January 2025

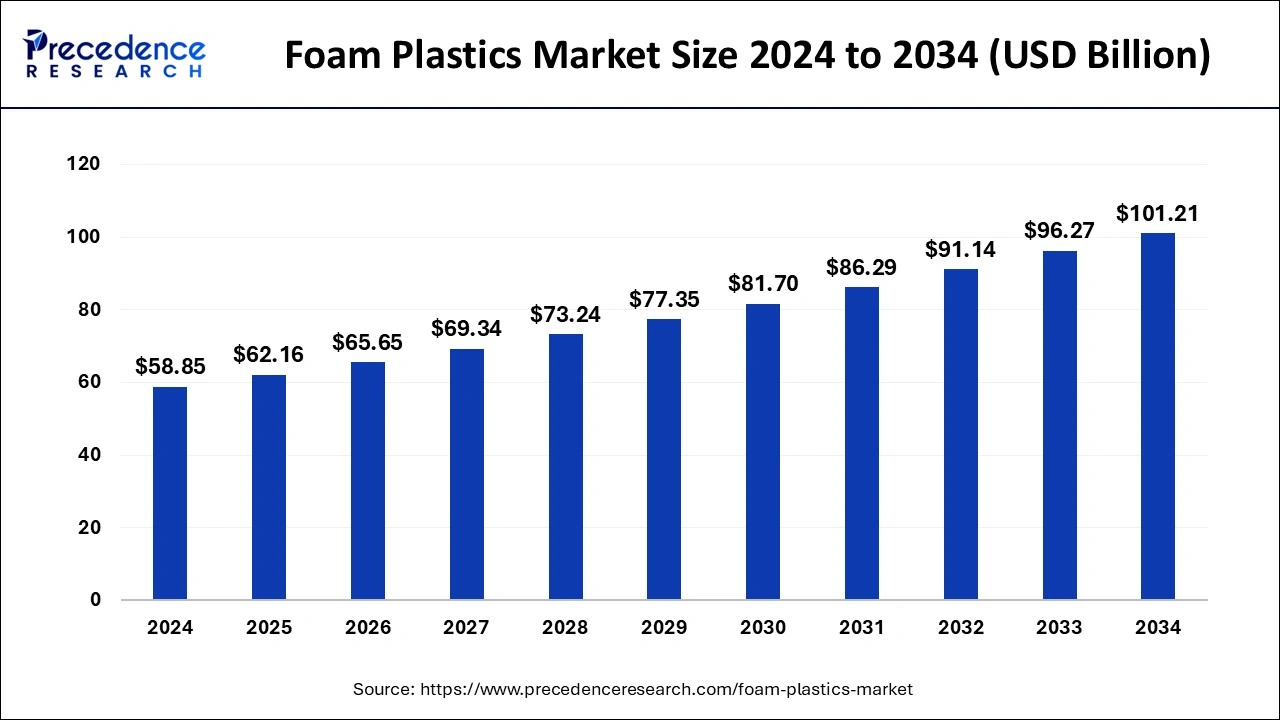

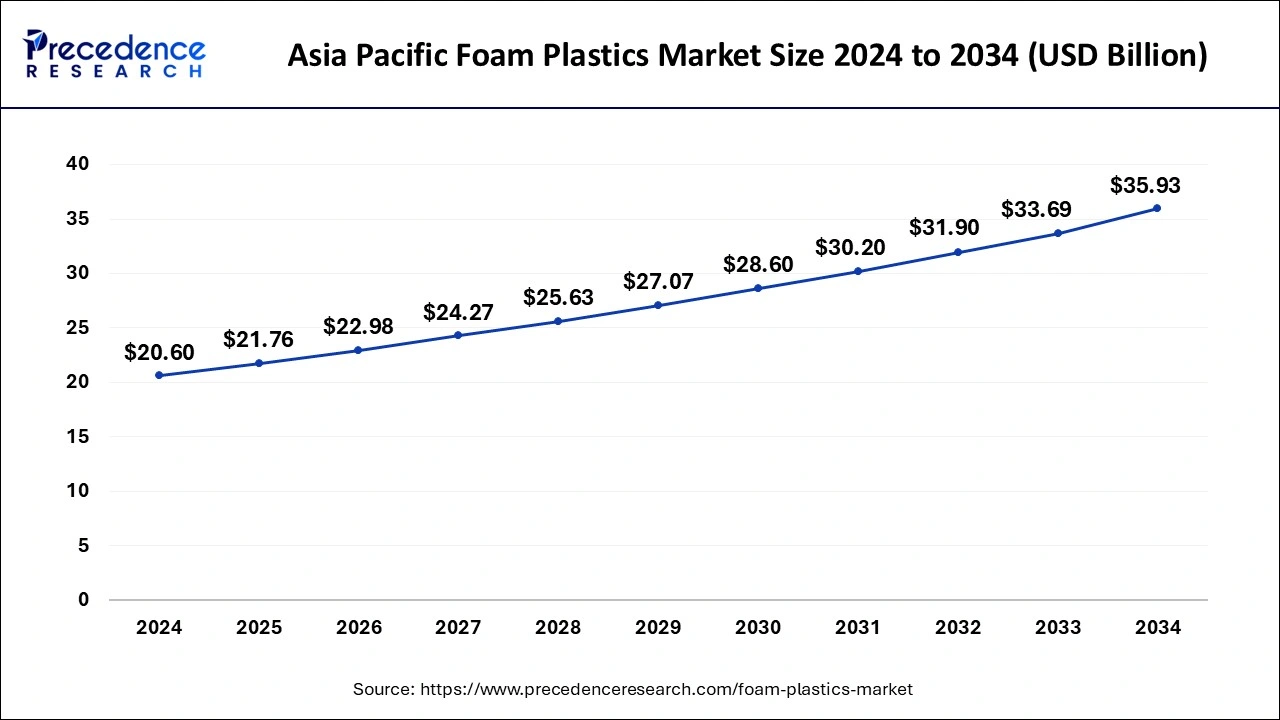

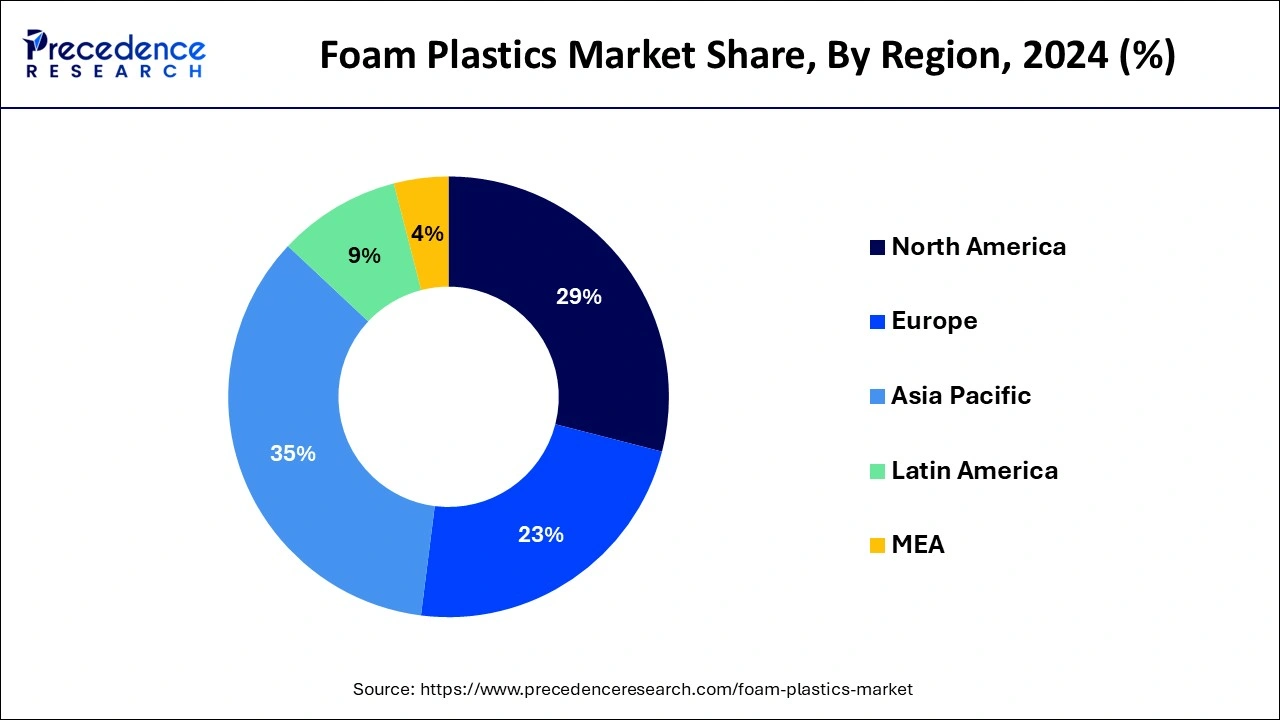

The global foam plastics market size is calculated at USD 62.16 billion in 2025 and is forecasted to reach around USD 101.21 billion by 2034, accelerating at a CAGR of 5.57% from 2025 to 2034. The Asia Pacific market size surpassed USD 20.60 billion in 2024 and is expanding at a CAGR of 5.72% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global foam plastics market size accounted for USD 58.85 billion in 2024 and is predicted to increase from USD 62.16 billion in 2025 to approximately USD 101.21 billion by 2034, expanding at a CAGR of 5.57% from 2025 to 2034. The expanding end-use industries and increasing demand for polyurethane foam in building insulation are the key drivers enhancing the market growth.

The Asia Pacific foam plastics market size was exhibited at USD 20.60 billion in 2024 and is projected to be worth around USD 35.93 billion by 2034, growing at a CAGR of 5.72% from 2025 to 2034.

Asia Pacific held the largest share of foam plastics market in 2024, particularly in countries like China and India. The demand for foam plastics in China is being driven by investments in production facilities to leverage cost advantages associated with labor and raw materials. Asia Pacific leads in foam plastics demand, fueled by increased consumer spending on luxury and household goods, particularly in bedding and mattresses. Factors such as rising disposable income, expansion of the furniture and bedding industry, and favorable foreign direct investment (FDI) policies are further contributing to regional growth.

North America is expected to grow at a notable rate during the forecast period. Many emerging economies are investing in infrastructure development, spurring industrial growth. EPE (expanded polyethylene) foam is commonly used as an acoustic material in construction projects, with the U.S. real estate sector driving its demand. Moreover, EPE foam is increasingly utilized as reusable floor protection in interior construction and can contribute to industry expansion. The U.S. dominates the foam plastics market, while Canada's market is experiencing rapid growth within North America.

Foam plastics, also known as plastic foams, are versatile materials with various forms, like semi-rigid or stiff structures. They are created by introducing dispersed gas and then cooling or curing the material. This process can be applied to many types of plastics, resulting in foam products ranging from film and sheet to molded shapes. Foam plastics find widespread use in the construction industry for applications such as insulation, doors, roofing, and slabs.

The global foam plastics market is expected to grow due to increased infrastructure development, investments in housing projects, and renovation of buildings in both developed and developing economies. These materials offer advantages like low heat conduction, low density, minimal water absorption, good mechanical strength, and excellent insulation properties.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.57% |

| Market Size in 2025 | USD 62.16 Billion |

| Market Size in 2024 | USD 58.85 Billion |

| Market Size by 2034 | USD 101.21 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The growing demand for polyurethane foam in building insulation

Polyurethane foam is extensively used in industries like construction, telecommunications, and automotive. In cars, it serves as cushioning material, while in electronics, especially refrigerators, it acts as excellent insulation. The construction sector benefits greatly from polyurethane foam, utilizing it for coatings, sealants, insulation, and adhesives, which ultimately reduces energy consumption and infrastructure costs.

Foam is also widely employed for sealing and thermal insulation in various industrial and construction applications, offering both thermal and acoustic insulation properties. Particularly in cold regions, foam helps maintain internal temperatures, making it valuable for domestic housing. Additionally, foam aids in noise reduction within structures by contributing to its growing demand in the foam plastics market.

Strict regulations on the use of flexible polyurethane foam

Strict environmental regulations and health risks associated with the use of TDI and MDI in polyurethane foam production are major obstacles to the growth of the foam plastics market. According to the Toxic Substances and Disease Registry Agency, the health effects of TDI and MDI depend on exposure frequency and duration, with some individuals experiencing asthma-related symptoms like wheezing and shortness of breath. These health concerns are expected to limit the foam plastics market expansion during the forecast period.

Bio-based polyols gain traction in polyurethane manufacturing

Industry participants in the polyurethane foam market are actively seeking to enhance or develop more efficient manufacturing processes that are environmentally sustainable, reduce reliance on fossil fuels, and minimize their environmental footprint. Bio-based polyols are used in polyurethane foam production, which gives a sustainable alternative that enhances efficiency.

Furthermore, these versatile raw materials are applicable to various products such as rigid foam, adhesives, elastomers, coatings, and sealants. The increasing adoption of bio-based polyols in polyurethane foam production and other applications presents significant growth opportunities for the global foam plastics market.

The polyurethane segment dominated the foam plastics market in 2024. Polyurethane foams are among the most used types of plastic foam worldwide, making up over half of the total plastic foam consumption. These foams possess a wide range of qualities that make them suitable for various applications, ranging from being rigid and dense to soft and flexible, depending on the specific requirements. They find extensive use in industries such as furniture and bedding manufacturing, insulation, and automotive production due to their versatility and cost-effectiveness.

The polystyrene segment is projected to be the fastest-growing segment over the forecast period. Polystyrene (PS) is a sturdy type of plastic made from styrene monomer units. It comes in various forms, including general-purpose PS, high-impact PS, and PS foam, with expanded PS foam being one variant. Known for its lightweight nature and cost-effectiveness, PS offers enhanced versatility, durability, thermal efficiency, and resistance to moisture.

The building & construction segment dominated the foam plastics market in 2024. Foam finds extensive application in the building and construction sector for sealing and thermal insulation, thanks to its lightweight and resilient nature. Its flexibility and absence of fibrous traits make it an excellent choice for both thermal and acoustic insulation. Sturdy polyurethane foam, available in various densities, proves beneficial for home walls and roofing, particularly in regions with extreme temperature fluctuations, where it helps maintain warmth. Additionally, this foam aids in reducing interior noise levels by effectively insulating sound within rooms. Rigid polyurethane foam, with its closed-cell structure, high crosslink density, and superior insulating properties, remains a popular choice in the building and construction industry.

The automotive segment is expected to grow significantly in the foam plastics market during the forecast period. Plastic foams in automotive applications are created by combining solid and gas phases. They come in various forms, typically made from raw materials like polyurethane, olefins, and polystyrene, derived from crude oil. With expanding economies like China, India, and Brazil witnessing increased consumer spending on both commercial and luxury vehicles, the automotive industry is booming. This surge is expected to drive growth in the foam market within the transportation sector.

By Type

By Application

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

July 2024

June 2024