January 2025

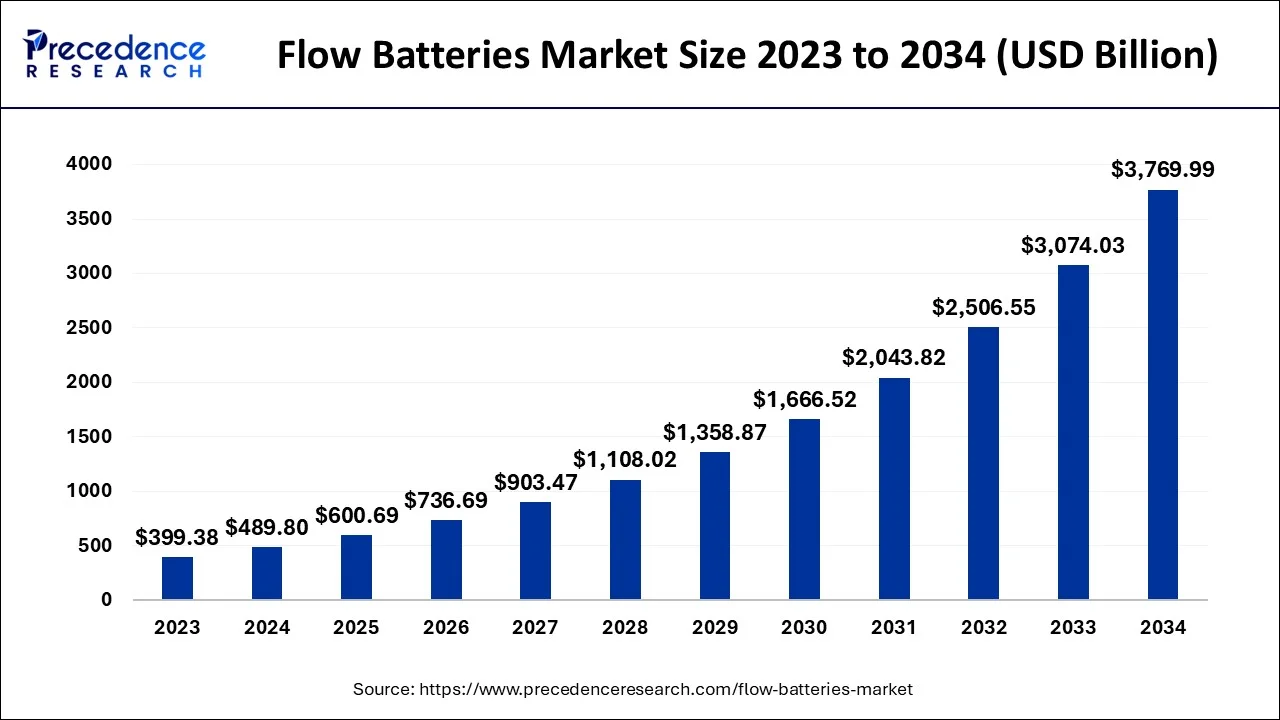

The global flow batteries market size accounted for USD 489.8 billion in 2024, grew to USD 600.69 billion in 2025 and is predicted to surpass around USD 3769.99 billion by 2034, representing a healthy CAGR of 22.64% between 2024 and 2034.

The global flow batteries market size is exhibited at USD 489.8 billion in 2024 and is predicted to surpass around USD 3769.99 billion by 2034, growing at a CAGR of 22.64% from 2024 to 2034. A flow battery is a completely rechargeable electrical energy storage system in which fluids containing the active ingredients are pushed through a cell to promote reduction/oxidation on both sides of an ion-exchange membrane, producing an electrical potential.

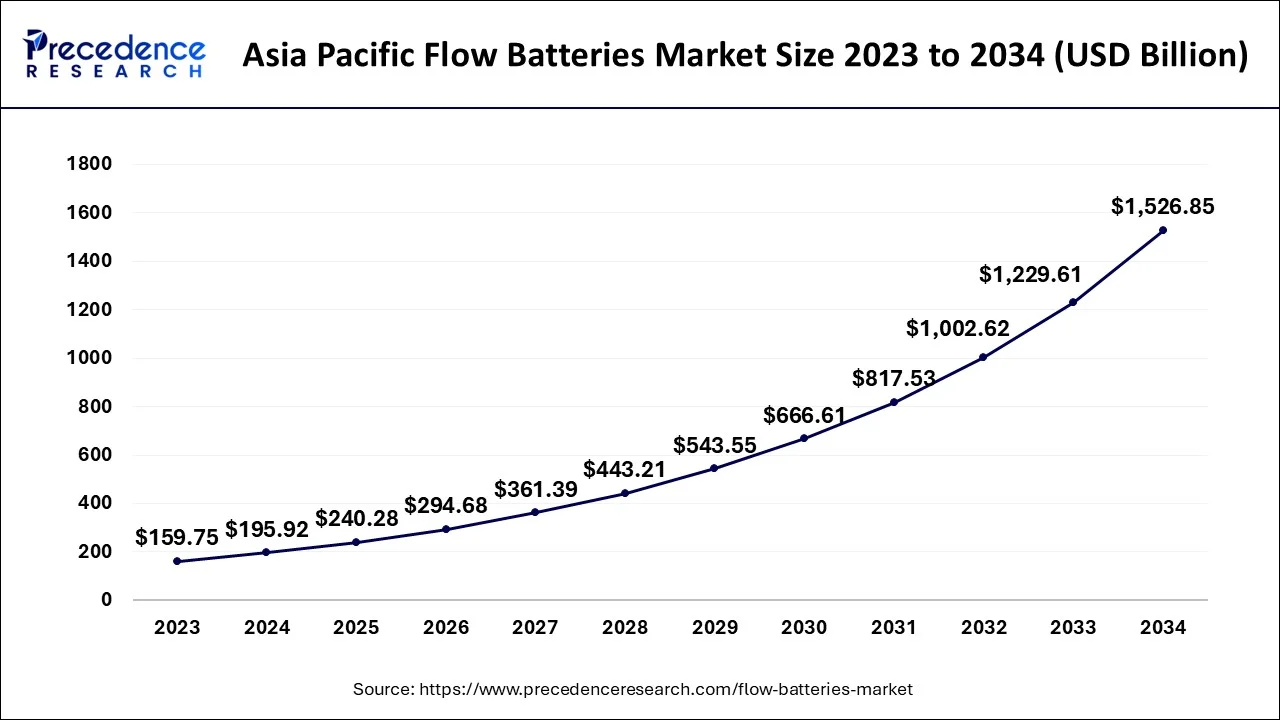

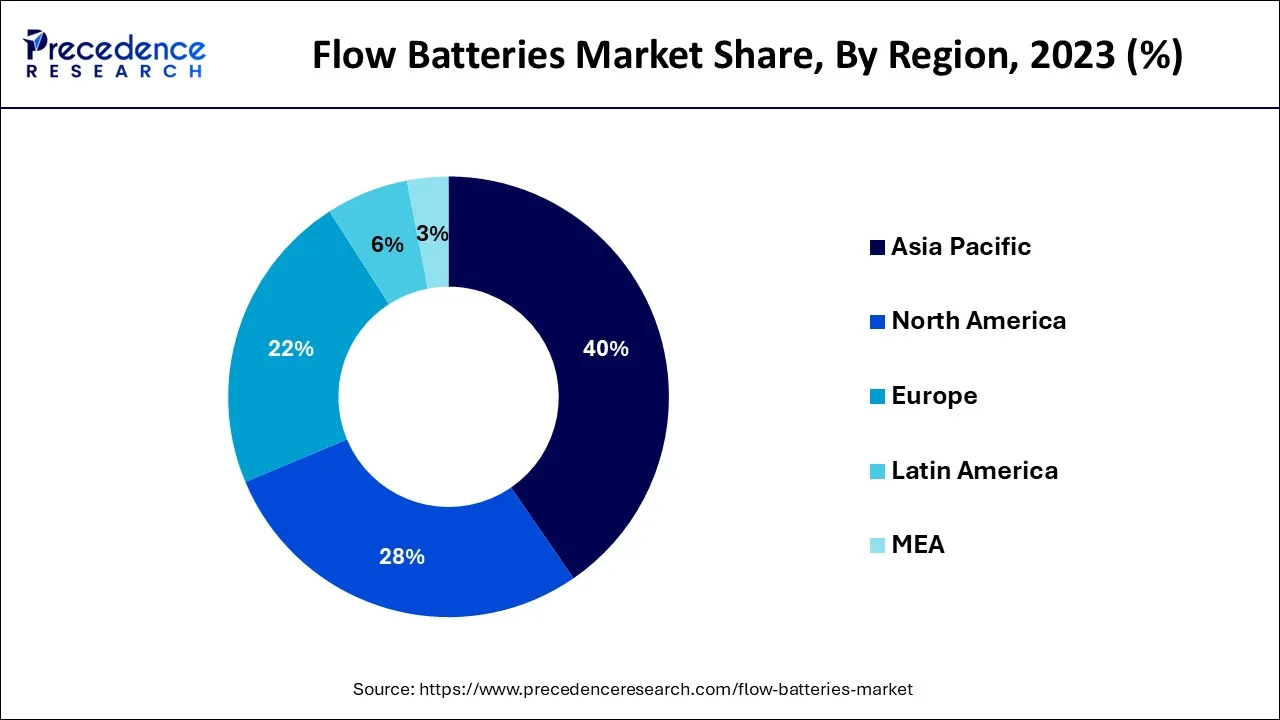

The Asia Pacific flow batteries market size is estimated at USD 195.92 billion in 2024 and is expected to be worth around USD 1526.85 billion by 2034, rising at a CAGR of 22.78% from 2024 to 2034.

The flow battery market in the US was projected to grow to US$ 63 million in 2023. The country now controls 20.6% of the global market. Over the course of the study period, it is expected that China, the second-largest economy in the world, would expand at a considerable CAGR reaching an estimated market size of US$162 million in 2033.

Two other important regional markets are Japan and Canada, with growth rates of 19.6% and 21.3% expected for each throughout the length of the inquiry. Germany is projected to grow within Europe at a pace of around 21.4% CAGR, and by the end of the research period, the market in the rest of Europe will be worth US$213.8 Million. Numerous flow battery-based systems with higher power ratings may be found in the Asia-Pacific area. Australia has the most flow battery-based projects in operation for its residential, utility, commercial, and industrial uses, while China has installed the most flow batteries to date with the highest capacity. One of the main factors propelling the market for flow batteries in the area is the necessity to store renewable energy.

There is a greater requirement for energy backup due to the rising need for a consistent supply in all major nations. In the event of power outages or high demands, flow batteries serve as a backup power source. The flow is viewed as a replacement for lithium-ion batteries and fuel cells. One distinctive feature that sets flow batteries apart from other alternatives is their ability to be scaled up and recharged simply by adding the necessary amount of electrolyte. The functioning of flow batteries is more adaptable because of the capability of recycling wasted electrolytes in storage tanks. Other benefits provided by flow batteries are their long operational life and low maintenance requirements. The demand for these batteries has grown along with the introduction of renewable energy sources like solar and wind, which has a negative impact on the market for flow batteries. With green energy targets set by several developed and developing nations, this trend is expected to continue globally. Utility companies use flow batteries primarily for energy storage. A further benefit for utility-scale grid operations is the scalability of the flow batteries, which can increase their capacity by using a higher amount of electrolyte. This, along with another benefit of longer operation duration and longer life, acts as a market driver for the global flow battery market. Flow battery installations have risen globally as a result of the expanding use of solar and wind energy.

| Report Coverage | Details |

| Market Size in 2024 | USD 489.80 million |

| Market Size by 2034 | USD 3769.99 million |

| Growth Rate from 2024 to 2034 | CAGR of 22.64% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

High demand for the flow batteries in the utilities

High initial expenditure needed to manufacture flow batteries

The use of flow batteries in residential applications is expanding

Flow batteries are thought to be appropriate for utilities as well as commercial and industrial clients looking for long-term and lengthy hours of energy storage due to their big and hefty properties. Flow batteries are mostly used in utility applications as a buffer between the supply of energy from the electric grid and the demand for electricity. Since flow batteries can reliably store and discharge power, utility owners may reduce the amount of excess electricity produced. Additionally, utilities need batteries that can handle a significant penetration of renewable energy throughout the grid and are durable, robust, and long-lasting. The focus on improving the electric grid systems has increased due to the rising demand for power in rural and urban regions, which is likely what will lead to the adoption of flow batteries in utility applications.

Blackouts interrupted power supplies, and machine downtime all have an influence on commercial and industrial applications, which can severely hinder corporate operations since they can harm production lines, delay deliveries, and cause product damage. Unexpected power outages in certain places might persist for a minute, an hour, a day, or even a week. Here, flow batteries are essential because they save energy costs for commercial and industrial businesses while also enhancing power quality and dependability. Additionally, they lessen the chance that output may be lost during blackouts or power supply shortages. Battery storage systems make it easier to deploy renewable energy systems that provide affordable, environmentally friendly power and generate income by selling any extra energy or grid-stabilizing services.

The market is divided into All-Vanadium, Iron, Zinc-Bromine, Hydrogen-Bromine, Polysulfide Bromine, Organic, and Others based on the kind of material used. Vanadium is anticipated to expand at a 22.4% CAGR and reach US$819.7 Million. Vanadium electrolyte, which is present in the majority of flow batteries, may deliver dependable charging and discharge for numerous cycles without degradation. Vanadium's electrochemical characteristics, which make it simple to take electrons out of the element and then put them back in, make this possible. Vanadium redox couples (V2+/V3+ in the negative and V4+/V5+ in the positive half-cells) are used in the vanadium redox flow battery (VRFB), a suitable redox flow battery (RFB), to store energy. These batteries' power and energy ratings are independent of one another, and each may be tailored specifically for a certain application. Numerous nations have continually concentrated on expanding energy demand without any fluctuation, leading to the installation of numerous energy storage devices in independent and renewable energy systems. The country with the greatest commercial success in renewable energy is China, which in 2020 deployed 1.6 GW of energy storage. Other nations also have a number of new technology energy storage projects planned. At its electrolyte manufacturing plant in Arkansas, United States, U.S. Vanadium started the capacity expansion project in September 2021 to produce Ultra-High-Purity Vanadium Redox Flow Battery Electrolyte. A USD 2.1 million investment was made in the project. The program is anticipated to have an impact on the entire region's sales of vanadium redox batteries.

The commercial effects of the pandemic and the economic crisis it caused have been carefully examined, and the growth of the ZINC-BROMINE segment has been readjusted to a revised 24.1% CAGR over the following seven years. Currently, this sector holds a 23.1% market share for flow batteries worldwide. The market for vanadium-based flow batteries is predicted to expand rapidly as a result of the battery's unique benefits, particularly for large stationary applications. The leading energy storage technology is vanadium redox flow batteries, which are in great demand in the mini-grid, utility, and off-grid sectors. Since most manufacturers choose zinc-bromine over vanadium due to the latter's high price and restricted availability, zinc-bromine is predicted to see rapid development. Additionally, grid, residential, industrial, commercial, and microgrid applications have all seen an increase in the utilization of zinc-bromine flow batteries in the past.

By Type

By Application

By Material

By Storage

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

February 2025

February 2025