January 2025

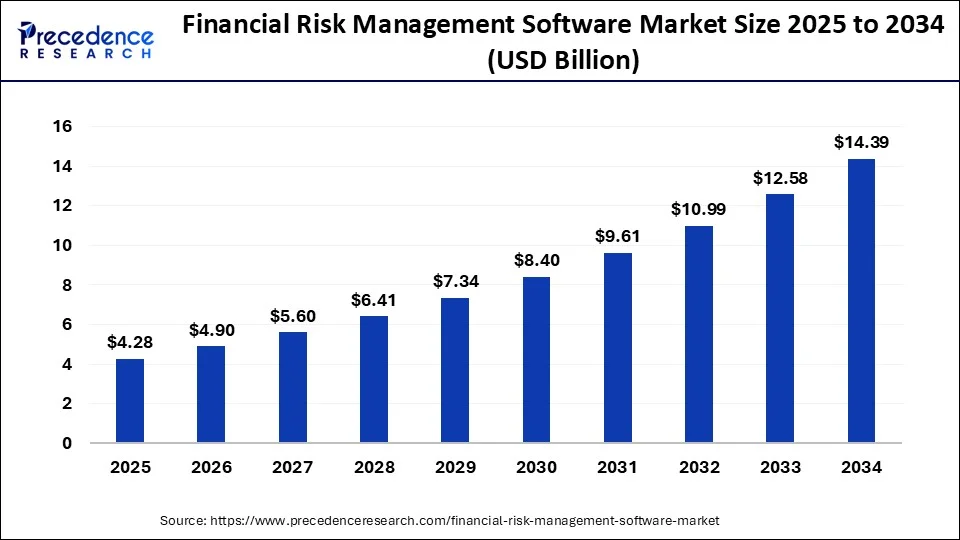

The global financial risk management software market size is calculated at USD 3.74 billion in 2024, grew to USD 4.28 billion in 2025 and is projected to reach around USD 14.39 billion by 2034. The market is poised to grow at a CAGR of 14.42% between 2024 and 2034. The North America financial risk management software market size is accounted for USD 1.38 billion in 2024 and is estimated to grow at a fastest CAGR of 14.56% during the forecast year.

The global financial risk management software market size is worth around USD 3.74 billion in 2024 and is anticipated to reach around USD 14.39 billion by 2034, growing at a solid CAGR of 14.42% over the forecast period 2024 to 2034. The rising demand for software that can manage and streamline the complexities of the financial sectors with real-time monitoring and risk modeling capacities is driving the growth of the financial risk management software market.

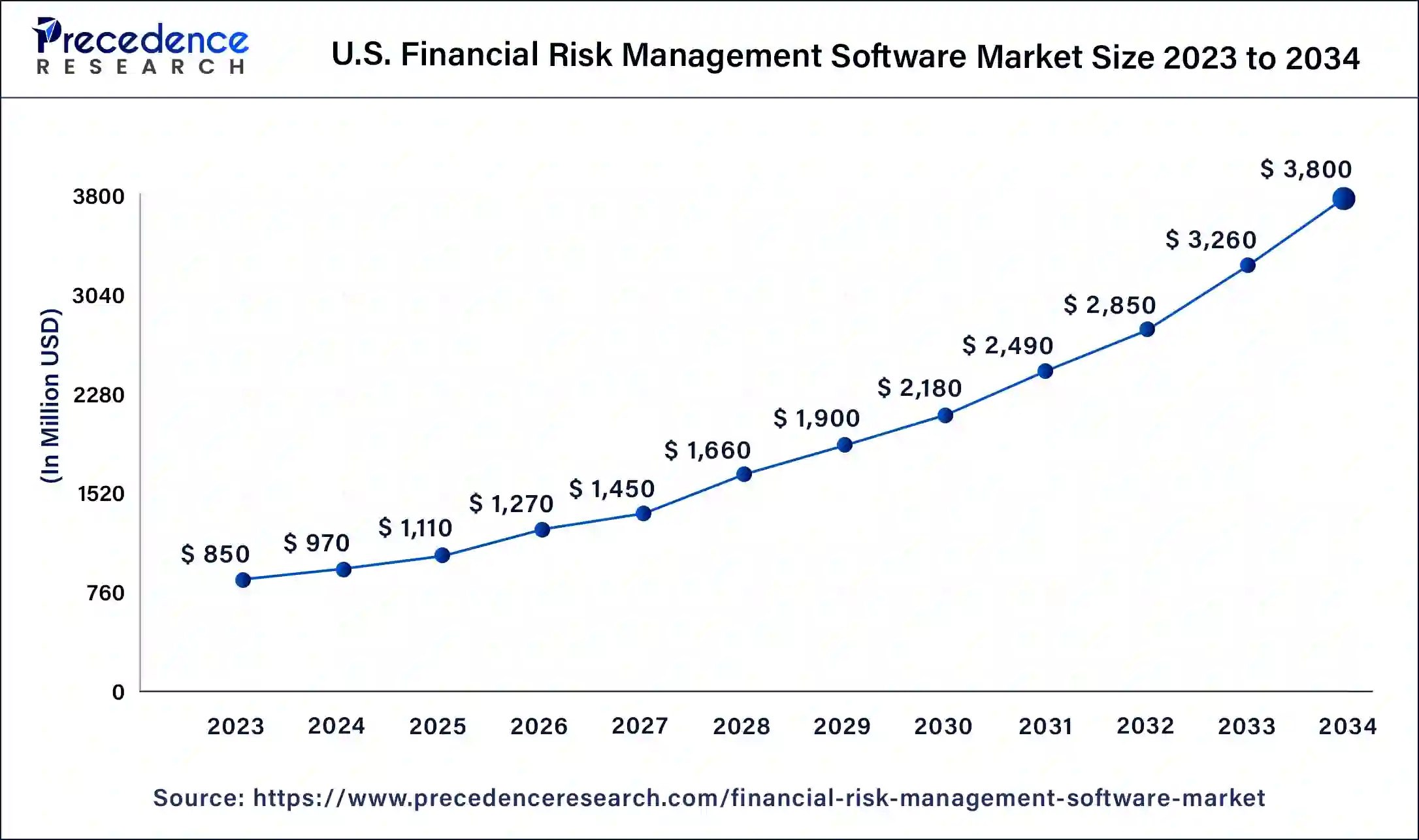

The U.S. financial risk management software market size was exhibited at USD 850 million in 2023 and is projected to be worth around USD 3,800 million by 2034, poised to grow at a CAGR of 14.58% from 2024 to 2034.

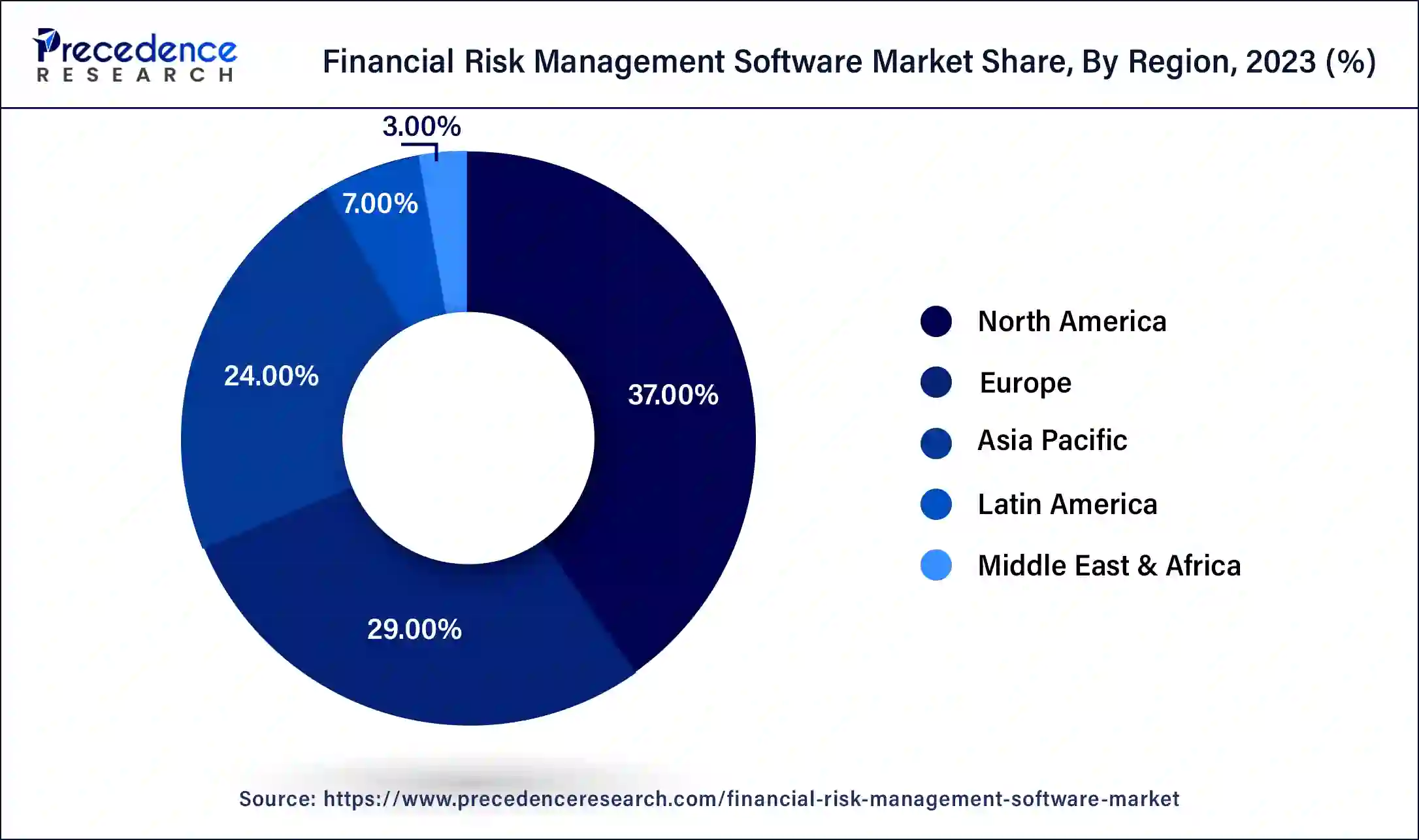

North America dominated the financial risk management software market in 2023. The growth of the market is owing to the availability of the well-developed economies in the region, such as the U.S. and Canada, and the rising per capita income in the population is driving the growth of the financial institutions for the management of finances and the rising cases of the cyber threat and security concerns over the financial data is driving the growth of the financial risk management software in the financial institutes. The region is also considered an early adopter of technologies like artificial intelligence, IoT, machine learning, and others in the industries that are accelerating the growth of the financial risk management software market across the region.

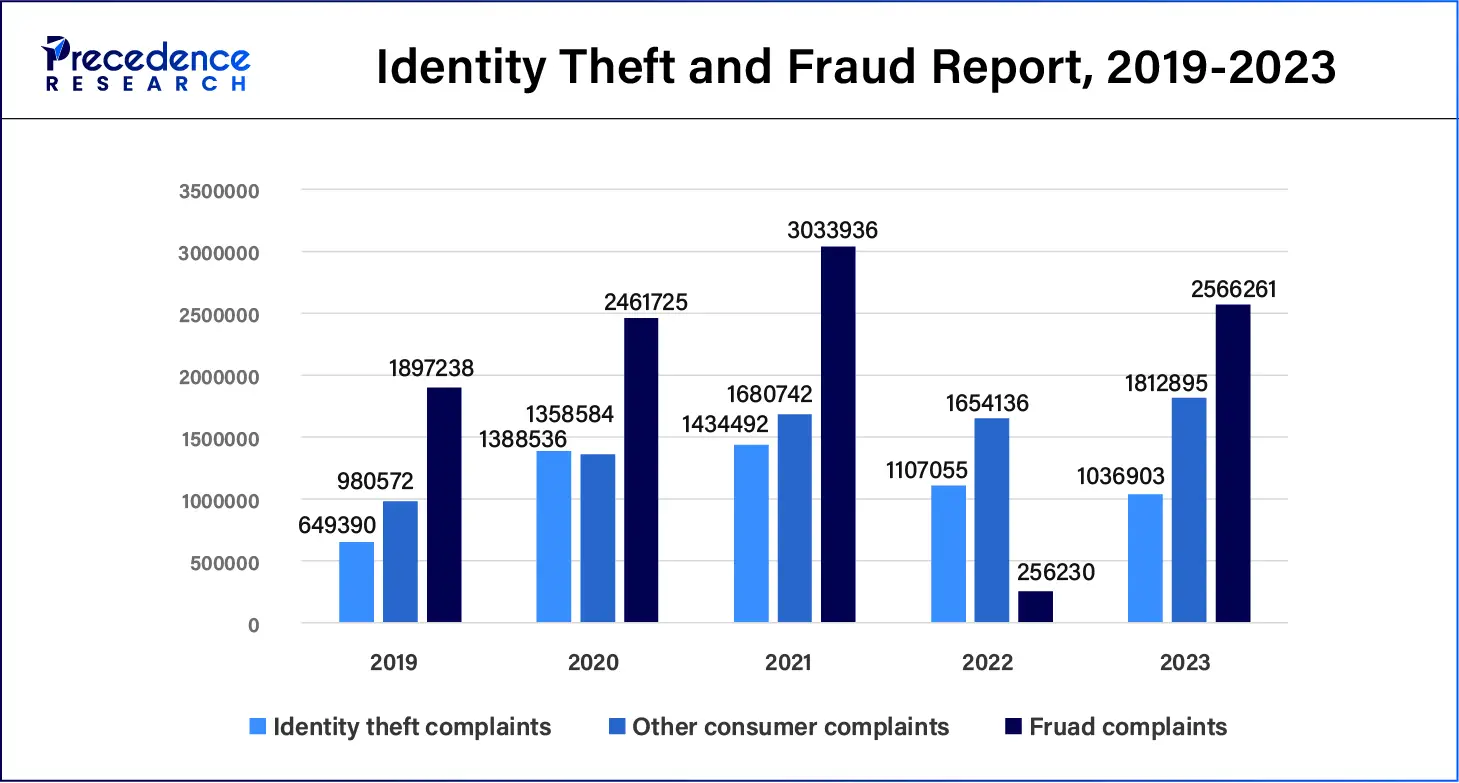

The percentage of companies affected by ransomware increased from 79% to 87% in 2023, which is the highest number of data breaches in the financial services industry since 2018 in the United States.

880,418 claims of cybercrime are made to the FBI each year, up 10% from 2022, according to the FBI's 2023 Internet Crime Report. The overall loss in 2023 is expected to rise from $10.3 billion in 2022 to $12.5 billion. The Federal Trade Commission's (FTC) Consumer Sentinel Network received 5.39 million complaints, of which 48% had to do with fraud and 19% with identity theft. 40.2 percent of identity thefts were related to credit card fraud, while the remaining 25.1% were related to miscellaneous identity theft, which includes identity theft via email and social media, payment account fraud, and online shopping.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The growth of the market is attributed to the rising population and the increasing demand for financial institutions for financial management. The rising adaptation of financial risk management software from the number of financial institutes for automating compliance processes. The rapidly growing economies like India and China in the region are contributing to the expansion of the financial institutes, which collectively drive the growth of the financial risk management software market in the region.

The financial risk management software is the technology or the solution that helps in identifying and mitigating the risk associated with the financial exposers. The rising threat in financial security is driving the adaptation of financial risk management software by several leading financial institutes due to their typical exposure to different counterparties and types of financial risks. The software helps mitigate different types of risks, such as credit risk, market risk, liquidity risk, and market risk. The financial risk management software is highly accepted by insurance companies, banks, investment managers, and other financial institutes.

How Can AI Impact the Financial Risk Management Software Market?

Artificial intelligence revolutionizes the overall financial sector by providing greater efficiency and operations. AI transforms financial risk management with an enhanced decision-making process with real-time monitoring and predictive maintenance. Machine learning algorithms help in risk assessment by analyzing and identifying data and patterns and making predictions according to them. AI-driven sophisticated algorithms predict market trends, analyze complex scenarios, and offer a comprehensive understanding of data for potential risks. AI-enhanced proactive risk management strategies with real-time insights.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.39 Billion |

| Market Size in 2024 | USD 3.74 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Deployment, Enterprise Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The rising global economic growth

The rising population and economic development in several countries are driving advancements in the financial sector. The rising per capita population is driving the demand for financial institutes to manage finances. The rising number of financial institutes causes the demand for financial risk management software to mitigate the existing and potential risks associated with financial institutes. Risk management is accepted by financial institutions like investment banks, investment managers, insurance companies, retail banking, and others, which are more prone to different financial exposures, internal risks, and regulations.

High cost

The high cost of the installation of the financial risk management software and the further cost of maintenance of the software is limiting the expansion of the financial risk management software market.

The technological evolution

The continuous research and development activities in the expansion of the financial sector and the integration of technologies in the overall financial sector are driving opportunities for the expansion of the financial risk management software market. Technologies such as advanced analytics and blockchain in the financial sector that predict and mitigate potential risks are driving further advancements in the financial sector. Additionally, there is rising competition among the technology players in the innovation and launch of new products.

The cloud segment held a dominant presence in the financial risk management software market in 2023. The rising adoption of cloud-based financial risk management software is due to its low operation costs and reduced upfront costs. Automation is one of the major advantages associated with cloud-based financial risk management software, and it reduces the overhead operations and costs of on-premise financial risk management software. Cloud-based financial management offers several advantages to enterprises and can be modified according to requirements. It provides easy scalability as per the demand from the enterprises, enhanced enterprise mobility, reduced the need for server maintenance, predictable monthly expenses, streamlined data management, and strong security for the financial systems and data.

The on-premise segment is projected to expand at a moderate rate in the financial risk management software market in the coming years. The on-premise financial risk management software is installed or deployed in the organizational infrastructure and enables the overall command over the data and the infrastructure. It offers benefits like a better decision-making process, improved risk identification, efficiency, and others, which drive the company leaders to adopt the on-premise financial risk management software segment.

The large enterprise segment led the financial risk management software market in 2023. The growth of the segment is attributed to the higher number of risks associated with the large enterprise in terms of finances, including credit, compliance risks, and others, which are driving the large enterprises to adopt financial risk management software for risk analysis in real time. Large enterprises have a number of financial risks, such as market risks, liquidity risks, credit risks, and others, for which financial risk management software is used.

The SMEs segment is anticipated to grow with the highest CAGR in the market during the studied years. Financial risk management software has different advantages for SMEs, such as fraud detection, analytics, real-time monitoring, identifying and assessing risks, mitigating losses, maintaining regulatory compliance, and others that are anticipated to accept financial risk management software in SMEs in the forecast period.

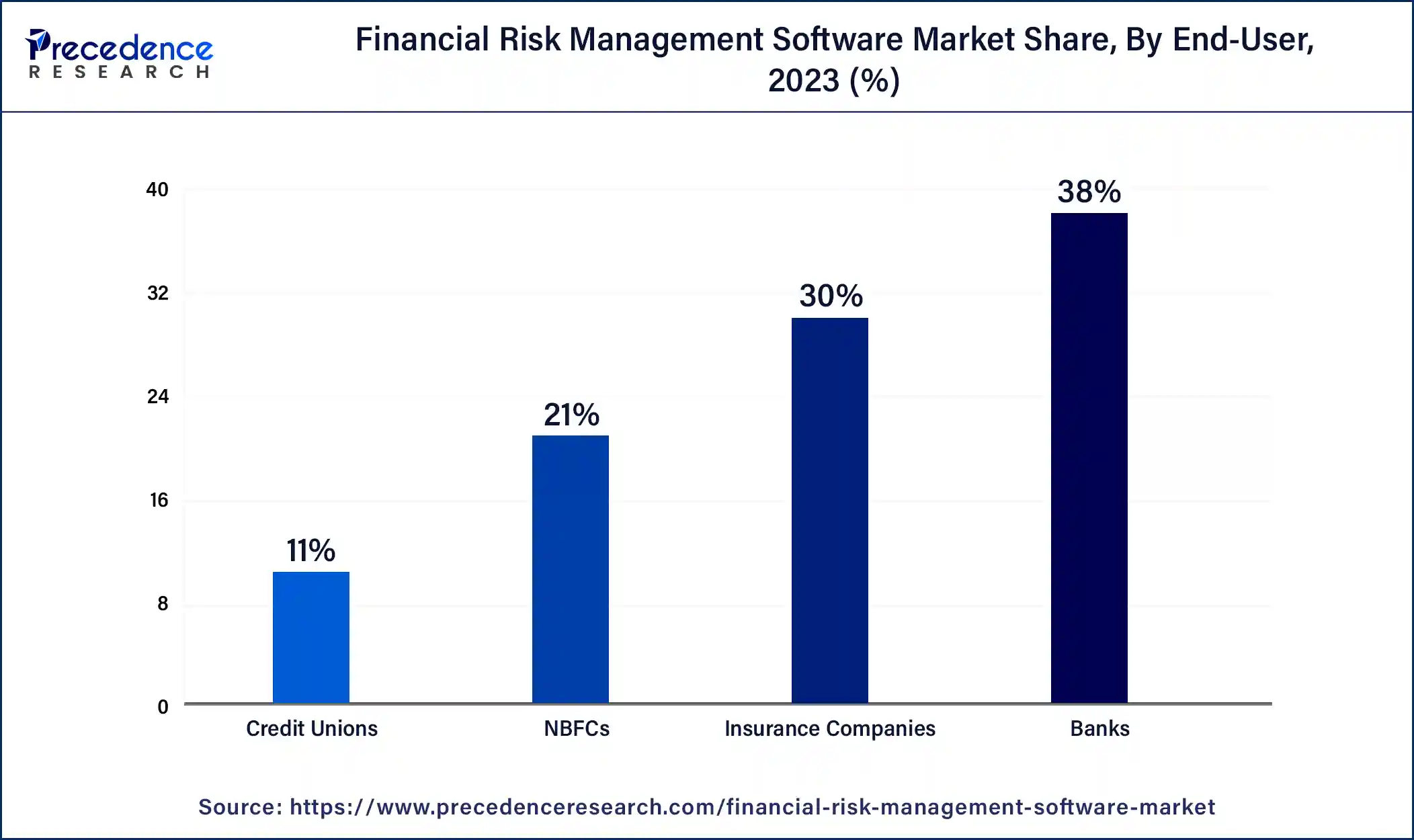

The banks segment registered its dominance over the financial risk management software market in 2023. The banking sector is one of the important parts of the country’s economy, and the sector is more likely to get attacked by cyberattacks, data breaches, data leakage, and other risks. The financial risk management software helps in identifying potential risks, analyzing them, and making investments. The financial risk management software in the banking sector helps ensure financial stability, trust, and reputation, facilitating efficient capital allocation, optimizing return, and long-term growth and sustainability.

The credit union segment is expected to grow at the fastest rate in the financial risk management software market during the forecast period of 2024 to 2034. Credit unions are a type of financial institute whose members are both customers and owners. The financial risk management software in credit unions helps monitor risk and actively address it internally and externally to safeguard the member’s interests and institutional stability. Risk identification, risk assessment and measurement, risk management, and risk monitoring and reporting are the major elements of financial risk management software in credit unions.

Segments Covered in the Report

By Deployment

By Enterprise Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2023

July 2024

October 2024