Flying Cars Market Size and Forecast 2025 to 2034

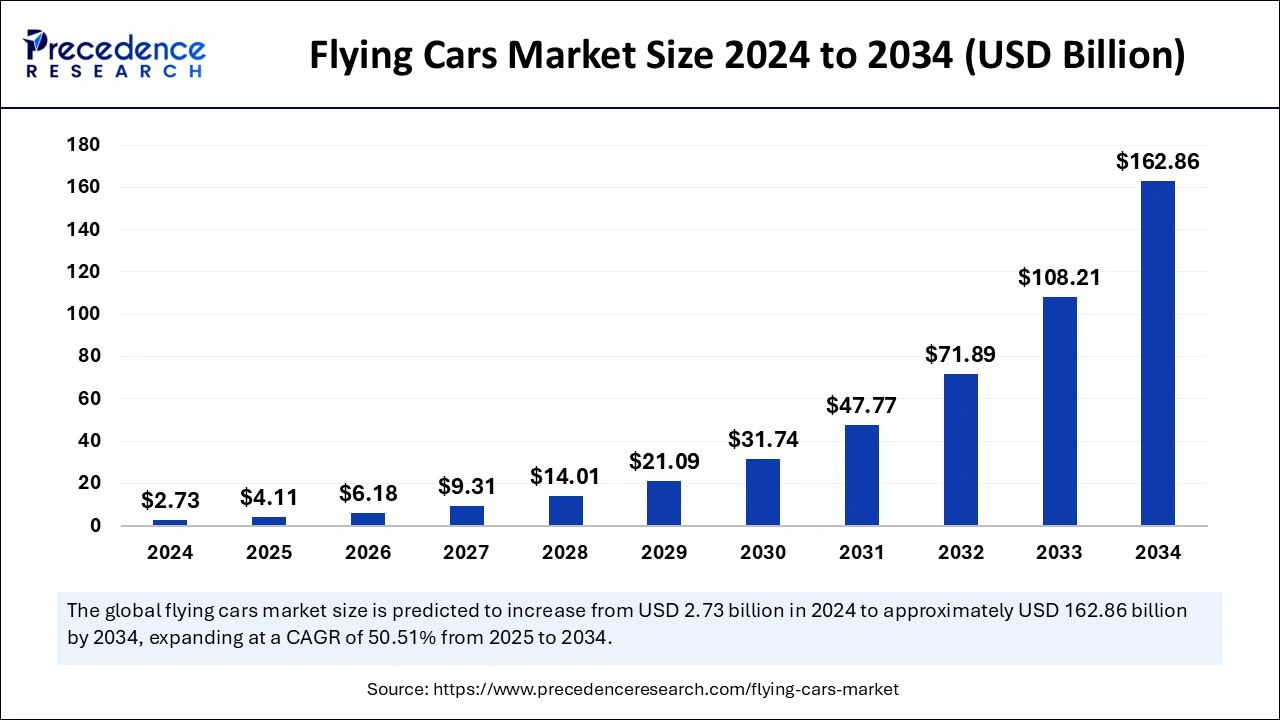

The global flying cars market size was estimated at USD 2.73 billion in 2024 and is predicted to increase from USD 4.11 billion in 2025 to approximately USD 162.86 billion by 2034, expanding at a CAGR of 50.51% from 2025 to 2034. Market players are increasing investment in flying cars, which is the key factor driving market growth. Also, rising purchasing power coupled with the surge in traffic can fuel market growth further.

Flying Cars Market Key Takeaways

- In terms of revenue, the flying cars market is valued at $4.11 billion in 2025.

- It is projected to reach $162.66 billion by 2034.

- The flying cars market is expected to grow at a CAGR of 50.51% from 2025 to 2034.

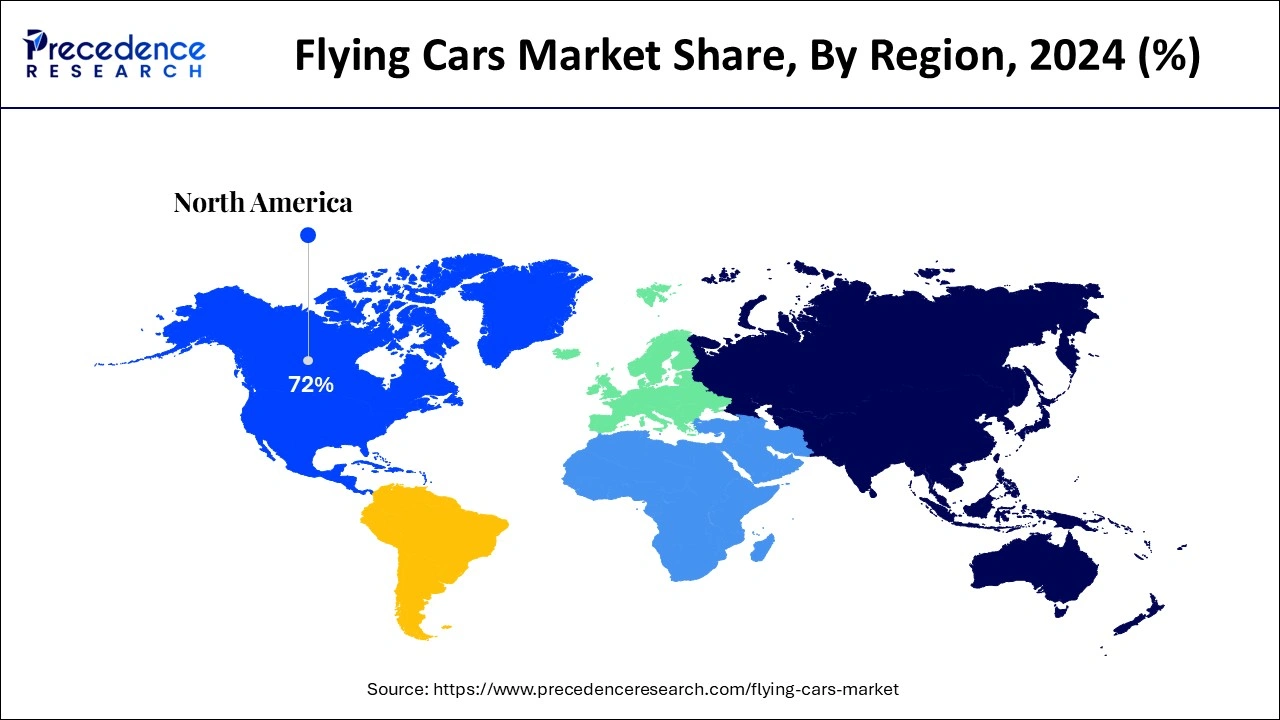

- North America dominated the global flying cars market by holding 72% of the market share in 2024.

- Asia Pacific is expected to grow at the fastest rate in the market over the projected period.

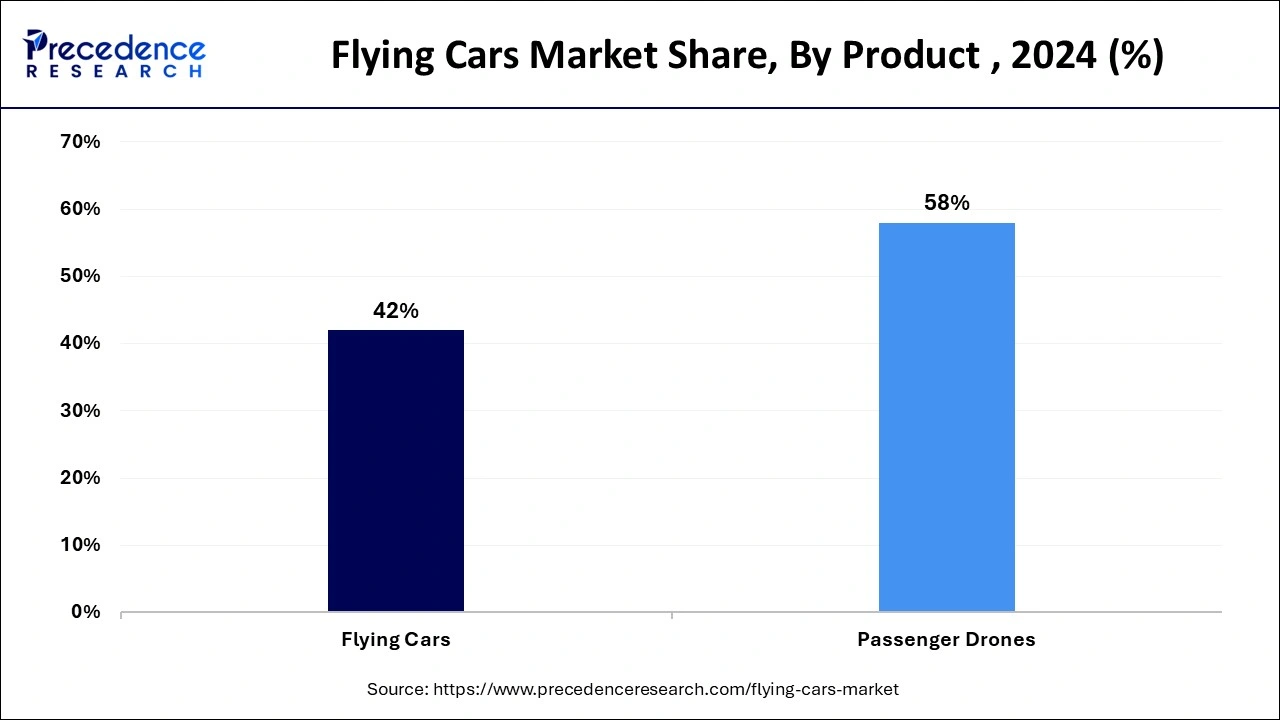

- By product, the passenger drones segment contributed the highest market share of 58% in 2024.

- By product, the flying cars segment is expected to grow at the fastest rate over the forecast period.

- By capacity, the 2-person sitter segment led the global market in 2024.

- By capacity, the 3 and 4-person sitter segment is anticipated to grow at the fastest rate over the projected period.

The Use of Artificial Intelligence (AI) in the Modern Transportation Sector

Artificial Intelligence combines data from various sensors such as radar, lidar, and cameras to offer a 360-degree view of the surroundings, enabling flying cars to process complex urban environments safely. Furthermore, AI can forecast when parts of the car will need maintenance and might fail, decreasing the chances of in-air hurdles. In emergencies, AI algorithms can take control, searching for the nearest spot or implementing safety measures such as parachutes.

- In August 2024, XPeng Motors announced the launch of the XPeng MONA M03; XPeng Motors also unveiled its XPeng AI system for the first time and launched the "XPeng Turing" chip, applicable to robots and flying cars, the all-new generation "AI Eagle Eye Vision Solution," and others.

U.S. Flying Cars Market Size and Growth 2025 to 2034

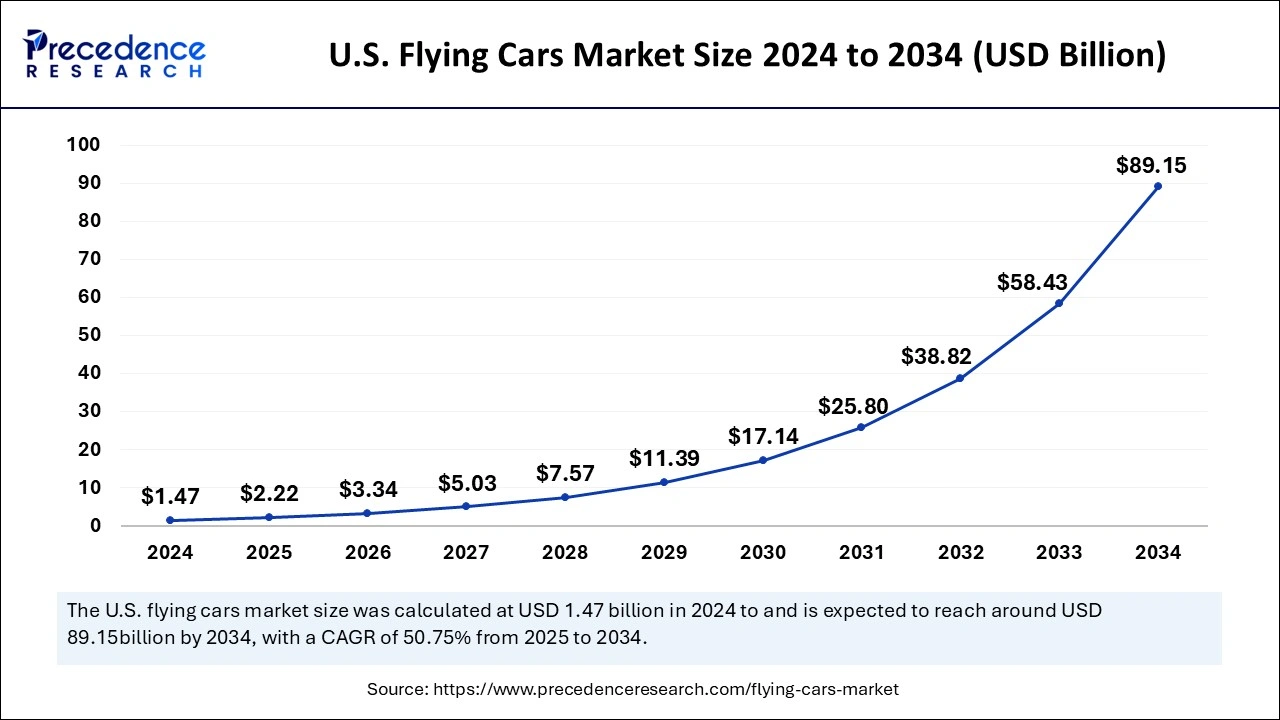

The U.S. flying cars market size was evaluated at USD 1.47 billion in 2024 and is projected to be worth around USD 89.15 billion by 2034, growing at a CAGR of 50.75% from 2025 to 2034.

North America dominated the global flying cars market in 2024. The dominance of the segment can be attributed to the ongoing investments in aerospace innovation, developed R&D, and favorable reimbursement policies for urban air mobility (UAM). In North America, the U.S. led the market, owing to the advanced infrastructure for air traffic management and increasing emphasis on sustainable mobility.

- In August 2024, LEO Flight virtually unveiled the LEO Coupe, an all-electric flying car, at Monterey Car Week. The LEO Coupe, featuring an electric jet propulsion system, offers speeds up to 200 mph and a range of 250 miles per charge.

Asia Pacific is expected to grow at the fastest rate in the flying cars market over the projected period. The growth of the region can be credited to the increasing tech investments coupled with large-scale urbanization, especially in countries like China and Japan. Furthermore, the region is also witnessing innovations in two-seater vehicles. In Asia Pacific, Japan held the largest market share due to frequent product launches and collaboration with other organizations.

Market Overview

A flying car is a vehicle that functions both as an aircraft and a road vehicle. It blends the features of a normal car, like an engine, seats, and four wheels, with the capability to fly like an aircraft. These cars are generally designed to work in dense urban areas or for large-distance travel, providing the opportunity to switch between flying in the air and driving on roads. Flying cars are also called "roadable aircraft" and can have rotary and fixed-wing configurations. The flying cars market offers an innovative mobility solution for transportation.

Flying Cars Market Growth Factors

- The surge in the urban population, along with the focus on smooth transportation, is expected to boost market growth soon.

- Flying cars have a wide range of applications, such as commercial transport and passenger commutes, which can propel market growth shortly.

- The increasing infrastructural development in emerging economies will likely propel market growth over the forecast period.

Market trends

- Lately, numerous firms are engaging in the advancement of flying automobile technology. Furthermore, lately, both car manufacturers and light aircraft producers are investing in developing related technologies. Uber has recently sold its air taxi service, Uber LEBATE, to Joby Aviation. There are some alterations, but the major trend is that associated companies are boosting their investments.

- The Aero HT Land Aircraft Carrier, developed by XPeng's subsidiary Aero HT, is a new effort to produce a flying car that has garnered interest from the automotive sector, following its presentation at the China International Aviation and Aerospace Exhibition in November 2024 and at CES 2025 in Las Vegas in January 2025, according to The Telegraph.

- Increasing investments and diverse industrial strategies are aiding the flying car sector in broadening its portfolio. Doroni Aerospace, a Florida-based eVTOL (electric vertical takeoff and landing) startup, has obtained $30 million in investment from Innovation Wings Industries (IWI), which functions as Kingdom Aero Industries (KAI) in Saudi Arabia, to manufacture and export its H1-X flying car.

Market Scope

| Report Coverage |

Details |

| Market Size by 2034 |

USD 162.86 Billion |

| Market Size in 2025 |

USD 4.11 Billion |

| Market Size in 2024 |

USD 2.73 Billion |

| Market Growth Rate from 2025 to 2034 |

CAGR of 50.51% |

| Dominating Region |

North America |

| Fastest Growing Region |

Asia Pacific |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Capacity, Geography, and Regions. |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for sustainable transportation

VTOL is a process utilized by these cars to launch themselves into the air. The flying car market is expected to grow because of the increasing demand for sustainable transportation. In addition, the most preferred land transportation method is train and road transportation, which is affected by track or road limitations, which in turn results in traffic congestion, especially in urban regions. This factor will further propel the market growth of flying cars.

- In October 2024, Supernal LLC, the U.S.-based urban air mobility (UAM) unit of Hyundai Motor Group, announced the launch of its electric vertical take-off and landing (VTOL) aircraft, dubbed S-A2, at the Los Angeles 2028 Summer Olympics and produced 100-200 units of the flying car annually, said automobile industry sources.

Restraint

Regulatory concerns and high cost

The flying car market is facing major restrictions due to high manufacturing and maintenance costs, infrastructure limitations, and regulatory challenges. Production and maintenance of flying cars require complex engineering, costly materials, and innovative technology. Moreover, regulatory laws are still in a developing state in various regions, with operational and safety guidelines creating barriers to their deployment.

Opportunity

Increasing demand for electric vehicles

The increasing demand for electric vehicles (EVs) and ongoing innovations in battery technology are creating lucrative opportunities in the flying cars market. The extensive adoption of electric vehicles has backed the development of flying cars. Furthermore, developments in battery technology, such as increased energy efficiency and density, make this car more viable, addressing performance and power needs. Together, all these factors boost the market growth to provide high-performance and innovative solutions.

- In June 2024, AeroHT showcased its X2 "flying car" at the 2024 China Langfang International Economic and Trade Fair. The demonstration took place at the Beijing International Airport Economic Zone.

Product Insights

The passenger drones segment held the largest flying cars market share in 2024. The growth of the segment can be attributed to the increasing demand and need to solve the problem of traffic congestion, along with the growing interest in investing in the manufacturing of sustainable passenger vehicles. Additionally, the ongoing advancement of aerial unmanned technology can drive market growth further.

The flying cars segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the many car manufacturers participating in the manufacturing and development of flying car technology. Also, light airplane producers are heavily investing in the development of flying car technology.

Capacity Insights

The 2-person sitter segment led the global flying cars market in 2024. The dominance of the segment can be linked to the growing use of this segment as the two-person configuration is favored and prominent for its balance between practicality and performance. Moreover, this configuration fulfills the demand of most potential users, such as small families and commuters, which makes it sophisticated for both commercial and private applications.

The 3 and 4-person sitter segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment can be driven by the growing adoption of this segment specific to families and small groups, improving their use for commercial uses like taxis and longer journeys. Furthermore, these models are important in demonstrating the viability of these cars for many applications.

- In October 2024, Sarla Aviation and Bengaluru Airport tied up to launch electric flying taxisThis initiative, developed in Karnataka, aims to revolutionize air travel by introducing seven-seater electric flying taxis, which promise faster, cleaner, and more efficient transportation. The company's proposed route from Bengaluru Airport to Electronics City would take just 19 minutes, compared to the 152 minutes required by road, with a fare of INR 1,700.

Flying Cars Market Companies

- Airbus

- AeroMobil

- Boeing Co

- EHang

- Lilium GmbH

- Volocopter GmbH

- Terrafugia

- PAL-V International B.V.

- Joby Aviation

- Other Key Players

Latest Announcement by Industry Leaders

- In January 2025, Chinese engineers introduced a distinctive type of flying car that can be compressed into a terrestrial vehicle resembling Tesla's debated Cybertruck for transportation, essentially converting it into a portable aircraft carrier. The aerial element is an electric vertical take-off and landing (eVTOL) aircraft, signifying that it depends on motors and propellers distributed along the width of the airframe for flight, a mechanism referred to as distributed electric propulsion.

- In January 2025, Covestro collaborated with China's Guangzhou Automobile Group to further the creation of battery-operated flying vehicles that can take off and land vertically. Covestro will provide GAC with lightweight polycarbonate for multiple components, such as glazing and lighting systems. Covestro produces a portion of its polycarbonate from chemically recycled postconsumer waste, which is in line with GAC’s strategy to utilize low-carbon materials. The company's prototype vehicle has traveled 200 km in 40 minutes.

- In October 2024, Boeing announced plans to raise USD 25 billion in new capital and agreed to a USD 10 billion credit facility as the U.S. plane maker seeks to shore up its balance sheet in the face of a crippling strike by its largest labor union. In a filing, Boeing told investors it intended to raise up to USD 25 billion in debt or equity, adding that this would provide "flexibility for the company to seek a variety of capital options as needed over a three-year period.

- In December 2024, Joby Aviation, Inc., a company developing electric air taxis for commercial passenger service, announced it had completed a landmark series of major aerostructure tests for certification credit with the Federal Aviation Administration ("FAA"). Joby has successfully completed static load testing of the tail structure, marking the first time the Company has tested a major aerostructure of its aircraft for credit with FAA representatives present.

Recent Developments

- In September 2024, XPeng AeroHT introduced the "Land Aircraft Carrier," a modular flying car that combines a ground vehicle with an attachable aircraft module. The first public manned flight is scheduled for November 2024 at the China Airshow in Zhuhai.

- In March 2024, Aviterra, a Dubai-based company, signed an agreement with PAL-V to acquire over 100 Liberty flying cars for deployment in the Middle East and Africa. The PAL-V Liberty, a gyroplane-car hybrid, has a 500 km flight range and a maximum airspeed of 180 km/h, aimed at advancing regional air mobility solutions.

- In August 2024, Archer Aviation officially introduced its most recent eVTOL model, Dope, demonstrating impressive technology in the aspect of flight and sustainability. The company highlighted the fact that they are carbon neutral and expects the Maker to be in service for urban air mobility activities by 2026, which will be a huge leap towards the AAM industry.

Segments Covered in the Report

By Product

- Flying Cars

- Passenger Drones

By Capacity

- 2-Person Sitter

- 3 And 4-Person Sitter

- 5-Person Sitter

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa