January 2025

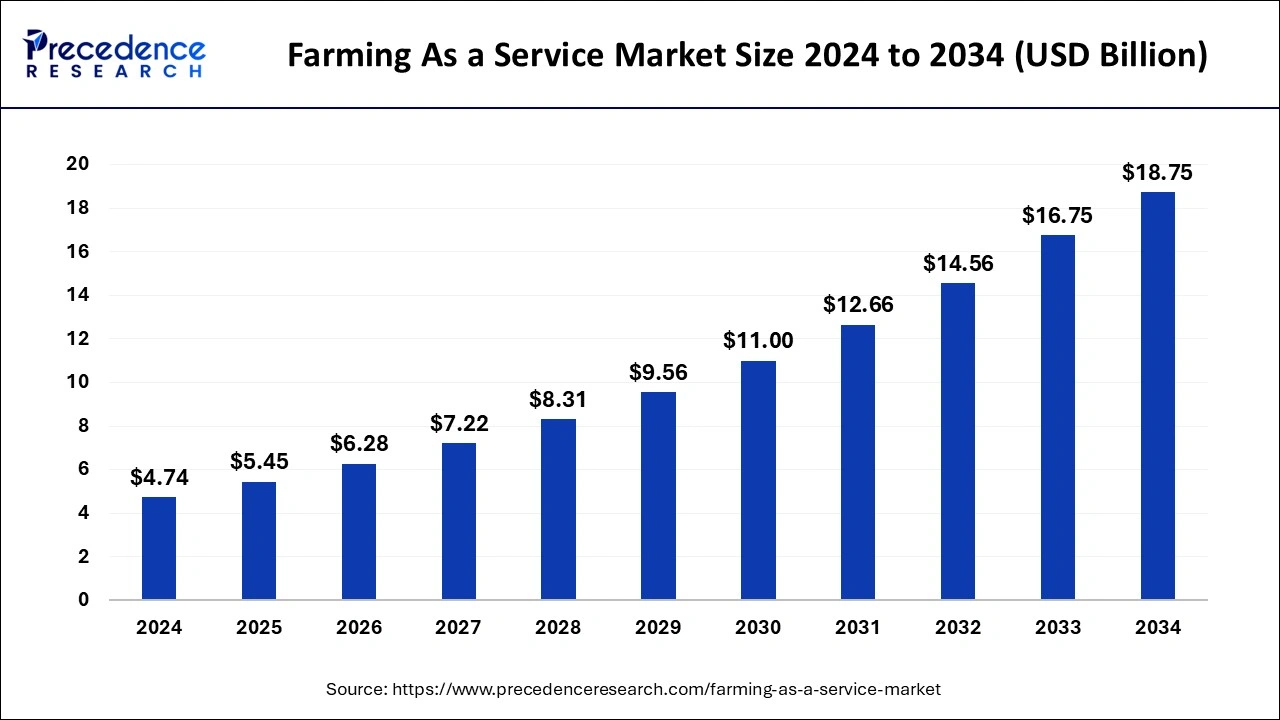

The global farming as a service market size is calculated at USD 5.45 billion in 2025 and is forecasted to reach around USD 18.75 billion by 2034, accelerating at a CAGR of 14.74% from 2025 to 2034. The North America farming as a service market size surpassed USD 2.18 billion in 2024 and is expanding at a CAGR of 14.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global farming as a service market size was estimated at USD 4.74 billion in 2024 and is predicted to increase from USD 5.45 billion in 2025 to approximately USD 18.75 billion by 2034, expanding at a CAGR of 14.74% from 2025 to 2034. Farmers can save money using FaaS, which eliminates the need for significant upfront expenditures in machinery and equipment, thus driving the growth of farming as a service market.

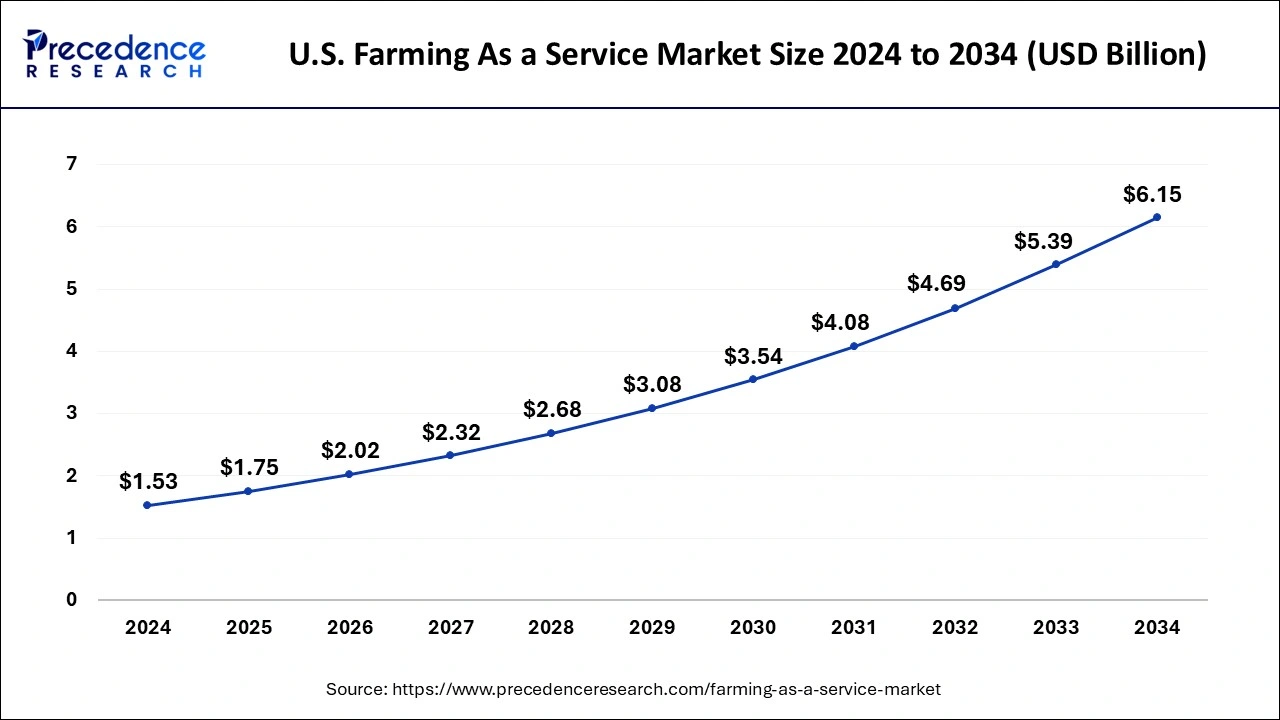

The U.S. farming as a service market size was valued at USD 1.53 billion in 2024 and is anticipated to reach USD 6.15 billion by 2034, growing at a CAGR of 14.93% from 2025 to 2034.

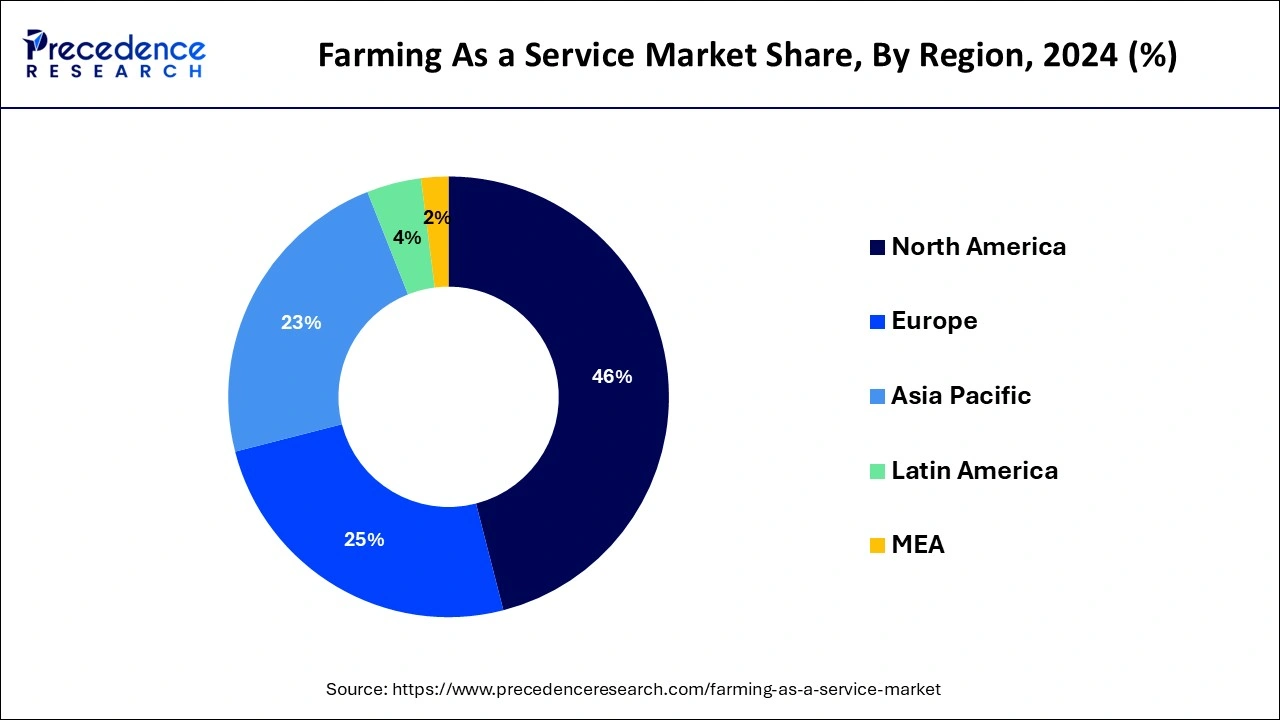

North America held the largest share of 46% in 2024. Farmers in this region were among the first to embrace agricultural technology because they saw how digital solutions might boost productivity, sustainability, and efficiency. The emergence of precision agriculture, facilitated by technological advancements like GPS, drones, sensors, and data analytics, has afforded service providers with prospects to deliver customized services such as yield monitoring, variable rate input application, and precision planting.

Due to a workforce scarcity in North America's agriculture industry, automation and mechanization are required. To overcome these obstacles, FaaS providers can provide services like robotic harvesting and autonomous machinery operation. Farmers are better equipped to manage their crops, allocate resources, and reduce risk when they have access to real-time data and analytics.

Asia Pacific is expected to witness significant growth in the farming as a service market during the forecast period. The adoption of technology has advanced quickly in the region, especially in nations like China, India, and Japan. This includes the pervasive use of internet-connected cellphones, IoT devices, and smartphones, all of which can be used in agricultural methods. Several regional governments are encouraging the use of technology in agriculture to solve issues related to food security, lessen the effects of climate change, and enhance rural livelihoods.

The expansion of FaaS providers may be encouraged by this support. Agriculture faces enormous problems from environmental deterioration and climate change. To reduce their adverse environmental effects, farmers can use FaaS to assist them in implementing more sustainable practices like precision irrigation and soil health monitoring.

The concept known as ‘Farming as a Service’ (FaaS) involves offering farmers agricultural services on a subscription or pay-per-use basis. This is frequently accomplished using digital platforms or technologically advanced solutions. The farming as a service market includes a variety of offerings to enhance agricultural output, effectiveness, and sustainability by combining knowledge and technology. This covers services like predictive analytics, drone-based aerial imagery, soil analysis, crop monitoring, precision agriculture, and farm management software. FaaS companies give farmers access to cutting-edge agricultural technologies and knowledge without requiring them to make significant upfront expenditures in infrastructure or equipment. These solutions are customized to meet the unique needs of farmers.

Due to regional variations in farm sizes, agricultural techniques, IT infrastructure, and regulatory frameworks, FaaS adoption varies. While emerging economies in Asia-Pacific and Latin America are also seeing significant potential, developed regions like North America and Europe are leading the way in the adoption of FaaS. It is anticipated that the farming as a service market will expand further as farmers come to understand the advantages of implementing digital technologies to enhance sustainability and streamline their operations. For small-scale farmers, the initial setup expenditures for putting FaaS solutions into practice, including hardware and software, can be unaffordable. Some farmers may find it challenging to integrate FaaS solutions with the workflows and farm management systems that are currently in place.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.74% |

| Market Size in 2025 | USD 5.45 Billion |

| Market Size by 2034 | USD 18.75 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Services, By Delivery Model, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enhanced sustainability

Using sensors, drones, IoT devices, satellite imagery, and other precision agriculture tools to monitor crop health, soil moisture, and nutrient levels lessens waste and its negative effects on the environment by enabling the targeted deployment of resources and promoting the use of regenerative farming techniques such as agroforestry, crop rotation, cover crops, and less tillage. These methods lessen erosion and nutrient runoff, increase biodiversity, improve soil health, and sequester carbon.

It is encouraging the use of climate-resilient agricultural varieties, such as heat- or drought-tolerant ones, that need less inputs and are more tolerant of shifting climatic circumstances and putting into practice methods that increase resource efficiency, such as integrated pest control plans, energy-efficient equipment, and irrigation systems that use less water. Such requirements for enhanced sustainability promise a significant driver for farming as a service market.

Data privacy and security concerns

FaaS platforms can gather personal data about farmers, including contact information, financial data, and data relevant to their farms. This data could be abused or accessed by unauthorized individuals. Ransomware and other malicious software can compromise data availability and integrity by infecting FaaS systems. This might have severe repercussions for farmers who depend on these platforms to make crucial decisions. FaaS technology supply chains include several partners and vendors, each of whom could be a weak point in cybersecurity. Farmers must evaluate the security protocols of all parties participating in the FaaS ecosystem. Such data privacy and security concerns act as restraint for farming as a service market.

Supply chain optimization

To precisely predict demand, one can use machine learning algorithms and data analytics to make sure that resources are deployed effectively and optimize production schedules by having a thorough awareness of seasonal fluctuations, market trends, and client preferences. Inventory management systems help monitor supplies, machinery, and final goods through the supply chain. These technologies can reduce carrying expenses, avoid waste, and have fewer stockouts by keeping your inventory levels at ideal levels. They also reduce lead times and transportation expenses by streamlining routes and modes of conveyance. FaaS uses technologies such as GPS tracking and route optimization software to increase fleet visibility and efficiency.

The farm management solutions segment held the largest share of farming as a service market in 2024. They are monitoring crops, soil conditions, weather patterns, and insect infestations with the use of sensors, drones, satellite imaging, and other IoT devices. Farmers can use this information to make well-informed decisions about pest management, fertilization, and irrigation. Software applications that help farmers with crop rotation planning, crop selection that is appropriate for their land, and scheduling of plantings are some of the facilities provided by the farming as a service market.

Additionally, these tools could offer suggestions for the ideal planting spacing and density. They are keeping track of the quantities of pesticides, fertilizers, seeds, and other inputs in stock. This makes it easier for farmers to make sure they have the goods they need on hand and can place new orders quickly. Financial analysis, tracking, and budgeting tools assist farmers in making strategic financial decisions. This may include elements like forecasting tools, profit and loss accounts, and cost analysis by acre or hectare.

They are keeping an eye on the use and maintenance plans of agricultural machinery like harvesters, tractors, and irrigation systems. This prolongs the life of machinery, reduces downtime, and maximizes equipment use. They are helping farmers adhere to laws about labor management, environmental preservation, and food safety. Creating reports for governmental organizations, accrediting authorities, and other stakeholders may fall under this category.

Numerous farm management solutions come with mobile apps that let farmers access important information and carry out necessary chores while they're out in the field. This increases overall efficiency and permits decision-making in real time. Compatibility with additional technology, software, and data sources for agriculture. This facilitates the consolidation of data from many sources and optimizes farming operations.

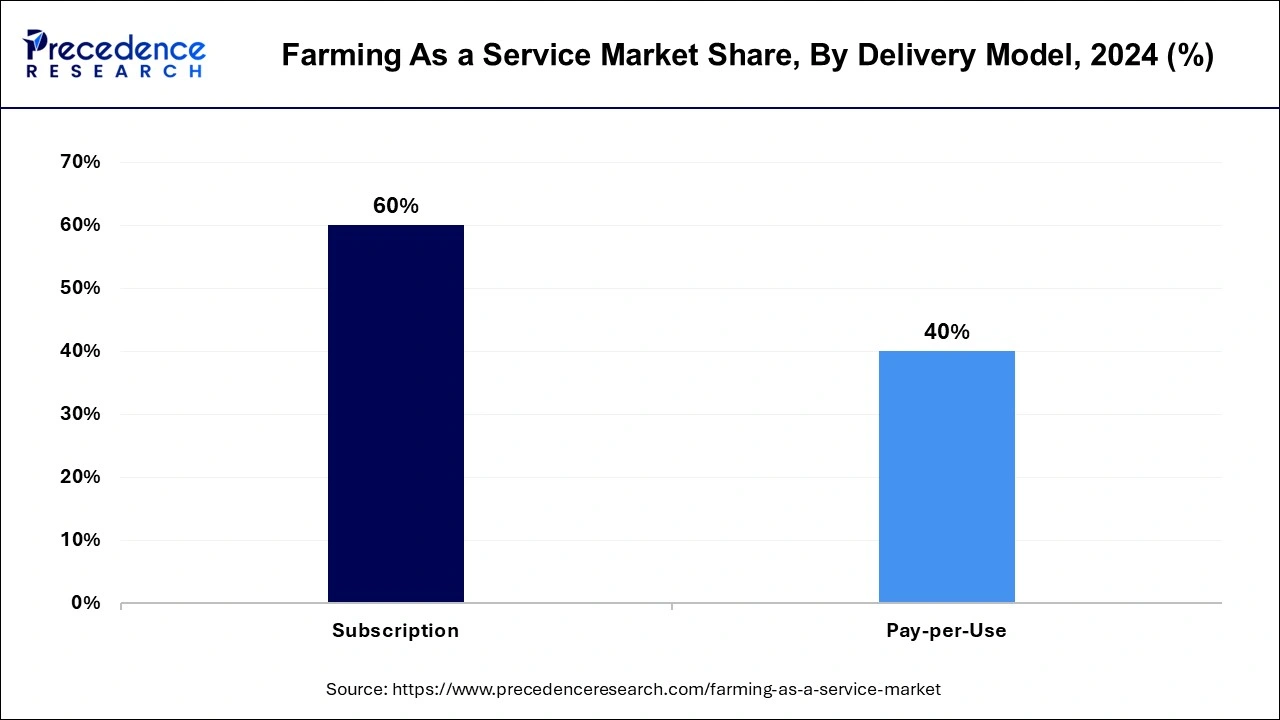

The subscription delivery model held the largest share of the farming as a service market in 2024, the subscription delivery model is a business strategy where farmers pay a subscription fee to access farming technology or specific agricultural services on a recurrent basis. With this arrangement, farmers may access the most recent agricultural technologies, knowledge, and resources without having to make a substantial initial investment in infrastructure or equipment. FaaS companies offer a range of subscription plans designed to meet the requirements of farms of varying sizes and sorts. Access to services like precision farming, soil analysis, crop monitoring, pest control, irrigation management, equipment leasing, and even professional agronomists or agricultural consultants may be provided under these programs.

To use the services offered by their selected subscription plan, farmers must pay a regular membership cost, usually once a month or once a year. Various factors, like the size of the farm, the level of service, and the length of the subscription, may affect the fee structure. Farmers who subscribe to the FaaS provider's services get access to cutting-edge farming technologies, software platforms, and tools.

Drones, sensors, satellite imaging, data analytics software, IoT gadgets, and other digital farming solutions targeted at enhancing agricultural productivity, efficiency, and sustainability may be among these technologies. Because of the scalability and flexibility of the subscription model, farmers can modify their programs to accommodate shifting crop varieties, seasonal demands, or farm requirements.

The farmers segment held the largest share of the farming as a service market in 2024. This group includes a diverse spectrum of farmers engaged in crop farming, livestock breeding, aquaculture, and horticulture, among other agricultural activities. Farmers who use FaaS services can be primary commercial agricultural operations or tiny, family-run farms. The extent of operations and the financial means at the farmers' disposal can influence the adoption of FaaS solutions. This group of farmers demonstrates differing degrees of digital literacy and technology usage.

While some farmers may be early adopters of cutting-edge agricultural technologies, others would need assistance and training to incorporate FaaS solutions into their farming operations. Geographically diversified, the farmer's segment in the farming as a service market is global, including many areas and climates.

Farmers are looking more and more for FaaS solutions to increase productivity, lower input costs, lessen their impact on the environment, and improve agriculture's sustainability. To meet these needs, FaaS providers provide services like predictive maintenance, livestock management, soil monitoring, precision farming, and crop analytics. By using FaaS services, farmers may access real-time data, analytics, and insights that help them make wise decisions and manage their farm operations proactively.

With FaaS services, farmers can access cutting-edge agricultural technologies and knowledge without having to make a sizable upfront investment. These services are often provided on a subscription or pay-per-use basis. To supply comprehensive solutions suited to farmers' needs, FaaS providers frequently work with agritech startups, government agencies, research organizations, and manufacturers of agricultural equipment.

By Services

By Delivery Model

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024