August 2022

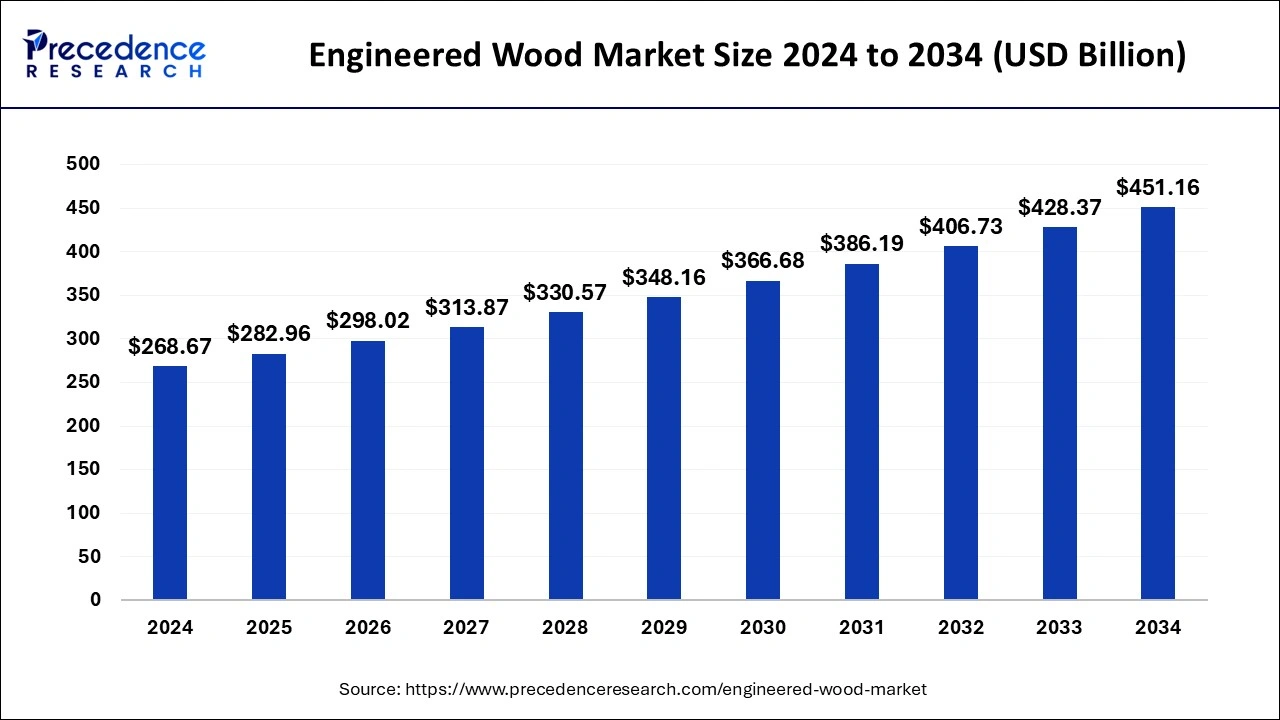

The global engineered wood market size is calculated at USD 282.96 billion in 2025 and is forecasted to reach around USD 451.16 billion by 2034, accelerating at a CAGR of 5.32% from 2025 to 2034.

The global engineered wood market size accounted for USD 268.67 billion in 2024 and is expected to exceed around USD 451.16 billion by 2034, growing at a CAGR of 5.32% from 2025 to 2034. The surge in population growth demanding sophisticated houses is the key factor driving the engineered wood market growth. Also, the increasing focus on sustainable practices coupled with innovations in furniture design is expected to fuel market growth further.

The integration of artificial intelligence in wood production has transformed the efficiency and quality of wood products. AI-powered machines are capable of accurately cutting, shaping, and grading timber with no wastage. Furthermore, AI has enabled real-time quality monitoring in the industry. This technology can identify the smallest anomalies in wood that the human eye cannot notice. Also, AI proves to be a good solution to optimize inventory management processes.

Engineered wood consists of many wood products created by joining particles, fibers, veneers, and wood strands with different materials to craft an artificial composite material. The engineered wood market encompasses a number of products ranging from roof trusses to plywood. This wood can sometimes be prepared from wood waste. Engineered wood has more benefits as compared to cement, which is responsible for CO2 emissions across the globe. This wood is also biodegradable, renewable energy efficient, and non-toxic, making it the best option while performing construction activities.

| Report Coverage | Details |

| Market Size by 2024 | USD 268.67 Billion |

| Market Size in 2025 | USD 282.96 Billion |

| Market Size in 2034 | USD 451.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.32% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Versatility and cost-effectiveness of engineered wood

Engineered wood is highly adopted because of its cost-effectiveness as compared to conventional hardwood. Its structure offers stability, durability, and resistance to warping, which makes it the best fit for many applications, including furniture, flooring, and structural components. In addition, this wood has lower manufacturing and installation costs, along with good flexibility, giving convenient solutions for construction projects.

The increasing adoption of alternative solutions

The growing adoption of replacements such as foils and plastic laminates over to engineered wood is the major factor hampering the engineered wood market growth. Because of the invariability of ceramic flooring, the alternative options gained traction. Furthermore, due to stringent laws on tree cutting, fewer raw materials are available for manufacturing composite wood, impacting the overall cost of these products.

Increasing wages in major manufacturing hubs

The growing wages in big manufacturing hubs are the latest trend in the market. The key factor impacting the engineered wood market growth is increasing wages in expanding industrialization and urbanization in developing countries. Furthermore, the surge in the global economy due to the growth in the GDP of nations like China and India also leads to raised wages. Several government initiatives have enforced urbanization.

The plywood segment dominated the global engineered wood market in 2024. The dominance of the segment can be attributed to the high versatility, strength, and higher price point of plywood. Plywood has a number of applications in cabinets, furniture, and things that necessitate more strength and durability. Additionally, the segment growth is expected to be driven by a rise in expenditures by key market players on technology and other operations.

The medium-density fiberboard (MDF) segment is expected to grow at the fastest rate in the engineered wood market over the forecast period. The growth of the segment can be linked to the advancements in manufacturing processes and the growing use of furniture due to its affordability. MDF is most commonly used in furniture-making and construction trades. MDF is sold in huge sheets of numerous s thicknesses and can be shaped using normal woodworking tools.

The construction segment led the engineered wood market in 2024. The dominance of the segment can be credited to the increasing demand for this wood for building materials such as panels, beams, and framing used in both commercial and residential projects. Moreover, the growing shift towards eco-friendly construction practices along with the surge in global infrastructure initiatives can expand segment growth in the market further.

The furniture segment is expected to grow at the fastest rate in the engineered wood market over the forecast period. The growth of the segment can be driven by the growing need for more customizable and affordable furniture, especially in rural areas where space-efficient designs are required. In addition, consumers are increasingly drawn towards e-commerce platforms as they offer substitutes for personalization and rapid product shipping.

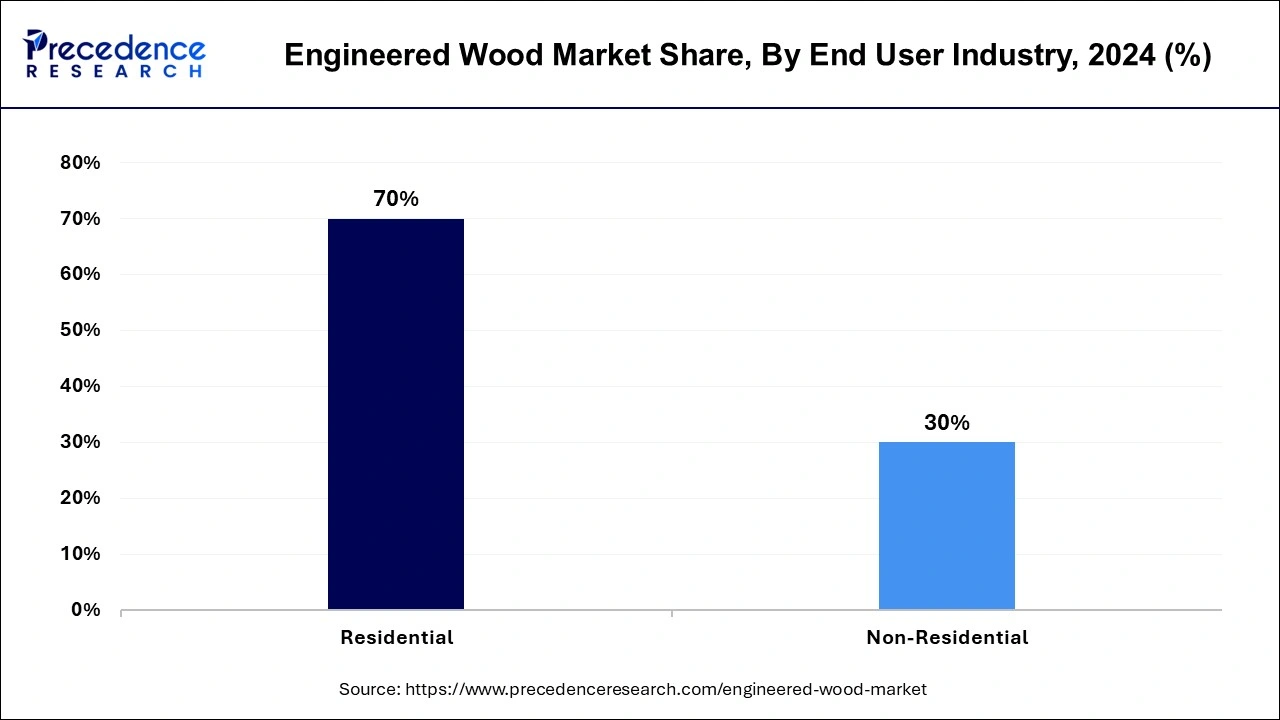

The non-residential segment is expected to grow at the fastest rate in the engineered wood market during the projected period. The growth of the segment is due to the increasing projects of multistory structures which require a significant amount of market. Moreover, for non-residential projects this wood offer adaptability, durability, stability, and cost-effectiveness. The flexibility of engineered wood is beneficial in non-residential applications.

Asia Pacific dominated the engineered wood market in 2024. The dominance of the region can be attributed to the growing industrial growth, ongoing urbanization, and growing construction activities in developing economies such as China and India. Moreover, Asia Pacific possesses strong population growth, which requires a substantial amount of residential infrastructure to live. Also, government initiatives promoting sustainable construction initiatives can impact regional growth significantly.

North America is expected to show the fastest growth in the engineered wood market over the studied period. The region's growth can be credited to ongoing innovations in manufacturing techniques. In North America, the U.S. led the market owing to the growing number of investors emerging into agriculture, transport, power, and utilities. The country also exhibits strong economic growth and an escalating real estate sector.

By Application

By Type

By End Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2022

March 2025

August 2024

July 2024