March 2025

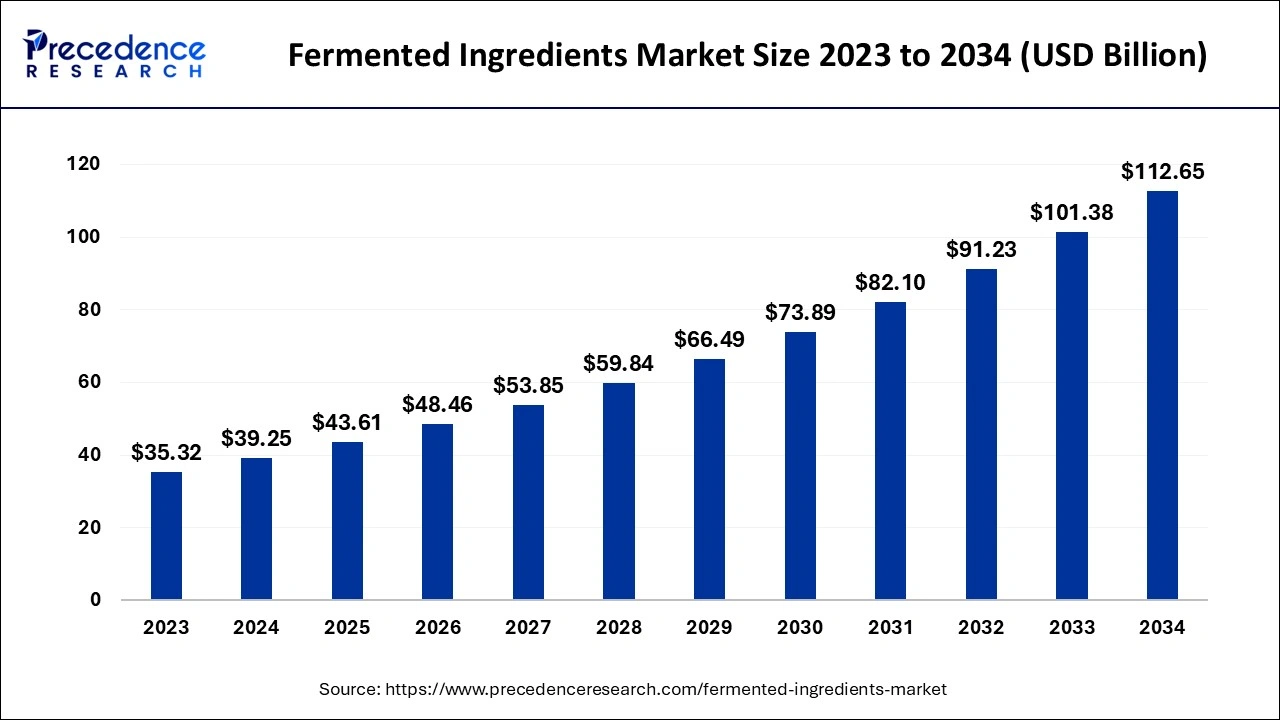

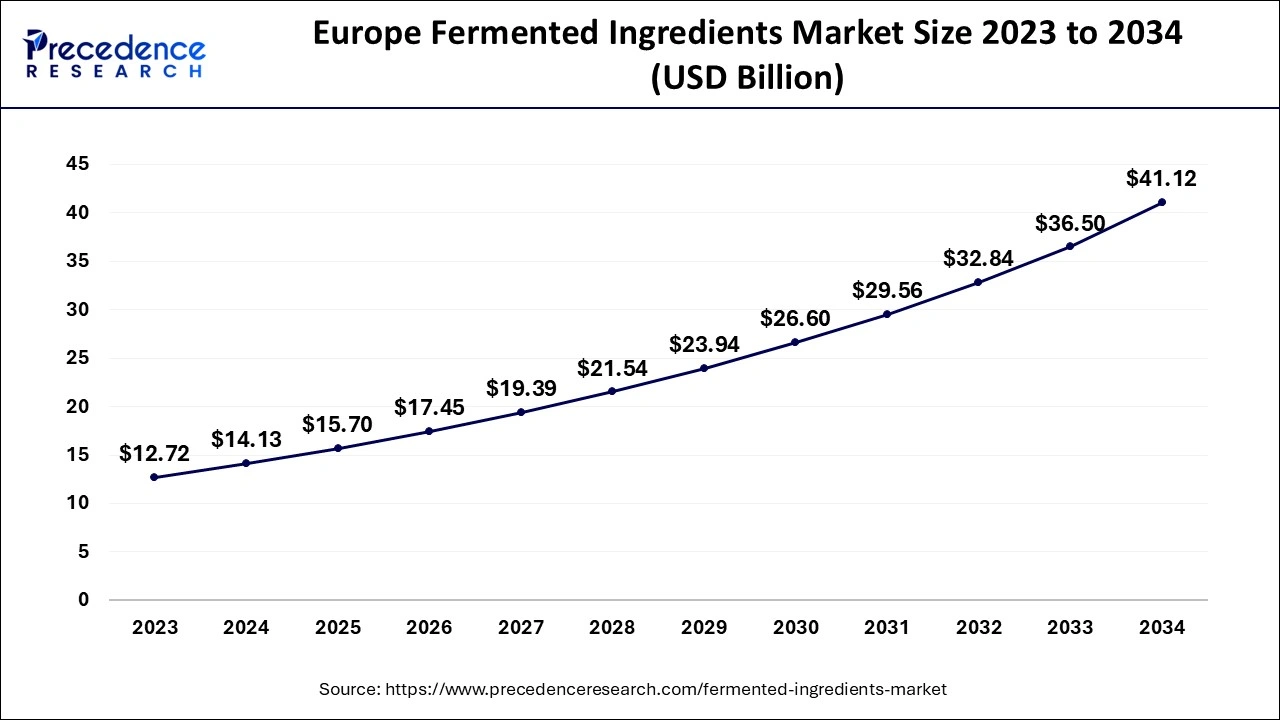

The global fermented ingredients market size is calculated at USD 39.25 billion in 2024, grew to USD 43.61 billion in 2025 and is projected to reach around USD 112.65 billion by 2034. The market is expanding at a CAGR of 11.12% between 2024 and 2034. The Europe fermented ingredients market size is evaluated at USD 11.13 billion in 2024 and is projected to grow at a notable CAGR of 11.25% during the forecast period.

The global fermented ingredients market size accounted for USD 39.25 billion in 2024 and is predicted to surpass around USD 112.65 billion by 2034, growing at a CAGR of 11.12% from 2024 to 2034. The fermented ingredients market growth is attributed to the increasing consumer demand for natural, healthy, and functional food products that incorporate fermented ingredients.

The Europe fermented ingredients market size is exhibited at USD 14.13 billion in 2024 and is anticipated to be worth around USD 41.12 billion by 2034, representing a CAGR of 11.25% from 2024 to 2034.

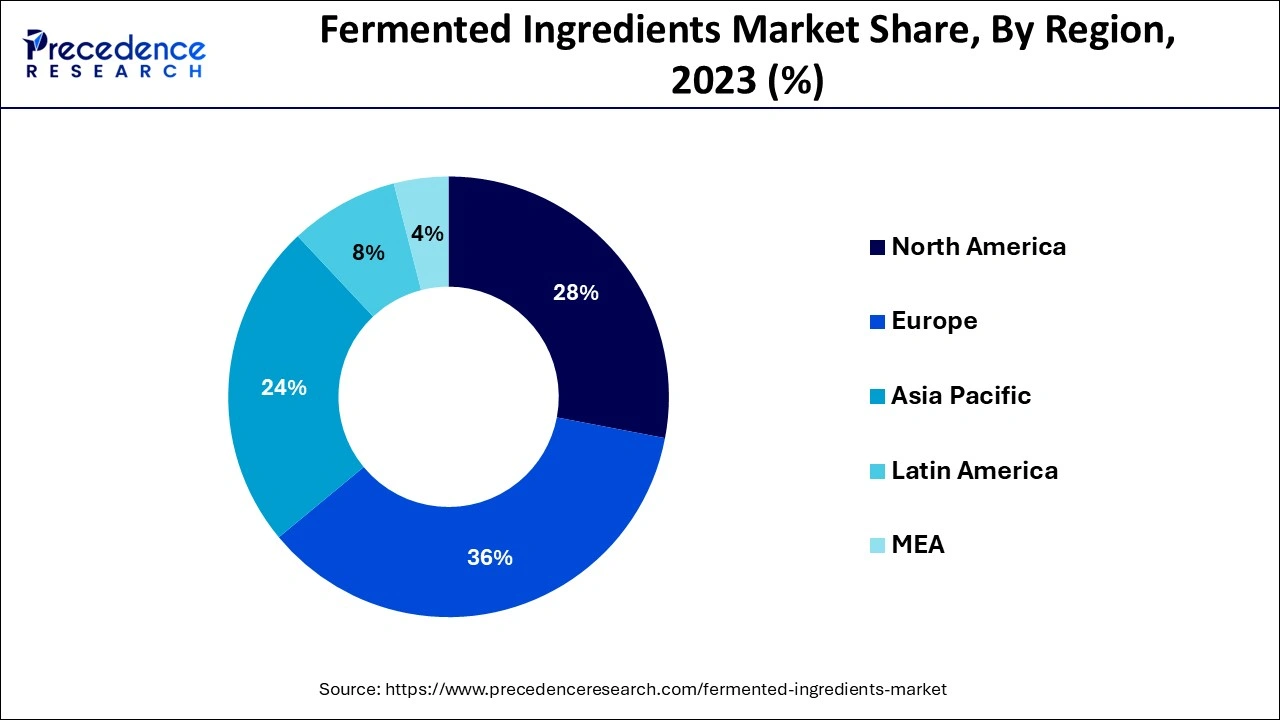

Europe dominated the market in 2023, capturing the largest share of 36%. This is mainly due to increasing sustainability concerns. However, fermentation processes reduce energy consumption, aligning well with sustainability goals. Fermentation also extends the shelf life of foods, making it indispensable for food production. In addition, the adoption of probiotics has increased as a result of growing concerns about gut health, which further boosts the demand for fermented foods.

Asia Pacific is expected to expand at the fastest growth rate throughout the forecast period. Consumers are rapidly shifting toward natural preservatives and fermented food products, which encourages food and beverage manufacturers to develop and use fermented ingredients. The increasing awareness about gut health has also increased the consumption of probiotics. In addition, the rapid expansion of the food and beverage industry and the rising demand for healthy food further contribute to regional market growth.

Rising demand among consumers to consume fermented ingredients for the health benefits they proffer, such as boosting nutrition and the improvement of gut health, further contributes to boosting the fermented ingredients market. This trend is facilitated by the growing popularity of functional foods, as consumer diet trends are shifting towards the clean label. The new trend in diets also includes plant-based, and therefore, there is market potential in plant-derived fermented products that are expected to gain market acceptance.

Impact of Artificial Intelligence (AI) on the Fermented Ingredients Market

In the fermented ingredients market, using analytical tools with artificial intelligence makes it possible to monitor and analyze the fermentation process conditions continuously. This makes informed decisions to reduce waste and increase the yield. AI assists firms in creating new fermented products to suit changing market needs. The use of the machine learning algorithm to check the quality of products ensures the quality of batches. They are not only increasing production rates and speeds but also reducing costs. Thus, the versatility of fermented ingredients is now being expanded to the food, beverage, pharmaceutical, and many more industrial sectors.

| Report Coverage | Details |

| Market Size by 2034 | USD 112.65 Billion |

| Market Size in 2024 | USD 39.25 Billion |

| Market Size in 2025 | USD 43.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.12% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Form, Process, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for natural ingredients

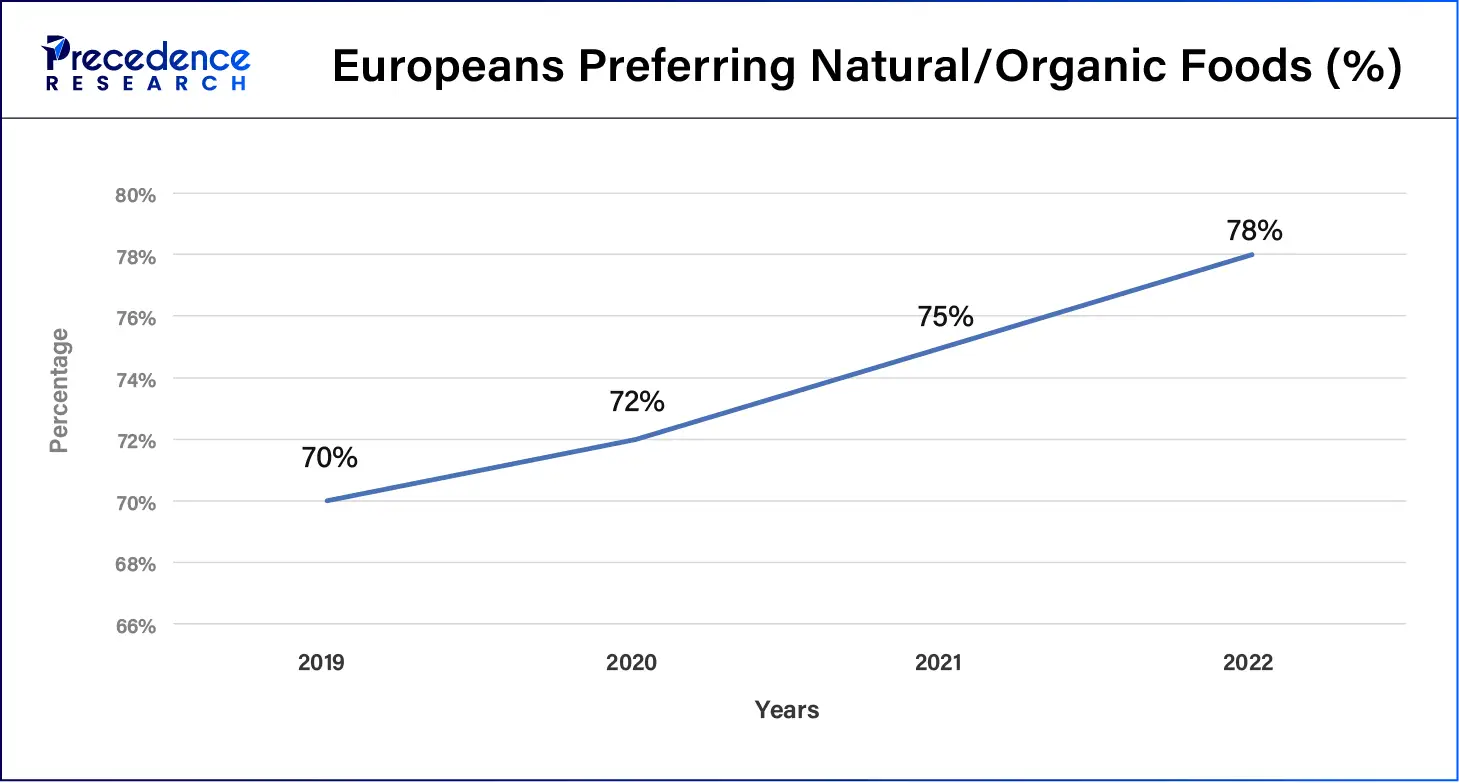

Growing consumer preference for natural and clean-label products is expected to drive the demand for the fermented ingredients market. High awareness of the importance of health means that consumers are looking for food products that do not contain additives and preservatives. Since fermentation is a natural process, it fits into this pattern of promoting ingredients, such as enzymes, amino acids, and organic acids, fermentation. This change in trend has become apparent, especially within the food and beverages industries, where manufacturers are adding these ingredients to their products to improve their quality and nutrients. This pattern is expected to boost the fermented ingredients sector, which plays a vital role in companies utilizing the technique of fermentation to introduce natural substitutes for synthetic compounds in products.

Stringent regulatory standards

Stringent regulatory standards are projected to hamper the fermented ingredients market growth, especially in regions with strict food safety and quality control requirements. Countries, including the United States, the FDA, the European Union, and the EFSA, bear great policies restricting the use of fermented ingredients in foods, drugs, and cosmetics. Bureaucracy is a major issue in business; approval processes take time, and all new products come with paperwork that takes a lot of time and frequent audits, which slows operational gradients and hikes up the costs considerably. Furthermore, this constant regulatory pressure affects small manufacturers and limits their progress in the industry.

High demand for plant-based fermented ingredients

High demand for plant-based fermented ingredients is expected to create favorable opportunities for the players competing in the fermented ingredients market. Businesses are finding new fermentation products from soy, peas, and rice sources as people shift towards veganism. These categories or ingredients, as used in plant-based meat & dairy products, have better nutritional values, better mouthfeel, and better shelf stability. In North America and Europe, this trend is expected to propel the desire for plant-based fermented products, as the uptake of plant-based foods is increasing in the world market.

The role of the fermented ingredients market is integral to improving the quality of new proteins. Moreover, the United Nations Food and Agriculture Organization (FAO) has appreciated how fermentation technologies enhance the quality of plant-based food products while cutting the dependency on animal-derived feeds. Increasing consumption of these items is anticipated to continue further.

The organic acid segment held a dominant presence in the fermented ingredients market in 2023 due to their usage in numerous sectors that offer services, such as food and beverages, pharmaceuticals, and agriculture. Natural acids, including citric acid, lactic acid, and acetic acid, are widely used in food processing. They function by preserving food, giving food flavor, and regulating pH levels, which is important in food production to control quality and safety. As per the report from the Food and Additionally, the increased use of fermentation in health supplements and functional foods where organic acids support gastrointestinal functions or metabolism.

The amino acids segment is expected to grow at the fastest rate in the fermented ingredients market during the forecast period of 2024 to 2034, owing to its importance in nutritional supplements and its remarkable functions in numerous fields. Essential amino acids are needed for human nutrition, and their popularity has risen in dietary supplements, functional food products, and animal feed.

The liquid segment accounted for a considerable share of the fermented ingredients market in 2023 due to the growing consumption of liquid-fermented ingredients in foods and beverages. These fermented components help to enhance the flavors, extend the shelf-life, and improve the functional properties of the products. Concentrated liquid fermented products, such as vinegar and kombuchas, have received a boost in consumer preference from health-conscious consumers looking for natural products that have gone through the fermentation process.

The dry segment is anticipated to grow with the highest CAGR in the fermented ingredients market during the studied years, owing to their easier-to-transport horticultural produce and hence have a longer shelf life compared to fresh produce. Powder and granular products have become popular in modern food products and dietary supplements.

They are easy to incorporate into other products without affecting the quality. This factor plays a great role for manufacturers and consumers by using the dry forms, as they are easier to store and measure, thereby bringing down costs. Furthermore, the rising consumer consciousness of health and nutrition and, conversely, the adaptability of those ingredients in a diverse method.

The batch fermentation segment led the global fermented ingredients market. Batch fermentation enables close control of local conditions that are required for achieving predictable and high-quality fermented products like yogurt, cheese, and fermented alcoholic beverages. This explains why FAO supports batch fermentation as one of the most popular among artisanal producers who insist on quality and traditional ways of producing. Furthermore, batch fermentation is suitable for developing new products, as producers change the factors affecting fermentation to obtain the necessary characteristics easily.

The continuous fermentation segment is projected to expand rapidly in the fermented ingredients market in the coming years, owing to its economy, especially while used in mass production. Continuous fermentation is especially preferred in industries that need high quantities of products, including bio-fuel industries and the production of organic acids. Fermentation is an essential process that the World Health Organization WHO has greatly prioritized to meet the increasing global concern for the development of sustainable and environmentally friendly systems. This technique also reduces operational costs since it optimizes time spent between breakdowns and improves productivity. Additionally, development in bioreactor systems offers enhanced control over the fermentation parameters.

The food & beverage segment dominated the global fermented ingredients market in 2023 due to the shifting trends among the consumers’ demand for healthy and functional foods. A global shift towards natural and organic products forces companies to include fermented elements, including probiotics, enzymes, and organic acids, in their products. Furthermore, the general public's awareness of the process of fermentation and the benefits attached to the production of fermented products.

The pharmaceuticals segment is projected to grow at the fastest rate in the fermented ingredients market in the future years, owing to the general trend in applying fermented ingredients in the formulation and development of drugs. During the process of fermentation, valuable bioactive compounds, such as antibiotics, amino acids, and essential vitamins for developing sound pharmaceutical products, are produced. Furthermore, continuous advancements in the fields of biotechnology and pharmaceuticals continue to stress the use of fermented substrates for production to increase the efficiency of the drugs.

Segments Covered in the Report

By Type

By Form

By Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

December 2024

October 2024

February 2025