November 2024

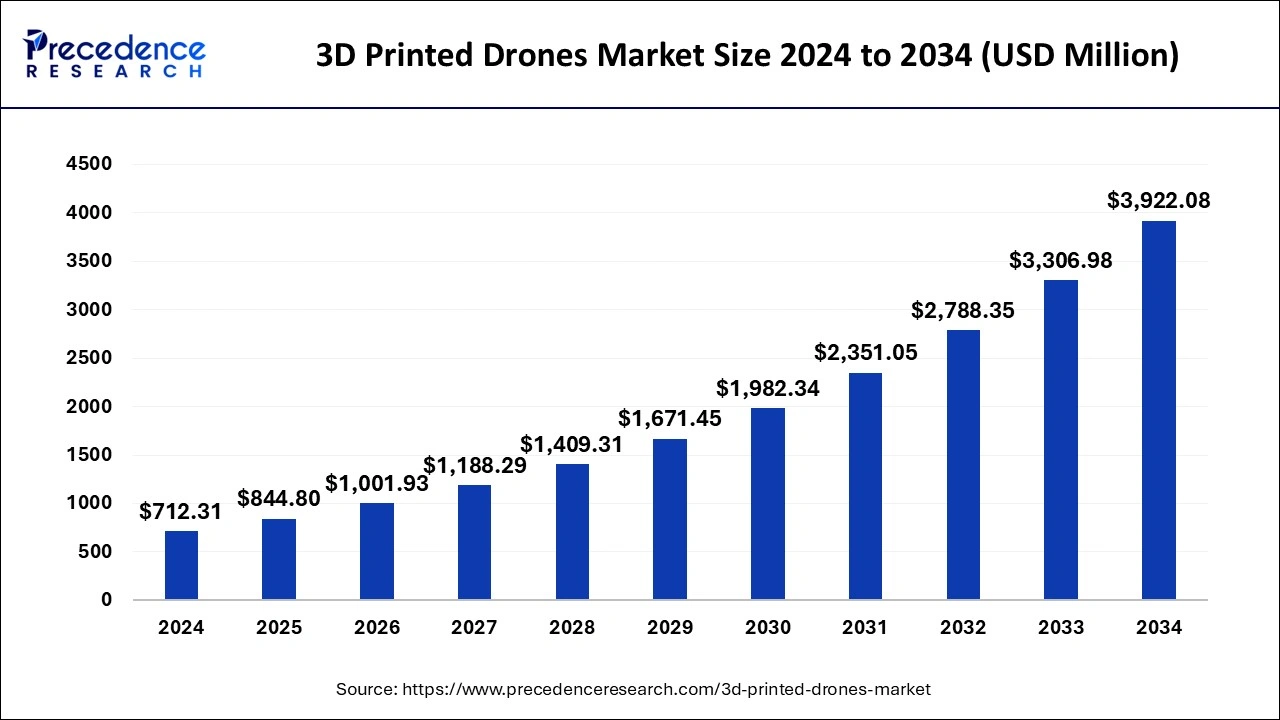

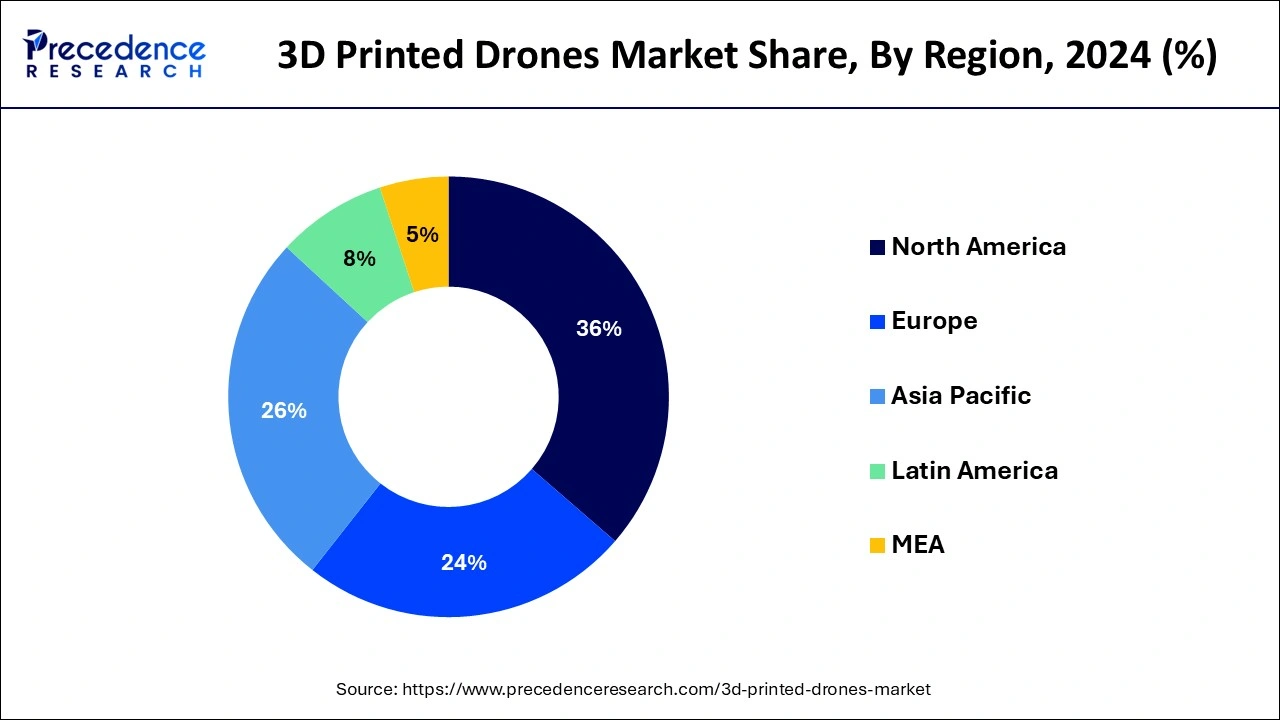

The global 3D printed drones market size is accounted at USD 844.80 million in 2025 and is forecasted to hit around USD 3,922.08 million by 2034, representing a healthy CAGR of 18.60% from 2025 to 2034. The North America market size was estimated at USD 256.43 million in 2024 and is expanding at a CAGR of 18.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Million), with 2024 as the base year.

The global 3D printed drones market size was calculated around USD 712.31 million in 2024 and is anticipated to reach around USD 3,922.08 million by 2034, growing at a CAGR of 18.60% from 2025 to 2034. The 3D printed drones market is growing steadily because of sustained demand from the defense and aerospace, agriculture, and logistics sectors, cost-effectiveness, along with favourable government policies also fuels market expansion.

The newly developed technologies, including artificial intelligence (AI), machine learning, and Internet of Things (IoT), have been integrated into the 3D printed drones market. AI & Machine Learning have the potential to improve drone technological features such as self–operation and powerful analysis of data collection. Artificial intelligence added to 3D printing technology improves the design and functionality of drones, thereby improving their efficacy. The function of AI is not only to increase production rates but also to enhance the functioning of drones. It leads to higher precision, efficiency, and material usage, which are critical in industrial applications.

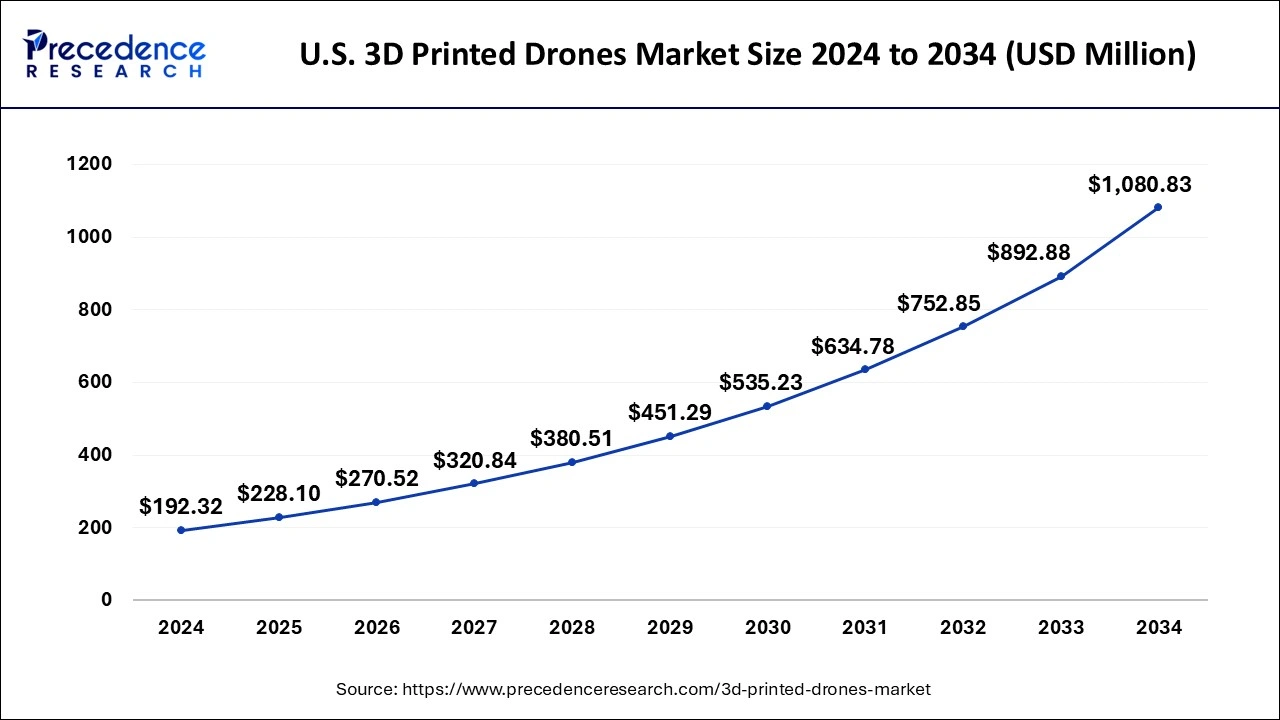

The U.S. 3D printed drones market size was evaluated at USD 192.32 million in 2024 and is projected to be worth around USD 1,080.83 million by 2034, growing at a CAGR of 18.84% from 2025 to 2034.

North America accounted for the largest 3D-printed drones market share in 2024. The market leadership of North America is further supported by the concentration of key drone manufacturers and a highly advanced drone industry ecosystem that fosters innovation and the use of high-performance, complex drone manufacturing facilitated by 3D printing technology. The U.S. market is growing rapidly due to robust investment in aerospace and defense sectors and gaining use in commercial applications.

Major market players are particularly working on the quality of the material used, as well as the printing methods to boost drone performance and opportunities. Besides, the growth of UAV hobbyists and recreational activities is also contributing to market growth. As North America continues to lead in technological innovation, the 3D-printed drone market will experience growth due to commercial and recreational purposes.

Asia Pacific is anticipated to witness the fastest growth in the 3D printed drones market during the forecasted years. With the help of 3D manufacturing, lightweight and complex components for drones can be designed quickly and for a low cost, opening the way to the immediate prototyping of their parts. China, India, and Japan are at the forefront of drone manufacturing; there is significant investment in research and development, most especially by start-ups involved in the manufacture of drone’s different models.

Additionally, favorable government policies and a supportive regulatory environment are further fueling market expansion. Increasing demand for more effective and varied drones for commercial operations and government systems in the Asia Pacific market is also expected to boost demand for 3D-printed drones shortly.

3D-printed drones are transforming UAV technology through additive manufacturing, allowing for the construction of more customizable, lighter, and inexpensive components. This innovation improves the maneuverability of drones and is crucial in developing new drones faster, making drone development quicker and, therefore, more efficient. The market has been growing because of the rising demand for drones. Its expansion is attributed to the increasing development of miniature and multifunctional economic UAVs in the military, agricultural, and logistics industries. Beyond increasing its efficiency, this capability contributes to the growth of adoption across industries seeking efficiency and customization.

| Report Coverage | Details |

| Market Size by 2024 | USD 712.31 Million |

| Market Size in 2025 | USD 844.80 Million |

| Market Size in 2034 | USD 3,922.08 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.60% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Type, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for customization and prototyping

Customization is typically achieved to the highest level with the help of 3D printing, which means that drones can be developed for their intended function. This flexibility in design supports a wide range of applications, from recreational to commercial and military uses in the 3D printed drones market. In addition, 3D printing lowers manufacturing costs since it cuts on the amount of material that is used, reducing the wastage factor and making production easier. This cost-effectiveness is attractive to small-scale start-ups as well as other large-scale firms due to the increased uptake of 3D-printed drones across industries.

The ability of 3D printed drones market technology to quickly produce prototypes and final products accelerates the development cycle for new drone models. With this capability, companies can create designs, test them in real-world situations, and introduce to the market products much faster than using conventional manufacturing techniques.

Material limitations and durability concerns

The 3D printed drones market has substantial difficulties, most of which relate to material constraints and stability issues. On the other hand, 3D printing can provide flexibility and cost-effectiveness, but the supply of the materials appropriate for the production of drones remains limited. Materials that are used in 3D printing may not possess adequate strength, heat resistance, or fatigue limit for high-performance or high-stress uses. This limits the pliability of 3D-printed drones to operate effectively in complex situations.

Drone-as-a-Service models

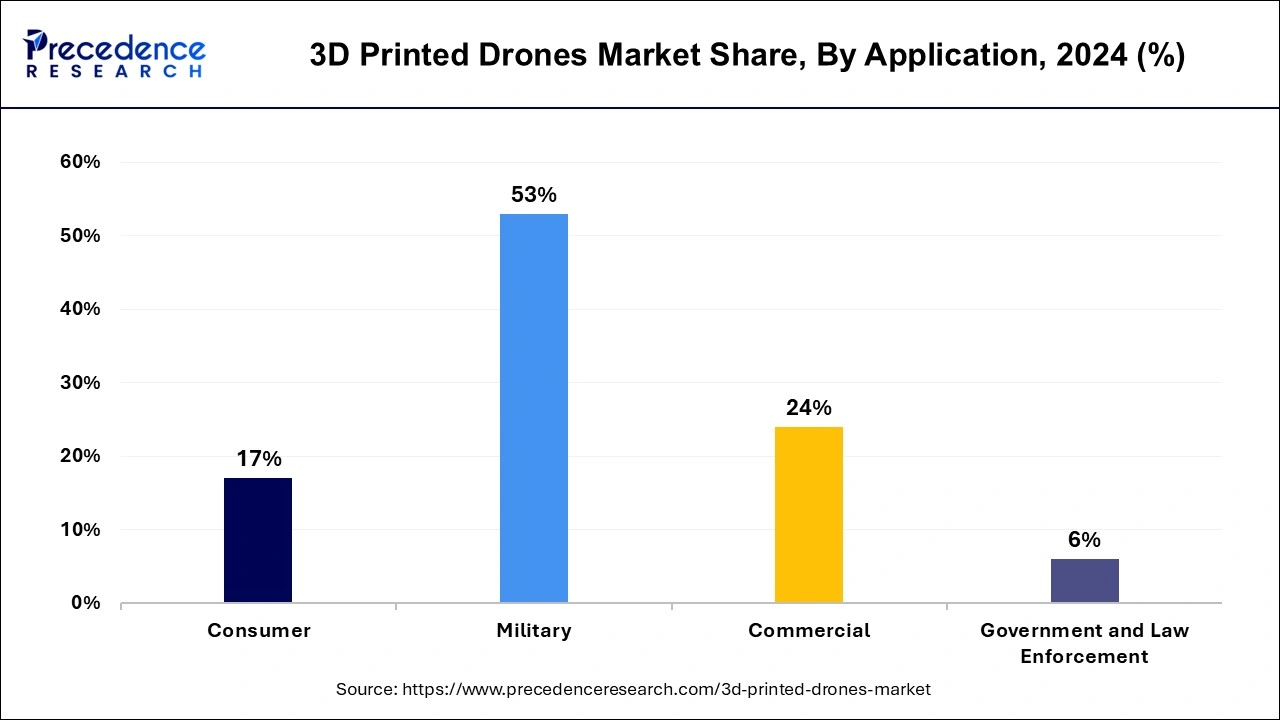

An adaptable business model that enables the business sector to use drone services with no need for equipment, software, trained personnel, and training. Drone services in the 3D printed drone market can also be described as unmanned aerial systems (UAS) services. Drones can be used for mapping, surveying, construction, agriculture, and disaster management.

This Drone-as-a-Service (DaaS) business model enables companies to rent 3D-printed drones. The service model is most effective in emerging 3D printed drones market as the scope of using drones is rapidly growing due to the increased digitalization of industries. Moreover, the Drones-as-a-Service model is gaining traction, offering on-demand drone services and decreasing the need for ownership.

The multi-rotor segment noted the largest 3D printed drones market share in 2024. Due to their versatility, ease of use, and capability to hover, they are suitable for applications such as aerial photography, agriculture, and surveillance. Its design, coupled with the ability for 3D printing, has, therefore, helped multi-rotor drones find applications in industries that involve low altitude and precise navigation. Multi-rotor models are preferred for their agility, stability, and easy control. In comparison with other types, these aerial platforms can be used for photography, monitoring, and inspection. It has preferred multi-rotor drones because of their stability in achieving vertical takeoff/landing, moving in confined areas, and hovering in a specific area, which is significant for aerial filming, monitoring, and delivery services.

The hybrid segment is projected to witness the fastest growth in the 3D printed drones market during the forecast period. It is possible to design and build hybrid drones as these are UAVs containing components produced through 3D printing technology. The type of mixed characteristics is especially appealing for applications that demand both long flight duration and versatility of the flight environment. Innovation in the 3D printer technology allows the production of lightweight and complex hybrid designs.

The airframe segment has contributed the largest 3D printed drones market share in 2024. Airframes are beneficial for housing key components, including sensors, cameras as well as batteries, and for forming the framework on which other sections, such as wings and propellers, are installed. Rapid prototyping and customizing airframes to meet requirements have made 3D printing a desired method for manufacturers, mainly in the military and commercial sectors, where performance and reliability are dominant. 3D-printed airframes can be fine-tuned for better aerodynamics, strength, or lighter weight, improving overall performance.

The wings segment is projected to witness the fastest growth in the 3D printed drones market during the forecast period. Highly optimized wings made through advanced 3D printing technology offer great strength and lightweight solutions and achieve better lift and maneuvers for drones. An increase in long-range applications, logistics, agriculture, surveillance, and other applications has boosted the requirement for sophisticated wing designs.

The fused deposition modeling (FDM) segment recorded the highest share of the 3D printed drones market in 2024. FDM is one of the traditional 3D printing technologies used to create an object's structure using thermoplastic material. The success of FDM in both affordability and availability proves ideal for both new entrants and veterans in the field of 3D printing. This technology is particularly preferred because it generates strong functional parts economically, and this is especially suitable for the production of drone frames and housings. The developments made helped to broaden the scope of FDM not only for prototyping but also for producing various drone parts that might require great detail and dependability.

The stereolithography (SLA) segment is projected to witness the fastest growth in the 3D printed drones market during the forecast period. SLA works by using a laser to solidify a liquid resin into a solid part, and manufacturers can make lighter and more complex designs for sophisticated drones used for tasks such as delivering medical supplies and providing images of high resolution. SLAs generate highly accurate and intricate components with complicated shapes, which makes them relevant in the application of drone interior structures and aerodynamic casing. The adoption of SLA in the drone industry is progressing because in defense and commercial delivery segments where quick market entry and design optimization are vital. These developments are driving innovation and competitiveness in drone manufacturing.

The military segment has contributed the largest share of the 3D printed drones market in 2024. Around the world, the military is incorporating 3D printing technology in the manufacture of customized drone equipment for specific missions, time efficient and less costly. The assimilation of 3D printing technology in military systems has been driven by the need for specific tools, such as drones, which can be developed through 3D printers at considerably reduced costs. These capabilities are of special importance in reconnaissance and planning strategies, depending on the constant development and shifting of threats.

The government and law enforcement segment is projected to witness the fastest growth in the 3D printed drones market during the forecast period. Government and law enforcement applications use drones for several applications, such as monitoring large crowds, border security, and search and rescue operations in the industrial and warehouse industries and in the passenger as well as public transport industries.

By Component

By Technology

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025