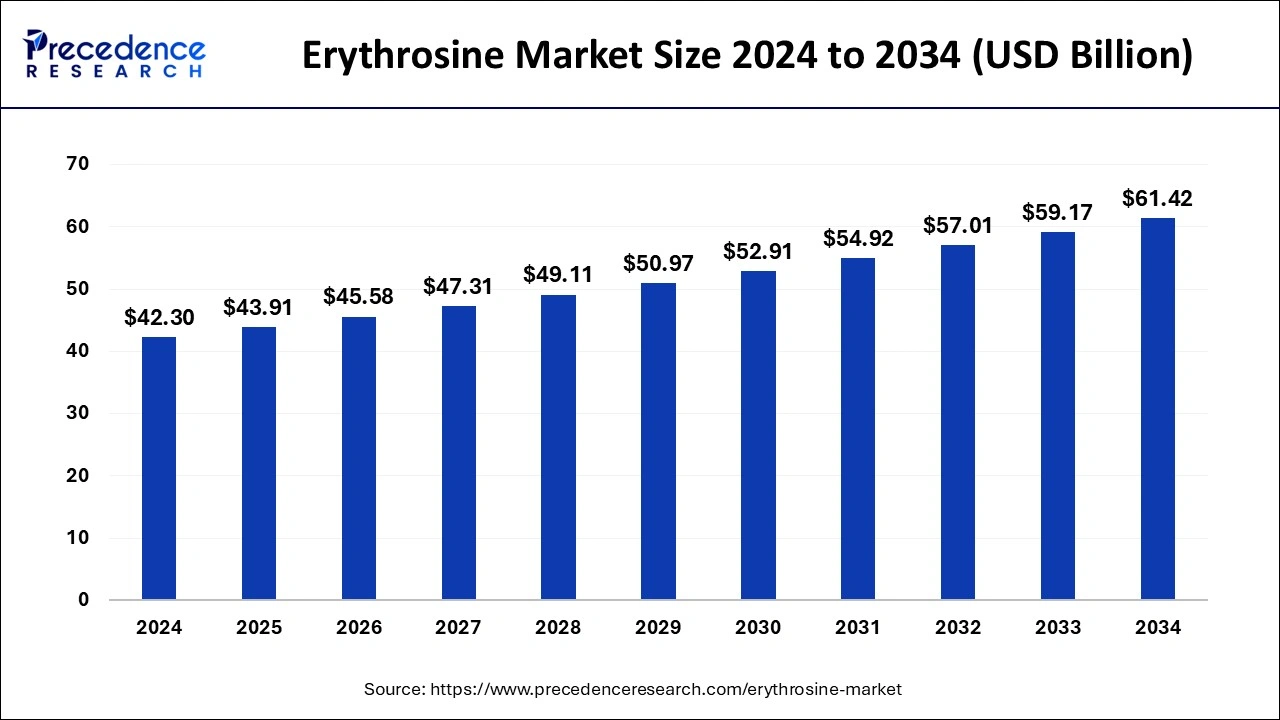

The global erythrosine market size is accounted at USD 43.91 billion in 2025 and is forecasted to hit around USD 61.42 billion by 2034, representing a CAGR of 3.80% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global erythrosine market size was calculated at USD 42.30 billion in 2024 and is predicted to reach around USD 61.42 billion by 2034, expanding at a CAGR of 3.80% from 2025 to 2034. Rising demand in the pharmaceutical, food, beverage, and cosmetic industries propels the erythrosine market.

Artificial intelligence technologies are being applied to determine the right proportion of erythrosine in its products to give standard concentrations and improve production processes. By using AI technology, the consumer’s preference and demand pattern are predicted accurately which helps business organizations in market strategy as well as in inventory management. In the areas of research and development AI simulation methodologies can be particularly useful as they can help find new uses for erythrosine.

Erythrosine is a red color; it is utilized for coloring foods, cosmetics, and drugs. Red number 3 or Food, Drug, and Cosmetics Red number 3, erythrosine, is a synthetic dye. Since consumers have shifted their focus towards health, the demand for natural and synthetic food colorants is increasing and it has been a good chance for the manufacturers to improve their product demand and use erythrosine.

The global erythrosine market is growing due to growth, supported by technological advancements in production processes and increasing consumer awareness of food safety and quality. Moreover, there is a growing trend for bright-colored food products in markets, and thus, food producers are using erythrosine in product formulations to meet consumer tastes and preferences. This growth is mainly attributed to the rising use of food color in confectioneries, dairy products, and in the preparation of several beverages.

| Report Coverage | Details |

| Market Size by 2024 | USD 42.30 Billion |

| Market Size in 2025 | USD 43.91 Billion |

| Market Size in 2034 | USD 61.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Demand in the Cosmetic and Personal Care Industry

Erythrosine is a bright red and highly stable color that is employed in the manufacture of cosmetic products. It is added to cosmetics such as lip glosses, eye shadows, and even skin care products that need a bright hue. Because of these factors, the process is preferred among cosmetic manufacturers because it is stable and can be easily modified. With advancements in the beauty and skincare industry and the trend of using natural substances, higher chances of using erythrosine are bound to come up. The stability, color, and solubility have ensured that erythrosine fits well with the requirements of cosmetics manufacturers.

Environmental and Regulatory Concerns

The increasing environmental and regulatory concern is a major factor that hinders the erythrosine market. The products containing erythrosine are rather stable, and their remains can be detected in the environment, which can potentially have adverse effects. They bring about restrictions that governments impose on the application, manufacturing, and elimination of such additives, and they also raise the expenses related to compliance. Moreover, due to an increasing number of people who prefer natural and organic products over synthetic and non-recyclable materials, the market for erythrosine is also restricted. These limit the ability of companies to increase the application of the products in production sectors.

Opportunistic business venture

Strategic alliances and joint ventures are the major factors that will fuel the growth of the erythrosine market. Alliances with local manufacturers in emergent markets can allow for the decrease of production costs and the growth of the market share. Collaboration with research facilities and technological vendors to jointly develop new technologies would ensure the sustainable and safe production of erythrosine while tackling environmental issues and regulatory barriers. Implementing global Supply Chain Management relationships guarantees the continuing supply of erythrosine for various uses and opens up new markets in other geographical locations. Also, collaboration with environmental organizations allows companies to embrace sustainable practices, enhances market reception, and adds regulatory compliance.

The liquid segment noted the largest erythrosine market share in 2024. Liquid erythrosine is a popular additive in the food and beverage sector since it dissolves in beverages, sauces, and candies, thus giving a homogenous and even color. Since it is in liquid form, it readily dissolves in aqueous solutions, expressing uniform color throughout liquid systems. Because of this property, it yields a smooth and proper dispersion pattern of the color, thus applicable to instances of color pension that need to be consistent.

The powder segment is projected to witness the fastest growth in the erythrosine market during the forecast period. Erythrosine B being a powder form is preferred in food products especially in baked goods, in dry-based products like milk powders, in cream-based flavored powdery products like mawa, powdered beverages, confectionery, etc. where color concentration is easily adjustable without compromising the texture of the product. It is also used in some cosmetic applications because, where a fine powder is needed for even distribution in formulations.

The food and beverages segment contributed the largest share of the erythrosine market in 2024. Erythrosine imparts a red color and is used in foods and beverages such as baked goods, breakfast cereals, confectionery products, dairy products, decorations for baked products, dressings and sauces, and dried fruits. In the Food & Beverages sector, the primary application of erythrosine is as a colorant in confectionery, beverages, and processed foods since color plays an important role in customer appeal. Most commonly, erythrosine is used to enhance the color of food products in the food and beverage industry. It is regularly used due to its stability in color properties and its capacity to be dissolved in water to make the food products more visually appealing to the customers.

The pharmaceutical segment is projected to witness the fastest growth in the erythrosine market during the forecast period. In the pharmaceutical industry, erythrosine is predominantly used as a coloring agent in drug formulations, medicinal supplements, and oral health care solutions, including tablets, capsules, and mouthwashes. Erythrosine, or Red Dye No. 3, is a red colorant that is used in some medicines, cosmetics, and foods. Erythrosine has found more application as a coloring matter in many pharmaceutical products' aesthetic value and identification. Furthermore, it is used in biological staining and diagnostic procedures, especially in fluorescence microscopy and dental plaque discs, which increases its demand.

North America accounted for the largest share of the erythrosine market in 2024 owing to its advanced pharmaceutical and food industries and policies that necessarily require the safe use of food additives and colorants. Moreover, well-developed healthcare and constantly rising investments in the pharmaceutical and food industries in North America are also the driving factors behind the market domination.

Another factor that contributes to erythrosine's constant use in different applications is the adequate support of agencies such as the FDA. Stringent norms for food colors and the high consciousness levels of consumers about health in the U.S. have led to higher demand for hi-tech food colors.

Asia Pacific is anticipated to witness the fastest growth in the erythrosine market during the forecasted years. The fast pace of urbanization and the changing pattern of eating have created more demand for processed and packaged food. Most manufacturers are focused on mass production to fill the needs of the food and beverages industries due to the ever-increasing market demand.

The increasing middle-income earners are also forced to develop those catchy formulations as the market progresses to high-quality products. The expanded automotive industry gets investment that boosts manufacturing processes and supply chain efficiencies. Companies have begun to explore localized production, which reduces costs and gains competitive advantages using one of the best distribution channels.

By Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client