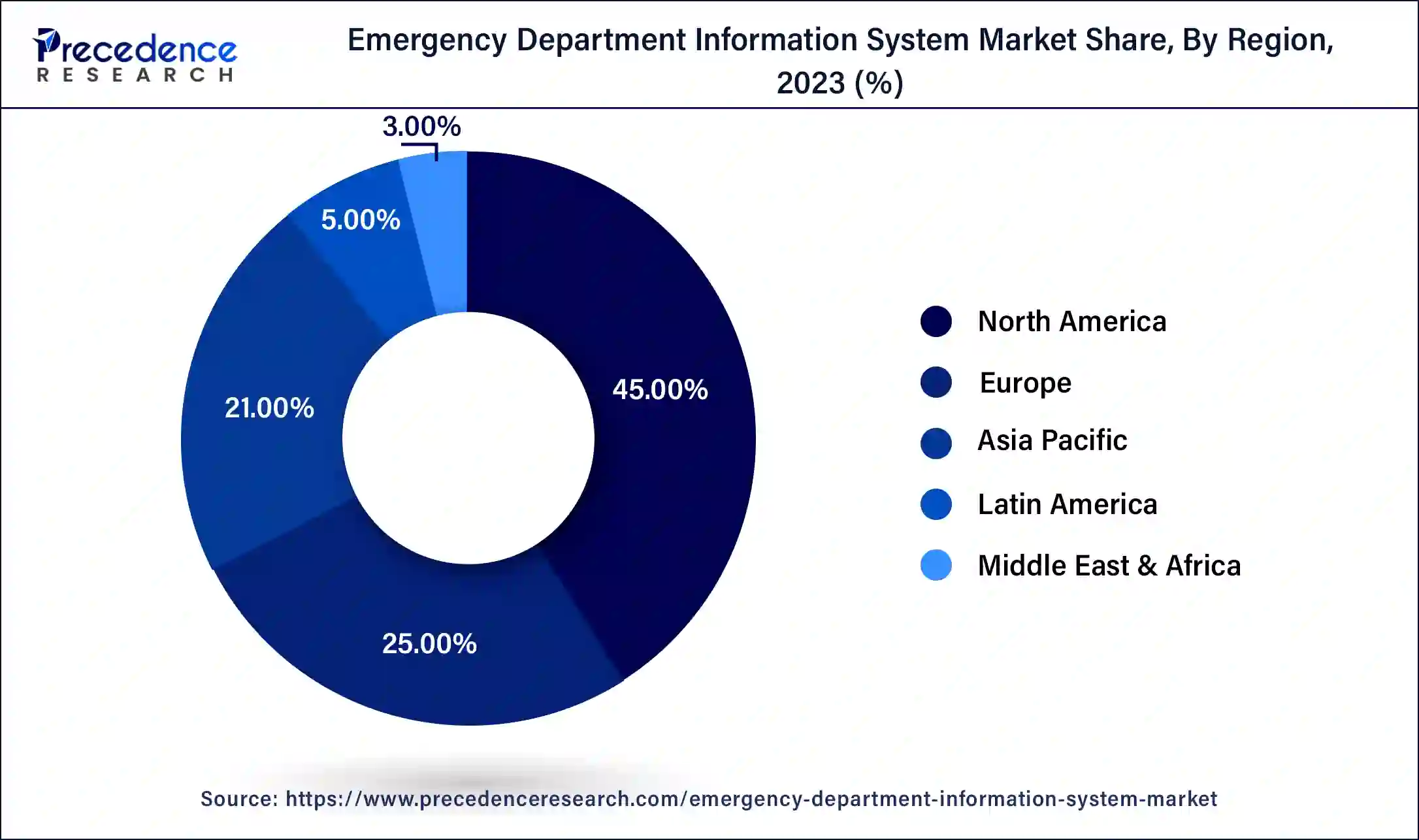

North America dominates the emergency department information system market due to robust healthcare infrastructure, technological advancements, and a high level of awareness regarding the benefits of EDIS adoption. The region's well-established healthcare systems prioritize efficiency and patient care, driving the demand for advanced information systems.

Favorable government initiatives, stringent regulatory compliance standards, and a concentration of key market players contribute to North America's dominance in the EDIS market, making it a leading hub for the implementation and growth of emergency healthcare technologies.

Asia-Pacific is poised for rapid growth in the emergency department information system (EDIS) market due to escalating healthcare demands, increasing investments in healthcare infrastructure, and a growing awareness of advanced healthcare technologies. The region's expanding population, coupled with rising incidences of chronic diseases, drives the need for efficient emergency care solutions. Moreover, supportive government initiatives, a surge in digital health adoption, and collaborations with key market players position Asia-Pacific as a promising market for EDIS, offering substantial opportunities for advancements in emergency healthcare management.

Meanwhile, Europe is growing at a notable rate in the emergency department information system market is attributed to factors such as the region's advanced healthcare infrastructure, increasing adoption of digital health solutions, and initiatives promoting healthcare information technology. The European Commission's focus on enhancing healthcare digitization and interoperability further propels EDIS growth. For the latest and specific statistics, I recommend consulting recent reports from reputable market research firms and healthcare organizations in the region.

The emergency department information system (EDIS) market is experiencing rapid growth driven by factors such as the increasing elderly population, rising prevalence of chronic diseases, and the expanding use of data-driven technologies. As demonstrated by partnerships and collaborations in the IT sector, like the notable one between Inflectra and Checkpoint Technologies, there is a growing emphasis on optimizing IT software solutions for efficient enterprise program management and enhanced software quality.

The demand for EDIS is poised to escalate due to the aging demographic, with projections indicating a substantial rise in the elderly population globally. This surge, coupled with the heightened adoption of technology to streamline emergency healthcare processes, positions the EDIS market as a pivotal player in addressing the evolving needs of healthcare systems worldwide.

Emergency Department Information System Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 14% |

| Market Size in 2023 | USD 994.55 Million |

| Market Size in 2024 | USD 1,133.79 Million |

| Market Size by 2034 | USD 4,203.20 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Software Type, By Application, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

An increase in the geriatric population

The escalating growth of the emergency department information system (EDIS) market is significantly propelled by the increasing geriatric population worldwide. As demographic dynamics shift towards an aging society, there is a simultaneous rise in the prevalence of chronic diseases and a greater susceptibility to acute medical conditions among the elderly. This demographic cohort tends to require more frequent medical attention, leading to a surge in emergency department visits and hospital admissions.

The EDIS market addresses the unique healthcare needs of the geriatric demographic by offering specialized systems that streamline emergency care processes. These systems facilitate efficient patient management, timely information dissemination, and seamless communication among healthcare professionals.

With the elderly population being more prone to complex health issues, EDIS plays a crucial role in optimizing the delivery of emergency medical services, ensuring rapid assessment, and contributing to better patient outcomes. The market's growth is thus intricately linked to the imperative of accommodating and efficiently managing the healthcare demands of an aging population through advanced and tailored information systems.

Integration challenges and resistance to technological

Integration challenges and resistance to technological change act as significant restraints on the demand for emergency department information systems (EDIS). The healthcare landscape often features a myriad of existing information systems, such as electronic health records (EHR), and integrating EDIS seamlessly with these systems poses a complex task. Compatibility issues and interoperability concerns hinder the efficient exchange of critical patient data, deterring healthcare providers from readily embracing EDIS solutions.

Moreover, the healthcare industry traditionally exhibits resistance to technological change. Healthcare professionals and staff may be accustomed to established workflows, and the introduction of new technology like EDIS necessitates comprehensive training and a cultural shift. Overcoming this resistance requires strategic change management, education, and demonstrating the tangible benefits of EDIS adoption. The reluctance to deviate from familiar practices can slow down the adoption curve, limiting the market demand for emergency department information systems despite their potential to enhance patient care and streamline emergency medical services.

Data analytics and predictive modeling

Data analytics and predictive modeling are pivotal in creating significant opportunities within the emergency department information system (EDIS) market. In the context of EDIS, leveraging data analytics allows healthcare providers to analyze historical patient data, identify patterns, and predict patient inflows and resource needs. Predictive modeling aids in optimizing emergency department operations, anticipating patient trends, and allocating resources effectively.

These insights underscore the substantial advantages that data analytics and predictive modeling bring to EDIS, creating opportunities to elevate patient care, resource management, and operational effectiveness in emergency healthcare settings.

The best of breed (B.O.B.) solutions segment is observed to hold the dominating share of the emergency department information system market during the forecast period. In the emergency department information system (EDIS) market, the "Best of Breed" (B.O.B.) solutions segment refers to specialized software that excels in specific functionalities, offering superior performance in a particular aspect of emergency healthcare management.

This trend is gaining traction as healthcare providers seek tailored solutions to address specific challenges, such as improved patient triage or streamlined communication. Best of Breed solutions in EDIS aim to deliver unparalleled efficiency in targeted areas, contributing to the overall optimization of emergency department operations and patient care.

The enterprise solutions segment is expected to generate a notable revenue share in the market. In the emergency department information system (EDIS) market, the enterprise solutions segment refers to comprehensive software solutions designed to manage and streamline various aspects of emergency department operations. These solutions typically integrate functions such as patient triage, electronic health records, and resource allocation to enhance overall efficiency.

Current trends in the enterprise solution segment involve an increased focus on interoperability with existing healthcare systems, the integration of advanced analytics for data-driven insights, and the incorporation of telehealth capabilities to facilitate remote patient monitoring and consultations.

The computerized physician order entry segment dominated the emergency department information system market in 2023; the segment is observed to continue the trend throughout the forecast period. The Computerized Physician Order Entry (CPOE) segment in the emergency department information system (EDIS) market refers to the digital system enabling healthcare professionals to enter medical orders electronically. This includes prescriptions, diagnostic tests, and treatment plans, enhancing accuracy and reducing errors in emergency care.

A prominent trend in this segment involves the integration of intelligent decision support systems within CPOE, aiding clinicians in making informed decisions swiftly. This trend aligns with the broader industry focus on leveraging technology to optimize workflow efficiency and enhance patient outcomes within emergency healthcare settings.

The E-prescribing segment is expected to grow at a significant rate throughout the forecast period. E-prescribing stands as a crucial component within the emergency department information system (EDIS) market, encompassing the electronic creation and transmission of prescriptions. This streamlined approach not only boosts precision but also mitigates errors in the prescription process.

The prevailing inclination toward the extensive embrace of e-prescribing within the EDIS market underscores the sector's dedication to refining medication administration and bolstering patient safety. This specific segment ensures immediate access to prescription details, aids in decision-making, and harmonizes with the broader healthcare industry's shift towards digital innovations. Its role is pivotal in facilitating efficient and secure prescription management within emergency healthcare settings.

The software-as-a-services (SaaS) segment is observed to hold the dominating share of the emergency department information system market during the forecast period. The growing preference for SaaS-based EDIS solutions is driven by their scalability, straightforward implementation, and reduced initial costs. This aligns with the industry's broader shift toward cloud-based solutions, promising increased accessibility and seamless updates. The SaaS segment's convenience and efficiency make it a pivotal player, holding a major share in the evolving landscape of EDIS deployment.

The on-premises segment is expected to generate a notable revenue share in the market. In the emergency department information system (EDIS) market, the on-premises deployment refers to the installation and operation of the software within the organization's physical infrastructure. This deployment model offers localized control, ensuring data security and compliance with regulatory standards. Despite the growing popularity of cloud-based solutions, the on-premises segment in the EDIS market remains resilient due to the healthcare sector's emphasis on maintaining control over sensitive patient data and the need for seamless integration with existing on-site infrastructure. Organizations opt for on-premises solutions to enhance data security, customization, and overall operational control.

In March 2022, HeartBeam, Inc. made significant strides by announcing a Business Associate Contract and Clinical Trial Arrangement (CTA) with Phoebe Putney Healthcare System. This partnership aims to conduct a trial assessing the effectiveness of HeartBeam's ED Myocardial Infarction (MI) technology solution. By engaging in this clinical trial, HeartBeam seeks to validate and refine its innovative solution for detecting and managing myocardial infarctions in emergency department settings.

In January 2022, Aidoc and Novant Health forged a strategic collaboration with a focus on improving patient satisfaction and reducing emergency room stays. Novant Health's proactive approach involves leveraging Aidoc's advanced AI system, equipped with seven FDA-cleared techniques for rapid evaluation and notification of individuals with severe illnesses. This alliance underscores the commitment to utilizing cutting-edge technology to enhance emergency healthcare processes, streamline patient care, and ultimately improve outcomes within the healthcare system.

Segments Covered in the Report

By Software Type

By Application

By Deployment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

February 2025

August 2024