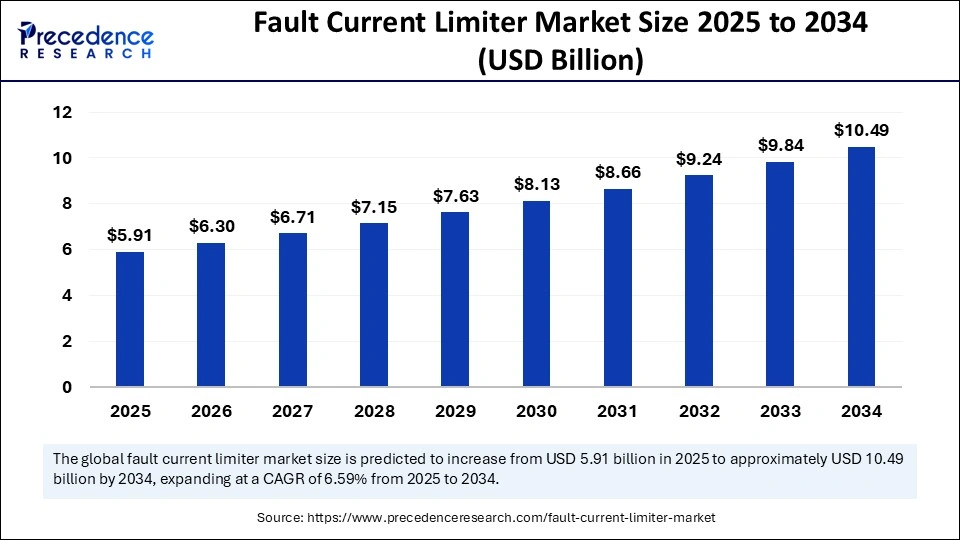

The global fault current limiter market size is calculated at USD 5.91 billion in 2025 and is forecasted to reach around USD 10.49 billion by 2034, accelerating at a CAGR of 6.59% from 2025 to 2034. The Asia Pacific market size surpassed USD 2.44 billion in 2024 and is expanding at a CAGR of 6.71% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fault current limiter market size accounted for USD 5.54 billion in 2024 and is predicted to increase from USD 5.91 billion in 2025 to approximately USD 10.49 billion by 2034, expanding at a CAGR of 6.59% from 2025 to 2034. Increasing the use of superconducting fault current limiters (SFCLs) is the key factor driving the growth of the market. Also, technological advancements in superconducting materials coupled with the growing focus on grid modernization can fuel market growth further.

Artificial Intelligence plays a crucial role in the market by enhancing the reliability, efficiency, and adaptability of the fault current limiter market. Driven techniques such as expert systems, fuzzy logic, and optimization algorithms are utilized to improve overall FCL performance and forecast potential issues. Furthermore, AI optimizes the coordination of FCLs, reduces outage areas, and improves system reliability. Predictive analysts predict potential failures, enabling proactive maintenance.

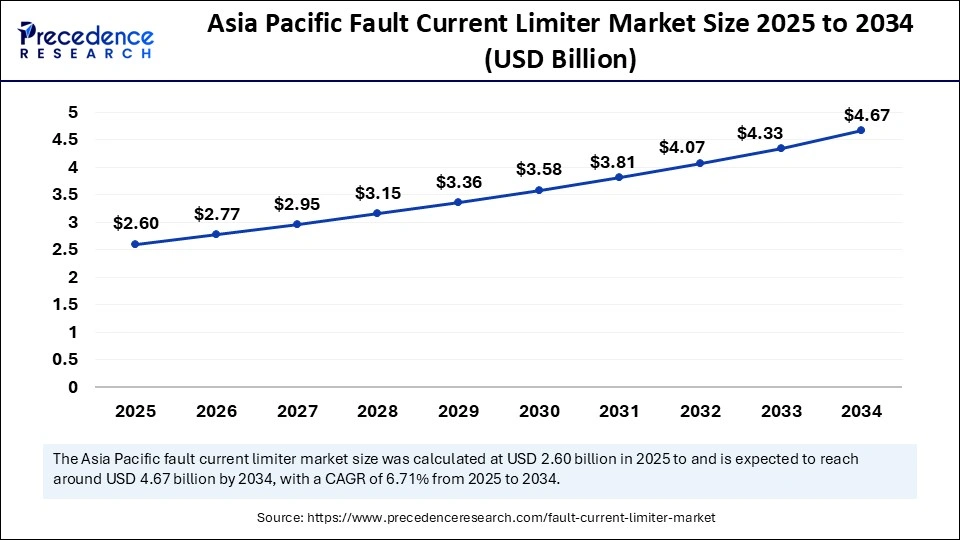

The Asia Pacific fault current limiter market size was exhibited at USD 2.44 billion in 2024 and is projected to be worth around USD 4.67 billion by 2034, growing at a CAGR of 6,71% from 2025 to 2034.

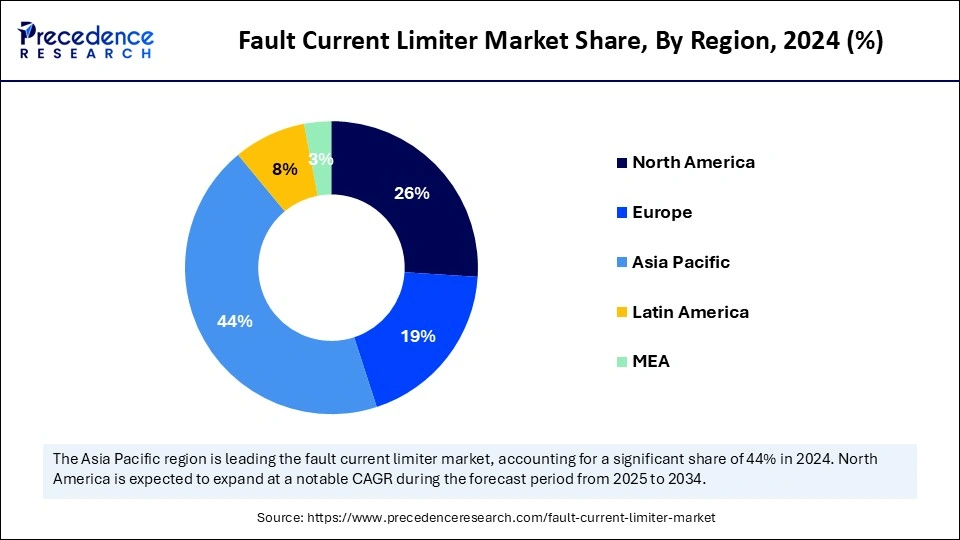

Asia Pacific held the largest fault current limiter market share in 2024. The dominance of the region can be attributed to the ongoing urbanization and industrialization occurring across many industries, such as China, India, and Japan. The increasingly growing transmission and distribution (T&D) infrastructure in this country is escalating the market reach in the region during the forecast period. Moreover, operators in the power generation field are rapidly investing in advanced power generation facilities to fulfill the increasing demand for power.

In Asia Pacific, China led the market owing to the country's robust plans for renewable energy integration and grid modernization. Also, the government in the country, emphasizing building resilient and strong power infrastructure, along with significant investments in power generation projects, is fueling the demand for innovative fault current limiters.

The North American fault current limiter market is expected to grow at the fastest rate over the period studied. The growth of the region can be credited to the low maintenance cost and high energy efficiency of these limits. The expansion of distributed generation and the integration of renewable energy sources will soon impact positive regional growth. Furthermore, technological innovations in FCL design, like the development of solid-state and superconducting limiters, are anticipated to contribute to market growth during the forecast period.

In North America, the U.S. dominated the fault current limiter market. The dominance of the region can be credited to the significant investment in innovative grid technologies, such as fault current limiters, to safeguard its extensive electrical infrastructure from the growing risks of fault currents and short circuits.

The market refers to the sector involved in the development, manufacturing, and sale of devices that restrict the quantity of current passing through a system during some electrical issues, like short circuits. Also, these devices safeguard equipment from potential damage and help monitor the proper stability of grids.FCLs have different applications, such as in distribution networks, power transmission, renewable energy projects, and industrial facilities.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.49 Billion |

| Market Size in 2025 | USD 5.91 Billion |

| Market Size in 2024 | USD 5.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.59% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Voltage Range, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for enhanced power grid infrastructure

The major factor driving the market's growth is the growing demand for improved and sophisticated power grid infrastructure and the rising shift towards the adoption of renewable energy applications. In addition, different visitors, glass, diodes, copper, solenoids, and metal wings are also involved in fault current limiters. The latest fault limiter shows a raised reliance on industrial lines of the future.

Low affordability and high cost

Deploying fault current limits can cause substantial costs, such as installation costs, all equipment costs, and some power shifts to current systems. Hence, the willingness and affordability of stakeholders to invest in this sector can pose a substantial challenge, particularly in small-budget items. However, some FCL technologies lack well-established track records, which can lead to hesitation among companies and consumers to adopt this option.

Grid modernization

Ongoing efforts to modernize power grids, such as the integration of distributed energy resources and renewable energy sources, often include the use of FCLs, which will likely create significant market opportunities in upcoming years. Furthermore, superconducting FCLs offer benefits in terms of weight, size, and performance as compared to conventional FCLs, which makes them convenient for an extensive range of applications.

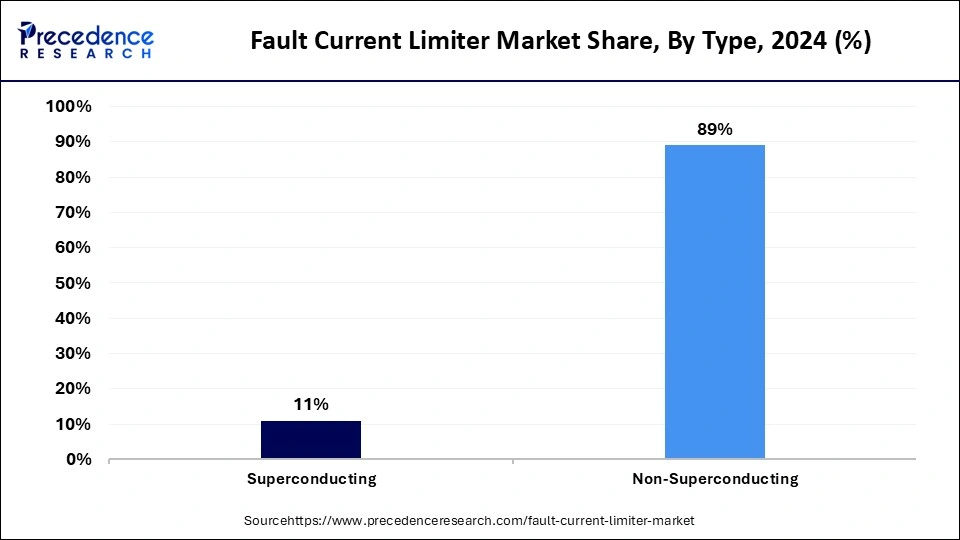

The superconducting segment dominated the fault current limiter market in 2024. The dominance of the segment can be attributed to the lower costs, reliability, and extensive applicability of this segment across different power systems. Additionally, the superconducting FCLs are more cost-effective as compared to other types. The materials used in non-excessive FCLs are more viable, which makes them useful for power system operators and companies.

The non-superconducting segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to its crucial role in tackling the challenges related to fault currents in power systems. Also, this segment encompasses an extensive range of materials where superconductivity is not required, such as many traditional materials and conductors used in different electronic devices and infrastructure.

The high voltage segment held the largest fault current limiter market share in 2024. The dominance of the segment can be linked to the growing demand for innovative protection solutions in high-voltage power grids. This segment mainly emphasizes FCLs designed for high-voltage transmission lines, which are important for safeguarding grid infrastructure from fault currents to ensure reliability. Countries are also heavily investing in expanding and modernizing power grids, which can positively impact segment growth.

The medium voltage segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the ongoing expansion of medium-voltage power grids, combining renewable energy sources into current networks. In addition, the medium voltage current limiter devices can be utilized to safeguard electrical systems by restraining the amount of fault currents. These types of FCL are essential for preventing equipment damage.

In 2023, the power stations segment dominated the fault current limiter market by holding the largest share. The dominance of the segment is owing to the important role of fault current limiters in improving the overall reliability and safety of power stations, which are crucial to electricity generation. Moreover, the surge in outdoor recreational activities and technological innovations in battery technology and portability is impacting positive segment growth soon.

The oil and gas segment is projected to grow rapidly during the forecast period. The growth of the segment is due to the increasing use of FCLs in different oil and gas facilities, such as refineries, pipelines, power plants, and offshore platforms. Furthermore, FCLs are important for safeguarding electrical systems in these settings from the damaging effects of fault currents. Both non-superconducting and superconducting FCLs are utilized in oil and gas applications.

By Type

By Voltage Range

By End Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client