January 2025

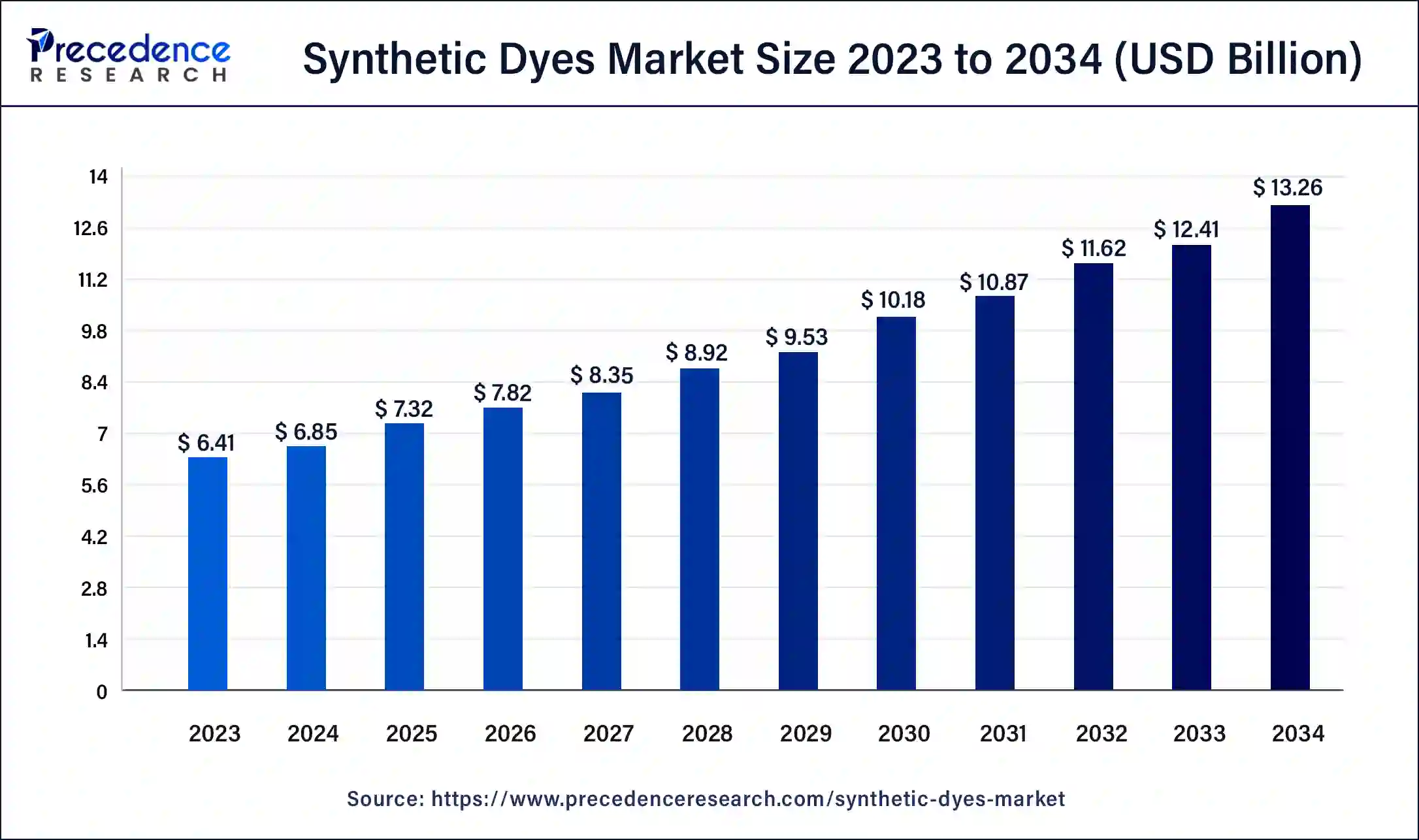

The global synthetic dyes market size surpassed USD 6.41 billion in 2023 and is estimated to increase from USD 6.85 billion in 2024 to approximately USD 13.26 billion by 2034. It is projected to growing at a CAGR of 6.83% from 2024 to 2034.

The global synthetic dyes market size is worth around USD 6.85 billion in 2024 and is anticipated to reach around USD 13.26 billion by 2034, growing at a CAGR of 6.83% over the forecast period 2024 to 2034. The synthetic dyes market is driven by the developments in dye science. Through ongoing research and development, advances in dye chemistry have produced new synthetic dyes with enhanced qualities, including increased colorfastness, brightness, and sustainability.

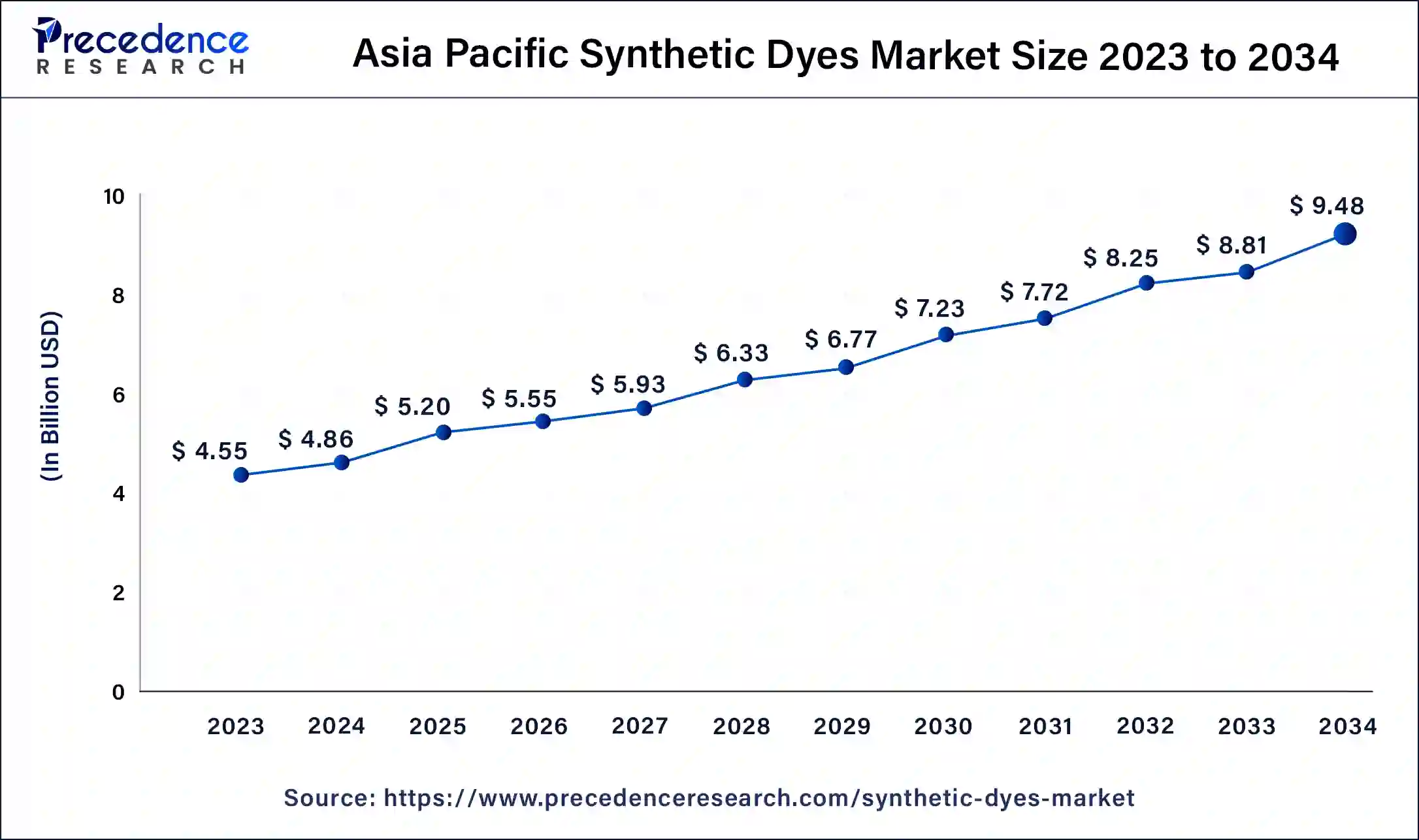

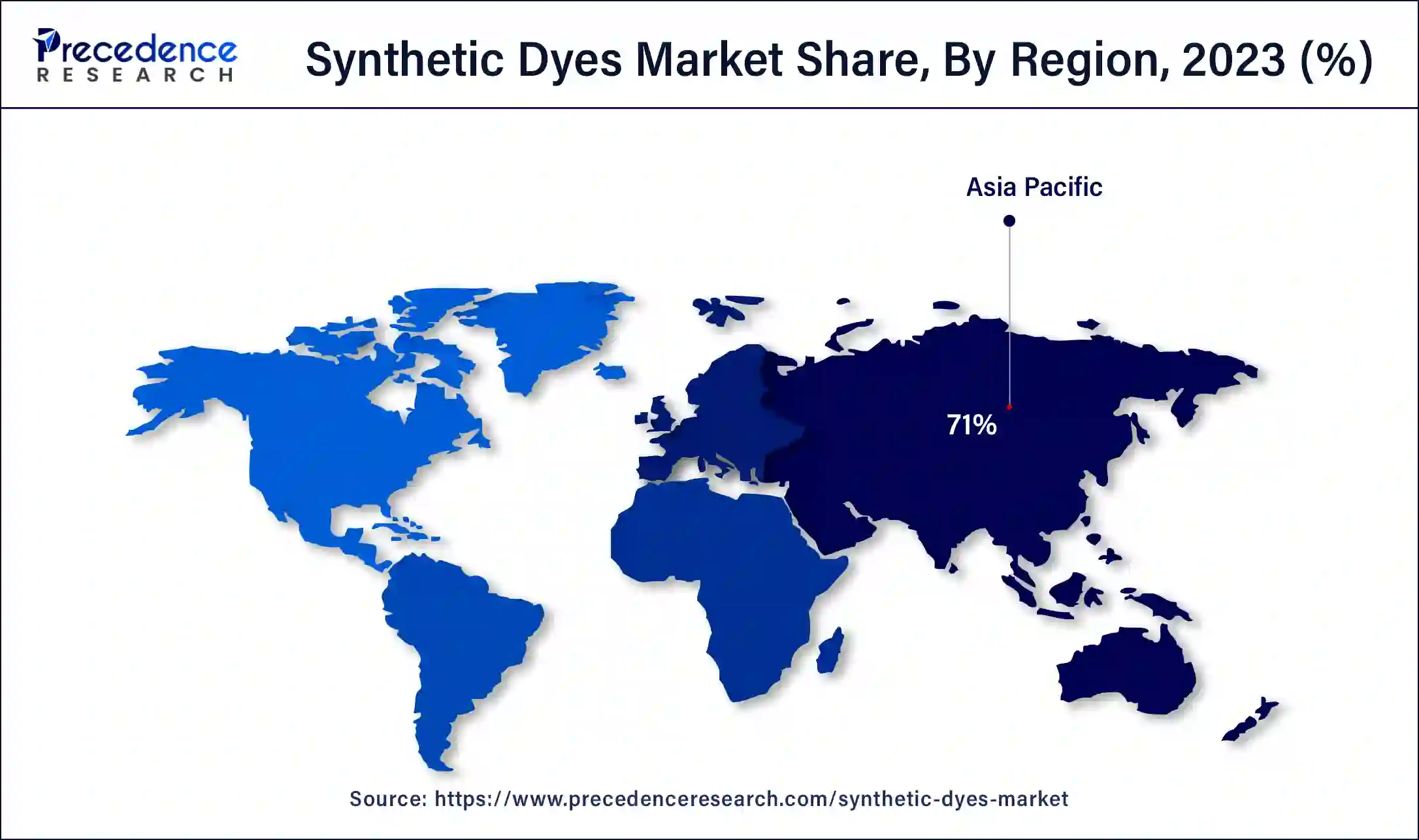

The Asia Pacific synthetic dyes size was exhibited at USD 4.55 billion in 2023 and is projected to be worth around USD 9.48 billion by 2034, poised to grow at a CAGR of 6.90% from 2024 to 2034.

Asia Pacific dominated the synthetic dyes market in 2023. Toluene, benzene, and xylene are examples of petrochemicals from synthetic dyes. Asia Pacific now enjoys a cost advantage due to its status as a center for petrochemical processing. There has been a shift in recent years towards more rigid environmental rules despite nations such as China historically being accused of having lenient environmental standards. Moreover, Asia Pacific manufacturers enjoy relatively cheaper compliance costs, which helps maintain competitive prices.

North America is expected to witness significant growth in the synthetic dyes market during the forecast period. The region's fashion and garment industries have long needed bright, color-rich fabrics and continuous innovation. Innovative dye solutions with lasting color vibrancy are basically required as fashion trends change. Synthetic dyes, well-known for their broad color spectrum and low cost, are important. These dyes are broadly used in the snack, candy, and beverage industries in the U.S. and Canada to generate visually appealing items.

The global markets for synthetic dyes include the manufacturing, distribution, and retail of dyes derived from chemical compounds. These dyes add color to various products, such as paper, plastics, textiles, food, cosmetics, and other consumer goods. Due to its extensive use, the synthetic dyes market represents a sizable portion of the more significant chemical sector and boosts the world economy. It employs a sizable manufacturing, research, and distribution workforce, especially in developing nations like China and India, which have a sizable textile industry. Synthetic dyes have a major role in the fashion industry's ability to create apparel in various colors and designs. The ability to mass-produce vibrant textiles at a reasonable price would be significantly constrained without synthetic colors.

How is AI helping the Synthetic Dyes Market growth?

The textile sector is essential to human existence. The difficulties with the synthetic dyes market, including effects on the environment and human health, have led to a rise in interest in using natural dyes in the textile and fashion industries. Natural dyes are mainly used to color natural textiles like cotton, silk, and wool. They can be derived from plants, animals, minerals, and microbiological sources. Artificial intelligence has been effectively applied in several textile-related sectors in recent decades and has been marketed as a potent tool for simulating nonlinear engineering systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.26 Billion |

| Market Size in 2024 | USD 6.85 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.83% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End-use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand from the textile industry

The increasing consumer demand for fashionable and functional clothes drives strong growth in the textile and apparel industry worldwide. Synthetic dyes are necessary to achieve the enormous range of colors and patterns desired in contemporary fabrics. In general, synthetic colors are less expensive than natural dyes. They are a cost-effective solution for large-scale textile production since they provide constant quality and come in various colors.

The budget allocation for the textiles sector has been increased by INR 974 crore to INR 4,417.09 crore in the Union Budget 2024-25.

Growing regulatory pressure and environmental concerns

When synthetic colors are dumped into waterways, they can seriously pollute the water because many are not biodegradable. Much water is used in dyeing, which might get tainted with dangerous substances. Businesses are embracing corporate social responsibility (CSR) strategies prioritizing environmental sustainability. This entails using fewer hazardous chemicals and choosing more ecologically friendly production techniques, even when these come at a higher cost. Reducing the ecological effect of production processes require expensive alterations to current infrastructure and machinery.

Rising trend toward sustainable and environmentally friendly solutions

Green chemistry aims to create novel synthetic dyes market goods and procedures that use fewer or no dangerous materials. New synthetic dyes that are environmentally friendly are being developed due to developments in green chemistry. These colors can be made using less energy, fewer byproducts, and renewable resources. Businesses can improve their product offers and obtain a competitive edge in a market that values sustainability more and more by implementing green chemistry principles.

The synthetic dyes markets in emerging economies are beginning to adopt more ecologically friendly practices as the focus on sustainability increases globally. Manufacturers of synthetic dyes now have a chance to expand into new markets by offering eco-friendly solutions. Using eco-friendly dyes to penetrate emerging markets can open new revenue streams and commercial opportunities.

The dispersed dyes segment dominated the synthetic dyes market in 2023. The popularity of disperse dyes is due to their compatibility with synthetic fibers, which are increasingly used in the textile industry and include polyester, nylon, and acetate. Polyester's cost, durability, and numerous uses in home, industrial, and apparel textiles have made it one of the most widely used synthetic fibers. Because of their easy application method and compatibility with high-temperature dyeing techniques like thermos and high-temperature batch procedures, disperse dyes are more affordable than other dyes.

The reactive dyes segment will show significant growth in the synthetic dyes market during the forecast period. The unique chemical characteristics of reactive dyes make them perfect for natural textiles such as silk and wool. Reactive dyes, in contrast to other dye types, create covalent connections with the fiber, which improves wash fastness, light fastness, and durability. Their capacity to generate vivid and lively hues along with environmentally sustainable alternatives renders them extremely attractive to sectors such as fashion, home textiles, and technical textiles. Reactive dyes are still used mainly by the textile industry, but their application in other sectors of the economy is expanding. Because of their stability and capacity to produce vivid colors, reactive dyes are becoming increasingly popular in the food, paper, and leather sectors.

The textile & apparel segment dominated the synthetic dyes market in 2023. Since synthetic dyes come in various colors and tones, textile producers satisfy consumer tastes and fashion trends. In contrast, natural dyes come in a restricted range of colors. Even though these areas produce fewer textiles than Asia, there is still a sizable market for synthetic dyes in upscale, specialty clothing markets, such as luxury fashion, where durability and color variation are crucial. Synthetic dyes are also used in textile recycling and circular fashion, which are growing areas of interest. Reusing and reusing synthetic materials that have been dyed helps create a circular economy by guaranteeing that synthetic colors persist in the environment even in the face of more ecological practices.

The food & beverage segment is expected to witness significant growth in the synthetic dyes market during the forecast period. Food makers discover synthetic dyes as a cost-effective alternative to natural colorants because they are generally less expensive. The beverage business has grown significantly, with both the alcoholic and non-alcoholic divisions experiencing growth. Soft drinks, energy drinks, flavored water, and spirits frequently use synthetic colors to get the right hue and brand identification. Better solubility and a wider range of hues are just a few of the innovations in synthetic dye manufacture that have increased synthetic dyes' adaptability to various food and beverage applications.

Segments Covered in the Report

By Type

By End-use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

November 2024