August 2024

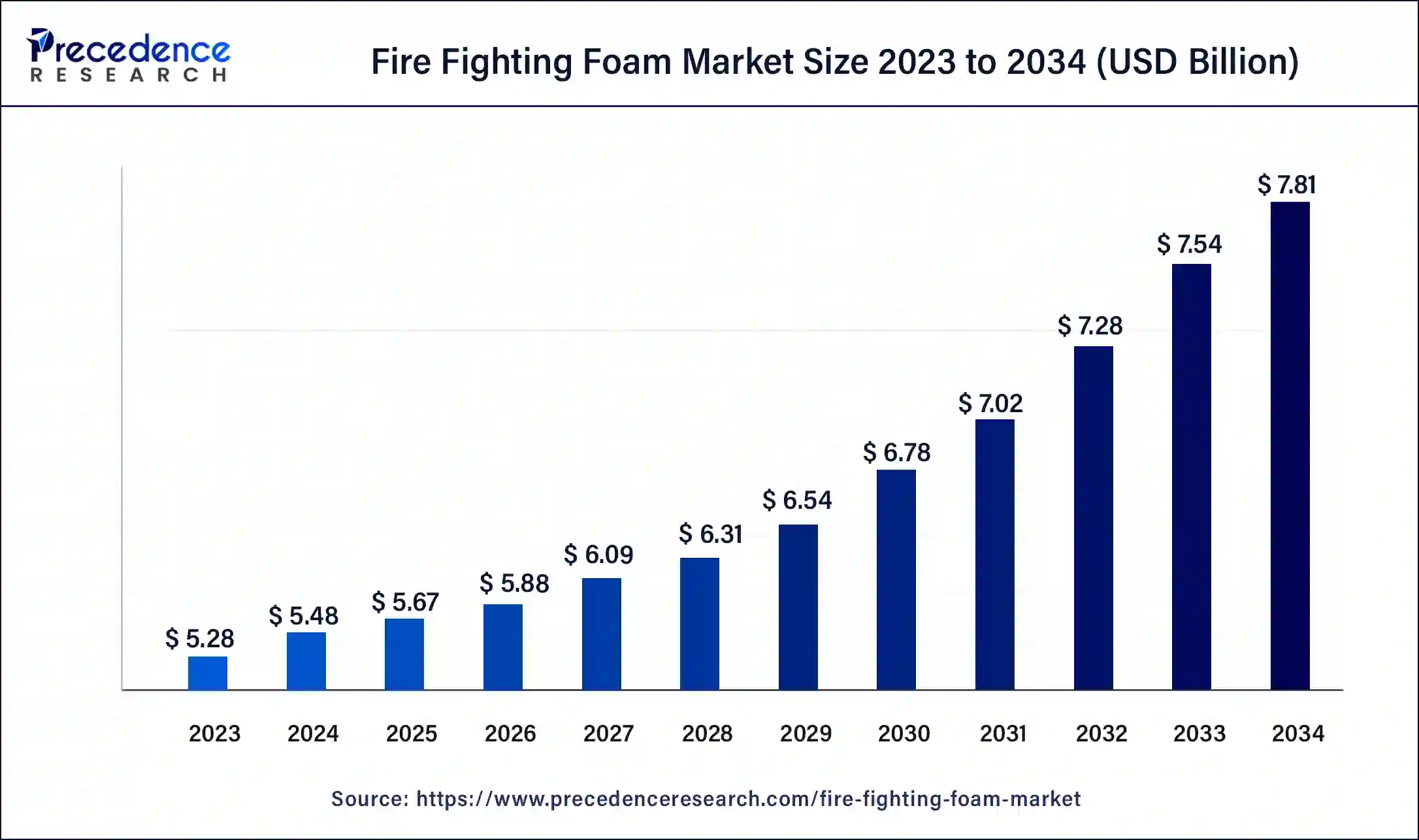

The global fire fighting foam market size was USD 5.28 billion in 2023, calculated at USD 5.48 billion in 2024 and is expected to be worth around USD 7.81 billion by 2034. The market is slated to expand at 3.62% CAGR from 2024 to 2034.

The global fire fighting foam market size is projected to be worth around USD 7.81 billion by 2034 from USD 5.48 billion in 2024, at a CAGR of 3.62% from 2024 to 2034. The benefits of fire fighting foam include providing a short-term fire barrier, reducing the amount of water required to fight fires, cooling surface temperatures, etc. These factors help to the growth of the market.

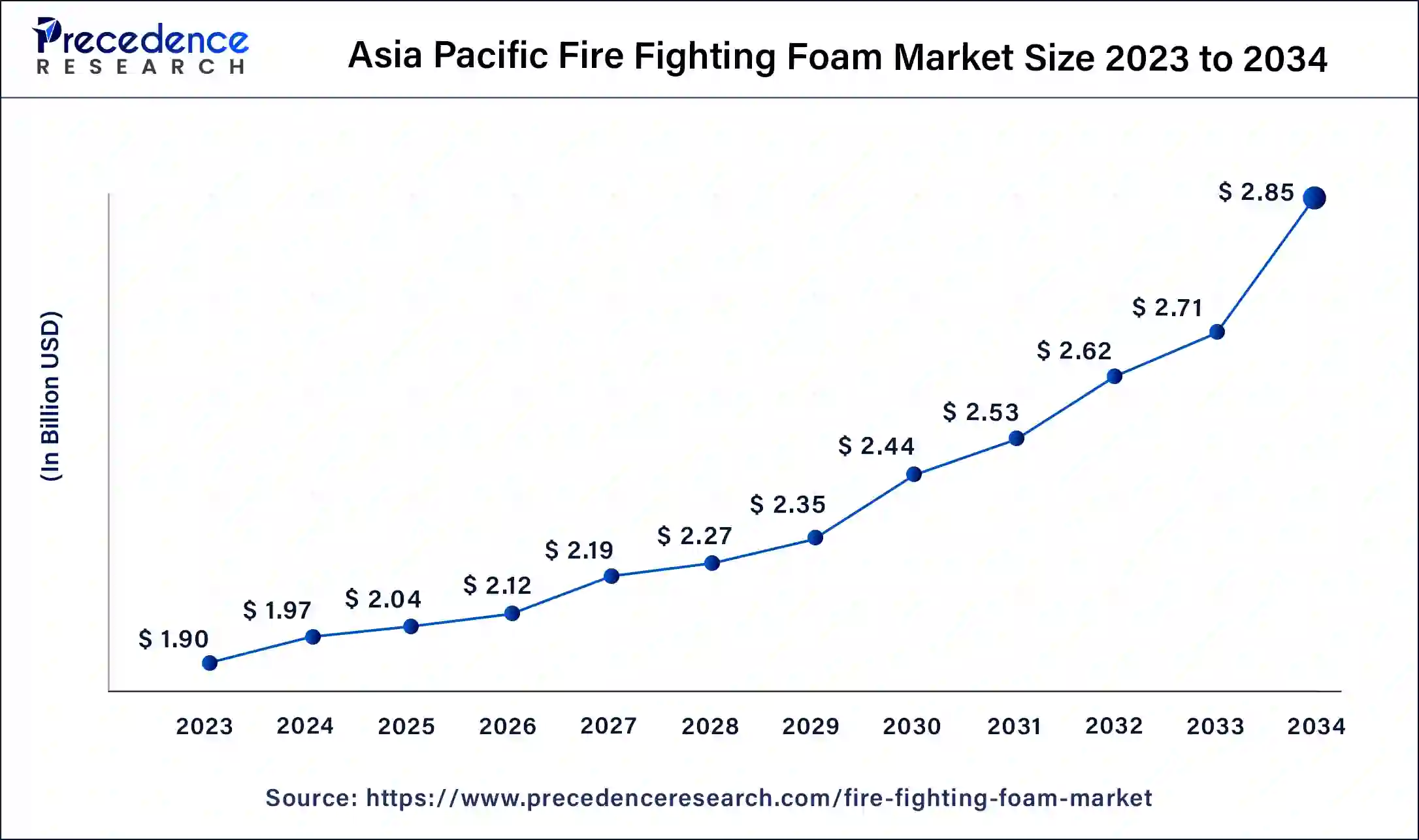

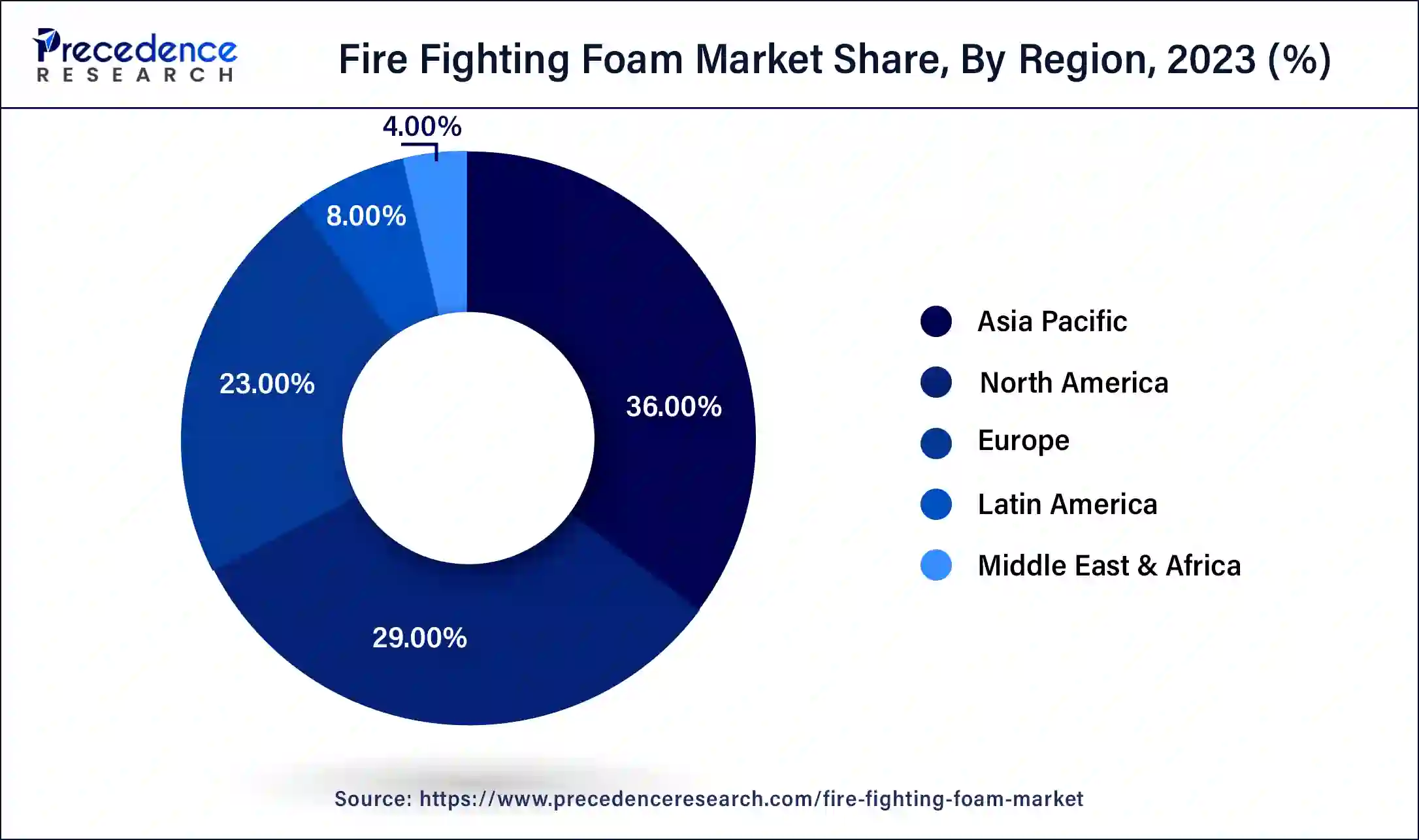

The Asia Pacific fire fighting foam market size was exhibited at USD 1.90 billion in 2023 and is projected to be worth around USD 2.85 billion by 2034, poised to grow at a CAGR of 3.75% from 2024 to 2034.

Asia Pacific dominated the fire fighting foam market in 2023. The lack of proper industrial safety, increased fire accidents, a major share of chemical production worldwide, and dry atmospheric conditions in many countries in the Asia Pacific region lead to the growth of the market. In India and China, rapidly growing industries like aviation, automation, marine, chemical, and others contribute to the growth of the market in the Asia Pacific region.

North America is estimated to be the fastest-growing during the forecast period of 2024-2033. Stringent regularities related to fire safety drive the growth of the fire fighting foam market in the North American region. The presence of a high number of users like oil & gas, manufacturing, and other industries in the North American region. Rising wildfires and fire-related accidents in the United States due to human negligence and atmospheric changes have led to the growth of the market.

The fire fighting foam market refers to the global industry responsible for producing and selling foam-based products that are useful during fire fighting activities. The foam has been highly used as a fire extinguishing medium for combustible and flammable liquids, different from other extinguishing agents like CO2, dry chemicals, water, etc. Firefighting foam is simply a stable mass of small air-filled bubbles with a lower density than water, gasoline, or oil. At the time of these events, foam-based products were used to extinguish fires, especially in cases when they were caused by flammable liquids or gases. These factors help to the growth of the market.

What is the role of AI in the Fire Fighting Foam?

The application of AI in firefighting brings many benefits, including improved resource allocation, enhanced risk assessment accuracy, and reduced response time. The use of AI also minimizes the firefighter's exposure to dangerous situations through the use of robotics, which helps the growth of the market. AI is changing and improving the way firefighters respond to emergencies. AI implementation can help improve the way fire professionals fight and prepare for emergency situations. These factors help the growth of the fire fighting foam market.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.81 Billion |

| Market Size in 2023 | USD 5.28 Billion |

| Market Size in 2024 | USD 5.48 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Foam Type, Fire Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising industrial fire incidences and oil & gas industry expansion

The rising industrial fire incidences and oil & gas industry expansion contribute to the growth of the market. The most common causes of industrial fire incidents include intentional fire, heating equipment, electrical distribution, and lighting equipment. Expansion and evolution of the oil and gas industry contribute to the growth of the market. These factors drive the growth of the fire fighting foam market.

Substitute availability and environmental concerns

Substitute availability and environmental concerns can restrict the growth of the market. There are many different types of firefighting foam, such as Class A type foam and Class B type foam. Class A type foam includes foam solution, compressed air foam, aspirated medium expansion foam, and system aspirated low expansion foam. Class B-type foam includes Aqueous Film Forming Foam (AFFF) and Alcohol Resistant-Aqueous Film Forming Foam (AR-AFFF). The environmental concerns include a negative impact on the environment from the discharge of foam solutions. These factors can hamper the growth of the fire fighting foam market.

Environmental protection

The use of available replacements for fighting foams to sand and water. These alternatives are environmentally friendly and less expensive, which leads to environmental protection. To overcome environmental concerns like negative impact on the environment from discharge of foam solutions. The use of environmentally friendly fire fighting foams including fluorine-free foams (FFF), green fire fighting foams (GFFF), and others. These factors help to the growth of the fire fighting foam market.

The aqueous film forming foam (AFFF) segment dominated the fire fighting foam market in 2023. The water film formed by aqueous film forming foam (AF) offers many benefits, including enabling flames to be extinguished quickly and the foam to reach even in a very large fire and more distant areas. It spreads very fast and allows the foam floating on it to spread fast. Imposing a barrier to mass transfer limits fuel evaporation. It is a highly effective Firefighting product used for highly hazardous, flammable liquid firefighting. It is a fluorine-containing fire-fighting foam primarily used to extinguish flammable liquids like petrol. These factors help the growth of the aqueous film forming foam (AFFF) segment and contribute to the growth of the market.

The alcohol resistant aqueous film forming foam (AR-AFFF) segment is expected to be the fastest-growing during the forecast period. The benefits of Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF) include providing effective fire suppression and extinguishing liquid class B fires, which contain polar solvents and hydrocarbons. These types of foams are required when the fuels are water miscible, such as acetone and alcohol.

The alcohol resistant aqueous film forming foam (AR-AFFF) may be required in high-risk facilities, including the chemical and oil and gas industries, such as pharmaceutical plants and process areas, tank farms, ships, and refineries. AR-AFFFs are acceptable for the fast extinguishment of high-scale class-B fires. AR-AFFF contains polymers that form a protective film between the foam blanket and the burning surface. These factors help the growth of the Alcohol Resistant Aqueous Film film-forming foam (AR-AFFF) segment and contribute to the growth of the fire fighting foam market.

The Class A fire-type segment dominated the fire fighting foam market in 2023. Class A fire type involves regular combustible substances like plastic, paper, wood, rubber, cloth, and fabric. This occurs when a heat source comes in contact with these types of materials, which can cause damage to property and pose a threat to human life. Class A fires with a steady flame that produces a specific amount of ash and smoke. These fires may spread fast if not addressed instantly, which makes it necessary to act fast and use the proper fire extinguisher to prevent potential harm and damage.

The best fire extinguishers for class A fire include multipurpose dry chemical powder extinguishers, foam extinguishers, and water extinguishers. These factors help the growth of the Class A fire-type segment and contribute to the growth of the market.

The class B segment is estimated to be the fastest-growing during the forecast period. A class B fire is a fire in flammable gases like propane and butane or flammable liquids, alcohols, lacquers, solvents, oil-based paints, oils, tars, or petroleum greases. It is caused by leaks of flammable liquids or accidental spills, improper storage or use of flammable materials in industrial facilities, lithium-ion batteries, careless handling of flammable substances like smoking near fuel storage areas, and faulty electrical equipment or wiring. These factors can lead to class B-type fire. These factors can lead to the growth of the class B fire type segment and contribute to the growth of the fire fighting foam market.

The oil & gas segment dominated the fire fighting foam market in 2023. The oil & gas are flammable materials, and any accidental release and leaks can lead to firing. In the oil & gas industry, the principal cause of the fire is the ignition of flammable vapors from auxiliary motors & mobile engines and improper hot work practices. It also includes fire and hazardous explosion factors like chemical storage, poor ventilation, static electricity, storage tank overfills, natural disasters, human error, etc. This leads to rising demand for firefighting foam. These factors help the growth of the oil & gas segment and contribute to the growth of the market.

The chemicals segment is anticipated to be the fastest-growing during the forecast period. When reaction conditions are met, oxidizers strip electrons from the fuel; oxidizers are highly electronegative and may be gases, liquids, or solids. Oxygen is the most problematic in industries due to its reactive concentrations in the atmosphere, which leads to high damage and loss. These factors can lead to the growth of the chemicals segment and contribute to the growth of the fire fighting foam market.

Segments Covered in the Report

By Foam Type

By Fire Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

November 2024

October 2024

October 2023