July 2024

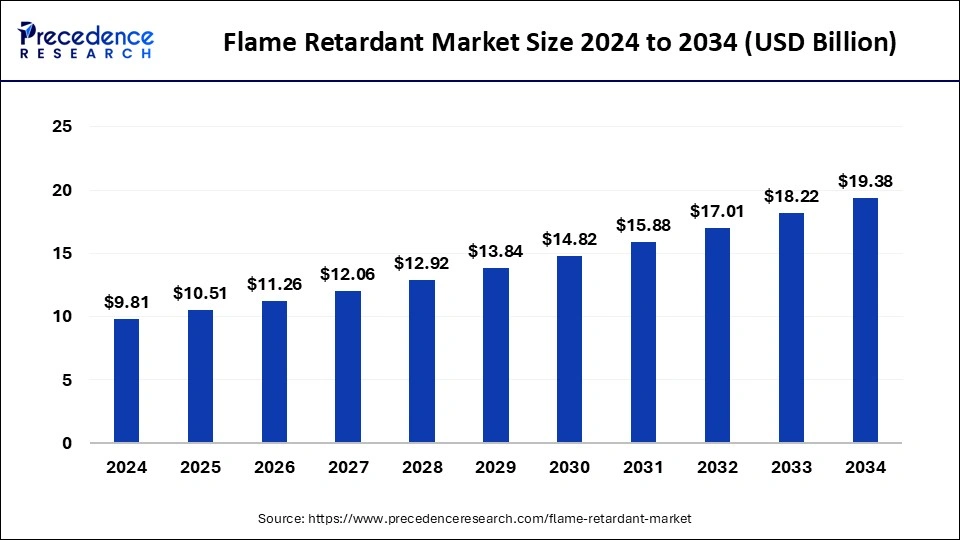

The global flame retardant market size is accounted at USD 10.51 billion in 2025 and is forecasted to hit around USD 19.38 billion by 2034, representing a CAGR of 7.05% from 2025 to 2034. The Asia Pacific market size was estimated at USD 5.59 billion in 2024 and is expanding at a CAGR of 7.17% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global flame retardant market size was calculated at USD 9.81 billion in 2024 and is predicted to increase from USD 10.51 billion in 2025 to approximately USD 19.38 billion by 2034, expanding at a CAGR of 7.05% from 2025 to 2034.

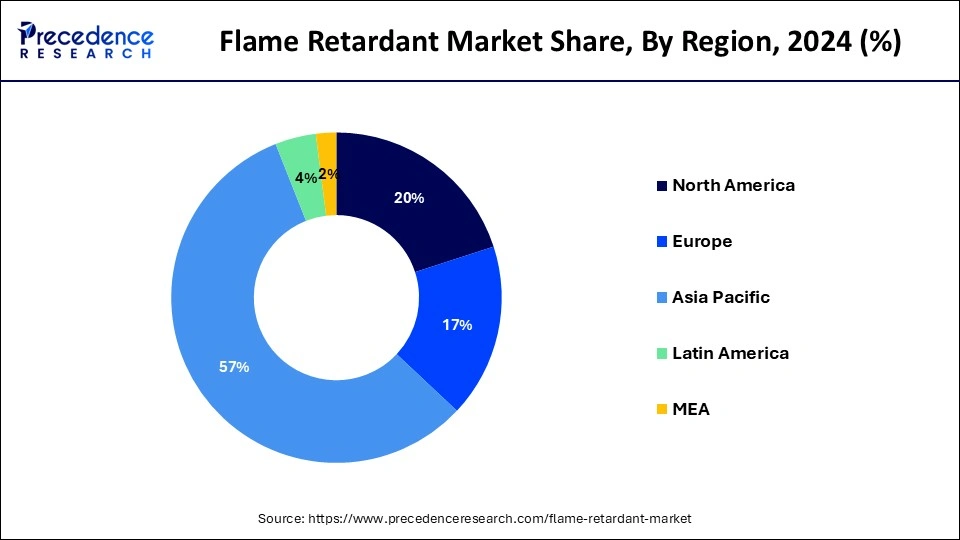

The Asia Pacific flame retardant market size was exhibited at USD 5.59 billion in 2024 and is projected to be worth around USD 11.17 billion by 2034, growing at a CAGR of 7.17% from 2025 to 2034.

Asia Pacific dominated the flame retardant market in 2024. The growth of the region is attributed to rapid industrialization & urbanization, a large population base of population, a rise in infrastructural development projects, easy availability of raw materials, including chemicals required for flame retardant production, and rising demand for consumer electronics and appliances.

In Asia Pacific, developing countries such as China, Japan, and India are the major contributors to the flame retardant market owing to the rising construction of residential and commercial buildings, growing public awareness of safety standards, and rising demand for flame retardant chemicals across various industries across construction, electrical & electronics, automotive, textile, and aerospace to meet safety guidelines. Furthermore, a stringent government framework for fire safety coupled with increasing cases of fire accidents in the Asia Pacific region is escalating the demand for flame retardants during the forecast period. Thus, this is expected to propel the market growth in the region during the forecast period.

North America is anticipated to grow at a significant CAGR in the flame retardant market during the forecast period. The United States dominates the North American market, followed by Canada. The region’s robust growth is driven by the rapid infrastructural development, rising investments in EVs, and increasing demand for electrical components for multiple applications, including wiring, power cables, connectors, and others used in construction & building, electronic devices, and automotive. Moreover, the rising government initiatives for fire safety are expected to accelerate the demand for flame retardants in numerous sectors.

Flame retardants are the chemical compounds that are added to the materials, such as plastics, textiles, and surface coatings, to prevent from starting or slowing the spread of fire. Flame retardants are widely used in electronic & electrical components, wires & cables, construction, appliances, and others. The flame retardant market has witnessed the increasing use of flame retardant chemicals added to a wide range of products, such as electronics, furniture foam, and building insulation, to meet stringent flammability standards. The usage of flame retardant improves the fire safety of combustible materials and products.

| Report Coverage | Details |

| Market Size by 2034 | USD 19.38 Billion |

| Market Size in 2025 | USD 10.51 Billion |

| Market Size in 2024 | USD 9.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.05% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand from various end-use industries

The growing demand for fire retardants from various end-use industries is expected to fuel the growth of the flame retardant market during the forecast period. Manufacturers and automakers are required to follow certain strict fire safety regulations in end-use sectors. The market is experiencing increasing usage of fire-resistant products in several end-use industries, including building & construction, electrical & electronics, transportation, textile, oil & gas, and others. These industries are extensively using flame retardant to enhance safety and meet fire regulations.

Flame retardants aid in protecting numerous equipment and materials, such as circuit boards, wires, furniture foam, car seats, transportation interiors, infant mattresses, paint & coatings, television cases, building insulation, fabric blinds, and others, from the ignition and spread of fire. Therefore, the demand for flame retardants is accelerating as more industries seek to reduce and eliminate fire-related risks, and is anticipated to boost the growth of the market during the forecast period.

Rising environmental and health concerns

The rise in the environmental and health issues associated with the use of traditional flame retardants is anticipated to restrain the flame retardant market's expansion during the forecast period. Fame-retardant chemicals, including brominated and chlorinated, have harmful effects on the environment and humans. The manufacturing of flame retardants includes numerous harmful chemicals that may cause several health disorders, such as respiratory problems, fatigue, conjunctival irritation, dizziness, skin diseases, and others.

Additionally, several renowned regulatory bodies around the world, such as the United States Environmental Protection Agency (U.S. EPA) and the European Union Legislation, have laid down several norms and regulations to restrict the use of harmful compounds in the manufacturing of flame retardants such as Hexabromocyclododecane (HBCD). Thus hindering the market’s expansion.

Increasing focus on fire safety regulations

The rising focus on fire safety regulations is projected to offer a lucrative opportunity for the growth of the flame retardant market during the forecast period. Several governing authorities and regulatory bodies around the world are implementing stringent fire safety regulations to minimize the risk of fires and promote public safety. Such stringent regulations are expected to escalate the sales of flame retardants in oil & gas, chemical manufacturing, construction, textiles, electric & electronics sectors, and the automotive industry.

Moreover, technical improvements coupled with R&D activities have significantly increased the demand for various electrical & electronic devices. The rising popularity of electrical& electronic devices and increasing customer inclination towards compact gadgets has increased the usage of flame-retardants for fire protection solutions. Thus bolstering the growth of the market.

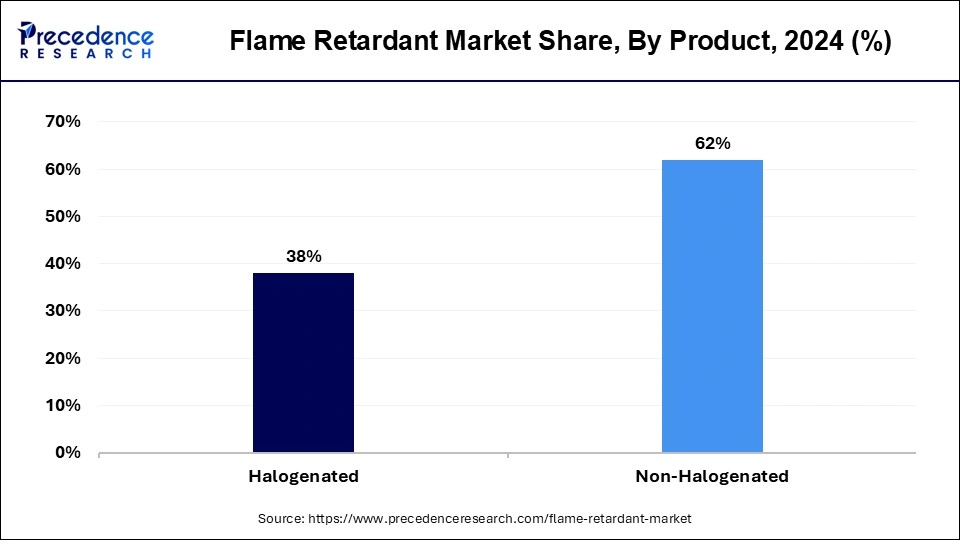

The non-halogenated segment accounted for the dominating share of the flame retardant market in the year 2023 and is projected to continue its dominance over the forecast period owing to several environmental initiatives to reduce the usage of halogenated compounds. They are also widely used for applications that require high levels of flame protection, such as aerospace, military, wire and cable, building and construction, automotive, and others.

Ammonium polyphosphate is rapidly gaining popularity among non-halogenated phosphorus-based flame retardants. Phosphate esters are highly effective in urethane foams and engineered resin systems. Non-halogen flame retardants are considered nontoxic and do not produce harmful gases during combustion. They are regarded as greener additives and can function independently without a synergist to provide the necessary performance. Such factors drive the growth of the segment.

The halogenated segment is expected to witness considerable growth in the global flame retardant market over the forecast period. Halogenated flame retardants include chlorine, bromine, fluorine, and iodine compounds. Brominated flame retardants are the most popular. Halogenated flame retardants are often combined with synergists to reduce the loading rate. Halogenated flame retardants are used in multiple products, including mattresses, carpets, building and construction materials, furniture, electronic devices, and transportation products. Some occupations, such as construction, firefighting, manufacturing, and other industries, are more exposed to halogenated flame retardants than the general public. The continuous exposure of halogenated flame retardants can occur through ingestion, inhalation, and dermal routes.

The epoxy resins segment held the largest share of the flame retardant market in 2023 and is expected to sustain the position throughout the forecast period. The segment is expected to sustain the position throughout the forecast period owing to the increasing flame-resistant epoxy resins extensively used in building & construction, aerospace, rail, coatings, composites, adhesives, civil engineering, and marine applications. Epoxy resins are formulated, making them adaptable for different industries and products. They are highly effective for longer periods and ensure fire safety throughout the lifespan of the product.

The polyolefins segment is expected to grow rapidly in the flame retardant market during the forecast period. Polyolefins help to reduce the spread of fire and also prevent the polymer from dripping. Mattresses, carpets, roofing and siding, construction, components in trains and planes, transportation interiors, and others that require flame retardants in polyolefin fabrics. Thus fueling the expansion of the segment.

The electrical & electronics segment accounted for the largest share of the flame retardant market during the forecast period. The growth of the region is mainly driven by the rapid growth of the electrical and electronics industry. The use of flame retardant in E&E products reduces the risk of fire-causing short circuits. Flame retardants offer reliable safety from switches to micro-assemblies, casings, printed circuits, and several other E&E components.

In addition, the rising adoption of televisions, smartphones, tablets, laptops, gaming systems, and others. These electronic devices are embedded in everyday life, and they cannot be used safely without flame retardants. Flame retardants play an important role in reducing the risk of a fire starting or spreading, leaving more time for people to escape and respond. Electrical & electronics manufacturers prioritize the usage of flame retardants to meet the safety rules and protect against the risk of fire.

The construction segment is expected to grow at a notable rate in the market over the forecast period. Flame retardants have been widely used in building and construction materials such as insulation materials, electrical wiring, coatings, roofing, insulation, and others. Fire retardants are used in building & construction projects to meet fire safety standards and codes. Flame retardants reduce the chances that an ignition source will initiate and spread fire.

Fire retardants are designed to prevent or slow down the spread of fire, providing additional time for building occupants to escape and emergency personnel to respond. Builders, developers, house owners, and construction professionals emphasize the use of flame-retardant materials in the design and construction of buildings to ensure the safety of occupants and reduce fire risks. Such factors are boosting the considerable growth of the segment.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024

August 2024