April 2025

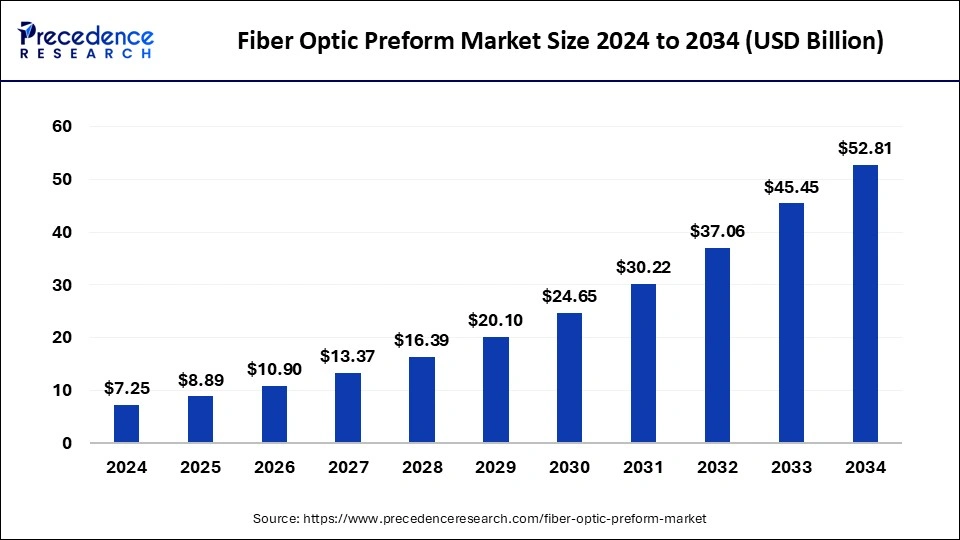

The global fiber optic preform market size is calculated at USD 8.89 billion in 2025 and is forecasted to reach around USD 52.81 billion by 2034, accelerating at a CAGR of 21.97% from 2025 to 2034. The Asia Pacific fiber optic preform market size surpassed USD 6.22 billion in 2025 and is expanding at a CAGR of 22.04% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fiber optic preform market size was estimated at USD 7.25 billion in 2024 and is predicted to increase from USD 8.89 billion in 2025 to approximately USD 52.81 billion by 2034, expanding at a CAGR of 21.97% from 2025 to 2034. The fiber optic preform market is observed to grow with the expansion of telecom industry across the globe.

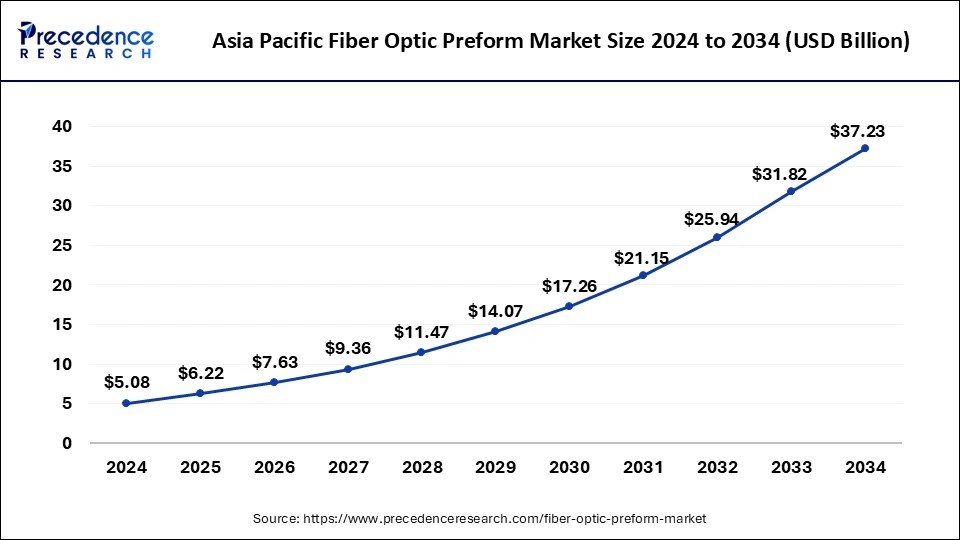

The Asia Pacific fiber optic preform market size was valued at USD 5.08 billion in 2024 and is expected to be worth around USD 37.23 billion by 2034, at a CAGR of 22.04% from 2025 to 2034.

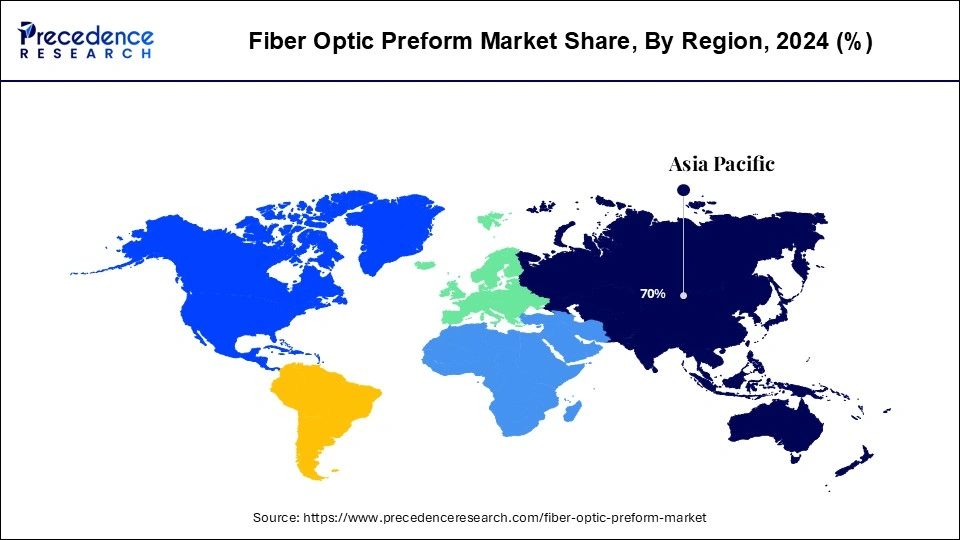

Asia Pacific held the dominant share of the fiber optic preform market in 2024. The region is observed to witness notable growth during the forecast period owing to the robust presence of the manufacturing hubs of optical fiber, increasing investment in the telecommunication sector, an increasing number of various end-use industries, rising digital transformation initiatives of governments and businesses, rising need for high-speed internet access, and increasing penetration of smartphones.

Among all, China, India, and Japan are the major contributors to the market. These countries are highly investing and focusing on 5G deployment and the production of 5G devices, which substantially contribute to the growth of the fiber optic preform market in the region. In addition, the rapid expansion of the telecom industry coupled with increasing demand for broadband connectivity and continual expansion of 4G and 5G networks led to an increasing demand for fiber optic preforms in the region.

Furthermore, several market players in the region are actively participating in various strategic initiatives, including investment, partnerships or collaborations, and new product or technology development which is anticipated to propel the fiber optic preform market growth in the region during the forecast period.

On the other hand, North America is expected to witness the fastest rate of growth in the fiber optic preform market during the forecast period owing to the rising internet penetration and data traffic, the presence of sophisticated telecommunication infrastructure, rising research and development in fiber optics technology, rising demand for broadband connectivity, increasing prevalence of various end-use industries, and rising development of 5G networks. Major market players in the region are focusing on developing enhanced fiber optics preform which is expected to boost the growth of the fiber optics preform market in the North American region.

A fiber optic preform refers to a cylindrical glass tube or rod that aids in the manufacturing of optical fibers in the fiber drawing tower. The making process of optical fibers involves the heating preform till it softens and then pulling it to form a thin fiber, capable of transmitting data over long distances at the speed of light. In an era of modern communication systems, fiber optics plays a crucial role in transmitting data at the speed of light across oceans and continents. Fibre optics are flexible transparent fibre cables made of high-quality glass, plastic, and silica used as a medium to transmit information using total internal reflection of light. The preforms are pieces of glass used to draw an optical fiber and are used as the starting material in the manufacturing of optical fibers.

| Report Coverage | Details |

| Market Size by 2034 | USD 52.81 Billion |

| Market Size in 2025 | USD 8.89 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 21.97% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process, Product Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for high-bandwidth communication

The rising demand for high bandwidth communication is expected to boost the expansion of the fiber optic preform market in the coming years. The rapid innovations in the telecommunication sector have opened the way for bandwidth-intensive communication based on fiber optic networks. The rapid adoption of Internet of Things (IoT) devices, laptops, smartphones, and numerous other technological innovations have significantly increased need for the high-speed internet, which results in spurring the demand for fiber optic cables.

High cost

The high production and installation cost of fiber cable in comparison to copper wires is anticipated to projected to hamper the growth of the fiber optic preform market. This financial barrier may limit the potential players to adopt fiber-optical solutions. In addition, the lack of adequate telecommunication infrastructure in lower and middle-income countries is likely to limit the expansion of the market during the forecast period.

Rising investment in telecom infrastructure

The increasing investment in telecom infrastructure is projected to offer lucrative opportunities to the fiber optic preform market during the forecast period. Due to the increasing demand for high-speed and reliable communication services growing along with the rapid expansion of network capabilities, the need for fiber optic preforms becomes important to meet the evolving requirements of the market. The development of fiber-rich network infrastructure increases the need for fibre optic cables has increased, which in turn fuels the growth of the fibre optic preform market. Moreover, the rise in data traffic increases the demand for optical fibre networks, which accelerates the fibre optic preform market’s revenue. Therefore, the rising investment in telecommunication infrastructure led to a surge in demand for fiber optic preforms during the forecast period.

The vapor axial deposition (VAD) segment held the largest share of the fiber optic preform market in 2024 owing to its capability to manufacture high-quality preforms that exhibit low attenuation and tremendous transmission characteristics. The vapor axial deposition method is increasingly becoming popular for manufacturing large glass in huge quantities, it has also opened the remarkable way for the mass production of optical fiber. On the other hand, the Outside Vapor Deposition (OVD) segment is expected to sustain its position throughout the forecast period. The OVD segment’s growth is driven by high flexibility, uniform deposition, lower signal loss during data transmission, and high scalability.

The multi-mode segment accounted for the largest share in the global fiber optic preform market in 2024. Multi-mode optical fiber is commonly used for high-speed data transmission over short distances like within a campus or an organization. The equipment used for communications for single-mode optical fiber is more expensive than multi-mode optical.

On the other hand, the single-mode segment is projected to grow at a notable rate during the forecast period owing to the rising need for internet services, increasing investment in 5G networks, growing usage of cloud computing, and rising need for reliable and effective data transmission in several industries. Such factors drive the growth of the segment during the forecast period.

The telecom segment accounted for the larger market share in 2024. The growth of the segment is driven by the increasing consumer and commercial demand for Internet services. Fiber optic technology is capable of providing the required information capacity which is larger than copper cable. Factors such as growing demand for high-speed internet and data transmission, increasing adoption of smartphones, increasing usage of cloud services, and increasing investment in 5G technology are anticipated to bolster the segment's growth during the forecast period. Both telecommunications companies and government institutions are aggressively investing in upgrading and expanding telecommunication infrastructure to provide better internet connectivity across untapped and rural areas.

The automotive segment is expected to grow at a notable growth rate. Fiber optic preforms are increasingly being used to establish vehicle connectivity and interconnectivity and autonomous driving as well as the integration of several sensors to enhance the safety of vehicles. Thereby driving the segment’s growth.

By Process

By Product Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

January 2025