July 2024

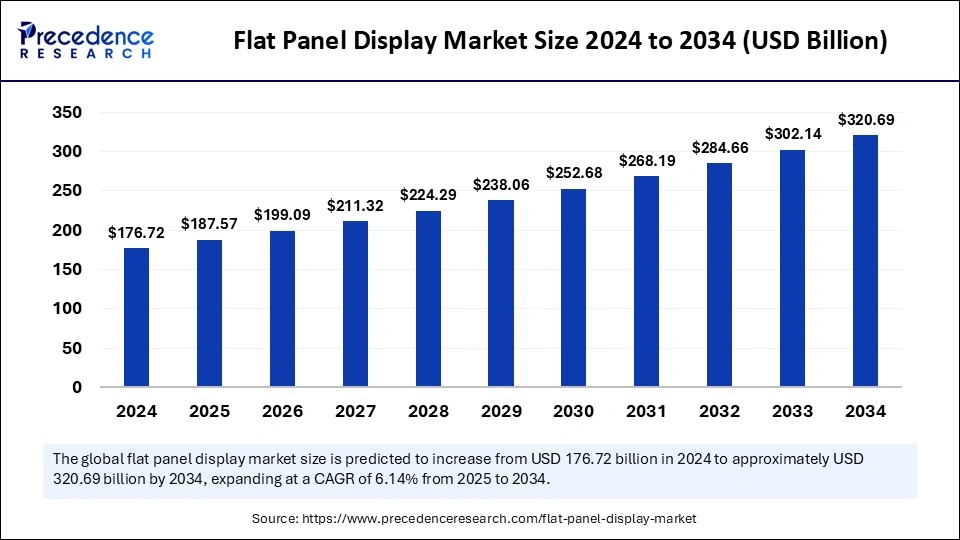

The global flat panel display market size is calculated at USD 187.57 billion in 2025 and is forecasted to reach around USD 320.69 billion by 2034, accelerating at a CAGR of 6.14% from 2025 to 2034.The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global flat panel display market size accounted for USD 176.72 billion in 2024 and is predicted to increase from USD 187.57 billion in 2025 to approximately USD 320.69 billion by 2034, expanding at a CAGR of 6.14% from 2025 to 2034.The is an increased demand for consumer electronics like smartphones and laptops. This increased demand for digital signage in commercial sectors is fueling the market growth. Moreover, the growing adoption of 5G-powered displays is holding market potential.

The flat panel display market is rapidly transforming due to the integration of Artificial Intelligence and automation in the manufacturing industry. AI is enabled to reduce downtime and enhance display performance by delivering predictive maintenance. AI is not only able to optimize the manufacturing process but also to improve image processing capabilities by adjusting brightness, color, and noise as per customizations. AI is further enabled to provide display settings for various applications like reading, video streaming, and gaming.

The development of personalized displays has become possible with the help of AI, as the leverage of AI allows for display settings as per user references for colors, size, and brightness. Moreover, leveraging AI made it easier for the development and utilization of gesture recognition technologies. Voice control displays, to work as per voice commands, have also become possible due to AI. AI is continuously seeking opportunities to rule the industries. The growing utilization of displays for automotive industries is likely to boost AI integration in the flat panel display market.

The flat panel display market has witnessed significant growth in recent years due to the increased adoption of consumer electronics, including large-screen-size smartphones, laptops, smart TVs, and tablets. Moreover, the increased adoption of such electronics is also leading to encouraging developments of cutting-edge technologies. The government has shifted focus toward the establishment of technological and electronic manufacturing companies to improve economic conditions; as a result, the market is rapidly gaining popularity.

Moreover, sectors like buildings and transport have witnessed spectacular contributions to the market growth. The demand for LCD, OLED, and quantum dot displays is trending in the market. Automotive displays are opening rooms for significant developments in display research. Technology developments and integration of automation are making it easier the development personalized and customized displays with demanded weight, brightness, and size, which further increases the adoption rate.

The adoption of smart home devices and the surge for public display mediums are emerging in the market. The growing competition is reducing the cost, making displays more attractive among consumers. Additionally, the sustainability trend is crucially changing market situations. The demand for eco-friendly and sustainable display solutions is emerging in the market. With the growing adoption of digitalization and utilization of automotive vehicles, the market is projected to witness spectacular transformation in the forecast period.

| Report Coverage | Details |

| Market Size by 2034 | USD 320.69 Billion |

| Market Size in 2025 | USD 187.57 Billion |

| Market Size in 2024 | USD 176.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.14% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, End Users, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased demand for high-resolution displays

The surge in demand for high-resolution displays has increased, driving the growth of the flat panel display market. High-resolution displays like 4K and 8K displays have witnessed significant growth in the demands due to increased utilization of ultra-high-definition content. Moreover, the demand for high-resolution displays for smartphones and tablets is heightening the market growth.

The demand for high-resolution displays in gaming consoles and PCs has also increased due to the growing need for enhanced visual experiences and gaming experiences. The developments of cutting-edge technologies, like increased pixel density of displays, are trending in the market. Moreover, with rising demand for HDR displays, esports, and gaming consoles is projected to drive the market further in the forecast period.

Increased disposable income

The rise in disposable income among the middle-class population is the crucial driver of the flat panel display market. The rise in disposable income is allowing spending on cutting-edge consumer electronics and rising demands for premium products, including high-end smartphones, tablets, gaming consoles, and monitors. Moreover, the increased disposable income is allowing the middle-class population to adopt 4K and 8K TVs as well as smart home devices, like smart speakers, smart thermostats, security cameras, and Internet of Things devices.

High costs

The high costs of materials required for FPD manufacturing, like glass, earth metals, and semiconductors, are high, which directly impacts production costs. Moreover, the complex process of FPDs incurs more costs in development and equipment to maintain. Yield rates lead to reduced manufacturers' portability, which further impacts the production cost and manufacturing profits. Similarly, the investment in the development of novel display technologies like OLED and Micro-LED is high.

Growing market competition is influencing the manufacturer's companies ' economies. Additionally, regulatory policies for licensing and patents can be costly and time-consuming, which also impacts product sealing, leading to it being costly for manufacturers. With growing government focus and investment in electronic manufacturing industries, the market can overcome this restraint.

Increased adoption of VR and AR applications

The growing demand for Virtual Reality and Augmented reality has increased in enterprises. The rising demand for high-resolution displays is driving the adoption of VR and AR. Also, the rise in demand for quick-response technologies and large screens is fueling the market growth. To satisfy consumer demands, the utilization of VR and AR has increased in flat panel displays to prevent motion sickness and improve immersive experiences. The growing developments of micro-LED displays are holding opportunities for further adoption of VR and AR applications.

The increased demand for OLED displays is surging in VR and AR adoptions to improve response time, wide viewing angles, and high resolutions. The ongoing developments of quantum dot displays are also playing a crucial role in the VR and AR application adoption rate to improve color accuracy and high brightness. The need for high-resolution displays is likely to enhance the adoption of VR and AR applications in the upcoming period, leading to extended market growth.

The liquid crystal display (LCD) segment noted the largest flat panel display market share in 2024 due to its vast utilization in consumer electronics, including smartphones, TVs, computers, digital signage, and tablets. Moreover, the affordability of LCD panels is a key reason driving adoption by manufacturers and consumers. The growing population led to increasing demand for consumer electronics with improved effectiveness and cost-effective solutions, making the segment more attractive. The ability of LCD panels to consume limited energy is contributing to the further growth of the segment. The demand for LCD panels in TVs, monitors, and mobile devices has increased due to their affordability. Additionally, the automotive industries are seeking navigation systems; infotainment systems are driving a shift toward the adoption of LCD segments.

The consumer electronics segment led the global flat panel display market in 2024. The growing adoption and utilization of consumer electronics like smartphones, laptops, tablets, smart TVs, and gaming consoles are the reasons driving market expansions. The rising demand for advanced technology utilization in such devices is encouraging manufacturers to develop innovative FPDs. Moreover, the growing demand for OLED and quantum dot displays in consumer electronics has increased due to their properties of picture quality and energy efficiency.

Increased Adoption of Consumer Electronics in Asia Pacific

Asia Pacific dominated the flat panel display market with the largest share in 2024. The growing population is leading to a rise in demand for consumer electronics like smartphones, laptops, and tablets. The demand for gaming consoles and smart home devices has also witnessed growth in Asia Pacific, encouraging the development of more effective display technologies. The growing urbanization, disposable income, and adoption of smart homes are driving demands for large-sized FPDs for public places and TVs.

China is leading the regional market due to rising investments in research and development and increased adoption of cutting-edge technologies in education and business sectors. India is projected to witness significant growth with growing government support for electronic manufacturing and investments in display technology research. The expanding technology and automotive manufacturing industries in the region are likely to shift the regional market toward success.

Significant Investments in Research and Development to Boost the North American Market

North America is anticipated to witness the fastest growth in the flat panel display market due to the region's strong research and development sector. The presence of competitive landscapes is making more investment in research and development of cutting-edge technologies in the region. Government support for research and development firms through policies like the National Science Foundation and the Department of Energy is supporting areas of innovative display technologies and material science.

The presence of research institutes like MIT, Stanford University, and the University of California is highly contributing to the growth and development of novel, cutting-edge technologies. Moreover, growing collaborations between academia and industries are advancing display technology R&D. High patent activities for innovative display technologies by research institutes and government investments for allowing researchers to explore new materials applications are expected to continue dominating the market growth in North America.

By Technology

By End-Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024