August 2024

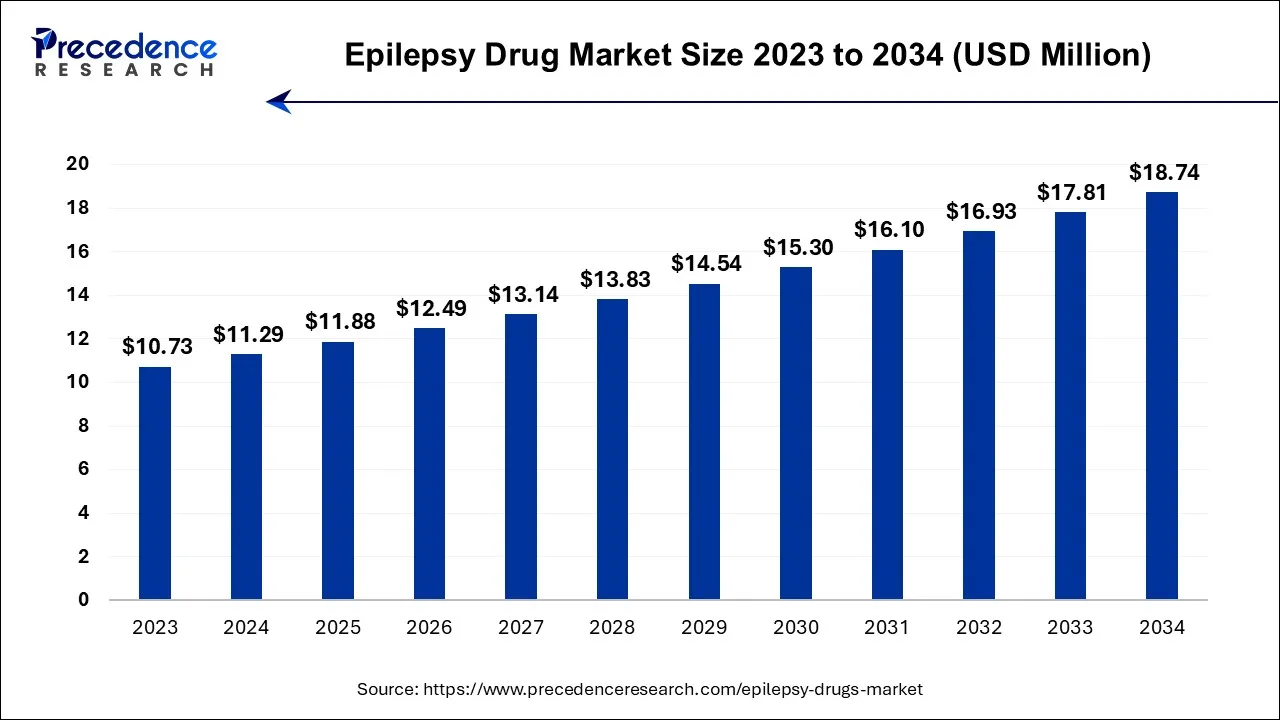

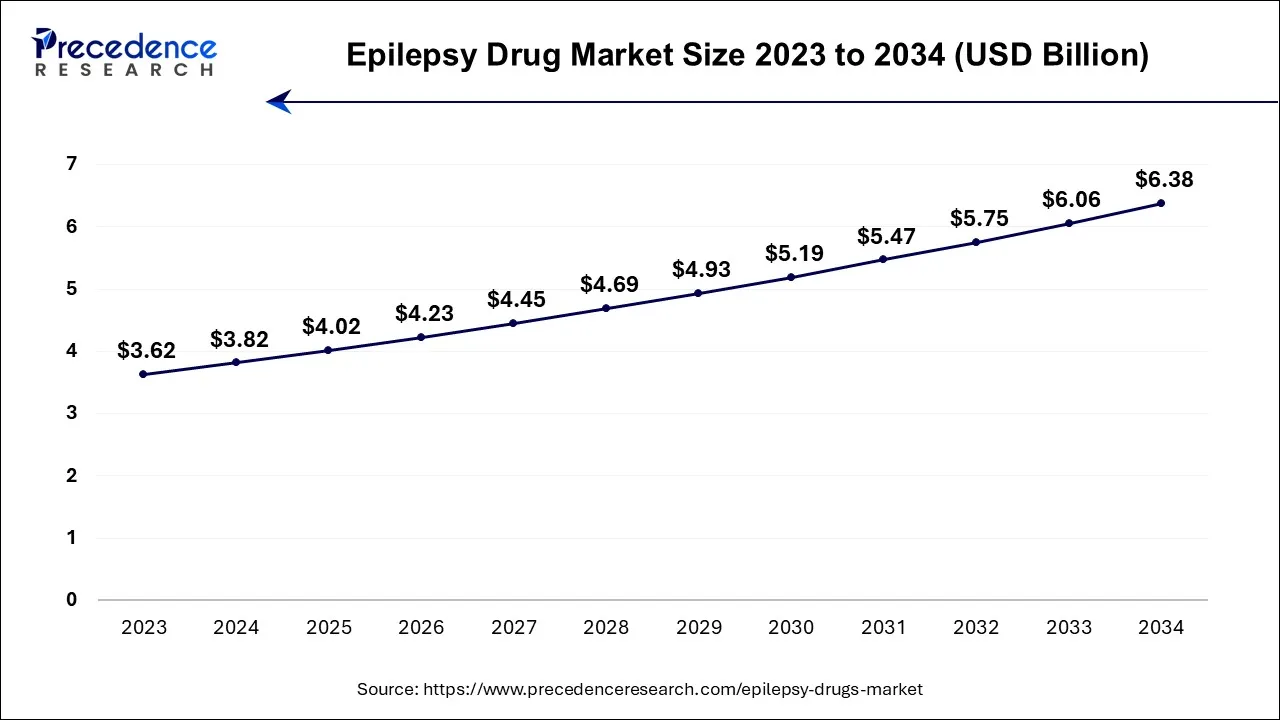

The global epilepsy drug market size is calculated at USD 11.29 billion in 2024, grew to USD 11.88 billion in 2025, and is predicted to hit around USD 18.74 billion by 2034, poised to grow at a CAGR of 5.2% between 2024 and 2034. The North America epilepsy drug market size accounted for USD 4.83 billion in 2024 and is anticipated to grow at the fastest CAGR of 5.25% during the forecast year.

The global epilepsy drug market size is expected to be valued at USD 11.29 billion in 2024 and is anticipated to reach around USD 18.74 billion by 2034, expanding at a CAGR of 5.2% over the forecast period from 2024 to 2034.

The U.S. epilepsy drug market size is accounted for USD 3.82 billion in 2024 and is projected to be worth around USD 6.38 billion by 2034, poised to grow at a CAGR of 5.3% from 2024 to 2034.

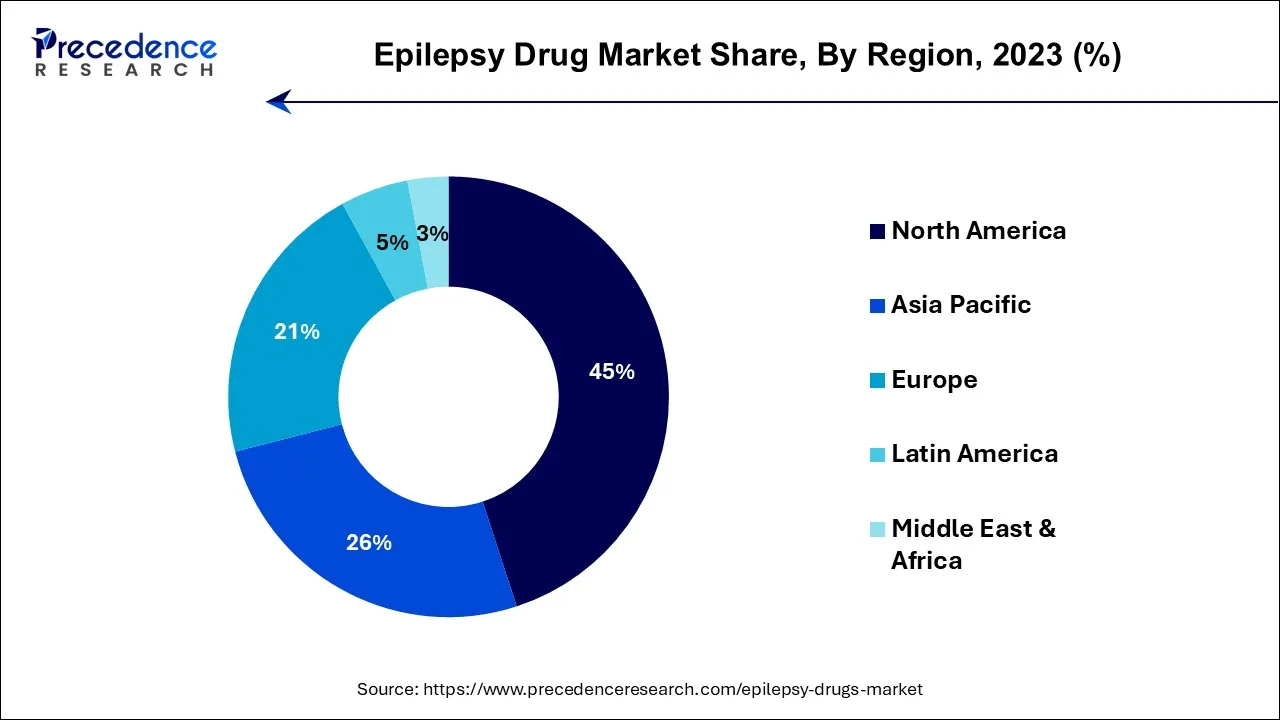

North America held the largest revenue share in 2023. North America, which includes the United States and Canada, is characterized by advanced healthcare infrastructure, substantial research and development activities, and a sizable patient population affected by epilepsy. It has a notable prevalence of epilepsy, with millions of individuals affected by the condition. This prevalence is influenced by factors such as an aging population, improved diagnostic capabilities, and various risk factors.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific is home to a significant portion of the world's population. Therefore, there is a substantial number of individuals affected by epilepsy, making it a critical healthcare concern. The Asia Pacific epilepsy market is characterized by its vast and diverse population, distinct healthcare systems, and a growing focus on research and innovation. Efforts to improve epilepsy care, raise awareness, and address cultural and economic challenges continue to shape the landscape of epilepsy treatment in the region.

Europe's epilepsy drug market is driven by its diverse healthcare systems, strong regulatory oversight, and the presence of a robust pharmaceutical industry. Collaboration across countries in research, care standards, and patient advocacy initiatives contributes to advancements in epilepsy management, aiming to provide high-quality care and improved outcomes for individuals living with epilepsy across the continent.

An epilepsy drug, also known as an antiepileptic drug or anticonvulsant, is a medication specifically designed to manage and control epileptic seizures. Epilepsy is a neurological disorder characterized by recurrent and unpredictable seizures, which are caused by abnormal electrical activity in the brain. The drugs work by stabilizing the electrical activity in the brain, reducing the likelihood and severity of seizures. There are various types of epilepsy drugs, and their selection depends on the specific type of epilepsy, the patient's age, and other individual factors.

These drugs can be taken orally in the form of tablets or capsules, or they may be administered intravenously in emergencies. The goal of epilepsy drug treatment is to improve the quality of life for individuals with epilepsy by minimizing the frequency and intensity of seizures. The epilepsy drug market is involved in the production, distribution, and sale of medications specifically designed for the treatment of epilepsy and the management of epileptic seizures.

It encompasses pharmaceutical companies that research, develop, manufacture, and market antiepileptic drugs (AEDs), as well as the various healthcare professionals, clinics, pharmacies, hospitals, and patients that participate in the purchase and use of these medications.

The market is influenced by several factors such as the prevalence of epilepsy, the development of new and more effective medications, patent expirations, pricing, and access to treatment. It is a crucial component of the broader pharmaceutical industry, serving the needs of patients with epilepsy worldwide.

| Report Coverage | Details |

| Market Size in 2024 | USD 11.29 Billion |

| Market Size by 2034 | USD 18.74 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.40% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Seizure Type, By Drugs Generation, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of epilepsy

Epilepsy is a neurological disorder characterized by recurrent seizures, affecting a growing number of people globally. This rise in prevalence can be attributed to various factors, including an aging population and improved diagnostic techniques, enabling more accurate identification of individuals with epilepsy. As the number of people diagnosed with epilepsy continues to increase, so does the demand for effective and accessible treatments.

The World Health Organization (WHO) has published in its 2023 report, the WHO estimated that there are over 50 million people with epilepsy globally. The reports also estimated that proportion of the general population with active epilepsy at a given time is between 4 and 10 per 1000 people.

Pharmaceutical companies are investing in research and development to create new antiepileptic drugs with improved efficacy and safety profiles. This ongoing innovation is vital to cater to the diverse forms and causes of epilepsy and to provide better treatment options for patients. The growing demand for epilepsy drugs emphasizes the need for continued efforts in the field of epilepsy research and drug development.

It also underscores the importance of regulatory approvals, expanded patient access to treatment, and increased awareness of the condition. By addressing the rising prevalence of epilepsy and the associated healthcare challenges, the epilepsy drug market plays a crucial role in improving the quality of life for individuals affected by this condition.

Limited treatment options for drug-resistant epilepsy

Epilepsy medications are generally effective in controlling seizures for a substantial portion of patients, there exists a subset of individuals who have drug-resistant epilepsy. These patients do not respond adequately to available antiepileptic drugs (AEDs), making their management exceptionally challenging.

For those with drug-resistant epilepsy, the lack of effective treatment options results in ongoing and severe seizures, leading to a diminished quality of life, increased healthcare costs, and significant personal and societal burdens. This limitation on treatment options underscores the urgent need for innovative therapies tailored to this specific patient group.

Pharmaceutical companies and researchers have been striving to develop novel AEDs or alternative treatment modalities to address drug-resistant epilepsy. However, the complex nature of the condition, with its diverse underlying causes and seizure patterns, makes finding effective solutions a formidable challenge.

Moreover, the regulatory approval process for new epilepsy drugs can be lengthy and demanding, which further hinders the availability of innovative treatments for drug-resistant epilepsy. The high cost of research and development for such specialized drugs also presents financial obstacles. In light of these constraints, the epilepsy drug market needs to prioritize research into treatments for drug-resistant epilepsy, streamline regulatory pathways, and foster collaboration between pharmaceutical companies, researchers, and healthcare providers to develop more effective solutions.

Addressing the unmet needs of these patients represents a substantial opportunity for the market and would significantly enhance the lives of those suffering from drug-resistant epilepsy.

Developing new & innovative antiepileptic drugs (AEDs)

Pharmaceutical companies have a compelling opportunity to drive progress in the field of epilepsy treatment by researching and developing new and innovative antiepileptic drugs (AEDs) with enhanced efficacy and safety profiles. The demand for more effective and safer treatment options is ever-present, particularly as epilepsy affects millions of individuals worldwide. Innovative AEDs offer the prospect of addressing the unmet needs of patients, including those with drug-resistant epilepsy or specific forms of the condition.

By tailoring drugs to the unique characteristics of patients, such as their genetic makeup, pharmaceutical companies can usher in an era of precision medicine that maximizes treatment efficacy while minimizing side effects. Moreover, the development of patient-friendly formulations, such as liquid medications or extended-release tablets, can improve compliance and treatment outcomes, especially in children and individuals with special requirements.

Enhanced safety profiles are a key focal point, as they can reduce the risk of adverse effects and encourage patient adherence to therapy. The pursuit of neuroprotective AEDs holds promise not only for controlling seizures but also for mitigating neurological damage associated with epilepsy. This focus on innovation aligns with the broader trend of advancing healthcare and pharmaceuticals through personalized, patient-centric approaches.

Furthermore, the integration of AED management into telemedicine services represents a forward-looking opportunity, offering convenient access to care and remote monitoring for patients. By staying committed to these research and development endeavors, pharmaceutical companies can shape the future of epilepsy treatment, contributing to improved patient outcomes and quality of life while fostering growth and innovation in the epilepsy drug market.

In 2023, the focal seizures segment had the highest market share of 51% based on the seizure type. Focal seizures originate in a specific area of the brain and typically affect only one part of the body or one side of the body. They may be associated with altered consciousness or awareness. Antiepileptic drugs (AEDs) for focal seizures aim to control and prevent the spread of abnormal electrical activity within the brain. These drugs target the specific area where seizures originate.

The generalized seizures segment is anticipated to expand fastest over the projected period. Generalized seizures involve widespread electrical disturbances in the brain from the outset. They often affect both sides of the body and can result in loss of consciousness. AEDs for generalized seizures are designed to control and prevent widespread electrical activity in the brain. They may include drugs that target both the cortex and deep brain structures to manage seizures effectively.

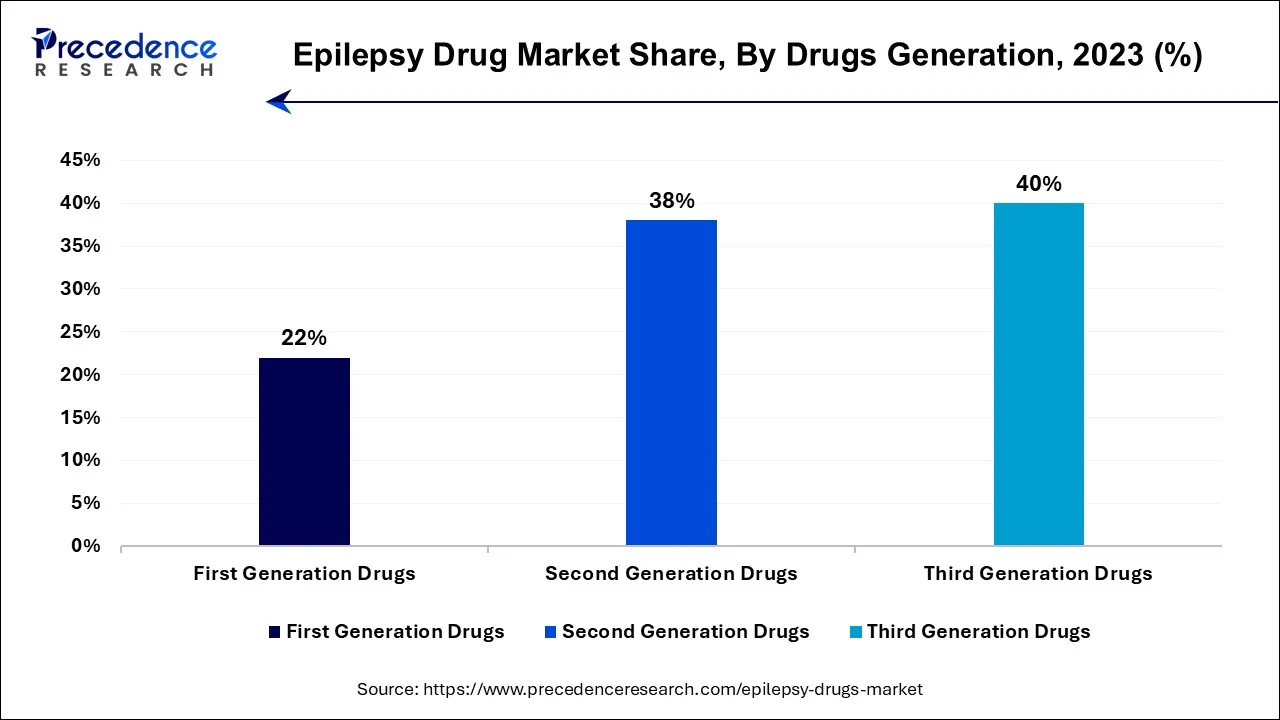

In 2023, the third-generation drug segment had the highest market share based on the technology. Third-generation drugs are at the forefront of innovation in epilepsy treatment. They may offer more precise mechanisms of action, better tolerability, and fewer interactions with other medications. The focus is on tailoring treatment to individual patients, including those with drug-resistant epilepsy. It is also known as advanced or next-generation AEDs, representing the latest advancements in epilepsy treatment. These drugs are continually being developed to further enhance treatment efficacy, safety, and patient quality of life.

The second-generation drug segment is anticipated to expand fastest over the projected period. This is due to second-generation drugs aim to provide more specific and targeted treatment for various seizure types while minimizing side effects. They often offer broader usage and a reduced risk of drug interactions. Second-generation drugs, or newer AEDs, are a more recent group of antiepileptic medications. They were developed to offer improvements in terms of efficacy, tolerability, and safety compared to the first-generation drugs. Some examples include levetiracetam, lamotrigine, and topiramate.

In 2023, the drug stores and retail pharmacies segment had the highest market share on the basis of the distribution channel. Drug stores and retail pharmacies are standalone or chain-based retail outlets that offer prescription and over-the-counter medications to the general public. These include popular pharmacy chains and local drugstores. These distribution channels play a vital role in providing AEDs to patients for outpatient use. They serve as accessible locations where patients can fill their prescriptions and receive counseling from pharmacists.

The online providers segment is anticipated to expand fastest over the projected period. Online providers refer to e-commerce platforms or websites where patients can order medications, including AEDs, via the internet. These platforms may include online pharmacies or direct sales from pharmaceutical manufacturers. It offers a convenient way for patients to order and receive their epilepsy medications, especially for those who may have mobility limitations, prefer home delivery, or live in remote areas with limited access to physical pharmacies.

Segments Covered in the Report

By Seizure Type

By Drugs Generation

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

June 2023

January 2025

November 2024