January 2025

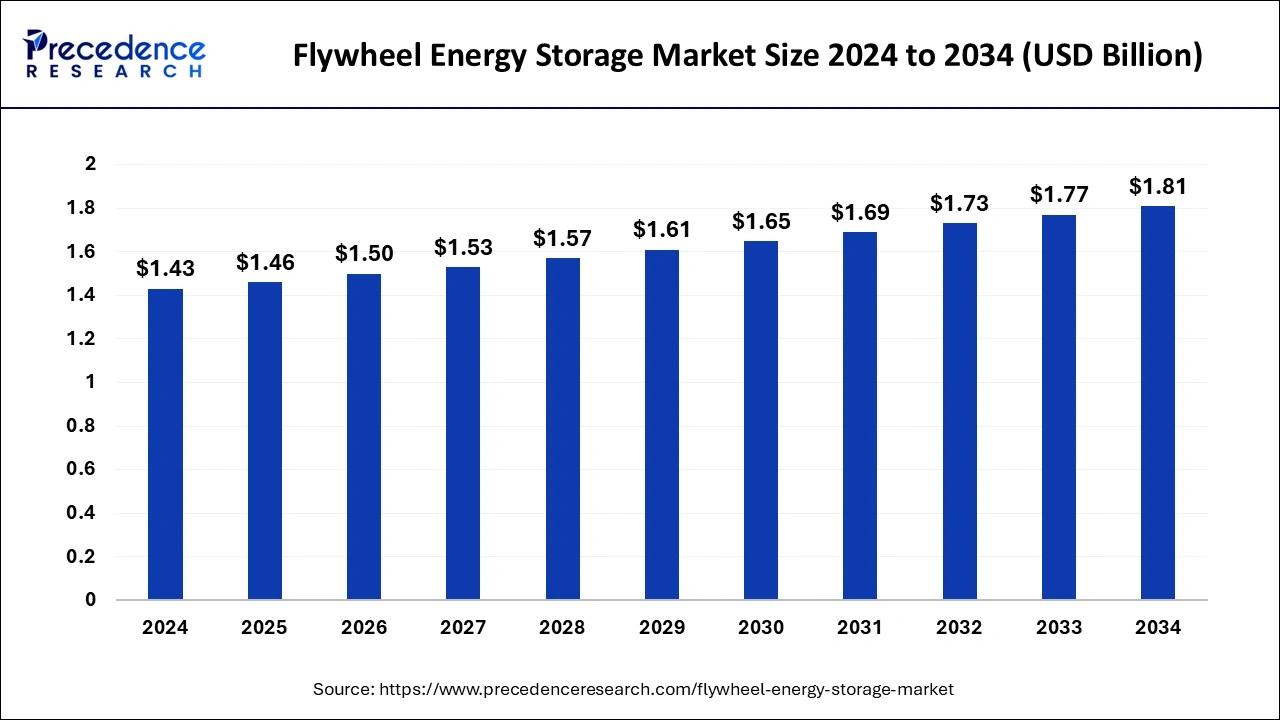

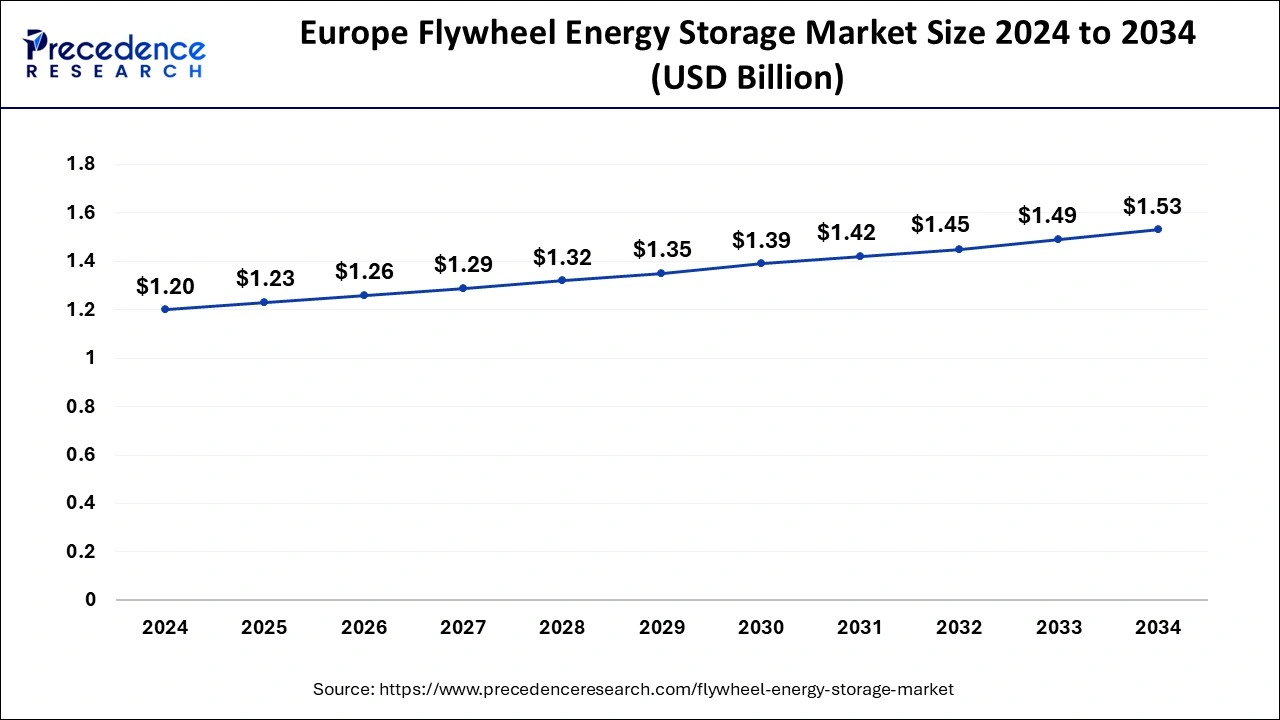

The global flywheel energy storage market size is calculated at USD 1.46 billion in 2025 and is forecasted to reach around USD 1.81 billion by 2034, accelerating at a CAGR of 2.38% from 2025 to 2034. The Europe flywheel energy storage market size surpassed USD 1.23 billion in 2025 and is expanding at a CAGR of 2.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global flywheel energy storage market size was estimated at USD 1.43 billion in 2024 and is predicted to increase from USD 1.46 billion in 2025 to approximately USD 1.81 billion by 2034, expanding at a CAGR of 2.38% from 2025 to 2034. The flywheel energy storage market is driven by the growing need for a continuous power supply (UPS).

The Europe flywheel energy storage market size was estimated at USD 1.20 billion in 2024 and is projected to surpass around USD 1.53 billion by 2034 at a CAGR of 2.46% from 2025 to 2034.

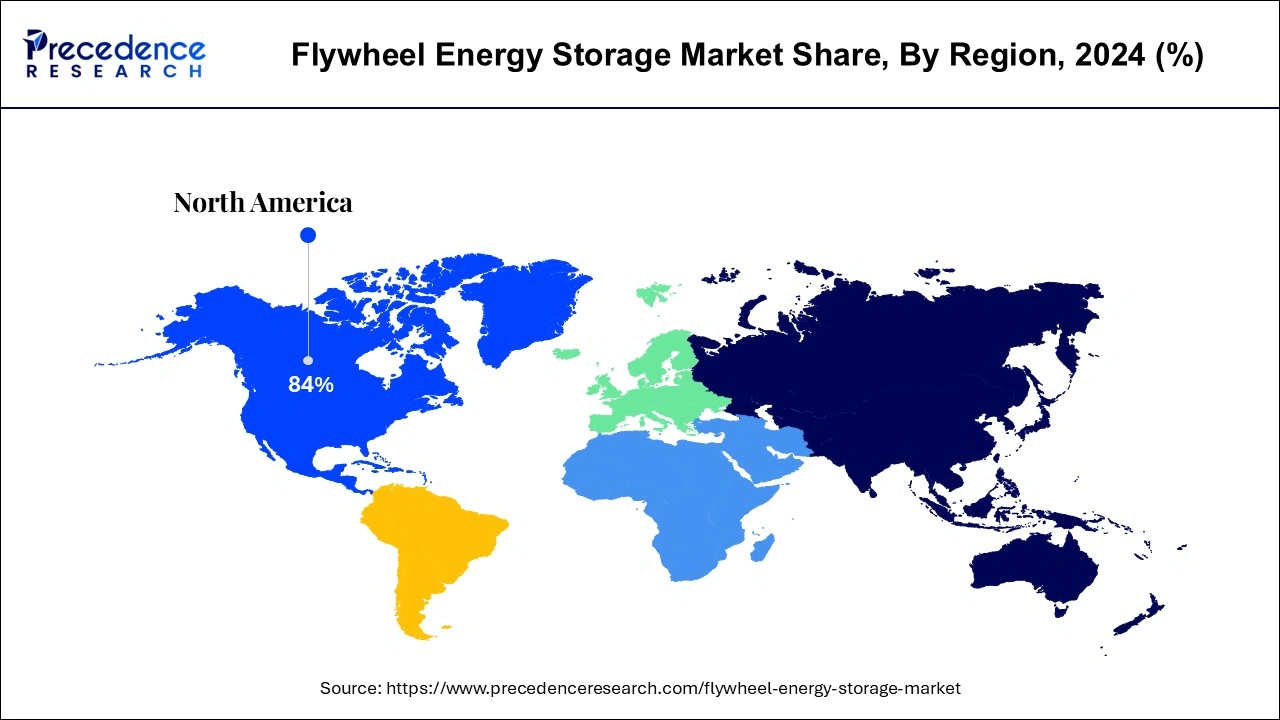

Europe has its largest market share in 2024 in the flywheel energy storage market throughout the predicted timeframe. Numerous well-known businesses and startups focusing on energy storage technology, such as flywheels, are in Europe. Because of their access to capital markets, highly skilled workforce, and research institution partnerships, these businesses can develop innovative solutions and hold a sizable portion of the worldwide flywheel energy storage industry.

These nations were among the first to use flywheels and other energy storage technologies for distributed and utility-scale energy applications. Flywheel energy storage has been deployed in various sectors thanks to projects backed by public-private partnerships, subsidies, and government incentives, which have increased market share and generated income.

Asia- Pacific is the fastest growing in the flywheel energy storage market throughout the predicted timeframe. There is a strong drive for grid modernization, and the integration of renewable energy sources, as outdated grid infrastructures, find it difficult to meet the demands of contemporary energy systems. Flywheel energy storage is valuable to renewable energy sources like solar and wind power because it offers quick-responding energy storage options that can improve grid stability, assist microgrid deployments, and stabilize intermittent power generation.

A technique for storing rotational kinetic energy is flywheel energy storage. It has a rotating rotor that can store energy until needed and is propelled to high speeds using electricity. The rotating rotor is coupled to a generator to transform kinetic energy into electrical when power is required. Flywheel energy storage systems can store extra electricity generated during low demand and release it during peak demand to help stabilize the electric grid.

Grid-scale energy storage, uninterruptible power supplies (UPS), transportation (such as hybrid buses), and industrial operations are just a few of their many uses. Because of its extended operational life and low degradation rate over time, it is a dependable and reasonably priced energy storage option.

Flywheel Energy Storage Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2025 | USD 1.46 Billion |

| Market Size by 2034 | USD 1.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.38% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth in the renewable energy sector

Since renewable energy sources like solar and wind power are naturally intermittent, the weather and time of day impact how much electricity they can produce. By storing extra energy produced during periods of peak production and releasing it during times of high demand or low renewable energy generation, flywheel energy storage systems assist in minimizing this intermittency. Because of this potential, renewable energy sources are more likely to be widely integrated into the energy mix and to improve grid stability and reliability. Thereby, the expansion of renewable energy sector is observed to act as a driver for the flywheel energy storage market.

High initial cost

Unlike other energy storage technologies like batteries, flywheel energy storage systems are not manufactured on the same scale. Because mass production offers economies of scale, per-unit costs can be significantly reduced. However, producers could not realize the same cost savings because flywheel systems are less in demand than more well-established technology. This makes lowering the high startup costs of establishing flywheel system production more difficult. Nevertheless, issues with storage valuation and the lack of cohesive storage policies at the member-state level impede this expansion. Concerns over contracts with grid operators and taxes are present in the Netherlands.

Increasing concerns toward security of supply

Flywheel energy storage devices offer quick response times for energy storage, which helps maintain grid resilience and stability. To help balance variations in supply and demand and avoid grid instability and blackouts, they can swiftly inject or absorb electricity. Flywheel systems serve as a dependable backup power source in areas vulnerable to power outages brought on by severe weather or grid faults, guaranteeing the continuation of essential services.

The utility segment dominated the flywheel energy storage market in 2024. Flywheels are less complicated and require less upkeep than other energy storage systems like batteries when it comes to maintenance. Utilities seeking dependable, affordable storage options with little lifetime expenses find them appealing. Utilities aggressively incorporate renewable energy sources into their systems as the globe transitions to a greener energy landscape. Flywheel energy storage is valuable to renewable energy sources because it offers quick-responding storage options that help balance out erratic wind and solar power production, improving grid stability and dependability.

The transportation segment is the fastest growing flywheel energy storage market during the forecast period. The demand for electric vehicles (EVs) has surged due to the global change in transportation towards electrification. Whether hybrid or entirely electric, EVs need effective energy storage systems to manage and store energy for propulsion. In this regard, flywheel energy storage devices are superior to conventional batteries in several ways, including high power density, quick response times, and extended cycle life. Flywheel energy storage is not limited to personal electric vehicles; it is also used in commercial fleets and public transit systems, such as electric buses and trains.

These industries have a need for energy storage, such as high-power requirements, a lot of stop-and-go traffic, and the ability to use regenerative braking. In these applications, flywheel devices can improve overall energy efficiency by effectively capturing and releasing energy throughout cycles of accelerating and braking.

The defense & aerospace segment shows a notable growth in the flywheel energy storage market during the forecast period. Flywheel energy storage systems are dependable and long-lasting, making them perfect for demanding applications like aerospace and defense, where system failures can have catastrophic repercussions. Flywheels are a reliable energy storage option since they may function effectively without experiencing appreciable performance deterioration over time, unlike batteries that deteriorate with time.

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

August 2024