March 2025

Expanded Polystyrene Market (By Product: White, Grey; By Application: Construction, Packaging, Automotive, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

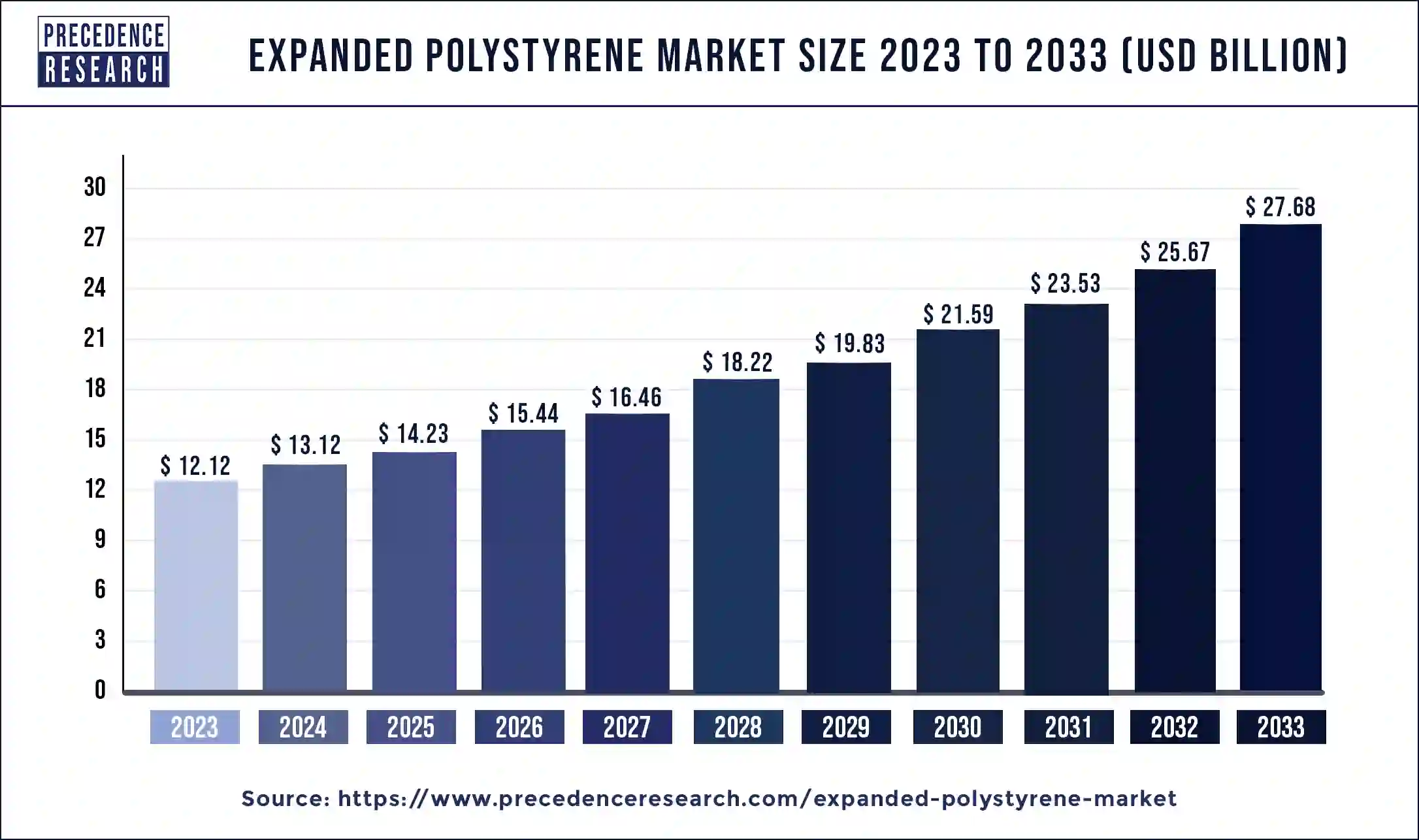

The global expanded polystyrene market size was exhibited at USD 12.12 billion in 2023 and is projected to hit around USD 27.68 billion by 2033, registering a CAGR of 8.65% during the forecast period from 2024 to 2033.

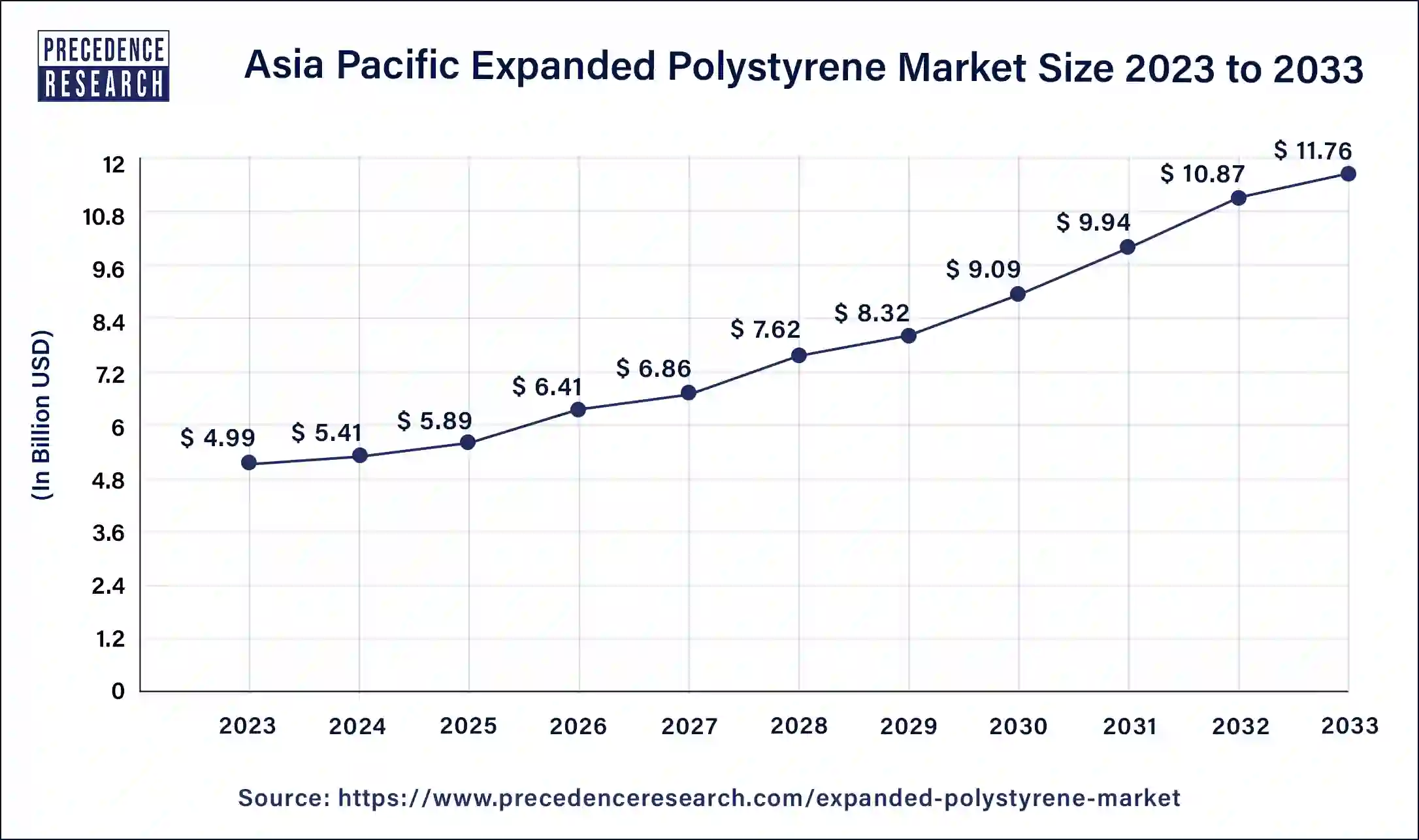

The Asia Pacific expanded polystyrene market size was valued at USD 4.99 billion in 2023 and is expected to reach USD 11.76 billion by 2033, growing at a CAGR of 9% from 2024 to 2033.

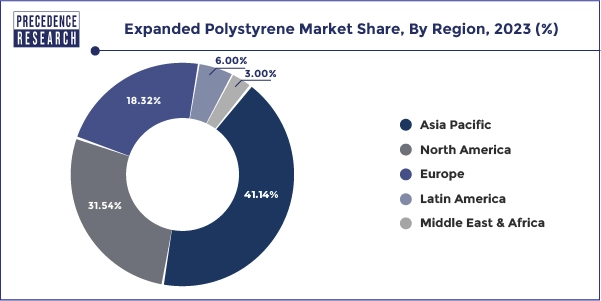

Asia Pacific has held the largest revenue share of 41.14% in 2023. Asia Pacific dominates the expanded polystyrenes market due to robust industrial and construction activities. The region's rapid urbanization, infrastructure development, and expanding manufacturing sectors drive significant demand for EPS in insulation, packaging, and diverse applications. Additionally, the booming e-commerce industry in countries like China and India fuels the need for lightweight and protective packaging, further enhancing EPS consumption. The continuous economic growth, coupled with favorable government policies, positions Asia-Pacific as a major contributor to the overall market share and growth of the EPS industry.

North America is estimated to observe the fastest expansion. North America holds a significant growth in the expanded polystyrenes market due to robust demand in the construction and packaging industries. The region's emphasis on energy-efficient construction, driven by stringent regulations, boosts EPS applications. Additionally, the thriving e-commerce sector fuels the need for lightweight and protective packaging, further contributing to EPS market dominance. Ongoing innovation and a strong focus on sustainability in packaging practices reinforce North America's key role, making it a major player in the EPS market.

Expanded Polystyrene Market Overview

Expanded polystyrene (EPS) is a lightweight and rigid cellular plastic material derived from the polymerization of styrene. It is commonly known as foam or Styrofoam, a trademarked term owned by Dow Chemical Company. EPS is created by expanding polystyrene beads using steam, which causes them to fuse together and create a closed-cell structure. This structure gives EPS its characteristic insulating properties, making it an excellent choice for various applications.

EPS is widely used in packaging, construction, and insulation due to its low thermal conductivity, affordability, and versatility. In construction, EPS is employed as insulation material for walls, roofs, and foundations, providing effective thermal resistance and energy efficiency. In packaging, its lightweight nature and shock-absorbing qualities make it ideal for protecting fragile items during transportation. While EPS has numerous practical applications, its environmental impact has raised concerns, as it is not easily biodegradable. Efforts are being made to promote recycling and sustainable disposal methods to mitigate these environmental concerns associated with EPS usage.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.65% |

| Market Size in 2023 | USD 12.12 Billion |

| Market Size by 2033 | USD 27.68 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Increasing awareness of energy efficiency and rising e-commerce activities

The increasing awareness of energy efficiency in construction practices has become a significant driver for the expanded polystyrenes market. Stringent regulations and a growing consciousness of environmental sustainability have led to a surge in demand for EPS as a thermal insulation material. Its lightweight and insulating properties make EPS a preferred choice for builders seeking energy-efficient solutions in residential, commercial, and industrial structures.

Simultaneously, the rising tide of e-commerce activities has propelled the demand for EPS in the packaging industry. With the exponential growth of online shopping, there is a heightened need for secure and lightweight packaging materials to protect goods during transportation. EPS, known for its shock-absorbing characteristics and cost-effectiveness, has become a go-to material for packaging fragile items, reinforcing its pivotal role in sustaining the burgeoning e-commerce market. As a result, the dual forces of energy efficiency awareness and the e-commerce boom synergistically contribute to the expanding market demand for expanded polystyrene.

Restraint

Recycling challenges

Recycling challenges pose a significant restraint on the growth of the expanded polystyrenes market. While EPS is technically recyclable, the lack of a widespread and efficient recycling infrastructure impedes its sustainable lifecycle. The lightweight and voluminous nature of EPS make collection and transportation for recycling economically challenging. Additionally, the cost-effectiveness of recycling operations is influenced by the demand for recycled EPS, which can be inconsistent. Limited awareness and access to EPS recycling facilities further contribute to the challenge.

The perception that EPS recycling is difficult and economically unviable hampers its overall sustainability profile. As environmental concerns intensify and recycling becomes a focal point in waste management, addressing these challenges is crucial for the EPS market to align with evolving regulatory standards and consumer expectations for environmentally responsible materials. Developing efficient and cost-effective recycling solutions will be instrumental in mitigating these constraints and fostering the sustainable growth of the EPS market.

Opportunity

Green innovations

Green innovations are pivotal in creating opportunities within the expanded polystyrenes market. The development of environmentally friendly EPS variants, such as bio-based or recycled content, aligns with the growing demand for sustainable materials. Companies investing in green innovations can differentiate themselves in the market, meeting consumer expectations and regulatory requirements for reduced environmental impact. These eco-friendly EPS options offer a compelling proposition for industries seeking sustainable solutions, contributing to the market's expansion.

As sustainability becomes a central focus across various sectors, including packaging and construction, the adoption of green EPS variants presents a strategic advantage. Furthermore, such innovations position EPS manufacturers to participate actively in circular economy initiatives, addressing concerns about plastic waste and supporting a more sustainable and responsible approach to material usage. Overall, green innovations not only open new avenues for growth in the EPS market but also contribute to the industry's positive environmental impact.

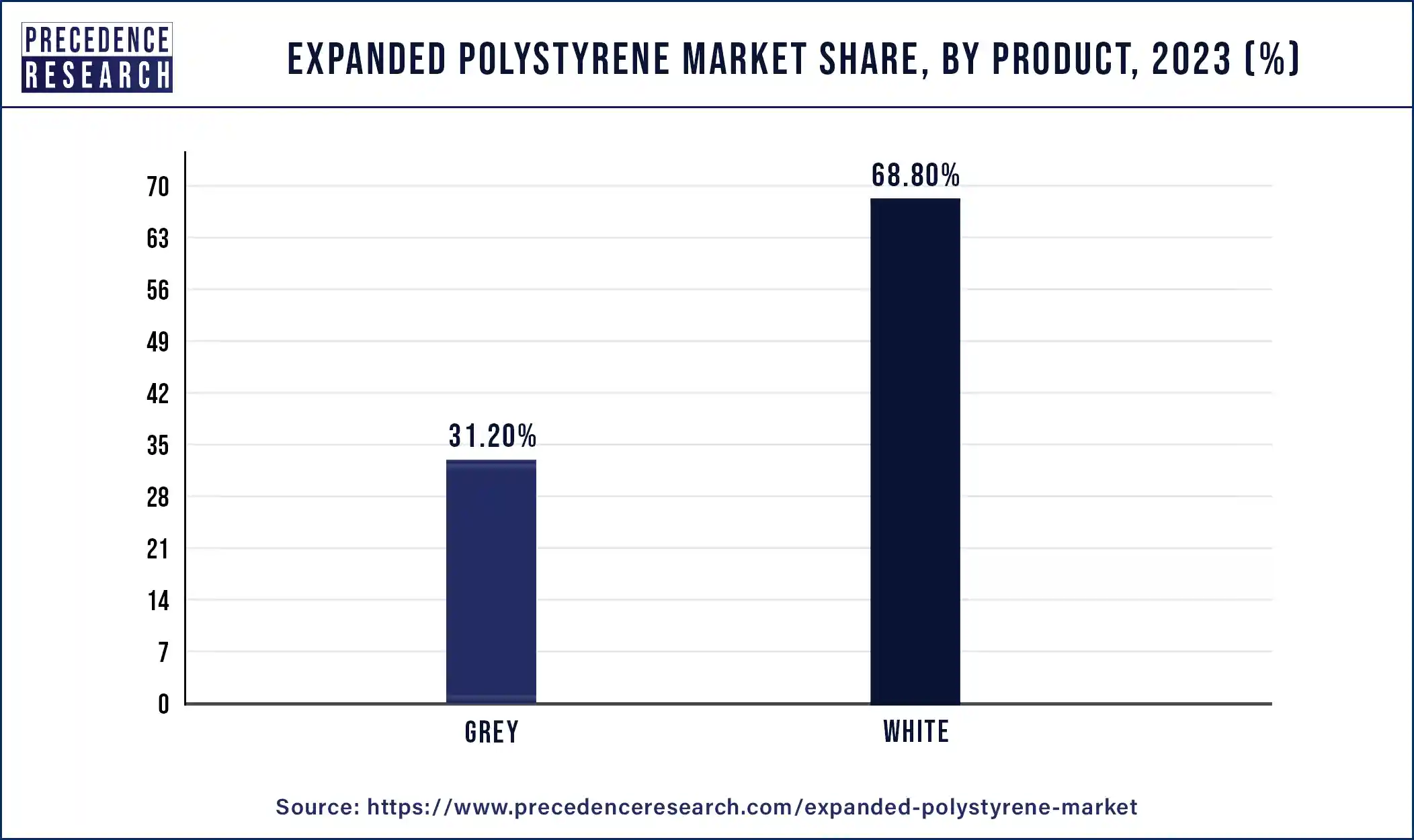

In 2023, the white segment had the highest market share of 68.80% based on the product. The segment in the expanded polystyrenes market refers to EPS products with a characteristic white color, often used in construction and packaging applications. This segment is witnessing a trend towards increased demand in the construction sector, driven by the growing need for energy-efficient insulation materials. The white EPS products are favored for their thermal insulation properties and versatility in diverse construction applications. As sustainability gains importance, there is also a trend towards developing eco-friendly white EPS variants, addressing environmental concerns and aligning with green building practices.

The grey segment is anticipated to expand at a significant CAGR of 9.2% during the projected period. In the expanded polystyrene (EPS) market, the "grey" segment refers to EPS with a graphite additive, enhancing its insulation properties. The addition of graphite particles enhances thermal performance by reflecting and absorbing radiant heat. This variant, often referred to as "grey EPS" or "graphite EPS," is gaining popularity in the construction industry due to its improved insulation efficiency. As energy efficiency becomes a priority in building design, the grey EPS segment is witnessing a rising trend, particularly in applications requiring enhanced thermal insulation for walls, roofs, and foundations.

According to the application, the construction segment has held 34% revenue share in 2023. The construction segment in the expanded polystyrenes market refers to the utilization of EPS in building and infrastructure applications. EPS is widely employed for thermal insulation in walls, roofs, and foundations due to its lightweight and excellent insulating properties.

A significant trend in this segment involves the increasing adoption of EPS as a sustainable and energy-efficient construction material. Stringent energy codes and regulations globally have driven the demand for EPS insulation solutions, contributing to its prominence in the construction industry as a preferred choice for enhancing building energy performance.

The packaging segment is anticipated to expand fastest over the projected period. In the expanded polystyrenes market, the packaging segment refers to the use of EPS in various packaging applications. EPS is widely employed for its lightweight, shock-absorbing properties, making it an ideal material for protective packaging.

In recent trends, there is an increased demand for EPS in e-commerce packaging, where its effectiveness in safeguarding fragile items during transportation is particularly valuable. Additionally, the packaging segment sees growth in sustainable packaging solutions, with a focus on recyclability and eco-friendly alternatives, aligning with broader industry efforts towards environmental responsibility.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

September 2024

September 2024

August 2024