February 2025

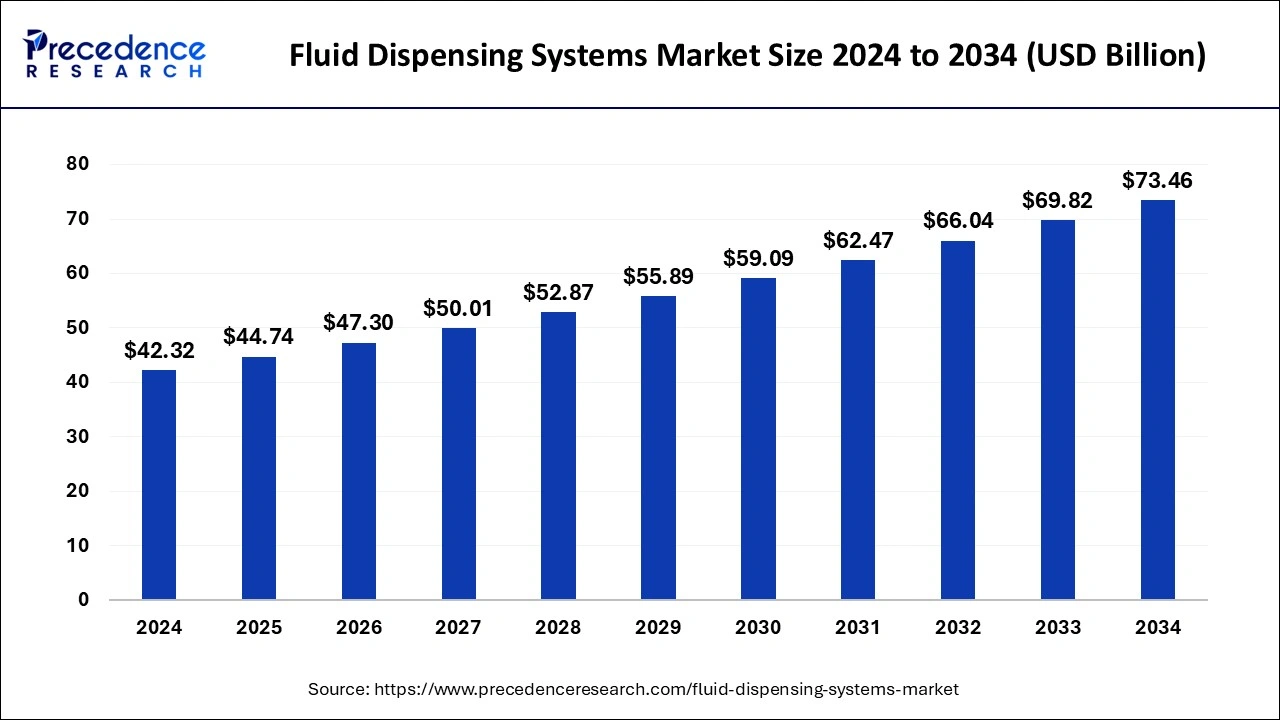

The global fluid dispensing systems market size is calculated at USD 44.74 billion in 2025 and is forecasted to reach around USD 73.46 billion by 2034, accelerating at a CAGR of 5.67% from 2025 to 2034. The Asia Pacific fluid dispensing systems market size surpassed USD 20.58 billion in 2025 and is expanding at a CAGR of 5.78% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fluid dispensing systems market size was estimated at USD 42.32 billion in 2024 and is predicted to increase from USD 44.74 billion in 2025 to approximately USD 73.46 billion by 2034, expanding at a CAGR of 5.67% from 2025 to 2034. The rise in the number of diagnostic centres and hospitals is driving the growth of the ultrasound market. The fluid dispensing systems market is becoming increasingly popular as a way to boost productivity and cut labor costs in the electronics, automotive, healthcare, and aerospace industries. This is due to the growing demand for automated manufacturing processes in these sectors.

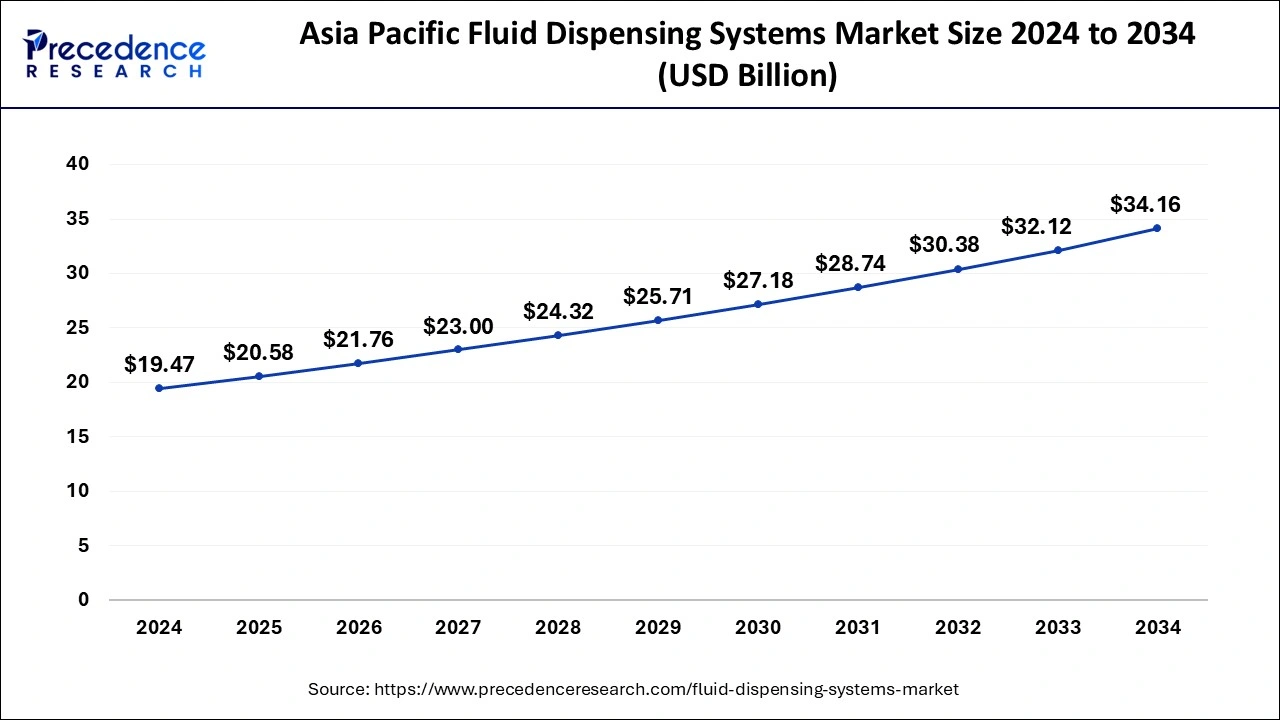

The Asia Pacific fluid dispensing systems market size was estimated at USD 19.47 billion in 2024 and is predicted to be worth around USD 34.16 billion by 2034 at a CAGR of 5.78% from 2025 to 2034.

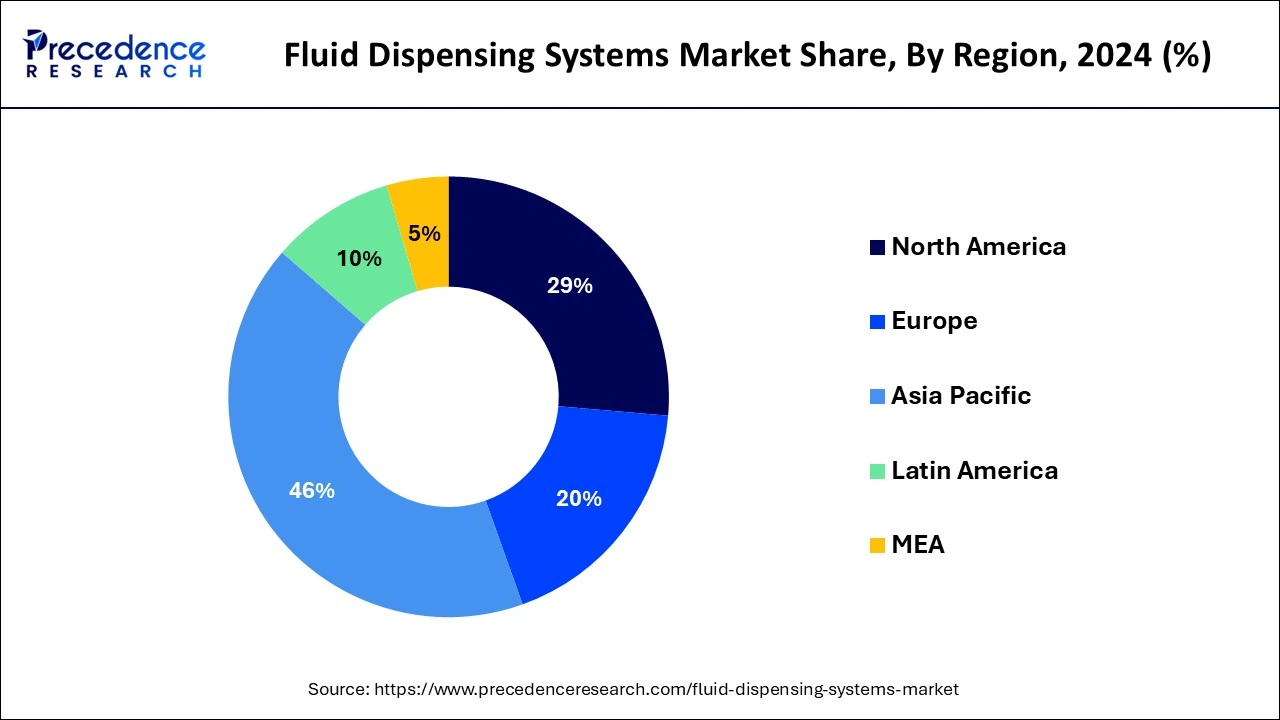

Asia Pacific led the fluid dispensing systems market in 2024. The need for automated manufacturing processes, such as fluid dispensing systems, is rising due to the fast industrialization of nations like China, India, and Southeast Asia. Leading nations in the electronics manufacturing industry are China, South Korea, Japan, Taiwan, and other nations in the area. In the assembly of electronic components, fluid dispensing devices are essential for the accurate application of sealants, varnishes, and adhesives. Asia Pacific's automobile sector is growing quickly, especially in the rising economies. In vehicle assembly lines, fluid dispensing systems are used for applications like sealants, lubricants, and adhesives.

Europe is expected to show significant growth in the fluid dispensing systems market in the upcoming years. Europe's market for fluid dispensing systems is expanding due to a number of factors, including the automobile, electronics, pharmaceutical, and other industries. In manufacturing processes, fluids are dispensed precisely and automatically by the use of fluid dispensing devices.

The industry was expanding because of advancements in dispensing systems, including enhanced precision, accuracy, and automation capabilities. The incorporation of Industry 4.0 technologies, including robotics and the internet of things, into fluid dispensing systems has been improving manufacturing processes' productivity and efficiency. Fluid dispensing systems were being adopted by a growing number of industries, including aerospace, automotive, electronics, and healthcare, in order to comply with strict regulations and quality standards.

Fluid dispensing systems have seen steady growth in the market due to the growing need for automation, electronic device downsizing, and developments in manufacturing technology. The fluid dispensing systems market is predicted to expand as more businesses depend on automated processes for accuracy and efficiency. Dispensing technology is evolving, with automation and robotics being used to achieve greater accuracy and efficiency. Furthermore, smart dispensing systems—outfitted with sensors and software for real-time monitoring and control—are becoming increasingly popular. These devices are essential for dispensing conformal coatings, encapsulants, and solder paste in the electronics manufacturing industry. They are employed in medicine to precisely dispense biomaterials in drug delivery systems and medical device manufacture.

The demand for the fluid dispensing systems market is present around the world, with emerging markets in Latin America and the Middle East, as well as North America, Europe, and Asia Pacific, being major consumers. Asia Pacific is expanding quickly because of the region's thriving electronics manufacturing sector, especially in China, Japan, and South Korea. The market has a lot of potential, but there are also obstacles to overcome, like expensive startup costs, complicated technology, and strict legal requirements. However, technological and material developments, as well as the expanding Industry 4.0 movement, offer chances for new product development and market expansion. In the market for fluid dispensing systems, environmental sustainability is also receiving more attention.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.67% |

| Market Size in 2025 | USD 44.74 Billion |

| Market Size by 2034 | USD 73.46 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption in healthcare and biotechnology

Fluid distribution needs to be done precisely and accurately in both biotechnology and healthcare. Even small mistakes might have major repercussions when it comes to producing biotech goods, performing tests, or giving prescriptions. Biotechnology and healthcare are two other industries that are being revolutionized by automation. By expediting procedures, automated fluid dispensing devices increase efficiency while lowering the possibility of human error. Conventional manual dispensing techniques may introduce impurities that jeopardize patient safety or experiment integrity. Fluid dispensing solutions with closed systems reduce the possibility of contamination, guaranteeing the integrity of samples, reagents, or pharmaceuticals.

Competition and pricing pressure

The fluid dispensing systems market is impacted by a number of factors, including technological breakthroughs, market demand, regulatory requirements, and worldwide economic situations. Common dynamics in this market include competition and pricing pressure. Pricing and competitiveness may be impacted by shifts in the demand for fluid dispensing systems, which are influenced by sectors including electronics, automobile, healthcare, and aerospace. Companies may be able to charge more when demand is strong, and when demand is low, competition heats up and drives up prices. Competition and price can be impacted by economic factors, including inflation, GDP growth rates, and currency movements. When businesses use competitive price methods to maintain market share and boost demand, economic downturns may result in pricing pressure.

Customization and integration

Different sectors have different needs when it comes to fluid dispensing, including those related to particular materials, levels of precision, throughput rates, and environmental factors. Manufacturers can adapt dispensing systems to suit unique requirements through customization. It is frequently necessary to smoothly incorporate fluid dispensing devices into already-existing production lines. Compatibility with robotic arms, visual inspection systems, conveyor systems, and other automation equipment may be a need for this integration. Since industries are always changing, production needs might also alter over time. Modular components or programmable features are two design options for customized dispensing systems that make it simple to adjust to shifting production requirements. To guarantee optimum performance and longevity, customization may entail choosing materials and parts that are suitable for the particular fluids being delivered.

The adhesive & sealant segment held the largest share of the fluid dispensing systems market in 2024. Within the larger industrial landscape, the adhesive and sealant industry for fluid dispensing systems is an important one. Advanced adhesive and sealant dispensing technologies are becoming more and more in demand as various industries, such as electronics and the automotive sector, continue to demand more accurate, dependable, and efficient bonding solutions. Fluid dispensing systems with robotic arms and automated controls are becoming more and more necessary to apply adhesives and sealants precisely and consistently as companies embrace automated manufacturing processes to increase efficiency and precision. Adhesive and sealant dispensing systems play a critical role in the electronics sector, which produces smartphones, tablets, and other electronic devices by helping to bond components and guarantee device durability.

The lubricants segment is expected to show the fastest growth in the fluid dispensing systems market during the forecast period. In fluid dispensing systems, lubricants are essential for both smooth functioning and preventing component wear and tear. Depending on the demands and particular application, many types of lubricants are employed in the fluid dispensing systems market. Because of their adaptability and compatibility with a range of materials, they are widely employed. In pneumatic and hydraulic systems, silicone-based lubricants are frequently utilized because of their superior lubricating qualities. In comparison to conventional lubricants, synthetic lubricants perform better and are designed for certain uses. In harsh circumstances like high temperatures, high pressures, or corrosive environments, they offer superior lubrication. Grease is a type of semi-solid lubricant that is made of basic oil that has been thickened with aluminum, calcium, or lithium soap.

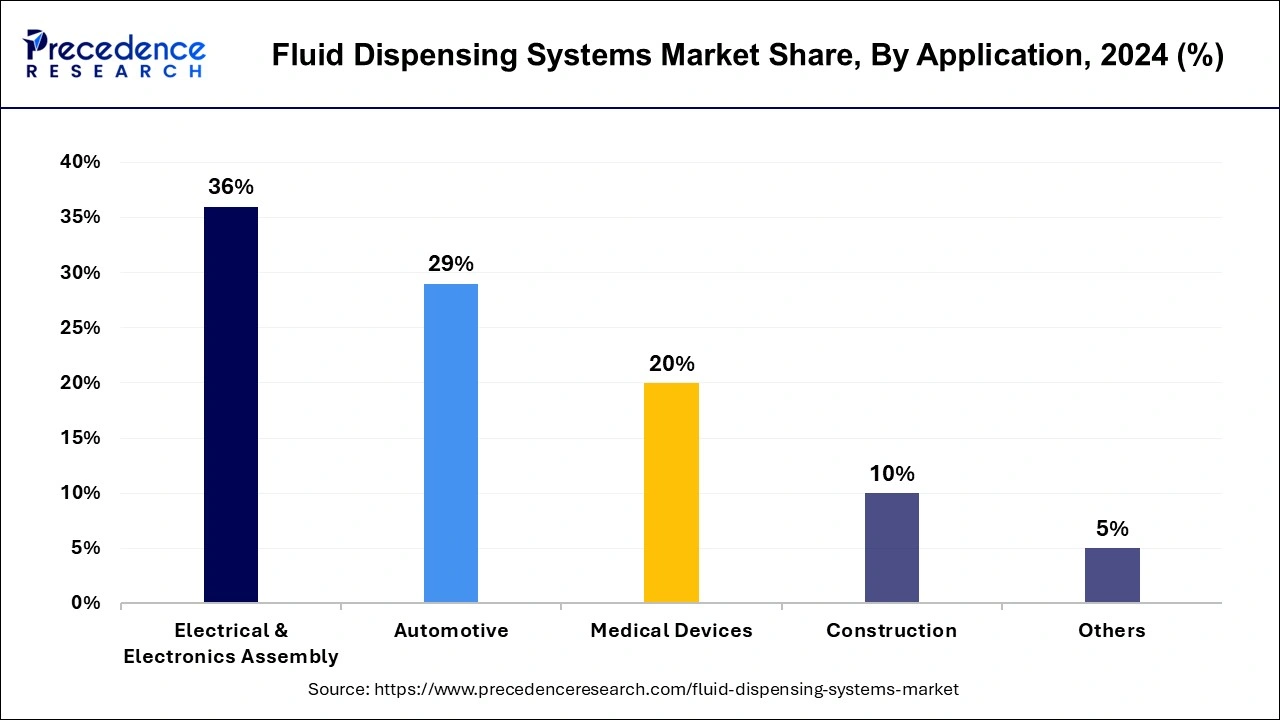

The electrical & electronics assembly segment dominated the fluid dispensing systems market in 2024. Fluid dispensing systems, which are used in many different industries for the accurate and controlled dispensing of fluids, including adhesives, sealants, lubricants, and solder pastes, depend heavily on electrical and electronic assembly. The integration of electrical and electronic components in the fluid dispensing systems market allows for precise control, automation, and monitoring of the dispensing process. Complex dispensing heads with electronically controlled valves, nozzles, and pumps are a hallmark of modern dispensing systems. These parts guarantee consistent and precise fluid dispensing, which is crucial for applications requiring a high degree of precision. Efficient production processes are enabled by the seamless integration of electrical and electronics assembly with robotic systems, conveyor belts, and other automation equipment.

The automotive is expected to show the fastest growth in the fluid dispensing systems market during the forecast period. Fluid dispensing systems are essential to the automotive industry for a number of purposes, including cleaning, sealing, cooling, and lubrication. These systems are essential to maintaining the effectiveness, dependability, and security of automobiles. Applications, including adhesives, sealants, coatings, and lubricants, are made possible in automotive production processes by the use of fluid dispensing devices. These systems are essential to assembly lines because they guarantee accuracy and uniformity when fluids are applied to various car parts. Fluid dispensing systems must adapt to handle a variety of fluids and viscosities while preserving compatibility with various surfaces as a result of advancements in vehicle designs and materials, including lightweight materials and composites.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

September 2024

January 2025