October 2024

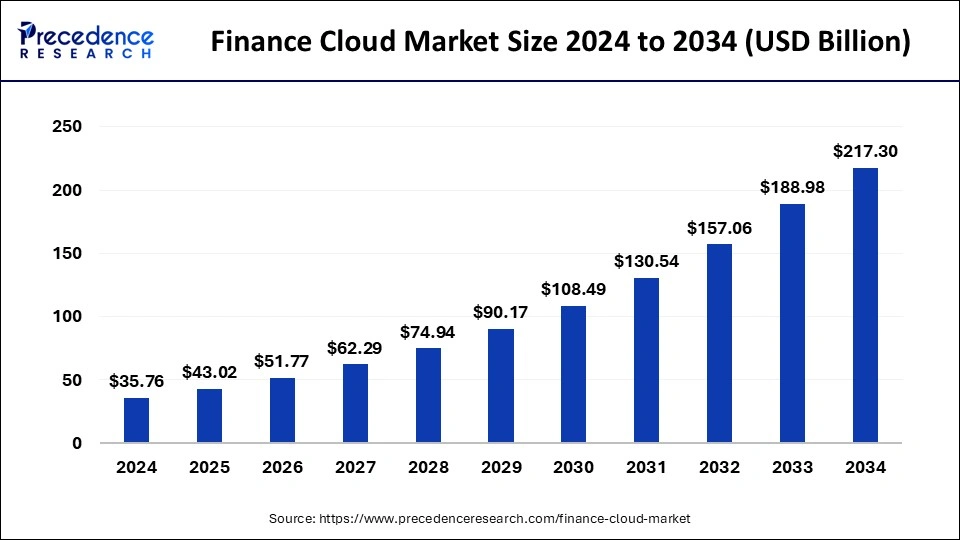

The global finance cloud market size is calculated at USD 43.02 billion in 2025 and is forecasted to reach around USD 217.30 billion by 2034, accelerating at a CAGR of 19.78% from 2025 to 2034. The North America finance cloud market size surpassed USD 13.23 billion in 2024 and is expanding at a CAGR of 19.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global finance cloud market size was estimated at USD 35.76 billion in 2024 and is predicted to increase from USD 43.02 billion in 2025 to approximately USD 217.30 billion by 2034, expanding at a CAGR of 19.78% from 2025 to 2034.

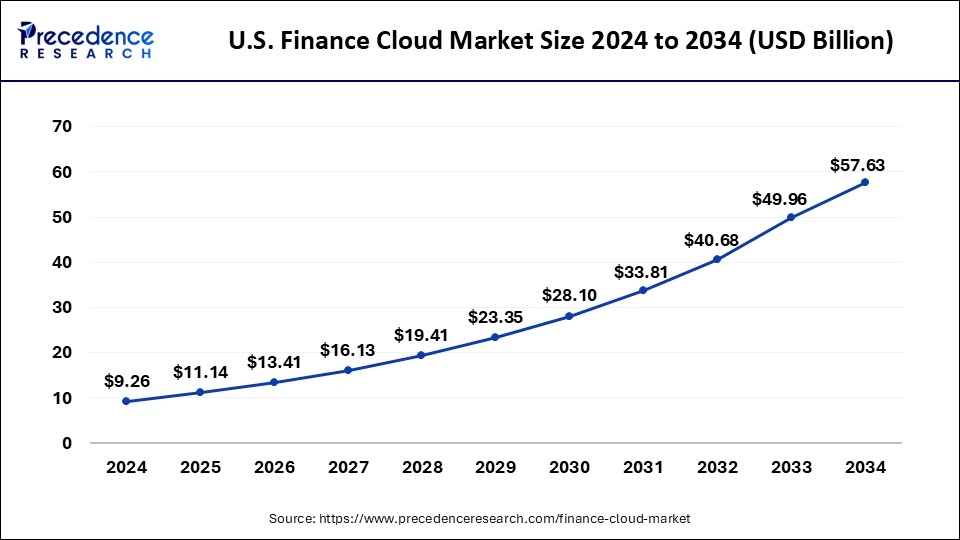

The U.S. finance cloud market size was valued at USD 9.26 billion in 2024 and is expected to be worth around USD 57.63 billion by 2034, at a CAGR of 20.06% from 2025 to 2034.

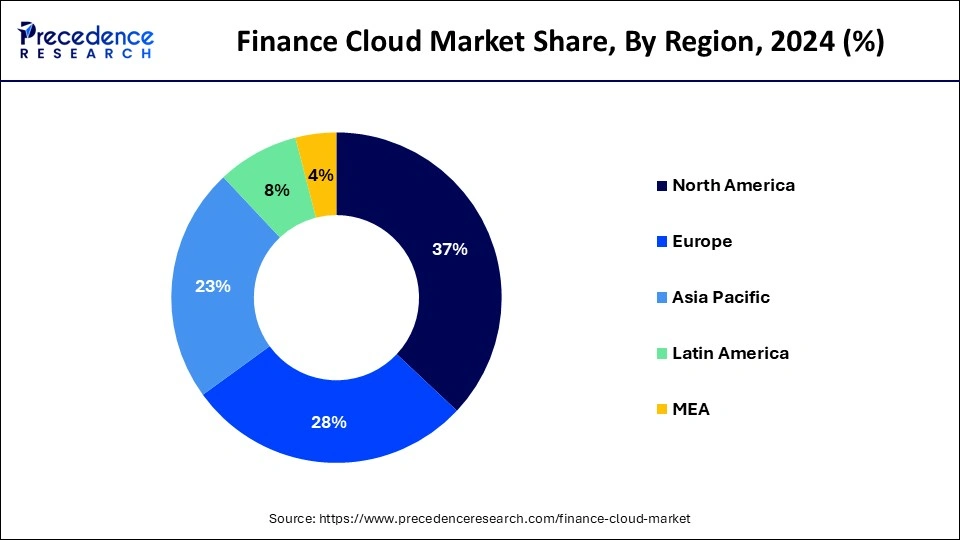

North America dominated the global finance cloud market with the largest share in 2024. The finance cloud market in North America is robust and is experiencing rapid growth due to factors like increasing risk of financial threats and data security. Countries like the United States and Canada with established economies and strong internet services are one of the largest contributors in the world. The highly established infrastructure enables various services for industries from different sectors too. Companies in these regions focus on the protection of sensitive data which improves the security and agility which are the key drivers of the North American finance cloud market.

The finance cloud market In Europe registered significant growth in 2024. The increasing awareness of the benefits of cloud services is the major reason behind the growth of the region. This is also resulting in the demand for innovative and personalized financial services. The region is witnessing a competitive business environment in the finance sector, which is driving the financial organization to adopt cloud services to improve their work quality.

Asia Pacific is expected to witness the fastest growth with an exponential CAGR during the forecast period. The region is witnessing rapid digitalization and financial institutions are adopting cloud services to boost their operations. The increasing infrastructure is shaping the whole business landscape in countries like India, China and Japan. Many startups have started fintech which grips the cloud technologies to provide new offerings to the clients. The increasing number of partnerships of cloud providers with fintech companies and other technical vendors is leading to the expansion of the finance cloud market.

Finance clouds are cloud-based applications and services that operate an organisation's financial operations. These services include different functions like budgeting, accounting, financial reporting, forecasting, expense management, etc. Finance services are provided by software companies and vendors that can be managed according to the specific needs of the clients of other industries. Using finance cloud services offers scalability of resources which may vary on the business needs. It also helps the company to track their real-time performances and gain valuable insights. The financial industry landscape has changed because of the growing interest in cloud services driven by the increasing digitisation.

The finance cloud market deals with companies like insurance, empower banks and others which manage their data, operations, and applications quickly. The finance sector is witnessing rapid growth due to the rising need for improved operational efficiency. With the changing consumer preferences and expectations banks and financial institutions are adopting the use of new technologies like finance cloud.

| Report Coverage | Details |

| Market Size by 2034 | USD 217.30 Billion |

| Market Size in 2025 | USD 43.02 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 19.78% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Service, Deployment, Enterprise, Application, End-use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing operational efficiency rate

Cloud software is gaining significant attention as it provides financial organisations with a solid foundation and information. The company working in the industry invest their efforts and time in communicating the financial information and making the right decisions for the growth of the organization. Public and private clouds are now being used for core purposes like credit risk management and payments. The process enables the institutions to optimize their IT resources which leads to improving scalability and cost management. The company needs continuous access to all the information which can be used to make decisions based on the data, this increases the competition in the industry. This competitive environment constantly helps fuel the finance cloud market.

Upsurge in demand for personalized services

The finance cloud market includes cloud-based solutions and services, especially for the finance sector which includes banking, investment, insurance, and many more. These components possess various demands regarding particular problems. Financial companies are focusing on customer-centricity which aims to provide personalized experiences that help in catering the needs and goals of the individual. Regulations in domains like open banking are driving a change towards open data systems. This enables the customer to share their sensitive data freely with third-party service providers. This builds the trust of the consumer and also increases the revenue opportunities by engagement of the consumers.

Expensive maintenance cost

The core market companies like Microsoft, Oracle, and SAP initially charge a high amount for their services. Many companies are also offering a subscription model which can include hidden costs for processes like data migration, ongoing, support, integration and many more. Once signed in with a vendor it makes it difficult to switch to another. The cloud systems also include internal charges like salaries, project management, user training and many more. These components are restraining the small-cap companies from the market and also reduce the willingness of the existing companies to upgrade their annual renewals. Therefore, a hybrid cloud approach should be considered that can help in optimizing the costs and avoid vendor lock-ins.

Upsurging number of cloud adoption

The increasing number of new startup companies especially in developing regions of Asia and Europe might help in the expansion of the market rapidly in the upcoming years. The institutions are focusing on industry-specific solutions which will help to develop cloud solutions tailored to different consumer needs. Cloud computing eliminates the requirement of premise hardware and IT infrastructure which leads to cost reduction during the long run. Many services can be scaled up or down according to the demand, which also allows businesses to match their requirements according to the resources available. The availability of these services might help to grow the companies in developing regions.

Advancement of technologies

The growth pace of the finance cloud market can be upsurged due to the introduction of artificial Intelligence (AI) and machine Learning (ML) in the industry. These technologies might be game changers as they can easily analyze the data to create personalized recommendations for loans and investment services. AI can also detect the risks associated by identifying irregular activities and increasing security. These tools reduce the consumption of time by creating data and managing the associated risks. By adopting these technologies, the finance cloud market can create more opportunities in the future and also generate more profit by enhancing the personalized needs of the consumers.

The security segment dominated the finance cloud market in 2024. Financial institutions often work with multiple third-party vendors and partners. Cloud security solutions help manage and mitigate the risks associated with these third parties by enforcing strict security protocols and providing secure communication channels. Cloud security includes robust disaster recovery and business continuity solutions. In the event of a security breach or system failure, these solutions ensure that data can be quickly restored and operations can resume with minimal disruption.

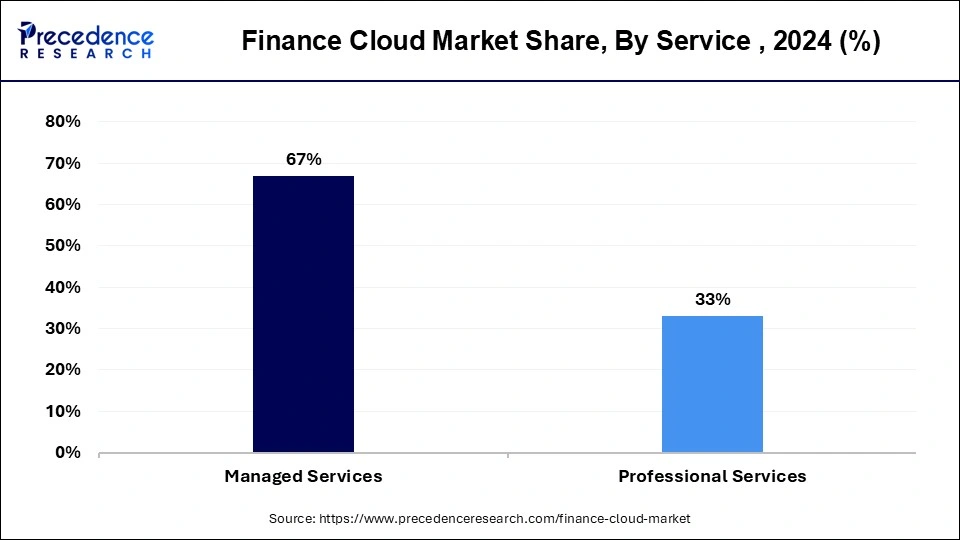

The managed services segment dominated the market with the largest share in 2024 and is also expecting rapid growth during the forecast period. Managed services are the ones in which IT operations are outsourced to third-party service providers. These service providers are known as MSPs, the reason behind outsourcing is that they could focus on the primary objectives. These services are delivered under a subscription-based model which includes infrastructure management, cloud management, and other security services. This helps in managing the business applications and it also enhances the overall customer experience.

The professional services segment is expected to register growth at the fastest rate during the forecast period. These services include providing specialized consultancy or advisory services to a particular industry. These services are offered on a project basis which aims to tackle specific challenges in an organization. Cloud service helps the company with personal guidance and strategy advice which increases the demand for professional services. Many organizations prefer professional services which could help in cloud adoption.

The public cloud segment secured the largest share in finance cloud marekt in 2024. In a public cloud, the resources and services are operated by third-party service providers which are made available through the internet. These services reduce the expenditure as the businesses are only needed to pay for the resources they have used. This saves the unwanted cost which makes public services a demanding option for companies. Public services are considered easily manageable which increases the reliability of the consumers.

The private cloud segment is expected to grow at the fastest CAGR during the forecast period. In a private cloud, the services and resources are dedicated to a single organization which provides better security and control. The private cloud also makes the infrastructure and services customizable according to particular needs. The private cloud includes various advantages like greater access and security control which makes it a highly demanded deployment model.

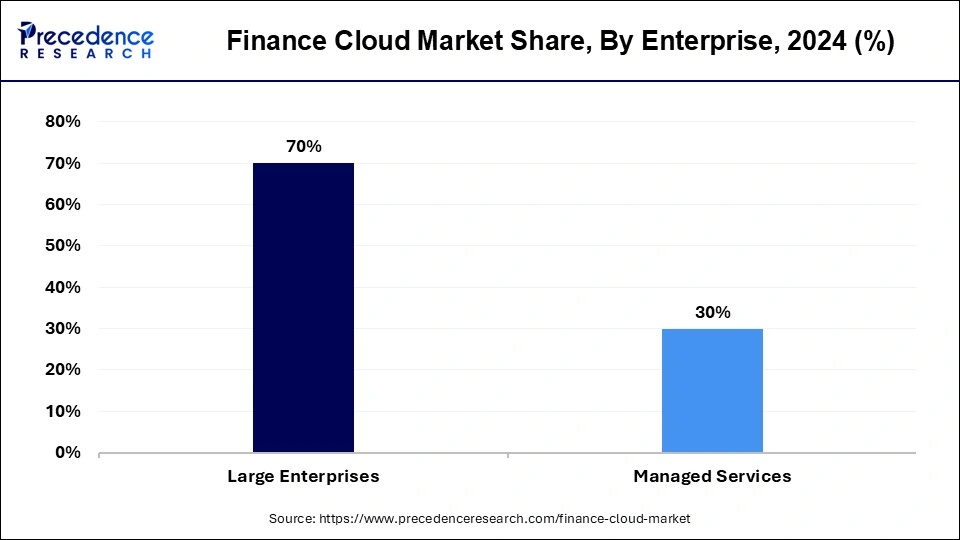

The large enterprise segment dominated the global finance cloud market with the largest share in 2024. The segment is more dominant due to its influence, scale and brand value. Large enterprises have greater access to capital and financial resources which allows them to have access to greater technologies and provide a specialized experience to the consumers. As a result, they provide better data security and customer support which can enhance the consumer experience.

The small and medium enterprise segment is expected to grow at a notable rate during the forecast period. Institutions are referring to small and medium enterprises as they adopt market changes at a faster rate with new ideas. These companies can hold a dominance in niche markets with specialized services. Small and medium companies offer a personalized customer focus which can help in enhancing the service as per the needs.

The wealth management segment dominated the finance cloud market in 2024. The increasing demand for cloud technologies in wealth organizations is leading to a rapid growth of the finance cloud market. These firms serve high-net-worth individuals who have bigger investable assets. They offer personalized financial advice according to particular needs. They have a strong brand reputation which makes them more valuable in the industry. Organizations associated with wealth management manage the investment portfolio and funds on behalf of the investors. They can gain various benefits using cloud-based asset management like financial accountability, accurate tracking and various software solutions.

The banking and financial services segment had the largest share in the finance cloud market in 2024. The dominance of this segment is attributed to factors like rising security concerns, and the need for disaster recovery. This has led to the adoption of cloud services in financial institutions and banks. Cloud services provide robust disaster recovery solutions that ensure business continuity. In the event of a system failure or data loss, cloud-based backups and recovery systems allow banks to quickly restore operations, minimizing downtime and financial loss.

The insurance segment is expected to witness the fastest rate of growth during the forecast period in the finance cloud market. The sector has witnessed significant demand after the outbreak of the coronavirus. The rising disposable income has also led to an increase in insurance. The financial cloud services provide digital experiences and operational processes which increases the demand in the insurance companies. The financial sector is undergoing rapid digital transformation, and cloud computing plays a crucial role in this process. By leveraging cloud technologies, in insurance sector can innovate faster, adopt new financial technologies (FinTech), and stay competitive in a rapidly evolving market.

By Solution

By Service

By Deployment

By Enterprise

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

February 2025

April 2025