January 2025

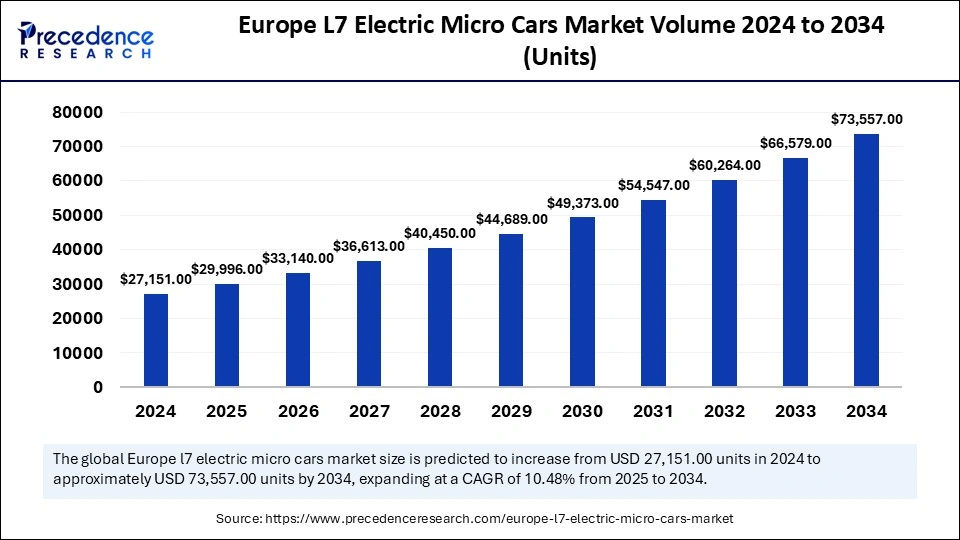

The Europe L7 electric micro cars market volume is calculated at 29,996 units in 2025 and is expected to hit over 73,556 units by 2034, accelerating at a CAGR of 10.48% from 2025 to 2034. The market sizing and forecasts are revenue-based (Volume Units), with 2024 as the base year.

The Europe L7 electric micro cars market volume surpassed 27,151 units in 2024 and is predicted to reach over 73,556 units by 2034, expanding at a CAGR of 10.48% between 2025 and 2034. The increased demand for personal mobility solutions is driving the Europe L7 electric micro cars market. The increased need for compact and efficient vehicles in urban areas is boosting the adoption of L7 electric micro cars in Europe.

Artificial Intelligence implementation in automotive sector is of key significance for changing lifestyles. AI provides predictive maintenance, optimization and smart decision-making abilities to advance efficacy, safety, and convenience of electric vehicles. AI is merging in electric vehicles to create a smarter transportation landscape. The consumer preference for personalized driving experience and optimization of charging schedules are two major concerns rising the surge for AI integration in electric microcars. Electric microcars are referred to as advanced transportation facilities in congested areas, with AI implementation, the electric microcars are accelerating advanced assistance and convenience.

The increased surge of Europe to leverage edge technologies with electric microcars is driving implementation of AI in L7 electric microcars. The advanced efficacy of L7 electric microcars by AI implementation is taking its market to the top level. The increased demand for battery-powered electric micro vehicles is expected to create significant opportunities for AI in L7 electric microcars. Additionally, Europe has promoted several landmark regulations for AI to set out safety requirements for autonomous vehicles by taking the high-risk AI systems requirements adoption, which are transforming the electric microcars areas in the region.

The L7 electric micro cars are shorter and narrower than a car and remain more mobile in traffic jams with the ability to emit 50% less CO2. The trend of micromobility has increased in Europe, driven by “the use of smaller, lighter and more specialised road passenger vehicles” to achieve clean urban transport and commuting. Expanding urbanization and awareness about consequences of gas emission have promoted the expansion of the Europe L7 electric micro cars market.

The increased manufacturers' focus on complying with personal mobility demands has surged in innovation and developments of light-heavy quadricycles (L6-L7 category) electric microcars in urban, suburban areas of Europe. The high cost and operational range of L7 electric microcars are hindering their adoption in urban areas, however, Factors such as rising fuel prices, and technological advancements for integration of electric and hybrid vehicles and automation trends are further contributing to the rising adoption of L7 electric microcars in Europe. The factors are extremely increasing the launching of innovative vehicles in the country.

| Report Coverage | Details |

| Market Volume by 2034 | USD 73,556.74 Units |

| Market Volume in 2025 | USD 2,7151 Units |

| Market Volume in 2024 | USD 29,996.42 Units |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.48% |

| Dominated Region | Germany |

| Fastest Growing Market | UK |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Range Per Charge, Battery Type, Seats, and Regions |

Government encouragement for Sustainability Trends

The demand for eco-friendly transportation options has experienced extreme growth in the Europe region while promoting the growth of Europe L7 electric micro cars market. The government initiatives and strict regulatory compliance regarding environmental impact are the key factors transferring a shift toward eco-friendly transportation options, including electric microcars.

Favorable policies and tax initiatives are leveraging the adoption of L7 electric microcars in Europe. With the government promoting initiatives of Medium Range (61-100KM), the Europe L7 electric microcars market is rapidly brought to life. Additionally, the increased urbanization and traffic issues are leveraging government focus to encourage adoption of L7 electric microcars.

Lack of charging infrastructure

The Europe L7 electric micro cars market is facing a significant challenge of limited widespread and easily accessible charging infrastructure. The lack of urban charging infrastructure and high cost of charging infrastructure hinders the widespread adoption. The limited development of charging infrastructure, mainly in Eastern Europe, contributes to a lower adoption rate of L7 electric microcars. Additionally, the majority of European charging stations provide slow charging speeds, inadequate for the adoption rate.

Technology advancements

Ongoing technology advancements of electric cars and implementation of cutting-edge features are the significant factors contributing to the advanced attraction and adoption of the L7 electric microcars. Manufacturers are innovating in advanced materials and designs to reduce weight and improve the efficacy of L7 electric microcars to enhance the overall driving experience.

Additionally, the integration of advanced technologies like electric motors, regenerative braking systems, and autonomous driving features with L7 electric micromcars is enabling safe, high-performance, and comfortable transportation solutions. With technological advancements, the L7 electric microcars are likely to access advanced performance, efficiency, and charging concerns, as well as range anxiety, making them more popular among consumers.

The medium range (61-100KM) segment dominated market by holding 45.55% of market share in 2024. The medium range of L7 electric micro cars is ideal for urban areas for daily transportation. The medium range of L7 electric micro cars requires smaller batteries, which helps lower costs and make cars more affordable. The increased demand for sustainable solutions drives high interest toward L7 electric microcars with a 61-100 km range, as their lower battery capacity reduces environmental impact.

On the other hand, the extended range (above 100KM) segment is observed to grow at a rapid pace during the forecast period. The above 100 km range is standard for longer traveling. The extended range is driven by increased demand for sustainable solutions and urban mobility solutions. The rise in concerns for reducing carbon footprints is driving the adoption of L7 electric microcars with longer ranges. The L7 electric microcars with ranges of above 100 km are more suitable for urban areas to ensure sustainability and a convincing transportation solution.

The lithium-ion battery segment accounted for the major market share of 72.31% in 2024. The segment growth is attributed to increased demand for long-range and enhanced performance L7 electric micro cars. Lithium-ion batteries provide high energy density, which enables electric microcars to get longer ranges. Lithium-ion batteries also offer excellent thermal stability to ensure the safety of cars in different environmental conditions.

The surge for cost-effective and long cycle life batteries for L7 electric micro cars drives the adoption of lithium-ion battery technology. Additionally, the continuous research and development in lithium-ion battery technology is expected to enhance energy density, charging speed, and cost reduction, and the appeal of L7 electric micro cars in the upcoming period.

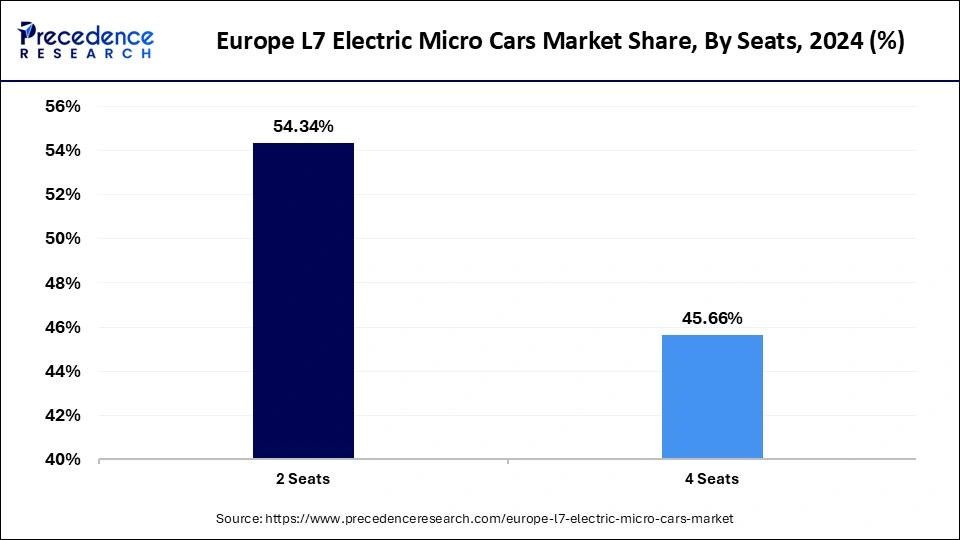

The 2 seats segment contributed the largest market share of 54.34% in 2024 due to the increased demand for eco-friendly, convenient transportation solutions. 2 seats L7 electric micro cars are widely being adopted due to their convenient urban mobility facilities. 2-seat vehicles are powered by a compact battery pack with electric propulsion power. The ability of 2-seat micro cars to carry one or two persons with their luggage and being able to park in difficult and congested areas makes them popular.

The 2 seats L7 electric micro cars are majorly popular among young groups as this vehicle can be driven by the age group above 16 years. These microcars are cost-effective compared to 4-seat microcars, ensuring cost saving on operations. The need for compact and fuel-efficient vehicles for personal use, leveraging the adoption of 2-seat L7 electric micro cars in the urban areas. Government initiatives and regulations are encouraging adoption of electric vehicles, enhancing the 2-setaed segment expansion. Additionally, the rising need for personalized mobility is transforming segment growth.

Germany L7 Electric Micro Cars Market Trends

Germany dominated the Europe L7 electric micro cars market in 2024 due to the country's strong automotive industry and high production value of electric micro cars. The growing battery-powered electric micro vehicles and sustainable mobility demands are the major factors contributing to the country's market expansion. The German government continuously offers initiatives of tax credits and subsidies to enhance the adoption of electric micro cars, making an essential impact on the country's dominance in the development of L7 category electric microcars. The presence of key competitor landscapes and well-developed charging infrastructure encourages widespread adoption of L7 electric micro cars in the country.

U.K’s L7 Electric Micro Cars Industry: Trends & Potential till 2030

The U.K. is the home for electric vehicles considering the region. The country is driving the Europe L7 electric micro cars market’s expansion significantly with high demand for sustainable mobility solutions, access to well-established charging infrastructures, and government initiatives. The U.K.’s government is being engaged closely with car manufacturers to reduce production of petrol and diesel cars and develop fully electric production by 2030. Government support and encouragement of the adoption of electric microcars are shaping the market expansion in the country. Government funding and tax reduction initiatives for electric vehicles are transforming the L7 electric micro cars market in the country.

By Range Per Charge

By Battery Type

By Seats

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

September 2024