February 2023

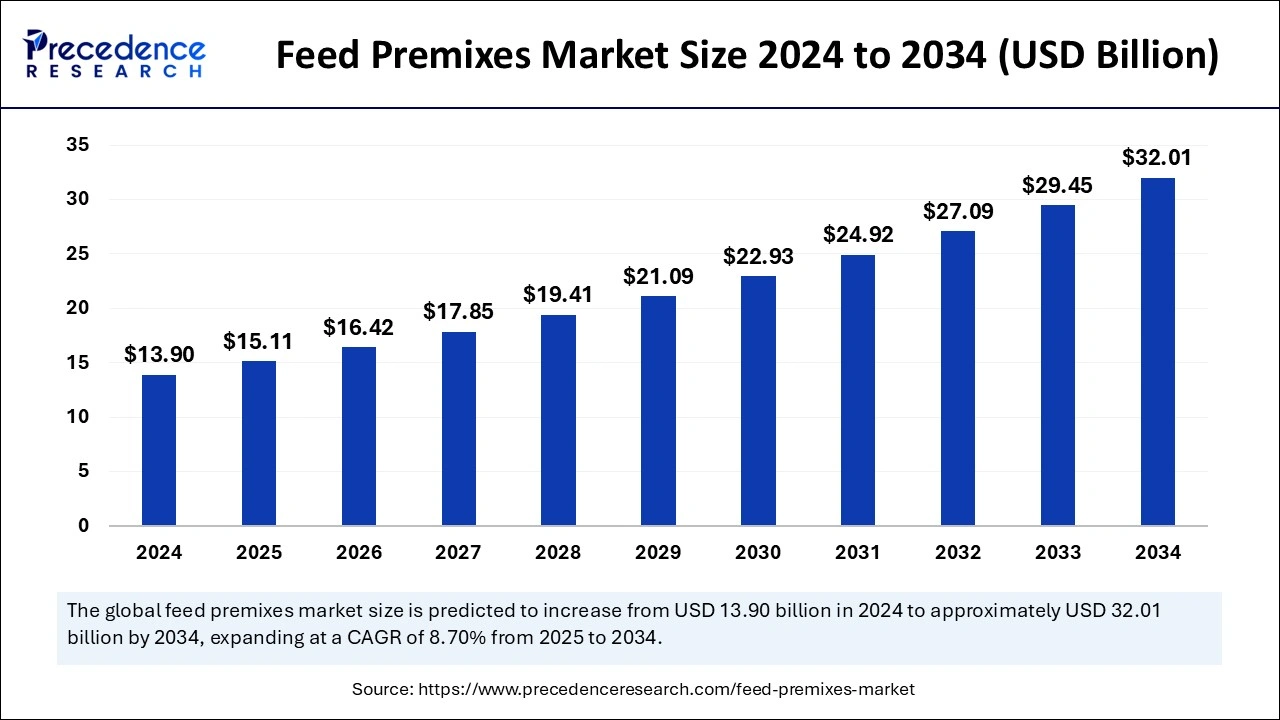

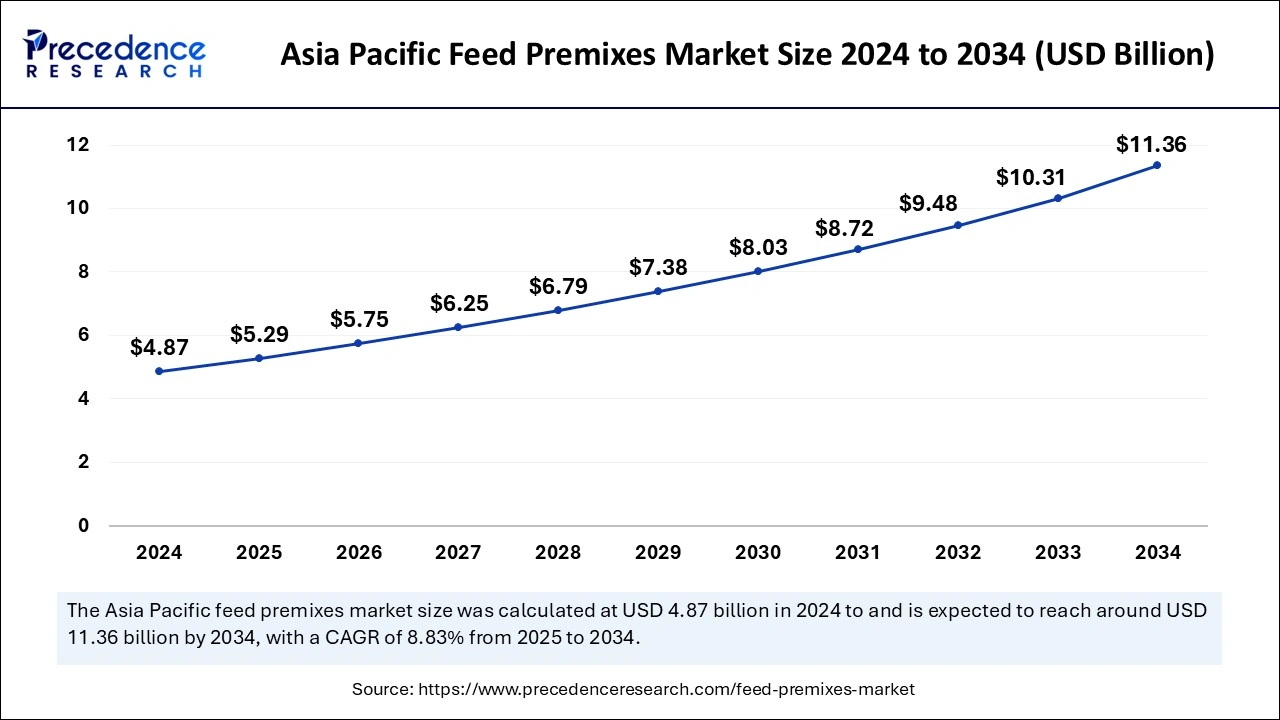

The global feed premixes market size is accounted at USD 15.11 billion in 2025 and is forecasted to hit around USD 32.01 billion by 2034, representing a CAGR of 8.70% from 2025 to 2034. Asia Pacific market size was estimated at USD 4.87 billion in 2024 and is expanding at a CAGR of 8.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global feed premixes market size was estimated at USD 13.90 billion in 2024 and is predicted to increase from USD 15.11 billion in 2025 to approximately USD 32.01 billion by 2034, expanding at a CAGR of 8.70% from 2025 to 2034.

Artificial intelligence is substantially revolutionizing the feed premixes market by improving the precision and efficiency in feed formulation and production systems to facilitate the analysis of huge data sets to stimulate nutrient profiles, decrease waste, and enhance overall feed quality. Furthermore, AI-powered predictive analytics helps predict demands more precisely, helping manufacturers manage inventory.

Asia Pacific feed premixes market size was evaluated at USD 4.87 billion in 2024 and is projected to be worth around USD 11.36 billion by 2034, growing at a CAGR of 8.83% from 2025 to 2034.

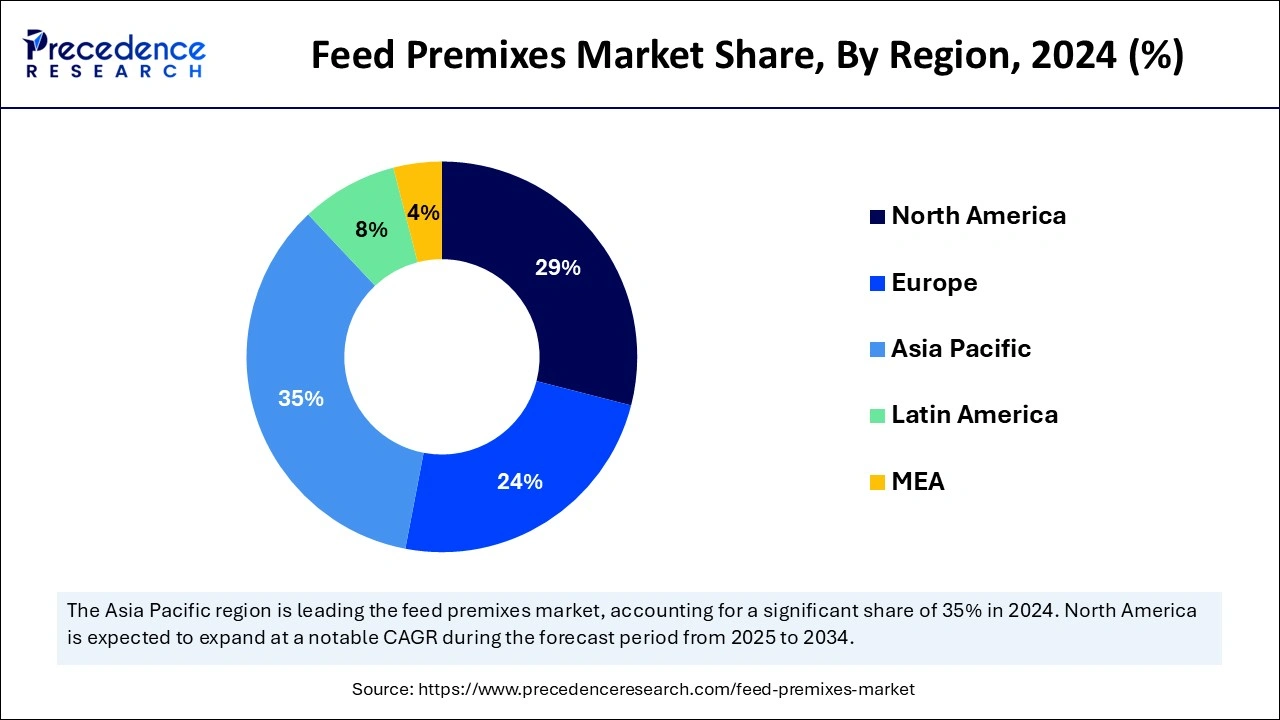

Asia Pacific dominated the global feed premixes market in 2024. The dominance of the region can be attributed to the strong presence of an extensive livestock population in emerging economies like China, India, and Bangladesh. However, the region also boasts the presence of some top producers of animal food. Increasing disposable incomes and substantial economic growth in China make it the top consumer of premix feed in the region.

North America is expected to grow at the fastest rate in the feed premixes market over the studied period. The growth of the region can be credited to the huge number of pet owners and the high level of investment in animal nutrition. In North America, the U.S. led the market owing to advanced feed solutions and raised awareness of balanced animal diets. This region holds exponential growth ability in the near future.

Feed premixes are important elements of animal nutrition, offering a combination of micronutrients, decreasing the need to incorporate multiple ingredients, and simplifying feed formulation. These mixes optimize productivity, livestock health, and reproductive performance. Feed premixes are a blend of necessary micronutrients such as trace elements, vitamins, minerals, and other additives. The feed premixes market helps fulfill the specific nutritional demands of various animal species and production steps.

| Report Coverage | Details |

| Market Size by 2034 | USD 32.01 Billion |

| Market Size in 2025 | USD 15.11 Billion |

| Market Size in 2024 | USD 13.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.70% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Product, Livestock, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rapid growth in emerging markets

Ongoing and rapid economic growth at the country level optimizes the use of feed premixes in many markets. Emerging economies, especially in Asia Pacific, are witnessing smooth economic expansion, which leads to heavy investment in livestock farming. In addition, countries in this region are focusing on increasing animal production to meet the demand of the country and export markets. This surge further drives the demand for the feed premixes market.

Animal disease outbreak

Outbreaks of animal disorders like African swine fever or avian influenza can substantially influence the livestock sector, decreasing the demand for the feed premixes market. However, this outbreak can disturb the supply chains, causing a shortage of essential raw materials and impacting feed premix production. Also, the cost of raw materials like minerals, vitamins, and amino acids can change rapidly due to climate change and geopolitical events.

Increasing adoption of animal-derived protein

The ongoing growth of the livestock industry to fulfill the increasing demand for animal-derived protein is impacting the feed premixes market positively. Also, the surge in the global population will require protein-rich food sources, which results in additional demand for feed premix. Furthermore, the increasing acceptance and requirement for protein foods across the globe are also creating market opportunities in the future.

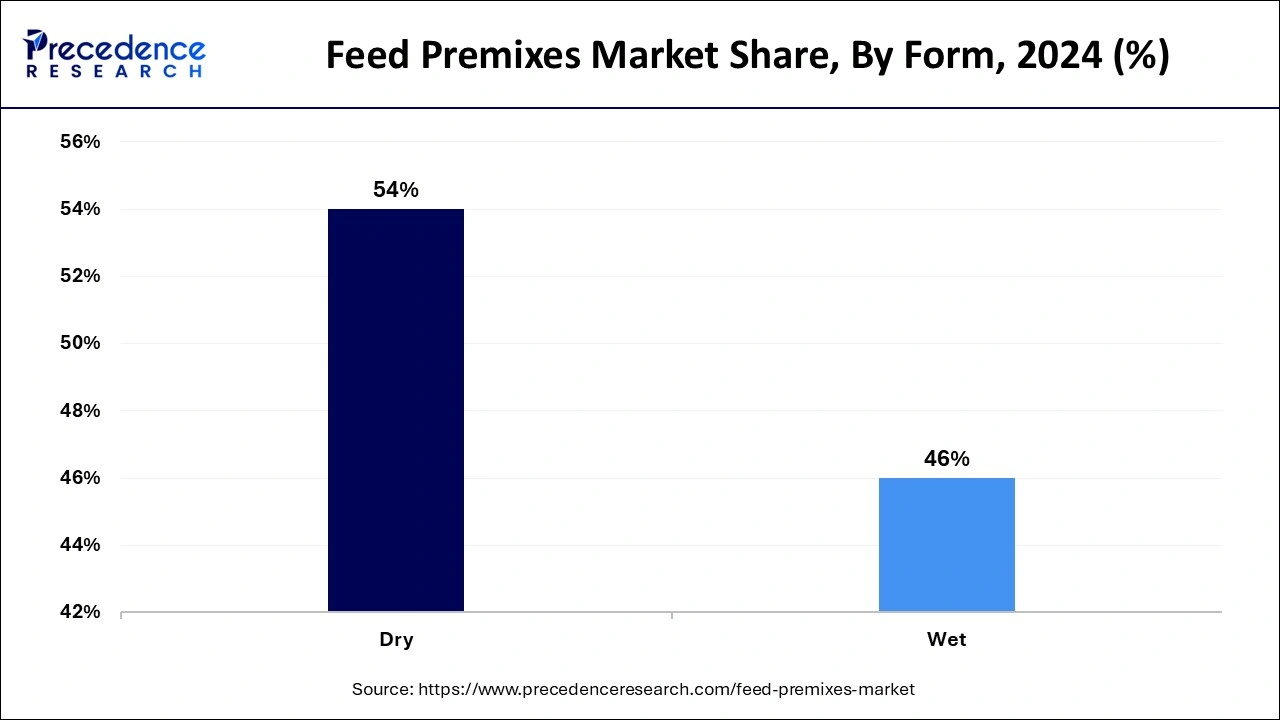

The dry segment dominated the feed premixes market in 2024. The dominance of the segment can be attributed to factors like easy handling, convenience in storing, and manufacturing costs, which in turn result in a wide range of applications in the livestock industry. Additionally, the dry form is convenient to mix with animal food and offers longer self-life than the liquid form. Therefore, dry form is gaining traction and acceptability among market players.

The wet form segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the benefits of wet form for livestock applications. The main advantage of this form is equal distribution of nutrients in the feed, enabling improved homogeneity. Also, the wet form optimizes the accurate dosages for animals, thereby giving the owners liberty over the nutrient quality of their livestock.

The amino acids segment led the global feed premixes market in 2024. The dominance of the segment can be linked to the growing focus on stimulating animal diets to accomplish maximum nutritional value and growth efficiency. In addition, amino acids are the vital building blocks of proteins and play an important part in many physiological and growth mechanisms in animals. As a result, the requirement for amino acid feed premixes is increasing.

The antioxidants segment is estimated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by increasing the use of antioxidants such as vitamin C, selenium, vitamin E, and others in premix feeds, as they enhance animal health by neutralizing free radicals in their body. Moreover, the antioxidants also safeguard other vital components in the premixes from the oxidation process.

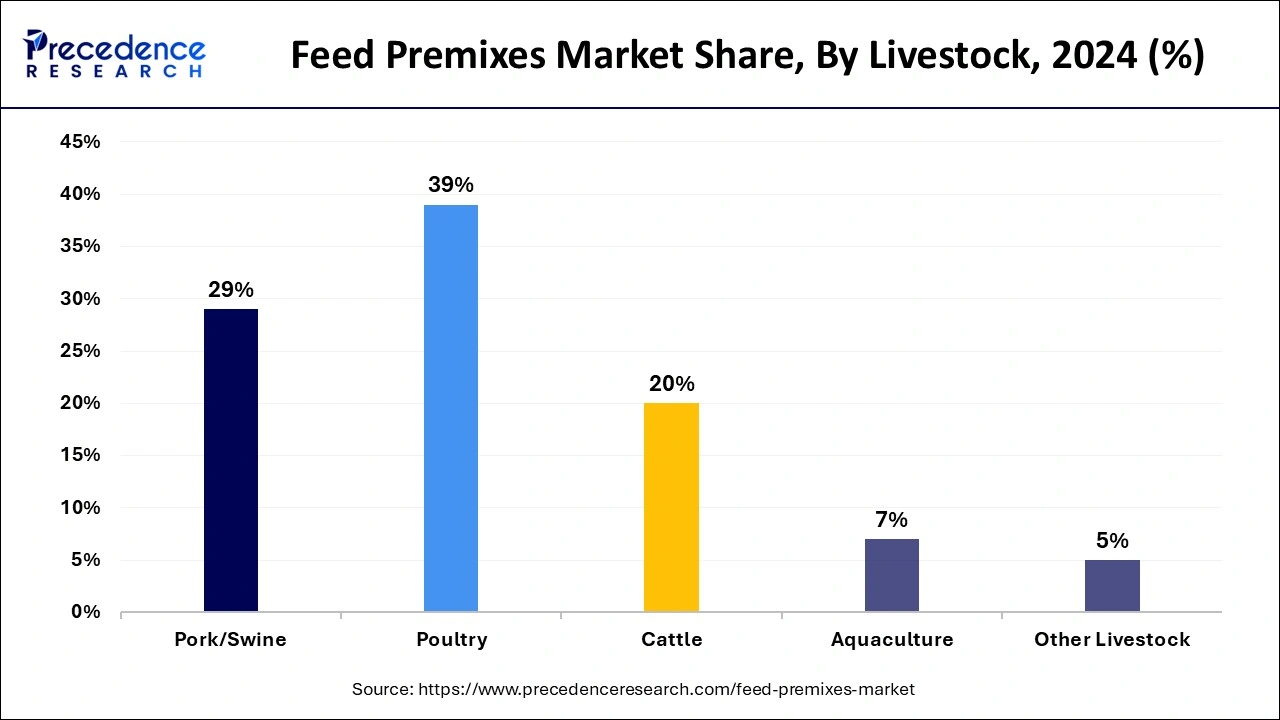

In 2024, the poultry segment dominated the feed premixes market by holding the largest share. The dominance of the segment is due to the surging global consumer demand for eggs and poultry meat, along with the need for cost-effective and efficient production. Furthermore, the rapid surge in poultry meat demand in emerging economies has impacted segment growth positively.

The swine/pork segment is expected to grow at the fastest rate during the projected period. The growth of the segment is because of rising industry emphasis on disease prevention among livestock coupled with the decrease in antibiotic use due to the incidence of fatal disorders among swine. These premixes also play a key role in enhancing the feed efficiency, carcass quality, and growth rates of swine.

Latest Announcements by Market Leaders

By Form

By Product

By Livestock

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2023