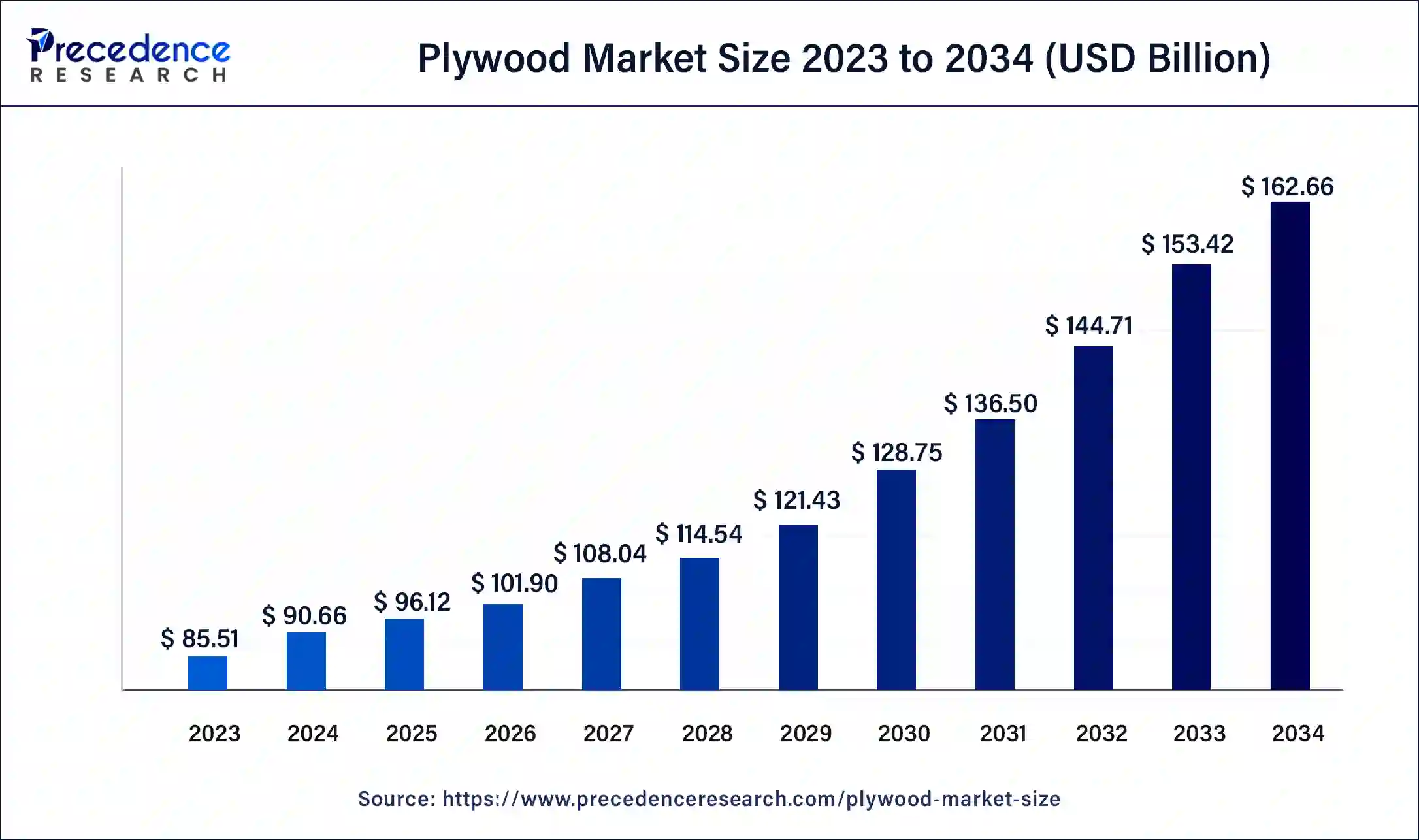

The global plywood market size surpassed USD 85.51 billion in 2023 and is estimated to increase from USD 90.66 billion in 2024 to approximately USD 162.66 billion by 2034. It is projected to grow at a CAGR of 6.02% from 2024 to 2034.

The global plywood market size is projected to be worth around USD 162.66 billion by 2034 from USD 90.66 billion in 2024, at a CAGR of 6.02% from 2024 to 2034. Major construction undertakings in emerging and established economies and growth in the furniture market are driving expansion in the plywood market.

Plywood is a composite material, a form of engineered wood made by gluing together thin sheets (also called plies or veneers) of wood with the grain of the layers arranged at wide or perpendicular angles to reinforce it. Cross-laminating sheets of wood provide several structural advantages, giving it a high strength-to-weight ratio, impact resistance, high sound and thermal insulation, material stability, and, when treated, resistance to corrosion.

Plywood is widely used in construction and manufacturing of wood furniture. In construction, plywood is used in wall siding, paneling, flooring, sheathing, roofing, and concrete form boards. In interior applications, plywood is used in furniture like cabinets, paneling, flooring, store fixtures, and doors. Growth in the construction industry in 2023, especially in emerging economies such as China, was spurred by an increased number of construction projects worldwide. This is, in turn, driving growth in the plywood market.

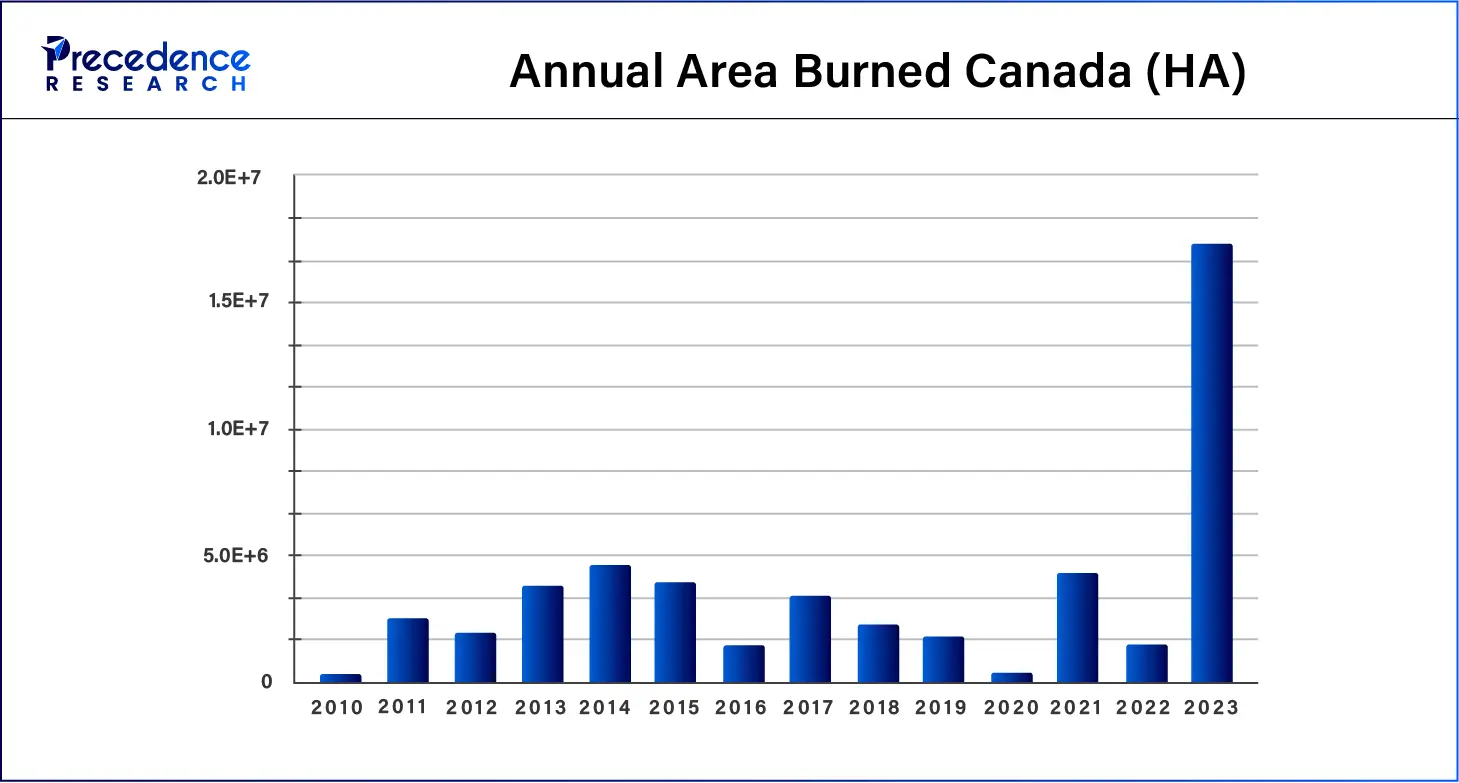

A crunch in the global supply chain for timber products has reduced log supply, leading to rising costs of wood. The Red Sea crisis along with environmental issues such as increasing global losses of timber-producing forest due to wildfires poses challenges to growth in the market. The global push towards net-zero emissions to combat climate change is leading to the replacement of unsustainable building materials such as steel and concrete with wood, providing an opportunity for businesses in the plywood market.

How Artificial Intelligence is Transforming the Plywood Market

Artificial intelligence is being used to enhance the production of plywood in multiple ways. Traditional human inspection of wood for defects, knots, and cracks is time-consuming and prone to errors. AI-powered computer vision systems use high-resolution cameras to capture images of the wood and use algorithms to analyze them for defects. Deep learning algorithms are being deployed to improve the speed and accuracy of defect detection in the wood used to manufacture plywood. In the plywood market, AI-based artificial neural networks are also being deployed to predict the bending strength of engineered woods, such as plywood, and improve product quality.

| Report Coverage | Details |

| Market Size by 2034 | USD 162.66 Billion |

| Market Size in 2023 | USD 85.51 Billion |

| Market Size in 2024 | USD 90.66 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.02% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for engineered wood

Plywood is widely used as a building material in construction. Economic growth is leading to urbanization in emerging economies and steady growth in the construction industry, which is, in turn, driving demand for engineered woods such as plywood. Among plywood, there is a shift in preference for waterproof and termite-resistant plywood, fire-retardant plywood, and decorative plywood. This is leading to growth in the plywood market.

A rise in government spending on infrastructure and private firms in terms of real estate development is leading federal and business spending on construction in emerging economies. These factors are contributing to rising demand in the plywood market. Among plywood, there is a shift in preference for waterproof and termite-resistant plywood, fire-retardant plywood, and decorative plywood.

Global disruptions in timber and the impact of climate change

The Red Sea Crisis and the Panama Canal backlog are adding to global disruptions in timber supply chains. A Yemeni Houthi rebel faction has been attacking shipping in the southern Red Sea since September 2023. This has deterred the major cargo operators from using the quicker route to Europe through the Suez Canal, creating backlogs and congestion and impacting China, Canada, Russia, Germany, Sweden, and the U.S. These nations are responsible for more than 70% of the timber exported using the seaway. These events are driving the prices of timber and byproducts such as plywood higher, making them less cost-effective for businesses.

As the impact of climate change becomes more pronounced, high-severity wildfires threaten the production of timber. According to an article in Nature Geoscience, the length and extent of the wildfire season are expected to increase significantly in the coming decades due to climate change, placing a large area of forests at increased risk of high-severity burning. Timber rotation times are as long as 21 years. Rotation cycles in the Russian and Canadian boreal forests are close to 100 years. Wildfire damages are estimated to lead to losses of 5.1 to 13.5% of timber forests. Losses in the United States timber forests could reach 8% across a harvest cycle. These environmental factors pose challenges to growth in the plywood market, which relies heavily on timber harvesting.

Demand for alternate forms of engineered wood

While plywood remains a relatively cheaper option in engineered wood, as purchasing power among emerging nations goes up and renovation cycles get shorter, consumers are increasingly going for superior alternatives to traditional plywood. This will hamper the growth of the plywood market.

Net-zero emission targets and a push towards sustainable construction

As the threat of climate change grows, over 149 countries, including the European Union and Taiwan, have signed up for net-zero targets. Using engineered wood, such as plywood, for constructing buildings helps avoid emissions associated with traditional building materials such as cement or steel. Wood is a renewable resource, carrying the lowest carbon footprint compared to other first-time-use building materials. The plywood market products have good energy-absorbing capacity, with the carbon stored in wood becoming preserved, making it a long-term carbon sink. Businesses in the sector can capitalize on this push towards sustainable construction with the adoption of sustainably sourced timber that is then turned into plywood through sustainable manufacturing processes and treated using green treatment processes.

The new construction segment dominated the plywood market in 2023. Housing construction and sales have a direct impact on several wood product markets. In countries such as the United States, new single-family starter homes have proved vital for demand in the wood industry, with new housing units consuming more value-added products than any other wood-utilizing sector.

By use, the rehabilitation segment is set to grow at the fastest rate in the plywood market during the forecast period of 2024-2034. Plywood is used in the protection and maintenance of rehabilitating historic buildings. For example, it is used to protect a leaking roof along with building paper until it can be properly repaired. A shift towards more sustainable building practices is driving demand for building rehabilitation and, in turn, relatively sustainable engineered woods such as plywood. This leads to a reduction in the environmental impact of construction and promotes the reuse of more efficient materials and technologies.

The softwood segment dominated the plywood market in 2023. Softwood is harvested from evergreen trees with needles and cones, such as cedar, Douglas fir, pine, and spruce. Pine is the most used softwood in plywood manufacturing. Softwoods account for almost 80% of all timber harvested. Softwoods are widely used in building components, furniture, paper, and fiberboard due to their less dense and hard-wearing characteristics. Treated softwoods are also used in building exteriors and are able to perform at par with hardwoods.

The hardwood segment is expected to grow at the fastest rate in the plywood market during the forecast period. Hardwood is harvested from deciduous trees such as hickory, birch, mahogany, oak, and walnut. Birch is the most widely used hardwood in plywood manufacturing. Hardwoods tend to be denser than softwoods, making them more durable and useful for heavy-duty construction. Hardwood is gaining popularity as a more sustainable building material due to the stability of deciduous trees and their ability to naturally replenish without requiring manual replanting.

The construction segment made up the largest share of the plywood market in 2023. Plywood is the most widely used engineered wood in the construction of houses. Its high strength, sound, and thermal insulation, and resistance to moisture, impact, and chemicals make it a preferred choice for flooring, roofing, ceilings, and walls to reduce cooling and heating expenses. Softwood plywood is also usually used for temporary, lower-impact construction.

The industrial segment is set to show notable growth in the plywood market during the forecast period. Wooden pallets are the most commonly used for the material handling of products. Plywood pallets are relatively lighter, saving money on transportation and handling costs compared to sawn wood pallets. They are also cheaper and easier to source. Due to these properties, plywood pallets remain a classic choice for many industries.

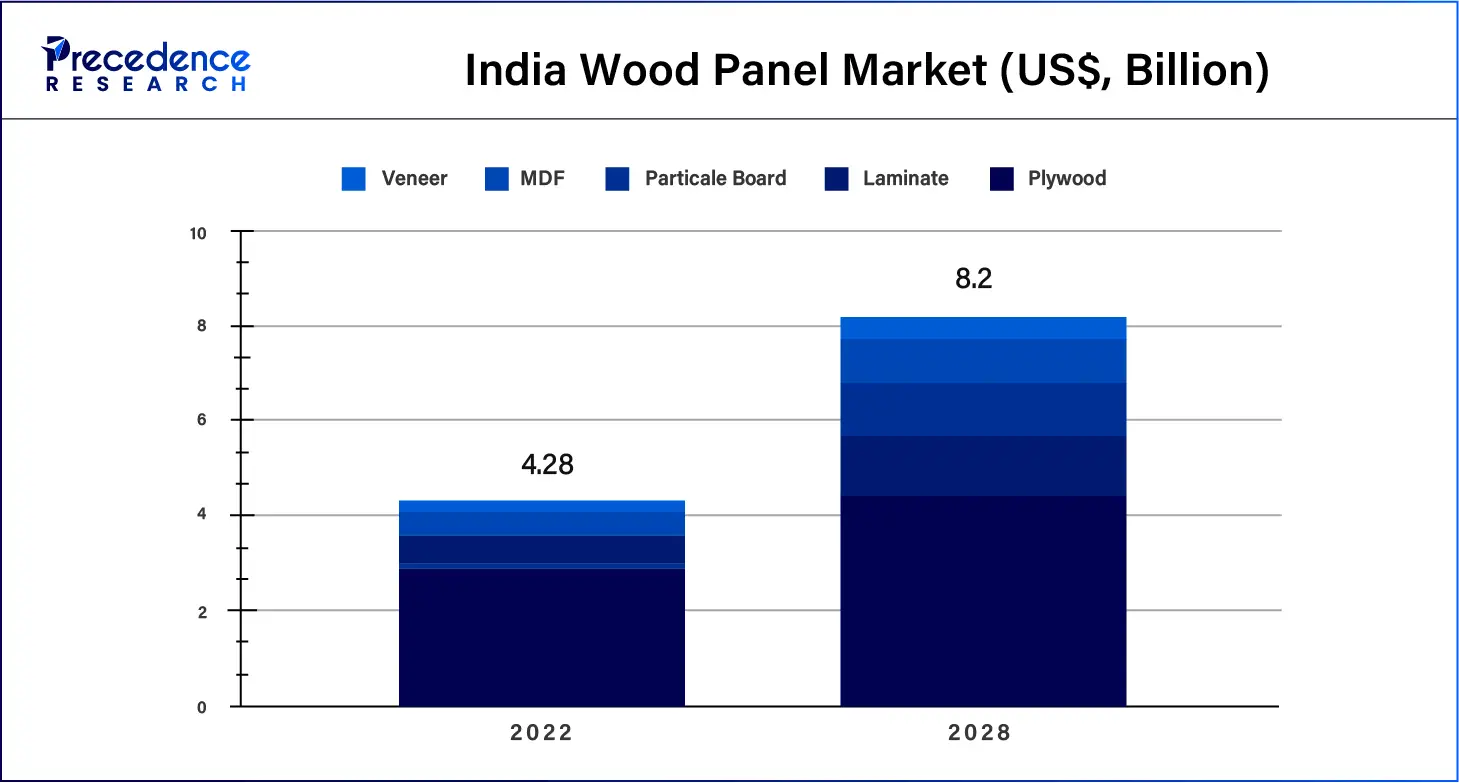

Asia Pacific dominated the plywood market in 2023. The wide availability of forests in the region leads to a high production of wood. Wooden furniture and wood-based panels are among the 23 main goods produced in the region. The high number of construction projects currently being undertaken in countries such as the Philippines, India, and Malaysia are leading to a high demand for plywood.

In China, there was a significant uptake in resort construction using wood and an interest in exposed wood construction. Despite a slowdown in construction in China, the sector showed steady growth in the second half of 2023.

India is also driving growth in the plywood market. The country is among six of the major consumers of plywood and one of the top three in consumption of tropical hardwood plywood.

North America is expected to drive substantial growth in the global plywood market over the forecast period. The construction activity index remained notable for the Americas with a +24 reading and a slight pick-up in momentum during Q4 of 2023. A reduction in construction costs and inflation rates in the Americas compared to a year ago. For the United States, the net balance reading in Q4 was +50% which compares with +46% in the preceding quarter.

Segments Covered in the Report

By Type

By Application

By Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client